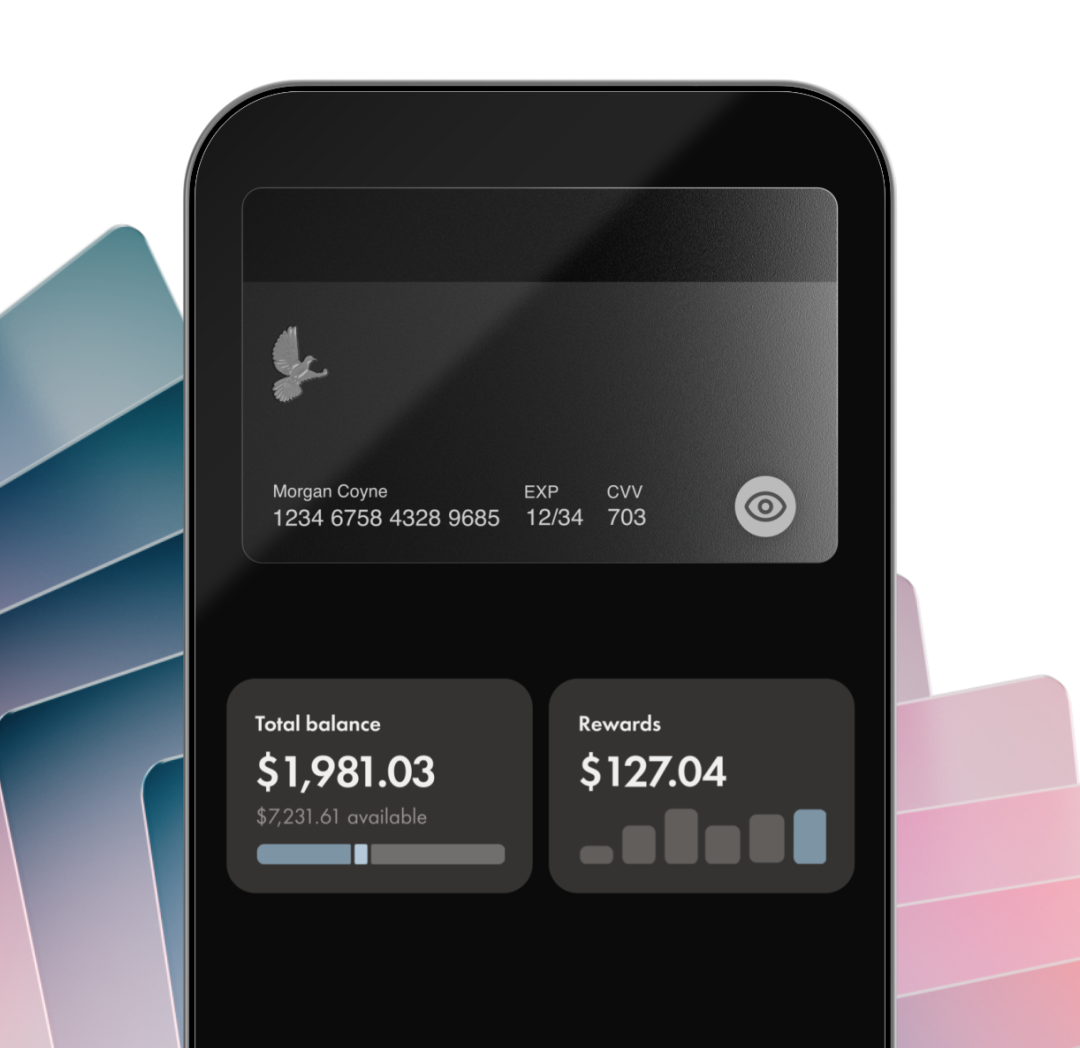

credit card

Get 2% cash back on everything

Earn on all your spending with no complicated categories, and pay no annual fee when you’re a qualifying client. Simple.

No annual fee

We’ll waive your fees (charged monthly) if you’ve got $100K+ with us, or when you switch a qualifying paycheque deposit to Wealthsimple.

No FX fees

Most other credit cards charge up to 2.5%. With us, it’s always zero. Even on late-night room service.

Clients with $100K+

Make it metal

Give your wallet an upgrade with the card you’ll actually want to take out of your wallet.

Premium benefits that beat the bank

We’ve compared the big bank’s credit cards with the free benefits you get when you have $100,000+ with us.

Wealthsimple credit card | Big bank credit cards | |

|---|---|---|

| Cash back | 2% on everything | Categories, caps, limits …it’s complicated |

| FX fees | 0% | Up to 2.5% — that could be spent on tacos in Mexico instead |

| Annual fee | Waived | Up to $139/year — enough said |

| Card material | Metal | Usually just plastic, unless you like paying lots of fees |

| Virtual card tap limit | No limit | $250 (if you’re lucky) |

| Earned interest on your cash back | Up to 2.25% | Non-existent |

The credit card that keeps on giving

visa infinite privilege card

Unlock first-class card perks

When you sign up for a credit card, you could qualify for Canada’s only Visa Infinite Privilege cash back card with top-tier travel perks — like access to 1,200+ airport lounges, car rental insurance, increased travel protection, and more. All at no extra cost.

FAQs

Can anyone apply for the Wealthsimple credit card?

Can anyone apply for the Wealthsimple credit card?

You can apply for the card if you're a Canadian resident, are the age of majority in the province or territory you're a resident of, and have an active Wealthsimple chequing account. If you qualify, we’ll match you to either a Visa Infinite card or a Visa Infinite Privilege card based on a number of factors.

To qualify for the Wealthsimple Visa Infinite card you must meet the requirements above and have a personal income of at least $60,000 or household income of at least $100,000.

To qualify for the Weathsimple Visa Infinite Privilege card you must also meet the requirements listed above and have a personal income of at least $150,000 or household income of at least $200,000. Or, you can also qualify if you have a minimum annual spend of $50,000, or hold at least $400,000 in assets with us.

We'll perform a full credit check after you submit an application.

Right now, the card is only available in limited quantities so even if you meet these requirements, you might not get one.

The Wealthsimple Visa Infinite* Credit Card and Wealthsimple Visa Infinite Privilege* Credit Card are issued under license by Wealthsimple Payments Inc.

What are the interest rates on the card?

What are the interest rates on the card?

The annual interest rate for purchases is 20.99%, and for cash advances or cash-like transactions, it's 22.99%. This rate comes into effect on the day the account is opened (whether or not a card is activated).

Your annual interest rates will increase to 25.99% on purchases and 27.99% on cash advances and cash-like transactions if we do not receive your minimum payment by the payment due date for 2 consecutive months. The increased annual interest rates will apply in the third statement period following the second missed payment that caused the rates to increase. The increased rates will continue to apply until we receive your minimum payments by the payment due date.

How does the cash back work?

How does the cash back work?

You'll earn cash back on net purchases for qualifying transactions and can redeem it at any point to almost any Wealthsimple account. The 2% does not apply to cash-like transactions, refunds, or any applicable fees and adjustments.

How do I switch my pay to get my monthly fee waived?

How do I switch my pay to get my monthly fee waived?

To be eligible for zero monthly or annual fees, you'll need to set up a monthly direct deposit of $4,000 or more to your Wealthsimple chequing account (switching your paycheque is usually the easiest way to do it).

First you'll need to have an open Wealthsimple chequing account, then copy your account details including our institution number (703), transit (or branch) number (00001), and your personal account number.

After that, go to your employer's payroll platform and update your direct deposit account information. You can find more details here.

How can I get a metal card?

How can I get a metal card?

Premium clients (clients with over $100,000 in assets with us) will automatically receive a metal card.

I'm not eligible to have the annual fees waived, how much will I pay in fees?

I'm not eligible to have the annual fees waived, how much will I pay in fees?

You'll be charged $20 monthly if you have under $100,000 in assets with Wealthsimple. Note that Quebec clients will be charged annually.

Remember, you can still waive this fee by having your paycheque ($4,000 or more per month) direct deposited to your Wealthsimple chequing account. Effective from July 10, 2025 for existing credit card clients. You can find out more about the fees here.

No FX fees? Really?

No FX fees? Really?

Really! We don’t charge any foreign exchange fees. However, the payment network (not us!) still applies a currency conversion rate.

How is the Wealthsimple credit card different from the Wealthsimple prepaid Mastercard?

How is the Wealthsimple credit card different from the Wealthsimple prepaid Mastercard?

The credit card is a way of borrowing money, while the prepaid card is spending your own money that is already in your chequing account. When applying for the credit card, a credit check is required and using the card will affect your credit score — good payment history helps, while missed payments may affect your score negatively.

The cash back rewards are higher on the credit card, and it comes with some additional benefits like insurance and access to the Visa Infinite perks.

How do tap limits work for the virtual and physical cards?

How do tap limits work for the virtual and physical cards?

There are no tap limits when you use your virtual card! Two things need to be true — you have to have enough credit to pay for whatever you’re tapping for, and the store (or whatever merchant) you’re at can’t have imposed their own tap limit on their machines.

Because your virtual card requires you to unlock your phone to pay, there’s an added layer of security compared to your physical card.

Thats why your physical card does still have a tap limit, which depends on the type of purchase you’re making.

How can I pay my credit card balance?

How can I pay my credit card balance?

At this time, you can only pay your Wealthsimple credit card balance from a Wealthsimple chequing account.

You can set up auto-pay to make payments to your card on the schedule that works best for you.

Where can I find more information about the insurance options?

Where can I find more information about the insurance options?

You can read our full insurance certificate for more details on the mobile device insurance, purchase protection, and extended warranty here.

Is this card available to residents of Quebec?

Is this card available to residents of Quebec?

Yes, any eligible client in Quebec can join the waitlist and apply for the Wealthsimple visa credit card. The card is available to all provinces in Canada.

Is the Visa Infinite Privilege cash back card really the only one in Canada?

Is the Visa Infinite Privilege cash back card really the only one in Canada?

That’s right. Although other financial institutions in Canada offer Visa Infinite Privilege cards, Wealthsimple’s is the only one that offers cash back on your spending — and that’s 2% back on everything!

Data collected as of October 17, 2025. As compared to all Visa Infinite Privilege cash back credit cards from Canadian financial institutions as listed under Schedule I under the Bank Act.