Income Portfolios

Boost the earning potential on your sitting cash

Choose from three professionally-managed portfolios for a low-risk, fully liquid way to earn steady income.

Up to 4.6%

Targeted return

0%–0.5%

Management fees

The Core and Vanguard Dynamic Income portfolio are subject to Wealthsimple’s standard management fee, based on whether you’re a Core, Premium, or Generation client. The Money market portfolio does not include any management fees.

Steady returns for shorter-term goals

Whether you’re putting cash aside for a new car, savings for a home reno, or just want to diversify your portfolio, our low-risk options are a perfect fit.

Yield you can count on

Our portfolio options allow you to earn low-risk income on your sitting cash that’s steady and dependable, no matter which risk level you choose.

Anytime access to your cash

Unlike with a GIC, there’s no lock-ups or penalties for withdrawing cash from any of our portfolios. You can access it easily, whenever you need.

Built with expertise

Our income portfolios are managed by experienced investment managers who carefully curate your holdings to strike the right balance between risk and yield.

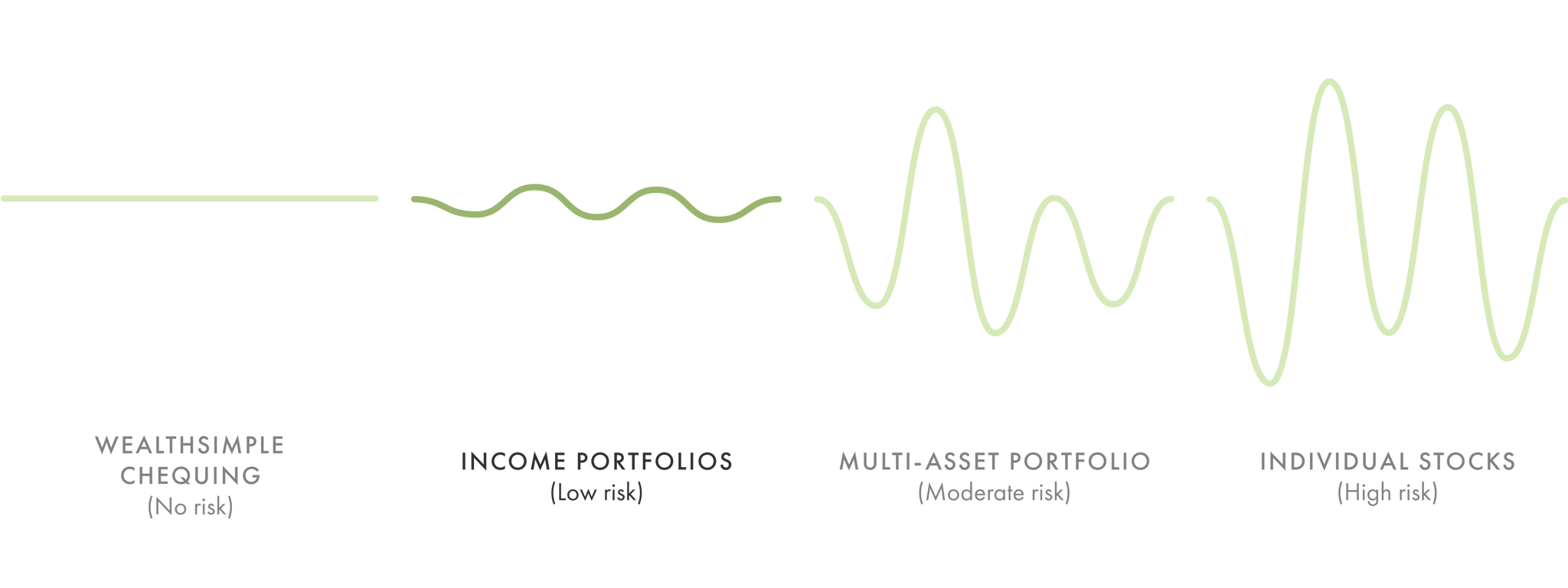

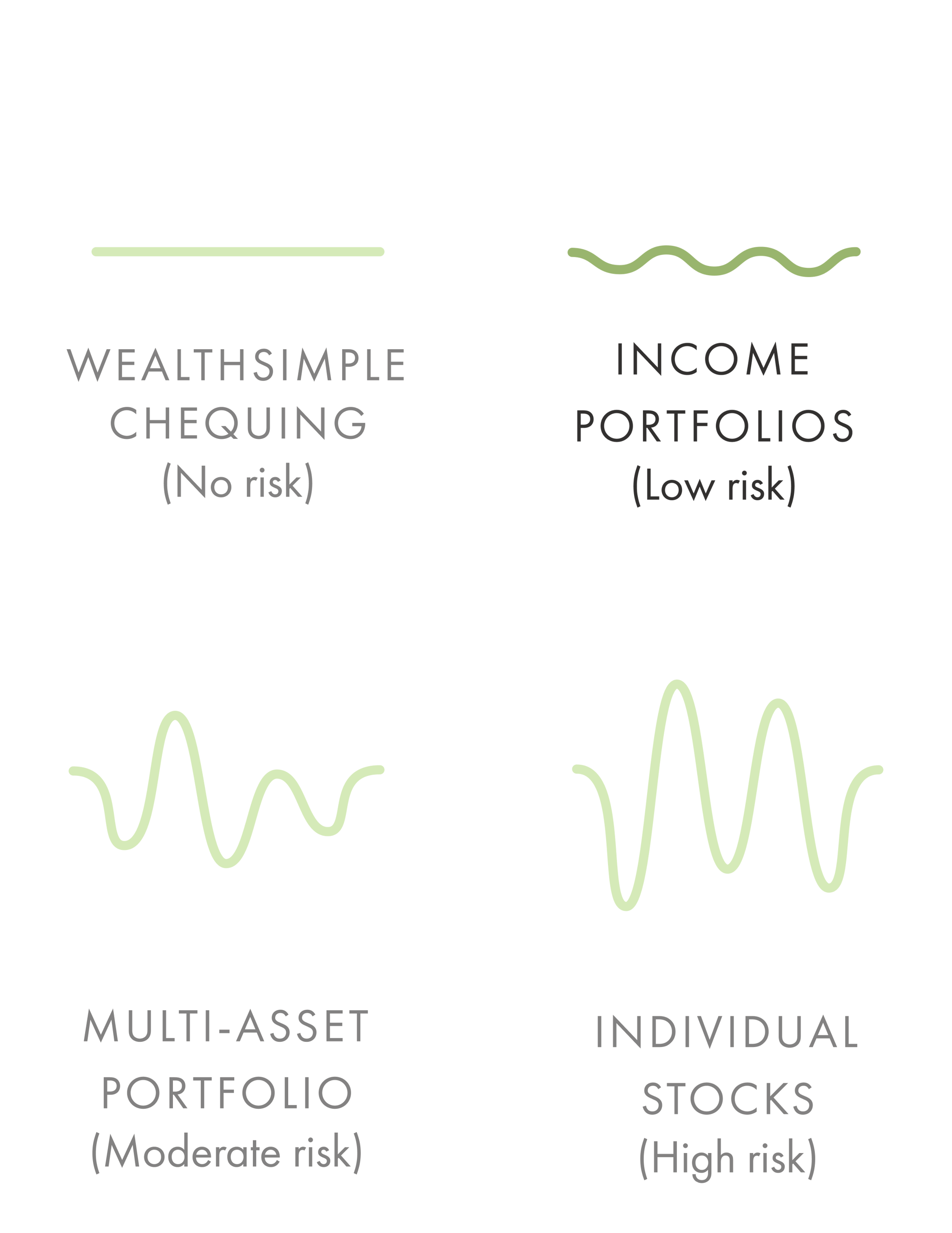

Chart is for illustration purposes only and does not represent investments made by Wealthsimple’s Income portfolios. Volatility shown is not an indicator of future performance of the individual investment options.

Income portfolios that fit your goals like a glove

All our Income portfolios are low risk, just to varying degrees. Get to know all three to find out which one suits you best.

- A portfolio containing a mix of bonds and dividend-paying stocks, all aimed at delivering higher returns

- Investments powered by Vanguard, professionally managed for you

- Withdraw and deposit penalty-free

- Perfect for medium-term goals, like renovations or a new car

- Invest in top-tier government and corporate bonds

- Professionally managed by our team to make sure you’re earning steady returns

- Withdraw and deposit whenever you like, with no penalties

- Ideal for earning stable income with low risk

- Near-zero risk, since the interest is earned on overnight deposits

- Withdraw and deposit whenever you like, with no penalties

- Pay zero management fees

- Perfect for short-term goals and everyday spending and saving

Vanguard Dynamic Income portfolio

4.6%

Targeted return

This refers to the overall performance of the portfolio. This portfolio holds a high proportion of bonds along with dividend-paying stocks, which have a combined yield of 3.8%.

Core Bond Portfolio

3.3%

Yield

Yield is net of underlying management expense ratios (MER) and gross of the Wealthsimple management fee.

Money Market Portfolio

2.5%

Yield

Yield is net of underlying management expense ratios (MER) and gross of the Wealthsimple management fee. The Money Market portfolio has no Wealthsimple management fee.

Where you put your money makes all the difference

Source: Past performance based on the asset-weighted average performance of clients in the bond ETF portfolio and the annualized interest for Premium client rates for Wealthsimple chequing accounts from July 29, 2024 to November 4, 2025 shown. Past performance is not indicative of future results. Full disclosure here.

Compare our Income portfolios with other low-risk options

Income portfolios | Big banks' chequing | 3-year GICs | |

|---|---|---|---|

| Product type | Managed investment portfolios | Chequing account | Investment accounts |

| Purpose | Short- and medium-term goals | Everyday finances | Short- and medium-term goals |

| Yield | Up to 3.8% | Up to 0.01% | Up to 3.34% |

| Risk | Low | None | Low |

| Access | Withdraw anytime | Withdraw anytime | Locked in for 3 years |

| Fee | 0%–0.5% | Up to $30/month | 0% |

Turn your sitting cash into stable earnings

Invest your money with low risk and full flexibility.

Dive deeper into these portfolios with our helpful articles

FAQs

How is the yield to maturity calculated?

How is the yield to maturity calculated?

Yield to maturity (YTM) reflects the targeted annual return if bonds are held to maturity at current market prices. For our Core Bond portfolio, YTM is the market value-weighted average of the underlying securities, shown net of management expense ratio (MER) and gross of the Wealthsimple management fee. The yield information is updated monthly.

It’s worth noting that the yield is subject to change due to fluctuations in dividend payments, ETF prices, and portfolio composition. Past performance is not indicative of future results.

What’s the difference between yield and targeted return?

What’s the difference between yield and targeted return?

Great question. Each portfolio has a unique strategy, which is why their potential returns are shown differently.

- Yield is shown for our portfolios that hold mostly cash and bonds (like the Money market and Core bond portfolios). It reflects the current income generated by their underlying investments.

- Targeted return is used for our portfolio that holds a mix of stocks and bonds (the Vanguard Dynamic Income portfolio). This is an estimated calculation of how we expect the portfolio to perform, including both income and potential growth from stocks. Actual returns may vary.

How do you calculate targeted returns for the Vanguard Dynamic Income portfolio?

How do you calculate targeted returns for the Vanguard Dynamic Income portfolio?

The targeted return for the Vanguard Dynamic Income portfolio is calculated using the proprietary Vanguard Capital Markets Model (VCMM), which generates forward-looking, 10-year return outlooks for most global stock and bond sub-asset classes. To get into the details, this portfolio is 30% equity and 70% fixed income. It includes 13 ETFs — roughly 22% of the portfolio is USD ETFs. The targeted return is calculated net of Wealthsimple’s management fees — which range, depending on if you’re a Core, Premium, or Generation client.

Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modelled asset class. Results from the model may vary with each use and over time. Simulations are as of December 31, 2025. These return assumptions depend on current market conditions and, as such, may change over time. Any total return illustrated does not take into taxes payable by clients that would have reduced returns.

The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature and do not reflect actual investment results. Targeted returns are not guaranteed. Past performance is not indicative of future results and may not be repeated. All investments involve risk.

What is Wealthsimple's relationship with Vanguard?

What is Wealthsimple's relationship with Vanguard?

They're one of our partners, and we work with them to make investing more accessible. We use some of their investing products — like, say, the Vanguard Dynamic Income portfolio — to build and manage certain portfolios. While we work with Vanguard, we also operate independently to provide our own tools and services.

One other thing: That Vanguard name? It's used under license, and is trademarked by the Vanguard Group.

Can I invest in all three of the Income portfolios?

Can I invest in all three of the Income portfolios?

Yes, you can invest in all three, but each one requires its own account. For example, if you wanted to invest in all three Income portfolios within a TFSA, you’d need to open three separate TFSAs — one for each portfolio.

Why choose an Income portfolio over holding cash?

Why choose an Income portfolio over holding cash?

The Income portfolios can offer a higher yield than just holding onto your extra cash, and it can add up over time if you’re comfortable taking a small amount of risk.

Although you can certainly do worse than holding your money in a Wealthsimple chequing account, investing in our low-risk Income portfolios might perform even better. Over a few years, the probability of outperforming our chequing account is 80-90%, and the probability of having losses over that period is very low. And even if you happen to underperform the chequing account once in a while, it typically won't be by much.

Disclosure: The probability of Income portfolios outperforming the Wealthsimple chequing account are modelled using normal distribution of returns, assuming 2% volatility, 0.5 Sharpe ratio (the measure of how good an investment’s returns are compared to its risk), and a 3-year time horizon.

Sharpe ratios and volatility assumptions are based on Wealthsimple's forward-looking asset class assumptions, which are derived from historical data and Wealthsimple analysis. There is no guarantee of return or the results described. Past performance is not indicative of future results.

Can I access my funds whenever I need them?

Can I access my funds whenever I need them?

Yes. Unlike GICs, you can withdraw your money anytime, without commitment periods or penalties. Just keep in mind that it takes 1–2 business days to process the sale of Income portfolios.

Why should I choose a managed Income portfolio instead of buying individual bonds or bond ETFs myself?

Why should I choose a managed Income portfolio instead of buying individual bonds or bond ETFs myself?

First, the risk of one company defaulting matters a lot less when you hold a diversified Income portfolio, rather than picking a few yourself.

We believe professional, active management has advantages over choosing individual bond ETFs. Our managed Income portfolios carefully mix two kinds of risks that balance each other out: the risk that borrowers might not repay their loans (credit risk) and the risk that interest rates might change (duration risk). We change how much of each risk we take on as the market changes, and we do it for two reasons:

- To lower the chance of losing money

- To earn you more interest than you would by just keeping your money in a savings account.

You won’t find those features in an off-the-shelf index ETF, which simply takes the issuance of bonds as they come. So, if the government issues a lot of bonds, you buy those. If risky corporations issue a lot of credit, you buy those. It’s not optimized for spreading out risk or protecting your money when markets aren’t performing in your favour. As a result, you might not earn as much money as you should for the risk you're taking — and if there's a market downturn, you might even lose more money than you'd expect.

What fees are associated with each of the Income portfolios?

What fees are associated with each of the Income portfolios?

The Money market portfolio does not include any management fees. The Vanguard Dynamic Income portfolio and the Core bond portfolio have two types of fees. And as you might expect from us, they're pretty low.

The first is a management fee. It's what you pay us to take care of your investments. The amount you pay depends on your tier:

Core: 0.5%

Premium: 0.4%

Generation: 0.2%–0.4%

The second is a Management Expense Ratio (also known as an MER). This goes towards the funds we use in your portfolio and is, on average between 0.15–0.2%. In the rare case where it happens, you will be notified of changes to the MER for your income portfolio.

Tip: We show Income portfolio yield to maturity net of ETF MER but gross of Wealthsimple management fees. For example: If your Income portfolio yield to maturity is 3.7% and you're a Wealthsimple premium client, your net yield to maturity after fees, is 3.7% – 0.40% = 3.3%

How is this different from GICs, HISAs, or investing in bonds directly?

How is this different from GICs, HISAs, or investing in bonds directly?

Income portfolios aim to give you reliable returns, but without the drawbacks of other options. Here are some of the advantages:

- Unlike Guaranteed Income Certificates (GICs), you can access your money at any time, because it’s not locked in.

- Compared to High-Interest Savings Accounts (HISAs), this portfolio offers higher targeted returns by investing in bonds instead of cash.

- If you’re considering managing your own portfolio of bond ETFs directly, this portfolio saves you the hassle of reinvesting, rebalancing, or adapting to changing market environments, while keeping fees much lower than the average mutual fund.

When is the interest paid out?

When is the interest paid out?

The interest from your Income portfolio lands in your account every month. We’ll automatically reinvest it so that all of your money is working harder, bringing you closer to your financial goals.

What are the risks associated with this portfolio?

What are the risks associated with this portfolio?

Like all investments, Income portfolios aren’t entirely risk-free. While they focuses on high-quality, low-risk bonds, bond values may decline if interest rates rise. There’s also some credit risk: during major market downturns, like in 2008 or 2020, the chance of defaults increases, which could lead to minor losses. Our team works hard to keep risks low, but it’s important to remember that returns aren’t guaranteed.

Is there someone I can talk to to help me choose the right portfolio?

Is there someone I can talk to to help me choose the right portfolio?

Yes! If you (or your combined household) have over $500,000 with Wealthsimple, you can work with one of our advisors for a small fee. They’ll work alongside you on decisions to help grow your wealth, like choosing the Income portfolio that best fits your goals.

If you have general questions about Income portfolios, we have a number of resources you can check out in your own time. Our guide to opening a bond portfolio’s a good place to start.