Taxes

Filing taxes isn’t fun, but it can be easier if you know your T4 from your tax bracket. Here’s how to get through tax season as close to pain-free as possible.

Canada Tax Brackets 2025 | Federal & Provincial/Territorial

You know there are tax brackets in Canada — but what are they this year? Wonder no more. Learn everything you need to know about income tax in Canada.

Wealthsimple is investing on autopilot.

Other resources

Learn more about taxes

How to Prioritize Year-End Contributions | Wealthsimple

1 min read

Lower your tax bill with a smart contribution strategy. Our flowchart shows you how to prioritize between your RRSP, FHSA, and other accounts.

The Ultimate Guide to T4 Slips

5 min read

The T4 is the king of the jungle of tax slips. This guide will provide all the T4 info you’ll need about the T4 statement of income paid and taxes withheld.

OAS Clawback Explained

7 min read

The government gives you a helping hand when you get old, as long as you don’t make, what it considers, too much money. Here’s exactly how the OAS clawback works.

Canada tax return basics and checklist

10 min read

New to Canadian tax returns? Check out the basics of filling out a tax return and filing your taxes in Canada.

How marriage and common-law unions change your tax status in Canada

3 min read

Got married or moved in together? Here’s what you need to know about your new tax status.

What Is Form TD1?

4 min read

TD1 is a Canada tax form used to calculate how much tax should be withheld from your paycheck. You hand it to your employer or pension payer.

How to Withdraw RRSP Money Without Paying Tax

6 min read

Most early withdrawals from your RRSP come with taxes or penalties. But there are some exceptions.

A Guide to Self-Employed Taxes and Rates in Canada

7 min read

If you run your own business or have picked up some side gigs, the Canada Revenue Agency considers you to be self-employed, which has big tax implications.

Form T2201 — Disability Credit Explained

6 min read

Form T2201 determines if you qualify for government benefits meant to help financially support Canadians with severe and prolonged disabilities. Here’s a guide.

How to File Taxes Online for Free in Canada

6 min read

Learn how to file taxes online in Canada. This guide will go over the different options you have to submit a complete tax filing to the Canada Revenue Agency.

Everything You Need to Know About T2125

1 min read

If you're self-employed or own a small business, then you'll need to file the T2125. Here's what you need to know.

How to change your tax return after filing

2 min read

Filed your tax return and then realized you made a mistake? We’ll tell you how to change your return after it’s been filed.

Estate Planning in Canada

10 min read

Estate planning in Canada follows many of the same rules and conventions as in other countries. As with estate planning anywhere else, the goal is to distribute your assets and minimize tax liabilities.

Everything you need to know about the T776

4 min read

If you receive income from a property you rent out, then the T776 is for you. Here's what you need to know.

Everything you need to know about the T2209

3 min read

If you've earned income outside of Canada and had to pay tax for it, the T2209 helps you claim tax credits on the paid amount. Here's what you need to know.

What is T5 Slip? Return of Investment Income Explained | Wealthsimple

2 min read

Here's everything you need to know about the T5, which you'll need when you're reporting income from any investments you hold.

RRSP Withholding Tax: How Much You'll Pay

6 min read

RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement. Here’s how it works.

Everything You Need to Know About the T1

2 min read

Here's everything you need to know about the T1, which every Canadian needs to fill out each tax year.

Things to Know About Tax Refunds in Canada

6 min read

A tax refund is not free money. It’s the money you overpaid in taxes over the course of the tax year. Here’s what you need to know.

Alberta Tax Brackets 2025 | AB Income, Credits & Deductions

4 min read

Find out the 2025 tax brackets and information about tax in Alberta.

Canadian Income Tax Explained

10 min read

Here’s everything you need to know about Canada’s income tax system.

Everything you need to know about the T777

4 min read

If you're an employee and you're looking to claim work-related expenses on your taxes, then this form is for you.

How Income Splitting Works

5 min read

Income splitting happens when a higher-earning spouse transfers part of their income to their partner for tax purposes. Here’s why people do it.

RIT/RIF on Your Bank Statement

1 min read

The term “RIT/RIF” refers to the refund you’re owed from the Canada Revenue Agency. Here’s how it works.

A Guide to Form T2200

4 min read

If you’re an employee who hopes to deduct work expenses, you’ll need Form T2200. This guide tells you everything you need to know.

BC Tax Brackets 2025 | BC Income, Credits & Deductions

4 min read

Here are the 2025 tax brackets and rates for British Columbia residents.

Ontario Tax Brackets for 2025 | Income, Credits & Deductions

5 min read

Here are the 2025 tax season brackets and rates for Ontario residents.

Seven Ways to Reduce Capital Gains Tax in Canada

6 min read

Capital gains tax is a way for the government to collect revenue on the profit you make from investments. While you can’t avoid them, you can do your best to minimize them.

Everything You Need to Know About the Canada Child Benefit

5 min read

If you live in Canada and have a child below the age of 18, you may be eligible for the Canada Child Benefit. Here's what you need to know.

What Students Should Know About Their T2202 Form

5 min read

Students enrolled at designated educational institutions receive a form T2202, which tells the CRA how much tuition can be claimed on your tax return.

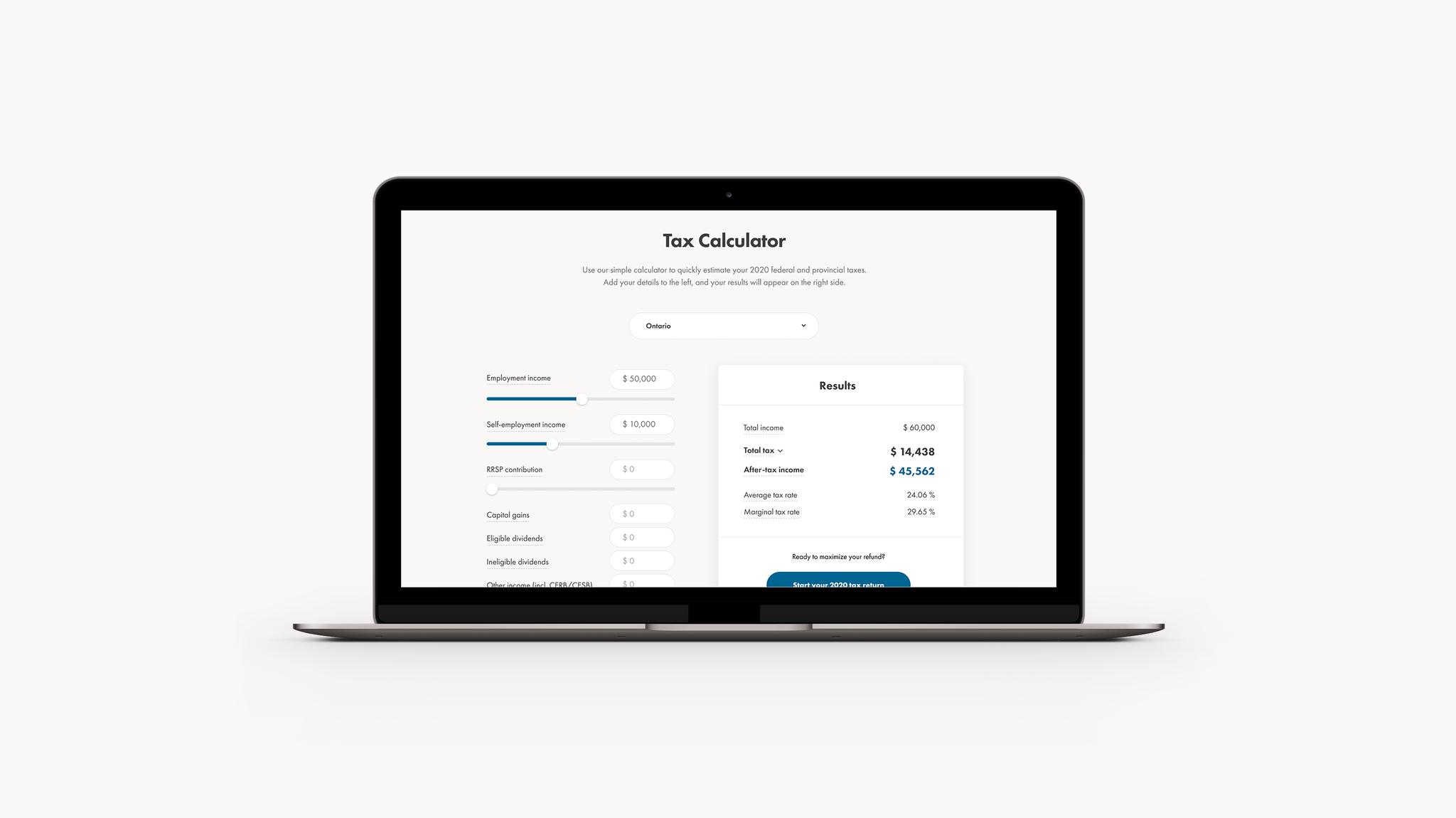

Average and Marginal Tax Rates

3 min read

Average and marginal tax rates are the ways taxes are applied and looked at in Canada’s progressive tax system. We break down both and how they might apply for you.

Everything you need to know about the Canada Workers Benefit

5 min read

If you're a low-income individual or family, you're eligible for refundable federal tax credits thanks to the CWB. Here's what you need to know.

Québec Tax Brackets 2025 | QC Income, Credits & Deductions

6 min read

Here are the Québec tax brackets in 2025.

What's Tax-Loss Harvesting?

1 min read

Tax-loss harvesting is a strategy to help reduce the amount you may have to pay in taxes. Learn more.

Does Inheritance Tax Exist in Canada?

5 min read

In Canada, there is no inheritance tax, but there are special tax issues related to a deceased person’s assets and income. Here’s what you need to know.

What is tax-efficient investing | Wealthsimple

3 min read

Tax-efficient investing is a strategy that aims to minimize the taxes investors will pay on investment gains, in order to maximize their after-tax returns.

Canada Tax Brackets 2025 | Federal & Provincial/Territorial

6 min read

You know there are tax brackets in Canada — but what are they this year? Wonder no more. Learn everything you need to know about income tax in Canada.

Capital Gains Tax in Canada in 2025

7 min read

You may be familiar with the term capital gains, but if you’re not sure about the details or how it might apply to you, this article is for you.

An Overview of Form T4A

6 min read

There are eight variations of T4 slips specific to the type of income earned. The difference between a T4 slip and a T4A is that it details earned income from different sources.

Everything You Need to Know About T778

5 min read

The T778 allows you to claim eligible child care expenses to reduce your taxable income. Here's what you need to know.

Everything You Need to Know About T2202

3 min read

If you're a student, you may be able to claim your tuition on your tax return via the T2202. Here's what you need to know.

What is the RL-31?

4 min read

The RL-31 slip needs to be filled out by residents of Québec who rent out property. Here's what you need to know.