Ever looked at a stock chart that’s moving sideways and thought, “I wish I could make money on nothing happening?” An iron condor could be what you’re looking for!

What is an iron condor?

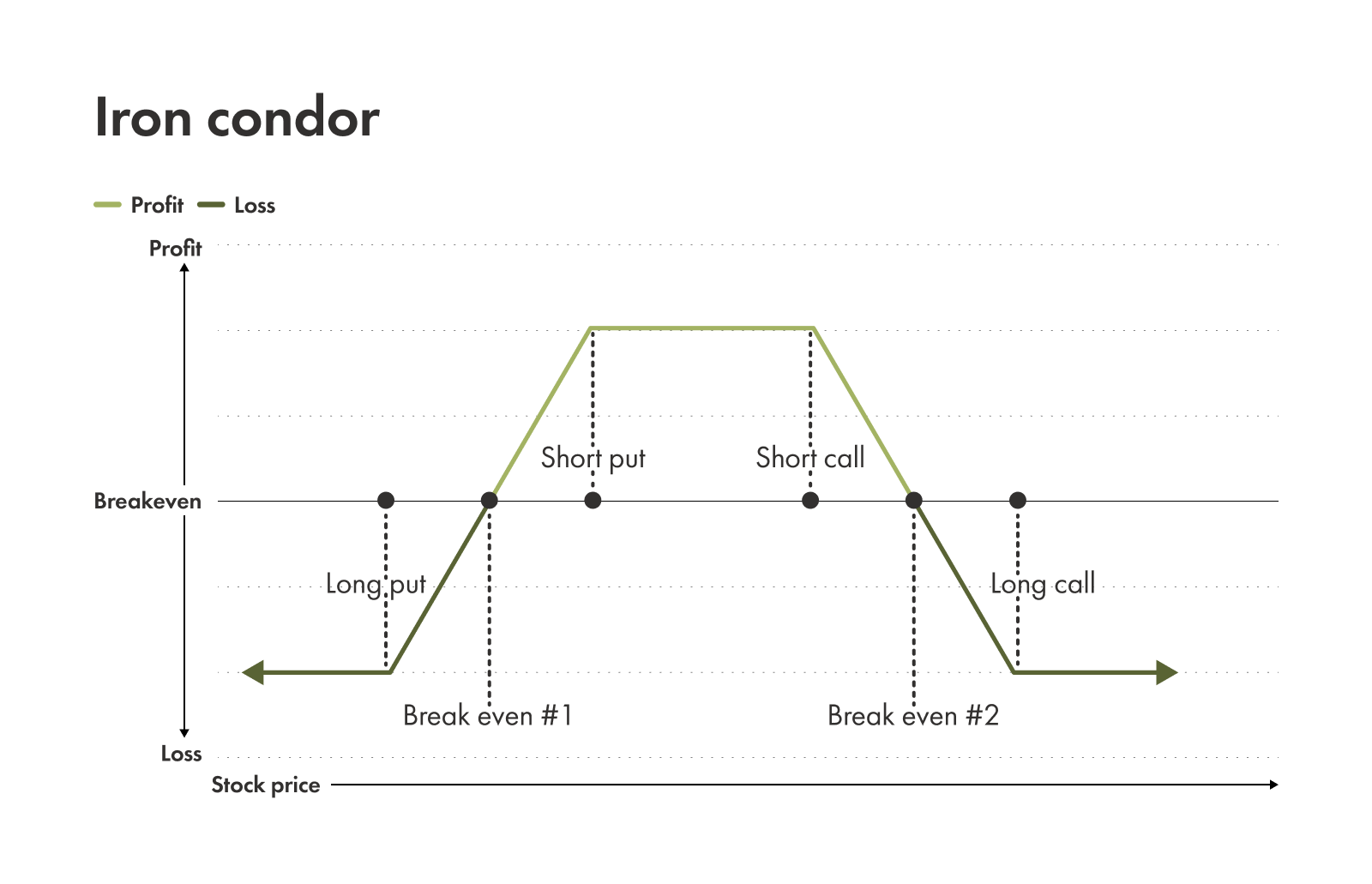

An iron condor is made of four options: two credit spreads glued together.

Credit spreads happen when you sell an options contract to make a profit, and then buy a second, further-out option to limit your risk of losing money.

In an iron condor, one of the credit spreads is above the stock price (the call spread), and one is below (the put spread). If the stock price stays in the middle range, you can make a profit.

Because of this neutral outlook, traders can find the iron condor useful in mostly sideways markets.

It also comes with two big benefits: defined risk and time decay.

Defined risk: Because you use credit spreads to create an iron condor, you can calculate ahead of time exactly how much you can gain or lose from an options contract.

Time decay: When it comes to an iron condor, time is on your side. Because you’ve sold options contracts that you hope will expire unused, time passing while the stock does nothing is a win for you!

But the iron condor also comes with two major risks: increased volatility and asset price changes.

Increased volatility: After the sale of the options contracts, you want volatility to fall so you can close with a profit. But if volatility explodes after you make the sale, it can really hurt your spreads.

Asset price changes: Beyond general market volatility, factors causing the iron condor’s underlying asset to spike or drop in price dramatically can hurt your spreads as well.

Iron condor construction

If you want to build your own iron condor, here’s a blueprint to follow.

Components

1. An underlying asset. You can buy and sell options on a number of different assets, but the most common include stocks, exchange-traded funds (ETFs), indexes, commodities, and currencies.

2. A short call spread. This credit spread contains two legs:

One out-of-the-money (OTM) call option, which you sell for a larger amount of money

One further OTM call option, which you buy for a smaller amount of money

3. A short put spread. This credit spread also has two legs:

One OTM put option, which you sell for a larger amount of money

One further OTM put option, which you buy for a smaller amount of money

4. An expiration date. All of your options will need to share the same expiration date.

Terminology to know

Wing width: This is the distance between the short strike (the one you sold) and the long strike (the one you bought) on each side. For example, if you sell a $100 call and buy a $105 call, you have a $5 wing width.

Net credit: This is the cash deposited into your account the moment you execute the trade. It’s the total premium you collect.

Setup

1. Choose an underlying asset: Traders start creating an iron condor by picking an asset they think will have little volatility going forward. This tends to be done with broad ETFs or large, active stocks with tight bid-ask spreads.

2. Pick the expiration date: When choosing the expiration date, the main thing you have to consider is time decay. A short expiry speeds up time decay while increasing exposure to sudden price changes. A longer expiry slows down time decay but can create sensitivity to market volatility.

Generally, 30 to 60 days to expiration (DTE) is close enough for theta to start kicking in, but far enough to avoid stress from minor price swings.

Note: Weekly or 0DTE iron condors exist, but they are like juggling chainsaws — for advanced traders only.

3. Choose the strike prices: Look for the “delta” column in your options chain. A common target is around 15 to 25 delta for your short strikes.

In plain English, a 20 delta roughly implies there’s only a 20% statistical chance the option finishes in-the-money. This creates a high probability of profit.

4. Pick the wing width: This determines your risk. You can adjust it to match your comfort level. If you want less risk per trade, keep the wings narrow.

Credit target rule of thumb: Among traders, common practice is to aim for a credit of roughly one-third of the wing width. For example, if your wings are $5 wide, you ideally want to collect about $1.66 in credit. This ensures the risk is justified.

Order entry tip: Enter this as a single multi-leg order (an “iron condor” order type). The market moves fast, and you’ll want to lock in one price for the whole bundle to control slippage!

Balanced vs. unbalanced condors

You can also customize an iron condor if you’re feeling more bullish or bearish.

Balanced: The classic approach. As its name suggests, a balanced iron condor has set the short strike at the same distance or delta from the current price. It’s used when you have a truly neutral outlook on the underlying asset.

Unbalanced: These iron condors skew to make the risk smaller on the side you fear more. For example, you might create a wider long wing or have fewer contracts on the riskier side.

An important aspect to note here is volatility skew. Often, puts are more expensive than calls because people fear crashes more than rallies. You might find you can go further out of the money on the put side and still collect a decent premium.

Capital, margin, and liquidity

Iron condors are a defined risk strategy, which is great for capital efficiency. But there’s still risk involved.

Max loss

Your max loss per contract = the wing width − the net credit

Buying power

With this strategy, your broker will usually hold collateral equal to the max loss.

Liquidity check

Before clicking "sell," look at the open interest. Is it in the thousands? Good. Is it 12? Run away. You need liquidity to exit the trade if things go wrong. Tight bid-ask spreads and good volume help here too!

Pro tip: Index options (like SPX or NDX) are cash-settled, meaning you don’t have to worry about owning the actual shares if you lose. This reduces the "assignment headache" significantly.

Payoff, breakevens, and ‘the Greeks’

Let’s look at the math using an example:

Stock PLUM is trading at $410/share and is expected to experience low volatility and price change over the next month.

A trader sets up the following iron condor:

Position | Strike price | Premium | Max number of shares |

|---|---|---|---|

| Long put | $385.00 | -$1.00 | 100 |

| Short put | $390.00 | $1.70 | 100 |

| Short call | $430.00 | $1.70 | 100 |

| Long call | $435.00 | -$1.00 | 100 |

Net credit

Short put premium + short call premium = net credit

$1.70 + $1.70 = net credit

$3.40 = net credit

Net debit

Long put premium + long call premium = net debit

-$1.00 + -$1.00 = net debit

-$2.00 = net debit

Maximum profit

Maximum profit = (net credit − net debit) x max number of shares

Maximum profit = ($3.40 − $2.00) x 100

Maximum profit = ($1.40) x 100

Maximum profit = $140.00

Maximum loss (per side)

Maximum loss = (wing width − credit) x number of shares

Maximum loss = ($5.00 − $1.70) x 100

Maximum loss = ($3.30) x 100

Maximum loss = $330.00

Lower breakeven:

Lower breakeven = short put strike − net credit

Lower breakeven = $390.00 − $1.40

Lower breakeven = $388.60

Upper breakeven:

Upper breakeven = short call strike + net credit

Upper breakeven = $430.00 + $1.40

Upper breakeven = $431.40

Picture a flat “profit shelf” between the two breakevens. As long as the stock price hangs out on that shelf between $388.60 and $431.40, you are green. You make the most if the price ends up comfortably in the middle. If it falls off the shelf, you enter the loss zone.

Ideal market conditions and timing

Not every market is condor-friendly. You are essentially selling insurance against disaster; you want to sell that insurance when premiums are high, but the actual risk of disaster is low.

When to fly the iron condor

There are three ideal times for this strategy.

Sideways or gently drifting markets: In this case, the asset is stuck within a certain price range.

High IV: When researching whether to use an iron condor, check the IV rank or IV percentile. If it’s above 30 or 50, premiums are “juicy.” Traders want to sell during high volatility with a good chance of falling.

A quiet calendar: There are lots of major events that can cause changes in both market volatility and sudden price changes in assets. Make sure there are no upcoming Federal Reserve meetings, earnings reports, or major geopolitical summits happening before your planned expiry.

When to be cautious or skip

It’s also important to know the three key times this strategy doesn’t work.

Extremely low IV: If the volatility level in the market is sleeping at historic lows, you aren't getting paid enough to take the risk. It’s like picking up nickels in front of a bulldozer.

Earnings season: It’s not a good idea to hold an iron condor through an earnings announcement or big macro announcements. The asset could jump or fall overnight, blowing right through your wings.

Strong trends: If a stock just broke out to a new all-time high on massive volume, now is not the time for a condor.

The playbook: trade management and adjustment

Taking your options trades to the next level means knowing how to manage a trade that goes wrong.

A strong setup is the key to a good trade. Before you start, make sure you have all of the following:

Entry checklist

IV rank is reasonably elevated (ex. >30)

Spreads are tight (ex. about $0.10 or less on $1 wide spreads)

Open interest > 500

Risks < 2% of your account on this trade

Exits and profit-taking

Just like being a good house guest, if you’ve entered an iron condor at the right time, it’s also important to know when to leave.

Remember: greed kills iron condors. It’s generally considered a good idea to close early at 25% to 50% of max profit to avoid surprises.

Many traders will opt to close around 21 DTE (21 days to expiration) to avoid gamma risk (or late-game swings).

Defence: when the market moves

What do you do if the asset challenges one of your short strikes?

1. Roll the untested side. If the stock is rallying toward your calls, your puts are now way out of the money and almost worthless. You can roll options on the put side up closer to the stock price and re-center the trade. This lets you collect more credit, which widens your breakeven points and reduces your max loss.

2. Roll the tested spread. If the price is breaching your call side, you can roll the call spread out to a later expiration date. This is the classic "rolling options" defense. You are buying time for the trade to work out and ideally collecting a net credit for the roll.

3. The "broken wing" adjustment. You can widen or move the long wings on the threatened side to change the risk profile, to reduce the worst-case loss, though this requires more capital.

4. The iron butterfly morph. If the price camps right on top of one of your short strikes, seasoned traders might roll the untested side all the way up to meet the tested side, turning the iron condor into an "iron butterfly." This collects a massive credit but creates a very narrow peak for profit. You can also consider morphing it into a single credit spread.

5. A small hedge. Adding a cheap debit spread to the challenged side can help when the asset challenges one of your short strikes.

When should you jump into action?

There are some clear triggers to act when it comes to assets challenging your short strikes:

Price touches or breaches a short strike

The delta of your short option hits 0.30

You’re down twice the amount of your initial credit

Offence: if the market stays calm

If the market does nothing (hooray!), you can add a second condor with a different expiration date. This “ladders” theta.

Risks, drawbacks, and how to reduce them

With research and defined risk on your side, iron condors tend to be high-probability trades, which means you win often. However, the losses can be large if you aren't careful. Some things to be aware of include:

Gap risk (tail risk): Imagine the market closes at $400 and opens tomorrow at $380 due to bad news. You can’t stop-loss your way out of an overnight gap. To mitigate this, keep your position size small, use wider wings, and consider earlier exits.

Volatility spikes: It’s good to favour entries when IV is already elevated and avoid known events that can affect the market. But even if the price stays in range, a spike in fear (IV) can pump up the price of the options you sold. You might see a loss on your screen temporarily. Usually, you just have to wait this out, provided the price is safe.

Assignment and pin risk: If you trade American-style options (which includes most stocks), you can be assigned early if your short option goes in-the-money. This is rare but happens, especially near ex-dividend dates on the call side. "Pin risk" is when the stock closes exactly on your strike price at expiration, leaving you unsure if you will be assigned. The solution: close your trades before expiration week.

Endgame (risk near expiration): Manage the iron condor before the final week if the price is near your shorts.

Liquidity and fees: Make sure you’re accounting for both of these factors. Wide bid-ask spreads and commissions can eat your edge.

Psychology: You will have many small wins and occasional larger losses. If you panic and close a trade every time it goes red, you will lose money. Also, set a firm max-loss per trade and respect it.

Early assignment: This can happen if options go in the money. Watch ex-dividend dates for short calls. You must trust the probabilities but respect your max loss stop.

Earnings-time premiums: Close to earnings, premiums look great, but the risk of an asset’s price falling dramatically overnight is very high. It’s best to avoid creating an iron condor for these situations, but if you try, keep the size tiny and use wider protection.

Common mistakes to avoid

Selling too close to the money. Don't get greedy. Selling a 40 delta option will increase the credit received, but with the increased rewards comes increased risk.

Ignoring the IV. Trading an iron condor when volatility is in the basement or wildly unpredictable might not have the most desirable risk-reward profile. It’s important to know where IV is sitting and what major events are on the horizon before diving in.

Trading illiquid assets. Review contract volume. Illiquid options have low trading volume and open interest, which makes it hard to find someone to trade with.

Adjusting too often. Sometimes the best adjustment is doing nothing. Over-adjusting can rack up commission fees and can lock in losses. Having a plan before you enter is essential.

Underestimating fees. An iron condor has four legs. Opening and closing it involves eight contracts total. Ensure your commission structure supports this style of trading and beware of slippage.

Holding to expiration near short strikes. Doing this can bring a lot of gamma risk along with it and potentially even assignment risk. Generally, it’s considered to be a better idea to close earlier to secure profits and cut down on risk.

Skipping max-loss exits. This is a great example of why managing an iron condor matters. By avoiding a maximum loss exit, traders allow the asset's price to go so far past the long strikes of their iron condor that the predefined loss limit is reached at expiration, or (in the case of poor management) they could even suffer losses beyond the intended maximum loss.