Private equity

Outperform public markets with private equity

Over the past 24 years, annual returns from investing in private companies beat the stock market by 4%.* But the asset class was largely reserved for institutional investors and the ultra-wealthy. Now many more clients can invest through us.

23.6%

Annualized total return

100%

Co-investments and secondaries

$404M

Assets under management

Information updated January 2026. Past performance is not indicative of future results and may not be repeated. See disclaimer.

How the fund works

Strong partners

We partnered with LGT Capital Partners, an institutional asset manager with a record of superior returns, and invest alongside their shareholders.

A mindful approach

Along with co-investing, which reduces overall fees, the fund also invests in secondaries, immediately broadening its diversification.

Long-term focus

Helping companies become more profitable takes time. The longer you can stay invested, the higher your potential earnings could be.

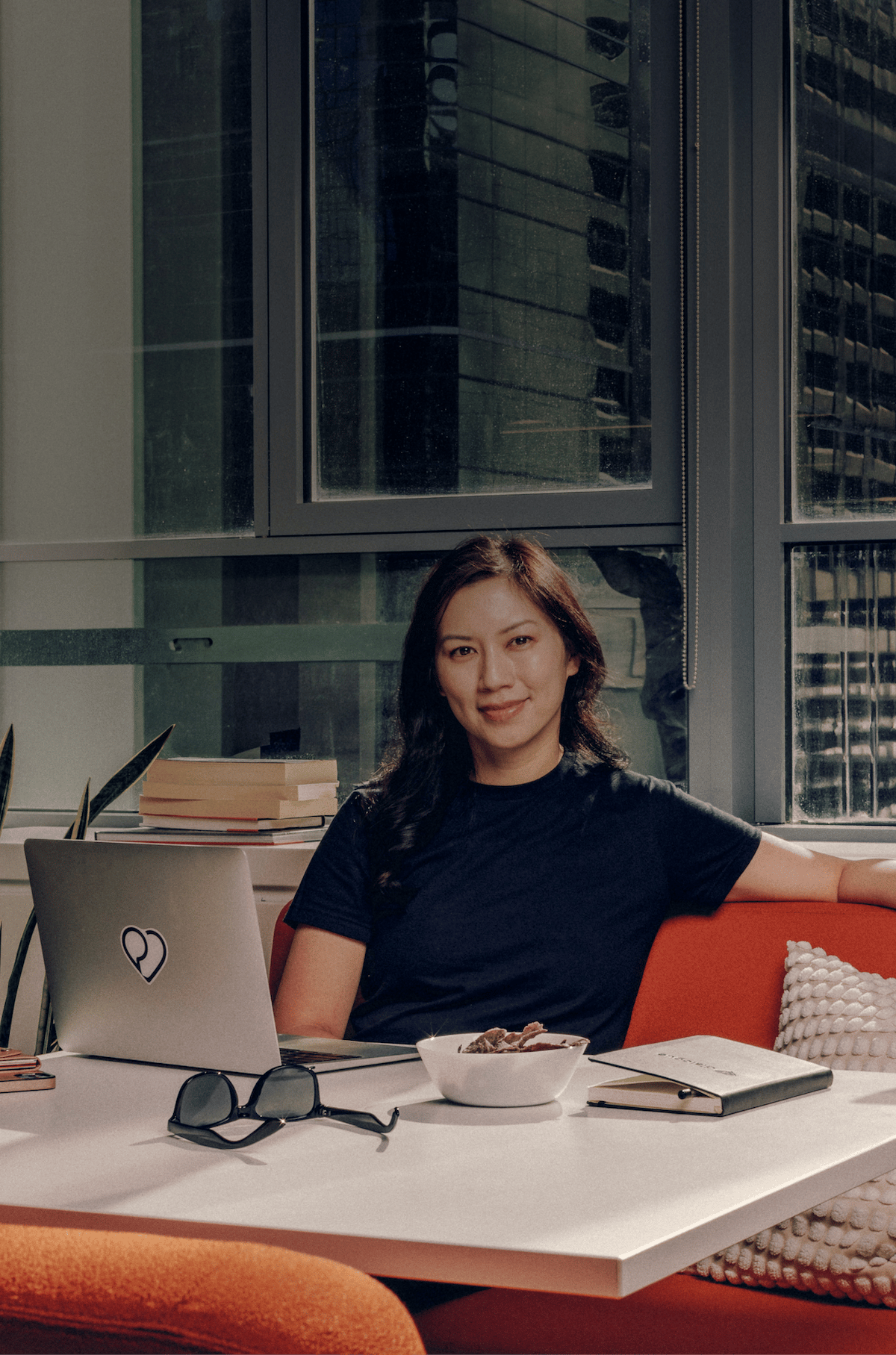

Who the fund is for

The Wealthsimple Private Equity fund is available to all eligible clients. Qualifications include:

$50,000

In investable assets

$10,000

Minimum investment

3+ years

Minimum investment horizon

Performance history

Here's what $10,000 invested when the fund launched in January 2024 would be worth today.

This data is for illustrative purposes. Past performance is not indicative of future results and may not be repeated. See disclaimer.

Monthly returns

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.9% | -0.3% | 2.2% | -2.4% | 1.0% | 1.2% | 1.7% | 3.1% | 2.4% | 0.0% | 1.1% | 0.6% | 12.0% |

This data was last updated January 2026. See disclaimer

Annualized performance of private equity vs. public equities

Since 2001, private equity has on average resulted in higher returns than similar assets in public markets.

Source: Bloomberg S&P500 Total Return Index; S&P600 Total Return index; Bloomberg MSCI World Total Return index; Preqin Global Private Equity index

This graph represents past performance of private equity from 2001/01 to 2024/09; it does not represent investments made by Wealthsimple’s private equity product. The past performance of private equity or any other security or investment strategy is not an indicator of future performance, and past performance may not be repeated. All investments involve risk.

Our strategy

Wealthsimple Private Equity invests in a fund managed by LGT Capital Partners, an institutional asset manager with 25 years of experience and a record of superior returns. We are investing alongside LGT’s shareholders, which means LGT is highly incentivized to manage for returns rather than simply gathering assets to collect more in fees.

The LGT fund we invest in consists primarily of direct investments in companies alongside other private equity funds and investments in secondaries — funds that have already deployed their investments. Co-investing reduces overall fees, and investing in secondaries allows the portfolio to be highly diversified since those investments provide immediate access to a broader spectrum of companies.

Current fund exposures

We invest in companies across a variety of industries and geographies, either directly or through secondary investments.

Breakdown by Industry

Information Technology

- 35%

Industrials

- 24%

Health Care

- 16%

Financials

- 10%

Consumer Discretionary

- 10%

Communication Services

- 2%

Other

- 3%

Breakdown shown as of January 2026. Fund sector composition may change over time and chart may not be reflective of current composition.

Invest beyond public markets

Boost your potential for profit by adding private equity to your portfolio.

FAQs

Why have private equity returns been higher than other investment options?

Why have private equity returns been higher than other investment options?

There could be many reasons: it could be because private equity managers have successfully identified companies that outperformed the broader market. They also tend to use more leverage than typical companies, which increases their risk — but also returns. And lastly: some private equity companies have shown the ability to improve company profits.

How much should I invest in private equity?

How much should I invest in private equity?

The appropriate amount depends on the riskiness of your overall portfolio. Private equity is a component of your allocation to equities, so it isn’t a source of diversification if you already have a significant portion of your investments in equities. Our team will assess how private equity fits into your broader portfolio and determine how much you can invest based on your overall target portfolio risk.

How risky is this?

How risky is this?

Equities are one of the riskier asset classes, and private equity is a high risk type of equity investing.

Investors also need to carefully consider the manager — some of whom may perform better (or worse) than the index as a whole. Top quartile funds have earned significantly more than public markets (ranging around 10%, with variance by year), while bottom quartile funds have actually underperformed public markets.

Beyond company and manager risk, private equity investors have limited liquidity, meaning that they can’t sell on the open market the way that they can with a public stock. This may be a source of return, but it also means that they can’t get their money back when they want it. Also, private managers may delay selling companies when they believe that valuations are low, which could align with when investors want to sell.

Specifically for Wealthsimple’s private equity, investors will also be subject to currency risk. However, this is no different than other international ETF investments with us.

Private equity investing is not for everyone. Our team of advisors will get to know you to determine whether you are a good fit for this product.

How does Wealthsimple manage the risk?

How does Wealthsimple manage the risk?

Because private equity is risky, and it’s not like the stock market where you can buy an index fund and get the returns, it’s important to manage risk carefully. We do this in a few ways:

Our investment research team conducts up-front due diligence in each manager, and monitors the manager to ensure performance is up to standards. Our due diligence includes manager interviews, quantitative benchmarking, a review of operational and governance practices, and reference checks.

We also manage risk by choosing a manager that will construct a highly diversified portfolio — think hundreds of positions instead of the ten or so that are common in many private equity funds.

Finally, portfolio construction is the ultimate form of risk management. We don’t overweight private equity in our portfolios too much, and we make sure that the amount held is appropriate for your individual situation.

What kinds of companies will I be investing in?

What kinds of companies will I be investing in?

We'll primarily invest in mature businesses across a variety of industries from around the world. Unlike venture capital or growth equity, private equity does not primarily invest in relatively young companies. Instead, private equity investments are made where the investors believe that they can materially improve the performance of an existing company, often through improvements in operations.

Is there a lockup period? How do I withdraw funds?

Is there a lockup period? How do I withdraw funds?

It's best to think of this as a long-term investment. Therefore, we plan to make redemptions available once per quarter (on the last day of the quarter), with 100 days notice required. Clients can collectively withdraw up to 5% of the portfolio value. In that event, if total cash redemption requests exceed 5%, we will allow clients to redeem their units for cash on a pro-rata basis. Redemptions may be suspended in certain circumstances and may vary depending on the liquidity of the Fund’s portfolio. Redemption requests in excess of any cash redemption limit may be satisfied by the issuance of redemption notes, which are non-transferable.

Withdrawals will be subject to a settlement period of up to 100 days after the end of the quarter in which the redemption is requested.

We're also taking a number of steps to make sure you know and can tolerate the illiquidity of this investment, including a cap on the investment size and a suitability check. Even with these steps, you should know that you may not be able to withdraw all of your funds.

Does private equity have management fees?

Does private equity have management fees?

On top of Wealthsimple's standard managed account fees for its advisory services, the investment will be subject to other fees based on the underlying managers. For example, the investment with LGT will be subject to 1.5% management fee and a 12.5% performance fee, calculated and payable on a deal-by-deal basis, provided the deal earns at least an 8% return.

There are often fees from the managers of private equity funds for secondary interests in funds, which will vary depending on the manager. While these can be substantial, keep in mind that they're often outweighed by the discount in price.

Historically, private equity as a sector has on average delivered net-of-fee returns well in excess of the stock market. It's been an attractive source of wealth-building for high-net-worth investors and institutional investors.

Who will manage my investment? How is Wealthsimple’s private equity different from other options?

Who will manage my investment? How is Wealthsimple’s private equity different from other options?

Our investment team chooses private equity managers after doing extensive due diligence, and will monitor managers’ performance on behalf of our clients.

Our clients will primarily invest with the Royal Family of Liechtenstein's wealth management group (known as LGT), which offers investment funds to co-invest with the family’s wealth.

We believe that makes investing with us a unique opportunity for a few reasons:

- Mutual incentive: The royal family is expected to co-invest alongside the external investors, which means that they're highly incentivized to manage for returns.

- Newly deployed capital: By deploying only new capital, our investors may achieve more attractive valuations.

- Track record and reputation: Since 1998, they’ve delivered annual returns averaging more than 18% across all of their secondary and direct investments. Many LGT funds have a track record of top or second quartile returns compared to Preqin benchmark for global private equities, and has decades of successful investing experience in private equity.

Our figures are based on LGT Capital Partners internal data dated 1998/01 to 2023/03. Calculated returns includes all LGT CP direct and secondary transactions (dollar invested weighted) and fees and costs charged by the underlying funds but excludes LGT fees.

As compared to Preqin Global Private Equities benchmark, 12 funds were top quartile, 6 funds were second quartile in 2022, and 5 funds were second quartile in 2023. The information provided here represents a discussion of aggregate LGT funds. The Fund is new and has no performance history. The ranking applies to funds that have reported data within the past 5 quarters.

As always: the past performance of an LGT or other security or investment strategy is not an indicator of future Wealthsimple performance, and past performance may not be repeated. All investments involve risk.

Note that we may decide to add other private equity managers in the future.

What type of private equity am I investing in?

What type of private equity am I investing in?

We'll invest in existing private equity fund investments (“secondaries”) and new private equity investments directly in companies (“co-investments”).

Secondary investments are often sold at a discount, tend to have a shorter holding period, and are, by their nature, fully deployed. Historically, secondary investments have achieved superior returns to direct fund investments, often because these investments are sold at a discount to reflect the seller’s need for cash.

Co-investments are direct stakes in companies that are being acquired by a private equity firm. Funds often make purchases that are larger than they want to include in one fund to be sufficiently diversified. To solve this, firms invite major investors to invest additional money. These investments are lower fee and have had similar returns to other private equity investments.

We may also invest in liquid assets to provide liquidity to investors.

* How did you calculate private equity returns versus the stock market?

* How did you calculate private equity returns versus the stock market?

Good question.

Our comparison is based on Bloomberg MSCI World Total Return index and Preqin Global Private Equity Benchmark from 2001/01 to 2024/09. The past performance of private equity or any other security or investment strategy is not an indicator of future performance, and past performance may not be repeated. All investments involve risk.

You can find out more about the comparisons here.