Wealthsimple Presents

Investing that puts you in CTRL

Tap into smarter investing with advanced trading tools, high-powered portfolios, and even lower fees. Ready to nerd out?

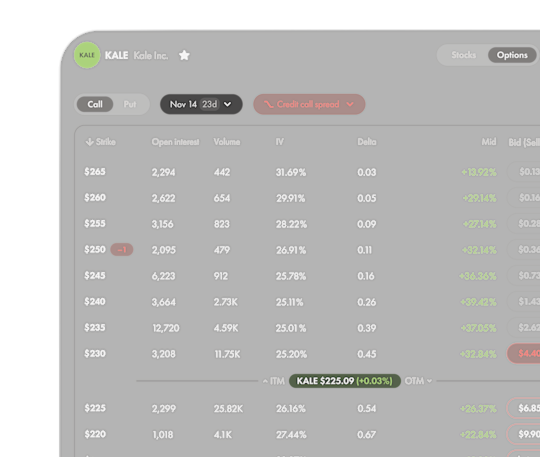

Break up with your broker

Out-trade your broker with intuitive tools, a powerful new desktop experience, and seriously low fees.

Gold

Trade gold with the lowest fees in Canada

We’ve built the the simplest way for you to own real, physical gold for as little as $1.

Lowest fees. Period.

Enter your monthly trades to see how much you could save by ditching the big banks.

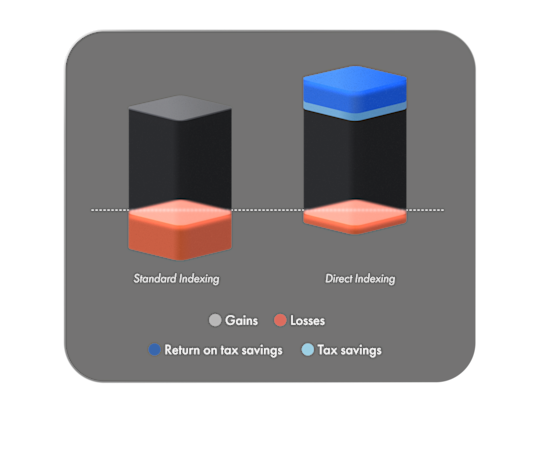

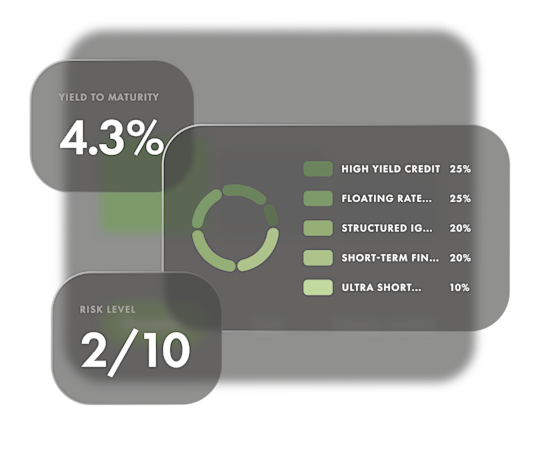

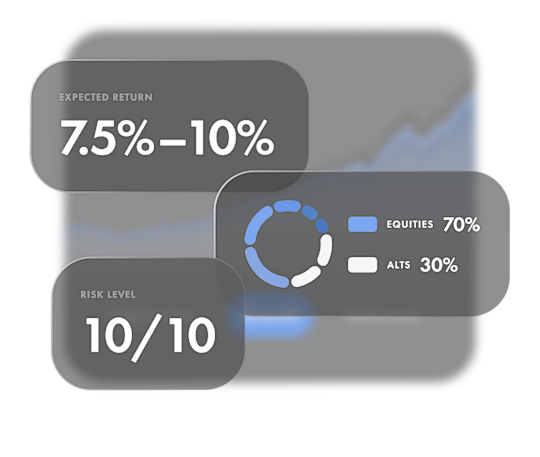

Portfolios that beat your mutual funds

Balanced, automated, and expertly built. Meet our most advanced portfolios yet.

Silvi Woods, wealth manager

Advice

Give your money the VIP treatment

Pamper your money with our full-service wealth management services — backed by dedicated advisors, our powerful platform, and smarter planning tools.

Plus, stay tuned for

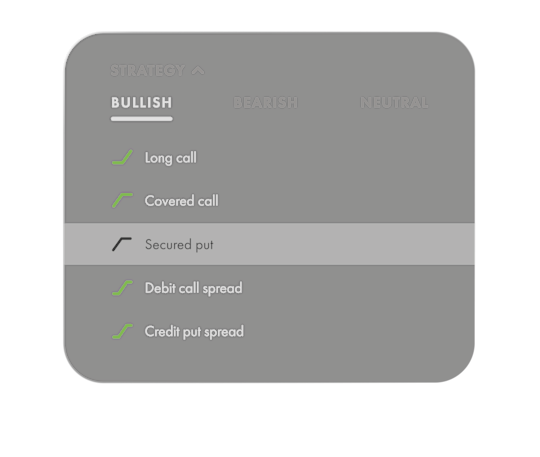

more complex strategies Early 2026

more complex strategies Early 2026

Norbert’s Gambit Early 2026

Retirement Accelerator Early 2026

natural languages stock screener Early 2026

earnings call insights & summaries Early 2026

AI research Early 2026

more complex strategies Early 2026

Norbert’s Gambit Early 2026

Retirement Accelerator Early 2026