Active Trading

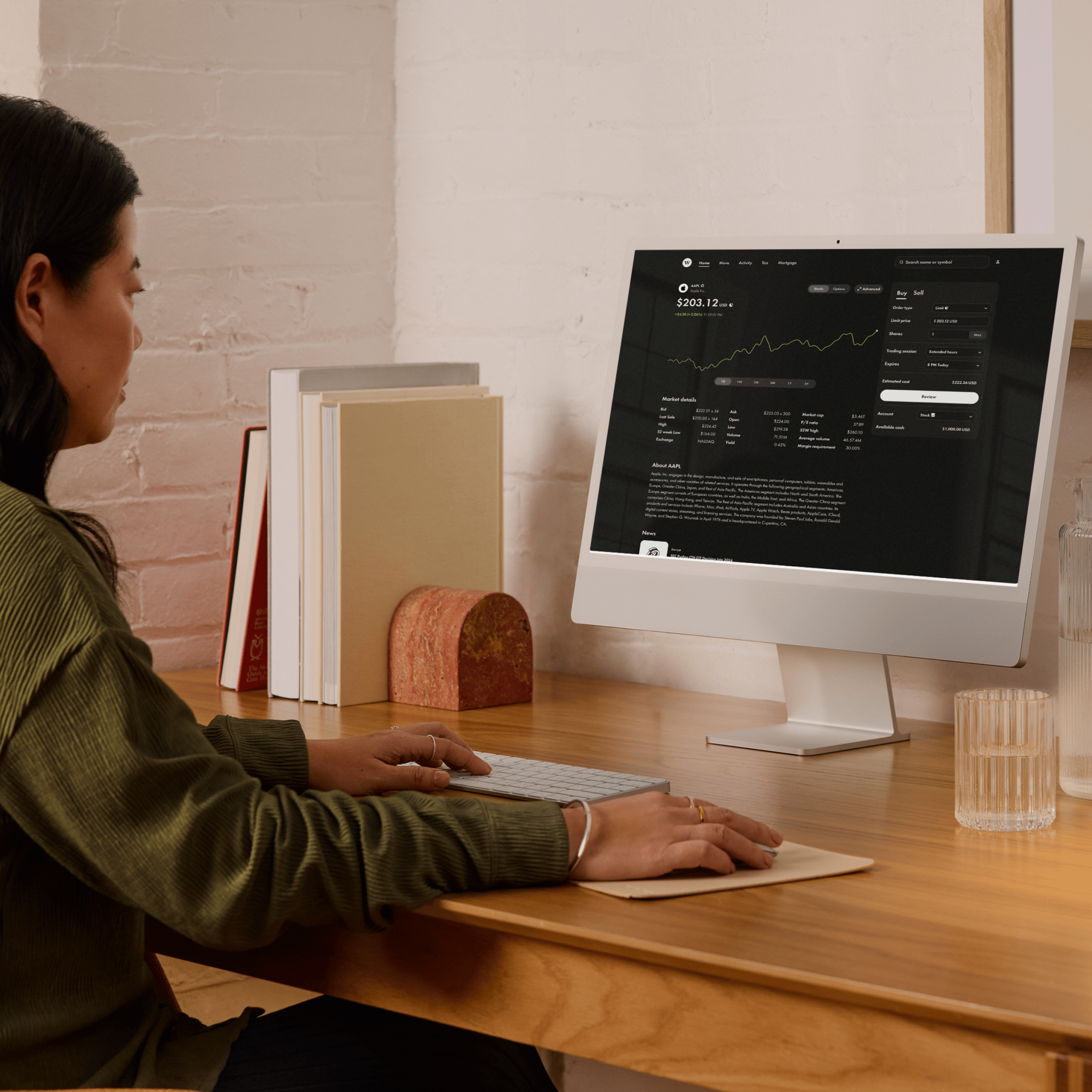

Welcome home, active traders

Unlock institutional-grade tools, real-time data, and expanded market access. All on a powerful, commission-free trading platform.

Meet the tools for your trades

React to market movements with advanced strategies, expanded hours, and smart tracking tools. Our platform’s made for skilled traders with complex strategies — like you.

Low fees. Period.

Active traders could save more than $4,200 a year on commission fees versus the big banks. Enter your monthly trades to see how much you could save by ditching the big guys.

Our competition is no competition

Wealthsimple | Green bank | Royal blue bank | Green broker | |

|---|---|---|---|---|

| Commission fees | $0 | $9.99 | $9.95 | $0 |

| Options contract fees | $0 | $1.25 | $1.25 | $0.00 - $0.99 |

| CAD margin rates | 3.95% | 6.75% | 7% | 8.95% |

| USD margin rates | 6.25% | 8.75% | 9% | 11.75% |

Coming soon

Your command centre, powered by AI: A preview

Your trading is about to get even smarter. We’re leveraging artificial intelligence to deliver insights tailored to your holdings — and here’s what’s coming soon.

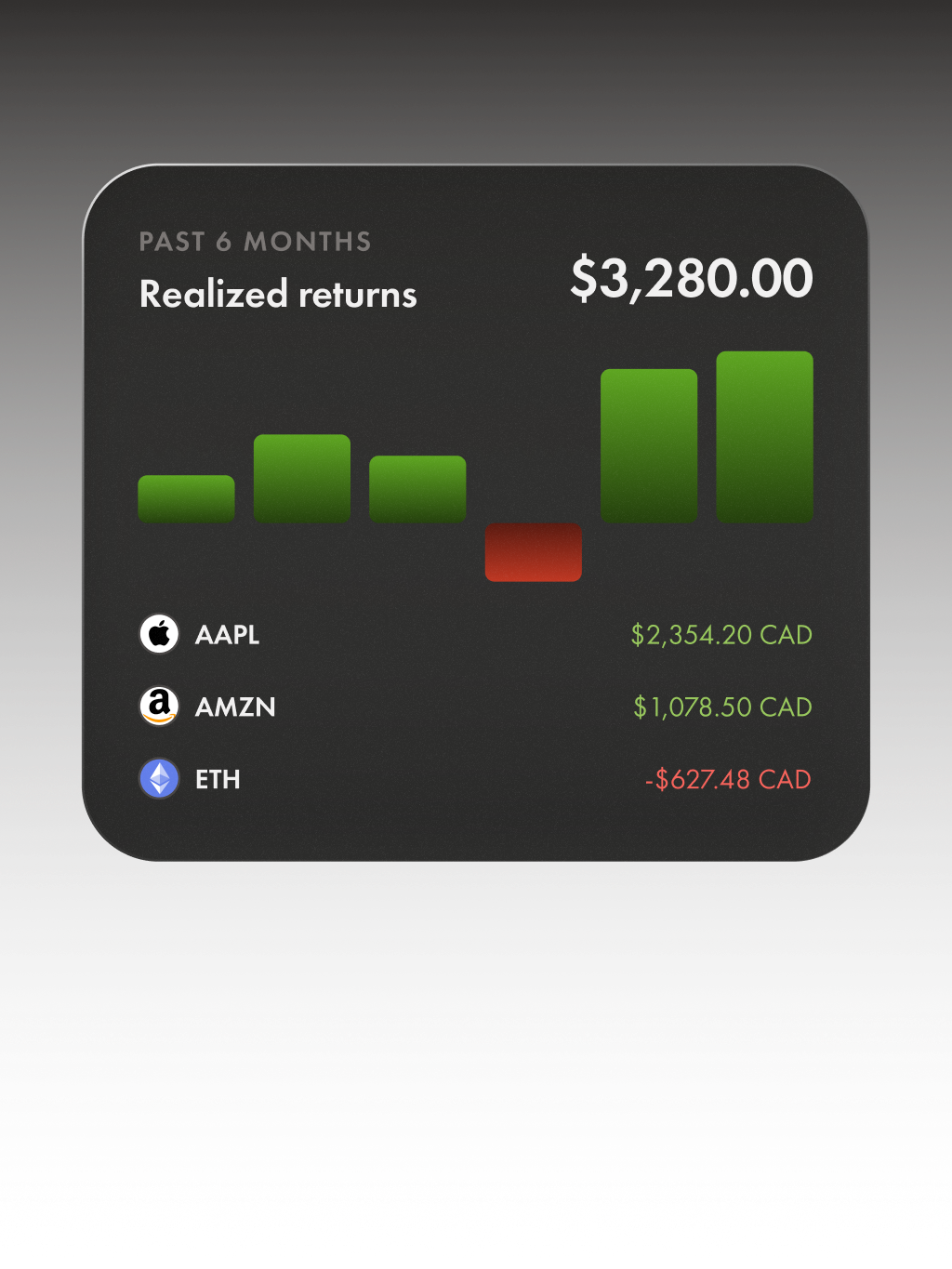

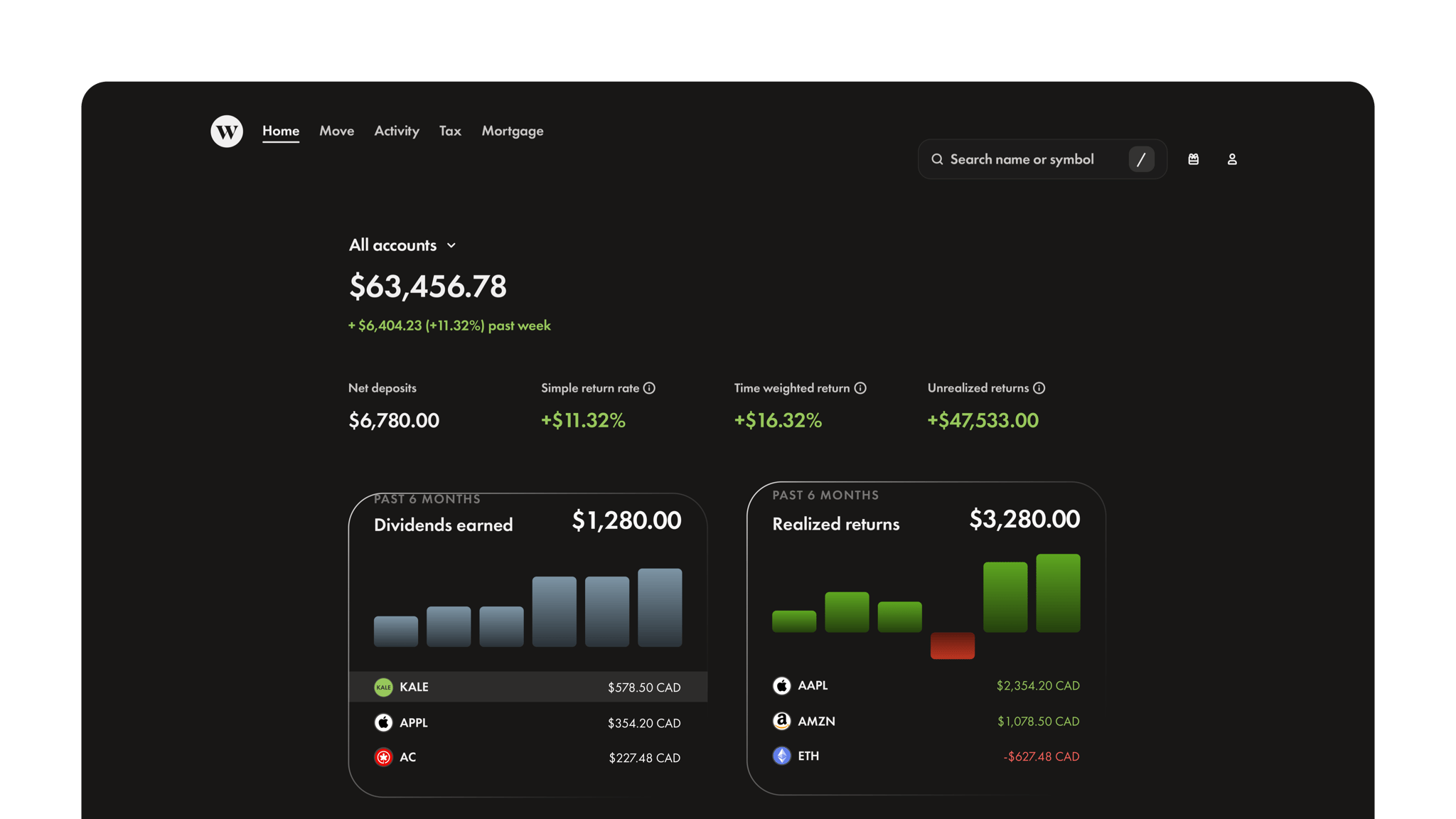

AI-powered performance summaries

Get curated insights for your portfolio, all aimed at delivering rich intel about what’s moving — and why.

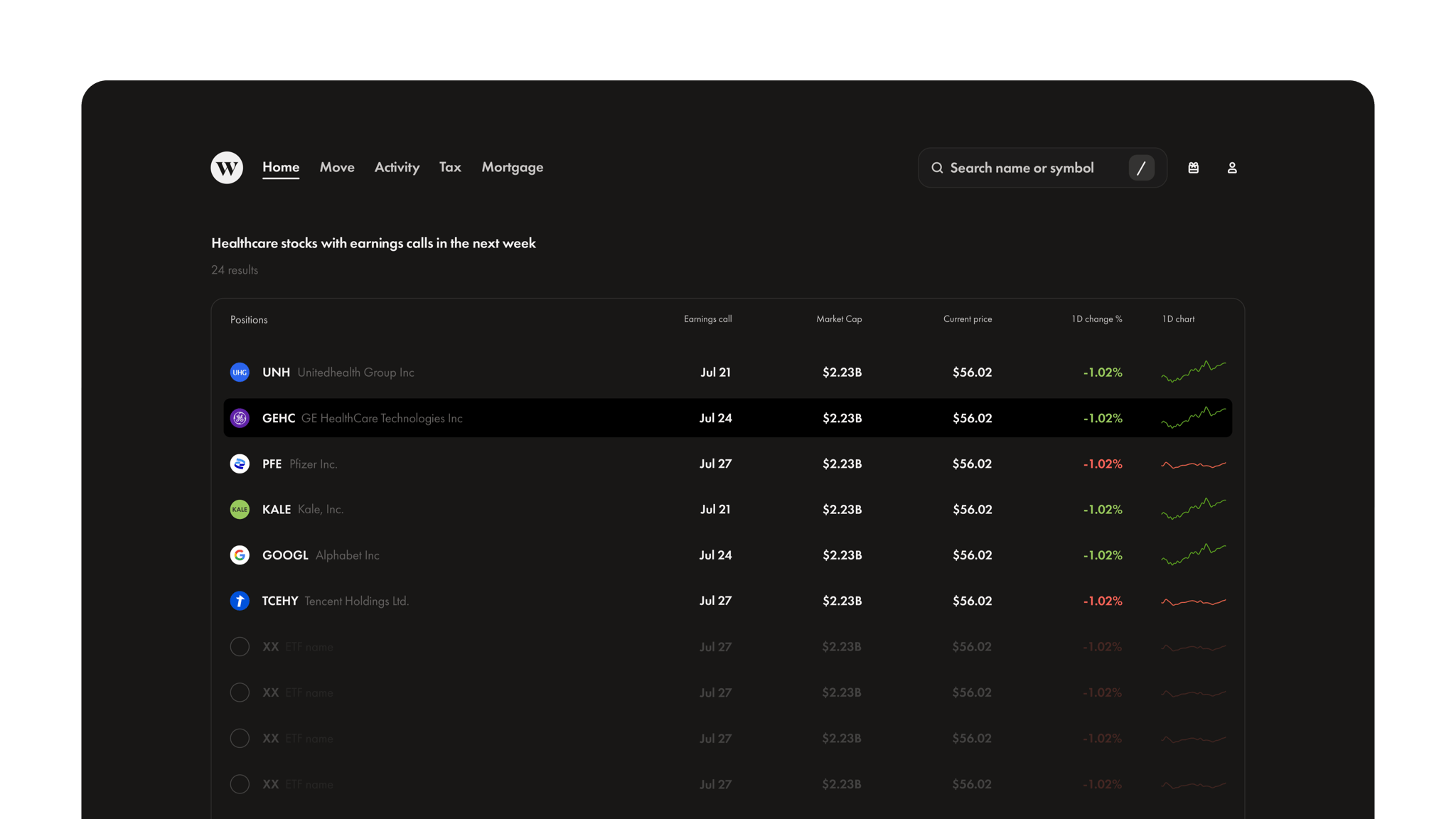

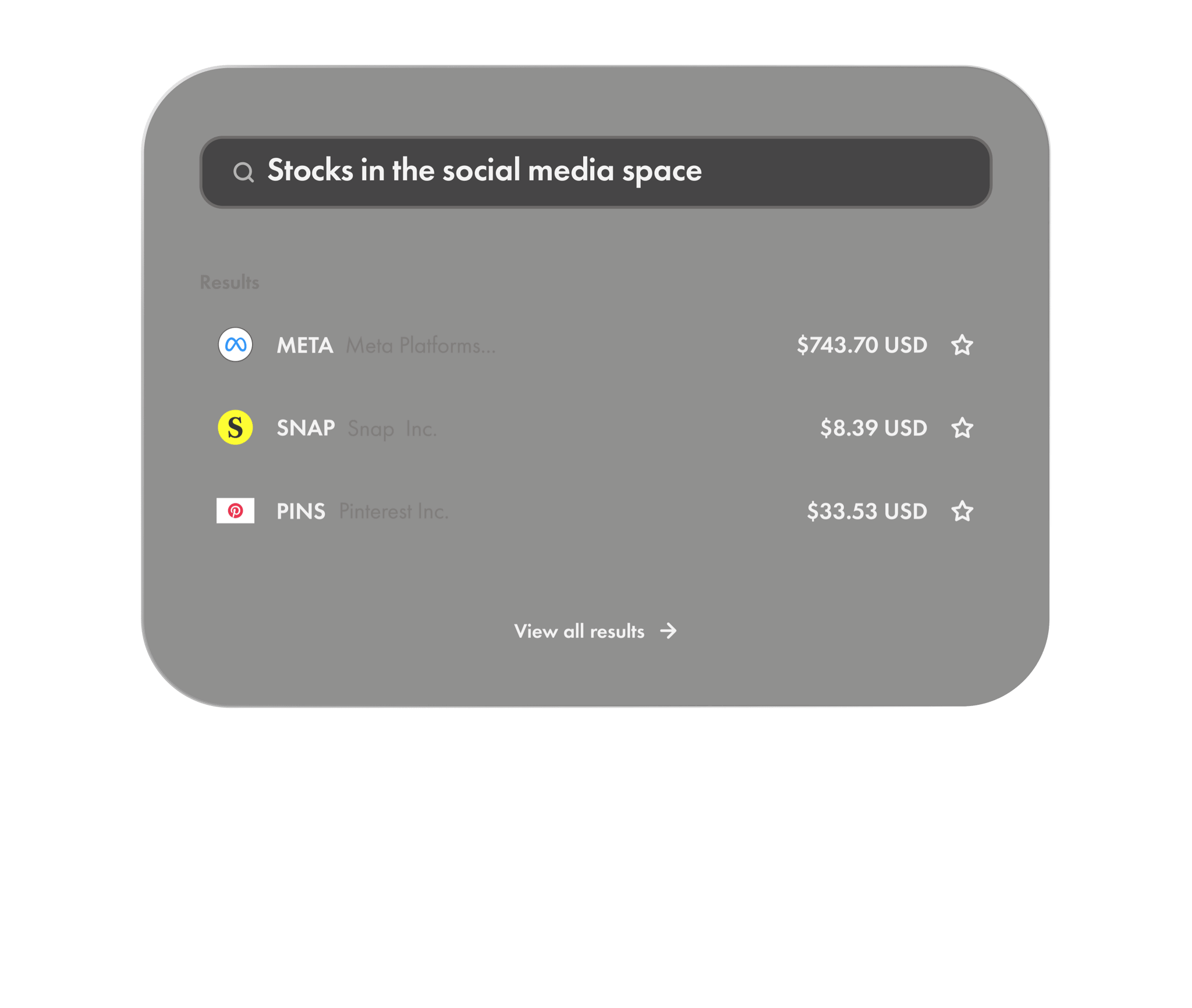

Faster stock screening

Use natural language — the kind you’d use while talking to a friend — to look up stocks of interest.

Earnings dates

Keep track of your holdings and watchlist with earnings call insights and summaries.

Say howdy to your partner

Wondering if we’re the right fit for your active trading? One of our dedicated relationship managers will talk you through it.

Take your investing to the next level

Upgrade your trading experience in less than three minutes.

FAQs

Which exchanges can I trade on?

Which exchanges can I trade on?

Choose from thousands of stocks, ETFs and OTC securities listed across the TSX, TSXV, CBOE Canada, CSE, NYSE, NASDAQ, CBOE, and a limited number of OTC-listed ADRs.

What times can I trade with Wealthsimple?

What times can I trade with Wealthsimple?

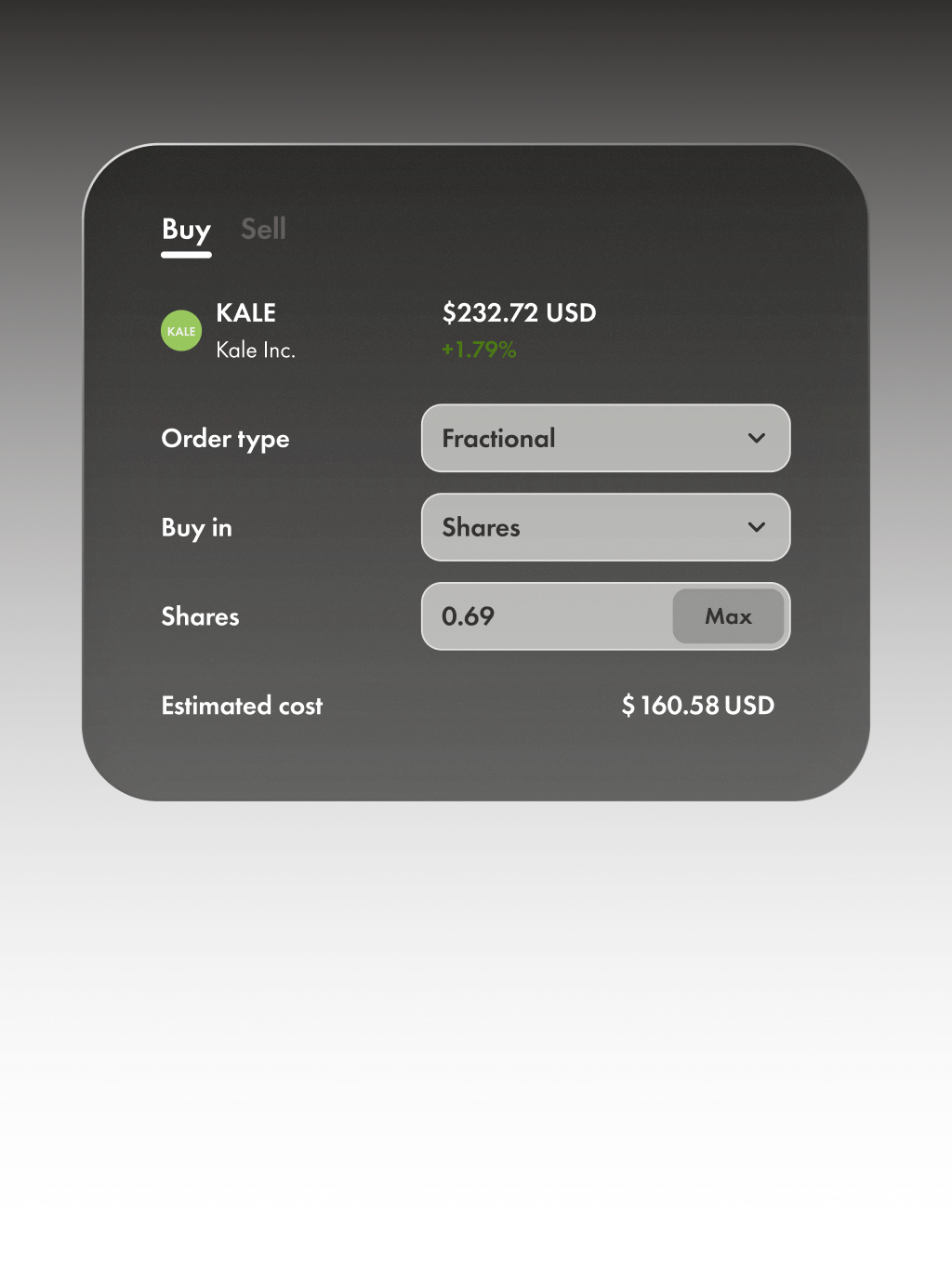

We’ve extended our trading hours to give you even more flexibility when it comes to your portfolio. Now, you can buy and sell stocks and ETFs from Sunday 8:00 pm to Friday 8:00 pm ET. For gold and crypto, you can trade 24/7.

And even though we can’t predict the market, our extended hours give you the convenience to trade within it on your own schedule. Currently, only a limited selection of US listed stocks and ETFs are available for trading during extended hours. You can browse eligible securities by searching for and selecting the “extended hours trading” category from the 'Discover' tab search bar in the Wealthsimple app. If you place fractional trades outside of trading hours, they will be queued to fill instantly once the market opens again.

Have more questions? Check out this helpful article. For details about the risks and considerations — click here.

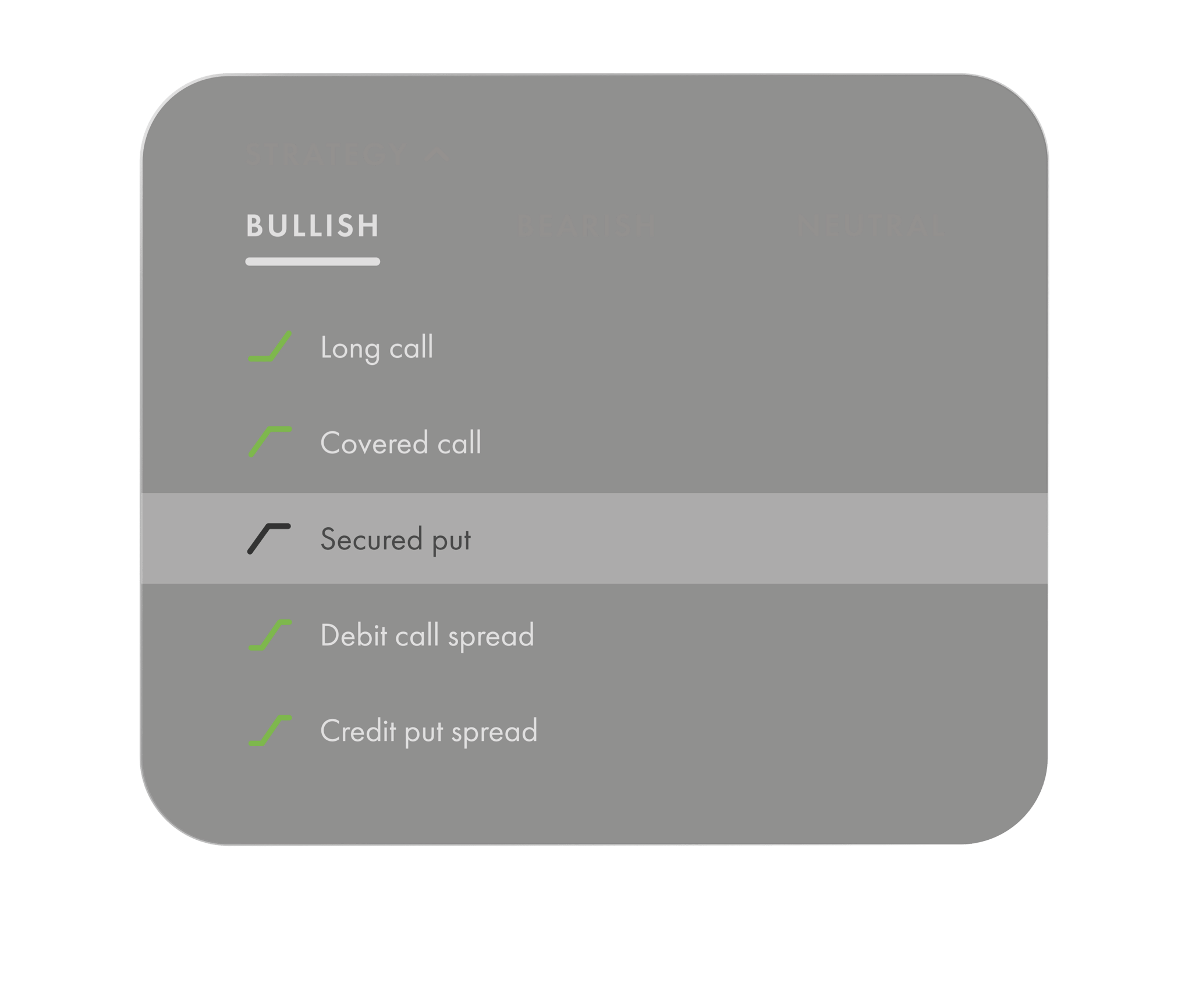

What options strategies do you currently support?

What options strategies do you currently support?

We support covered calls, secured puts, and multi-leg strategies (like vertical and calendar spreads). Learn more about our options trading strategies here.

What account types are available for active traders?

What account types are available for active traders?

We have account types for all your goals. Registered accounts include RRSP, TFSA, LIRA, RESP, FHSA, RRIF. For non-registered accounts, we have Cash accounts and Margin accounts for additional buying power.

We also have Corporate accounts to help grow your business commission-free and with access to leverage with margin interest rates lower than any Canadian bank.

Do you offer margin trading? What are your margin rates?

Do you offer margin trading? What are your margin rates?

Yes, we offer margin trading. Get access to increased buying power with rates lower than any Canadian bank. Unlock additional buying power by linking your TFSA account. Learn more about margin trading here.

How do we save active traders over $4,200 a year in fees?

How do we save active traders over $4,200 a year in fees?

These savings are based on the maximum commission fee amount shown at September 30, 2025 from the leading five Banks in Canada, with commission fees ranging from $0 to 7.00. per trade for stocks and options only, for active traders, trading more than 150 trades a quarter with $1.25 per options contract. Actual commission fees and total fees may vary. All amounts shown are in USD. All investments involve risk. See our fee schedule for self-directed accounts and our plans and benefits for details.