It’s happened to your dad, your childhood best friend, your boss, and—if you’re reading this post—it’s probably happened to you. You’ve gathered all your documents, completed your tax return, filed it through NETFILE, and are feeling pretty good about being done. But then you receive another slip, find a missing receipt, discover a typo, or simply realize that you need to make a change.

First, don’t panic. You can change your return. While you can’t resubmit your return through NETFILE, making a change isn’t hard. Let’s walk you through it.

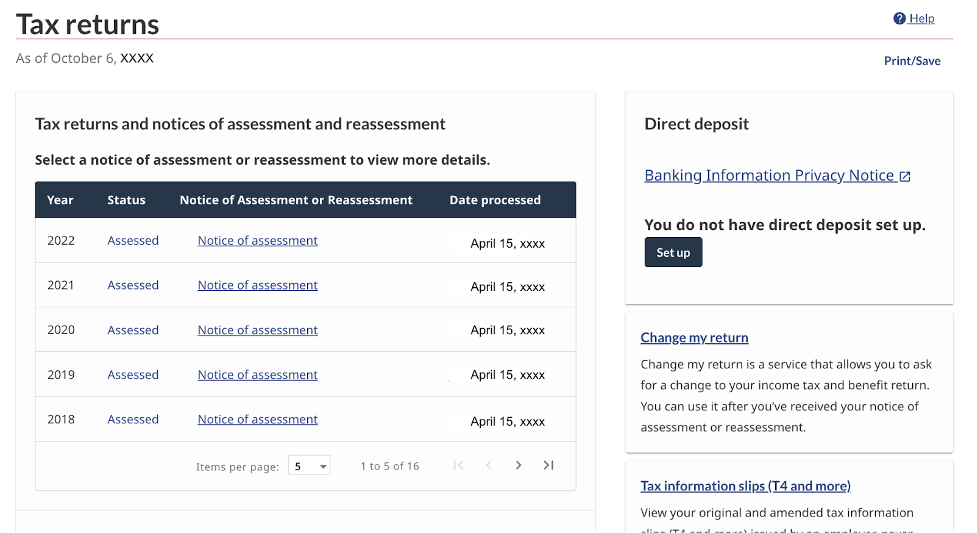

You can only change your return once it’s been assessed. This usually occurs within seven days of filing but the Canada Revenue Agency’s (CRA) service standard is to have your return assessed and Notice of Assessment within two weeks if filed through NETFILE. Note that if you didn’t use NETFILE, or if you invest in tax shelters, this can take longer. Using CRA My Account, you can click on the “Tax Return” tab to see whether your return has been assessed.

How to change your tax return

Using CRA My Account

Some tax software allows you to change your return, but you can also do it online using CRA My Account. Log in to CRA My Account and click the blue Change my return link in the Tax Returns section.

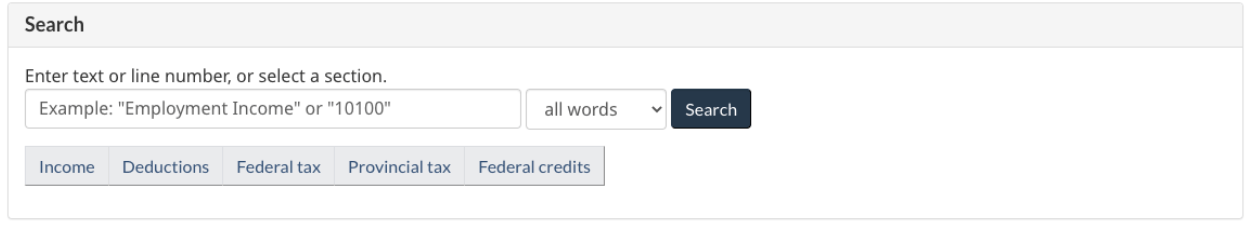

Select the year you want to change. A page like this will appear:

Use the search box to find the line numbers that have changed on your return. Enter any amounts that have changed (several fields won’t accept decimal places, only enter decimals, if the field you are changing shows decimals in CRA My Account).

Make all of your changes before clicking Review and Submit Changes. The CRA will save your changes as you go. (There’s no save button, but it saves.) When you’re happy with your changes, click Submit.

When you’re ready to confirm and submit the changes, the CRA may display “errors” or “warnings.” Errors stop you from making a change until you provide additional information, while warnings give you the opportunity to add additional information that may be applicable to you.

After submitting your changes, you may have an amount owing. Depending on the size of the amount, you may also be able to arrange paying in installments. You can send money to the CRA through your bank, similar to how you pay bills. Simply add the CRA as a payee with your SIN as the account number. You can confirm your changes and payment by checking My Account.

On paper (T1 Adjustment Request)

If you aren’t able to use ReFILE or CRA My Account, you can file a paper T1 Adjustment Request. Simply transcribe the changes from the Show Differences box onto the T1 Adjustment Request. Mail the T1 Adjustment Request and any supporting slips or documents described on the form to your tax center (find the address on page 2).