Trade gold with the lowest fees in Canada

We’ve built the simplest way for Canadians to own real, physical gold. Start building your fortune for as little as $1.

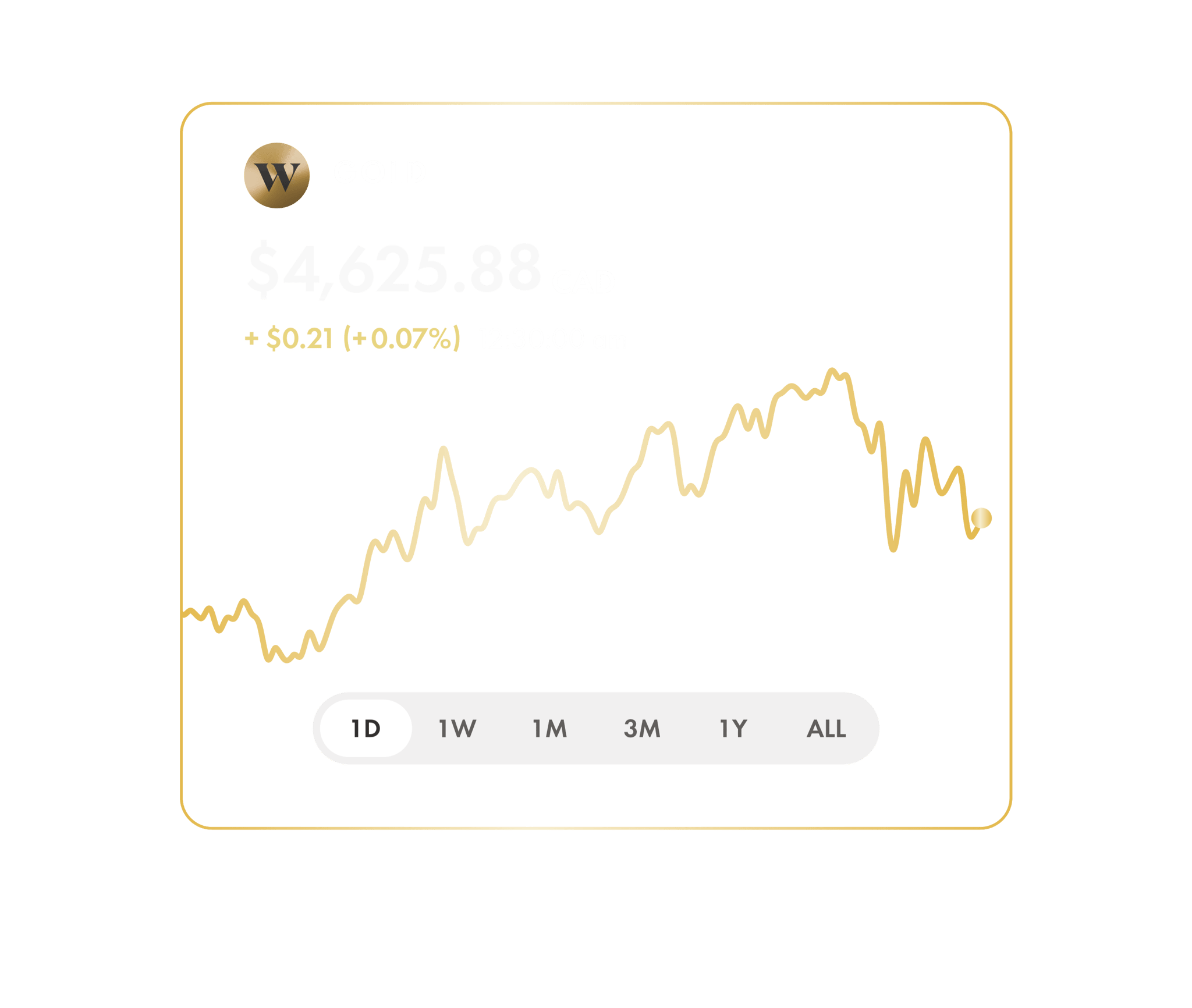

A brief history of how gold has kept on giving

Gold’s value has held steady throughout history, making it a smart choice during uncertain times. Or anytime, really.

The content presented in this chart is for informational purposes only. For more information read the full disclaimer.

Instant trading, anytime

We’re the only brokerage in Canada where you can buy and sell physically backed gold, 24/7 — with fractional trading, real-time pricing, and instant order execution.

Stored in safe hands

Your gold is fully insured and safely stashed away, fee-free, with our leading Canadian storage partners.

Cash it in for coins

Redeem your gold and we’ll send you limited-edition 1/10 oz or 1 oz coins, batch-made for Wealthsimple by the Royal Canadian Mint. Keep them on your mantel or in your sock drawer — just don’t let them end up in a tip jar.

Low fees that are easy to follow

Other brokerages have complicated fee structures. Here, we keep it simple with low fees that don’t take much figuring out.

Wealthsimple | That other online broker | |

|---|---|---|

| Pricing currency | CAD | USD |

| Trading fee | 1% on top of spot price | 2–4% on top of spot price |

| Commission fee | None | $19.95 USD per trade |

| Storage fee | None | 0.6% |

| Redemption fee Our partner arranges for raw metal to be minted into gold coins, then ships them to your door — all fully insured. This fee covers those costs. | 1 oz = 2.25% 1/10 oz = 11% | $75 USD |

| Delivery fee | Included in redemption fee | $35 USD per 500oz or per $100K USD value |

| Insurance fee | Included in redemption fee | $6.5 per $1K USD value |

FAQs

How does physical gold trading work?

How does physical gold trading work?

When you buy gold in the Wealthsimple app, it's the real deal: actual, physical gold, kept fully-secured and insured by our partners. Our exclusive Wealthsimple coins are available in either 1/10 oz or 1 oz, so once you’ve bought enough gold to make a coin (or multiple!), you can redeem it and have the coin(s) securely delivered to your door.

Even if you choose not to redeem it, you’ll still own a piece of 99.99% pure gold, and that’s a pretty nice feeling.

Gold trading isn’t available on web for now.

What’s the difference between trading physical gold and a gold ETF or stock?

What’s the difference between trading physical gold and a gold ETF or stock?

With physical gold, you have fractional ownership of a securely stored physical bullion. With an ETF or stock, you own a financial instrument that tracks the gold price, but have no entitlement to the physical underlying asset — and you’ll also pay MER fees.

What accounts can I trade and redeem gold from?

What accounts can I trade and redeem gold from?

You can trade gold within all Wealthsimple self-directed accounts, both registered (like a TFSA or RRSP) and non-registered accounts.

Redemption of Wealthsimple gold coins is only available for non-registered accounts.

Is my gold covered by CIPF?

Is my gold covered by CIPF?

Your accounts are protected by the Canadian Investor Protection Fund (CIPF) up to $1M per eligible account. Precious metals purchased and held in an account with Wealthsimple are covered under CIPF.

If you redeem your gold for coins, CIPF coverage no longer applies. You’ll need to make sure you have your own insurance in place.

What’s a redemption fee? And what does it cover?

What’s a redemption fee? And what does it cover?

Redemption fees cover our partners production fees, including cost of labour, materials and technology used in the minting process, and the cost of fully insured coin deliveries to our clients door. They’re determined by our partners and are outside of our control.

The cost to mint and ship gold coins is fixed and varies by the weight of the coins.

Where is my gold stored until I redeem it?

Where is my gold stored until I redeem it?

Your gold is stored securely in facilities including the Royal Canadian Mint and Brinks with $0 storage fees. We use segregated program level storage. This means means your gold is held in-trust for you with other Wealthsimple clients’ gold, and kept separate and apart from Wealthsimple’s assets, the assets of our storage partners, and the assets held by our storage partners for other parties. Your specific ownership amount is precisely tracked in our records.

How will my Wealthsimple gold coins be delivered? And when?

How will my Wealthsimple gold coins be delivered? And when?

When you redeem your gold, your Wealthsimple coin(s) are shipped securely by courier. Deliveries are fully insured, and most packages arrive within 7–10 business days of your redemption request.

Who has Wealthsimple partnered with to source the gold?

Who has Wealthsimple partnered with to source the gold?

We’ve partnered with Silver Gold Bull — a trusted Canadian precious metals dealer with expertise in sourcing, storing, and delivering physical gold. They provide the infrastructure and custody services for offering gold trading and redemption through Wealthsimple.

Is Wealthsimple really the only brokerage in Canada to offer gold trading online?

Is Wealthsimple really the only brokerage in Canada to offer gold trading online?

Yes! We’re the only brokerage in the country that allows you to buy and sell physically backed gold online, with 24/7 trading. While other brokerages do offer gold trading, it can’t be done through their online platform and can be a complicated process. Plus, their trading hours are limited, too.

We’ve compared Wealthsimple with all Canadian order-executions-only investment dealers regulated by CIRO that offers gold trading on August 2025. Wealthsimple's gold trading fee is 1% and is subject to change. As of October 2025, Wealthsimple’s Gold trading fee is 0% for a limited time. Full terms of the offer can be found here. Annualized rates, calculated daily, charged monthly. All investments involve risks. See here for details.

How does Wealthsimple offer such low trading fees?

How does Wealthsimple offer such low trading fees?

Since we’re a digital-first brokerage with fewer overhead costs, we’re able to pass those savings straight on to you. And, because you can trade gold directly in CAD, you won’t have to worry about pricey FX fees either.