Check your fees – save money

Canadians pay some of the highest management fees in the world for their investments. Using the form below, see just how much you could save in fees over time by investing with Wealthsimple.

Canadians hold $1.78T in mutual funds

And typically pay 1.64% in annual fees

That's about 3x US investor fees

Costing Canadians $19B in missed returns

Why choose Wealthsimple?

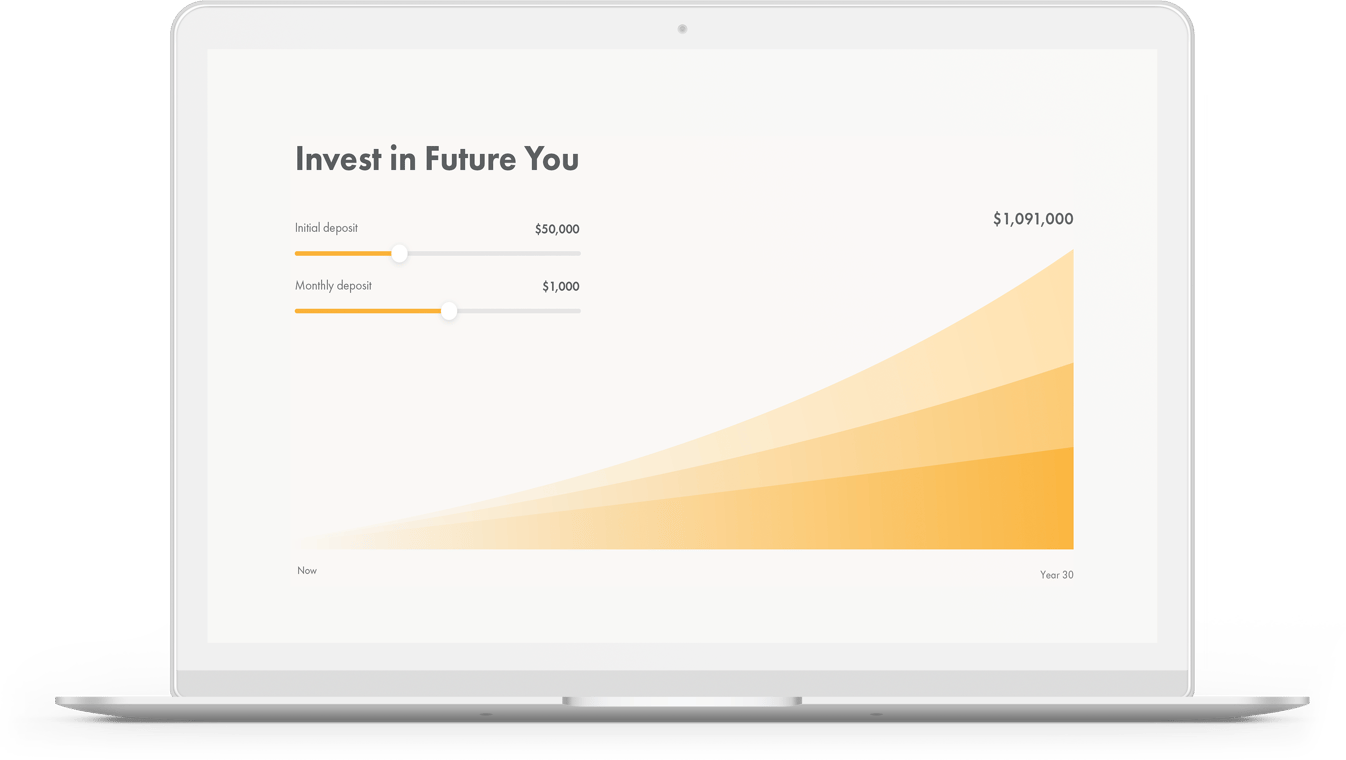

Put your money on autopilot – Invest in an intelligent portfolio of low-fee funds that are designed to meet your financial goals.

- Low Fees - Pay an annual management fee of 0.50% (or 0.40% for accounts over $100K)

- Stay on track - We'll instantly rebalance your portfolio and put your stock dividends back to work, earning you more

- Human advice - Our advisors will deliver sophisticated financial advice whenever you need it.

- Easy access - Manage your accounts from anywhere with our award-winning website and mobile app

FAQs

What’s the difference between a Mutual Fund and an ETF?

What’s the difference between a Mutual Fund and an ETF?

ETFs stand for exchange traded fund, which is a fund you can invest in that functions as a sort of basket: It contains a wide selection of stocks, bonds, or other assets, depending on the ETF. It allows you to invest in wide swaths of the market without having to go into the time and effort (and cost) of selecting individual stocks, which is quite risky. ETFs let you participate in the market without the expense of buying individual shares because ETFs usually invest in fractional shares of companies, which obviously only cost a fraction of what a whole share costs.

ETFs don’t usually require any human management, so they don’t have high management expense ratios (MERs), which means that high operating costs aren’t passed along as fees to investors.

Mutual funds are similar to ETFs, but they differ from their low-cost sibling in terms of fees. Like ETFs, mutual funds function like a basket that contains various stocks, bonds, or other assets, but those assets have been individually selected and managed by a fund manager. That means that a mutual fund is actively managed and therefore will have higher fees. Read more about their benefits and differences here.

Where can I learn more about this?

Where can I learn more about this?

To learn more about mutual funds and how they perform compared to their Benchmarks over time, reference SPIVA here. To learn more about the changing size of the Mutual fund market in Canada, reference the 2020 IFIC Investment Funds Report, and to learn how Canadian fees compare to other developed markets, you can download the Global Fund Investor Experience Fees and Expenses report from Morningstar.

Where did you get these numbers?

Where did you get these numbers?

Size of market data as of 2020 IFIC Investment Funds Report, Fee data as of 2019 Morningstar Global Investor Experience Survey. Estimated fees at other institutions based on publicly available mutual fund fees, where not available, an estimate is used. Analysis by Wealthsimple.