Regardless of where you invest your money, you're essentially giving it to a company, government, or other entity in the hope that they provide you with more money in the future. People generally invest money with a specific goal in mind — retirement, their children's education, a house, etc.

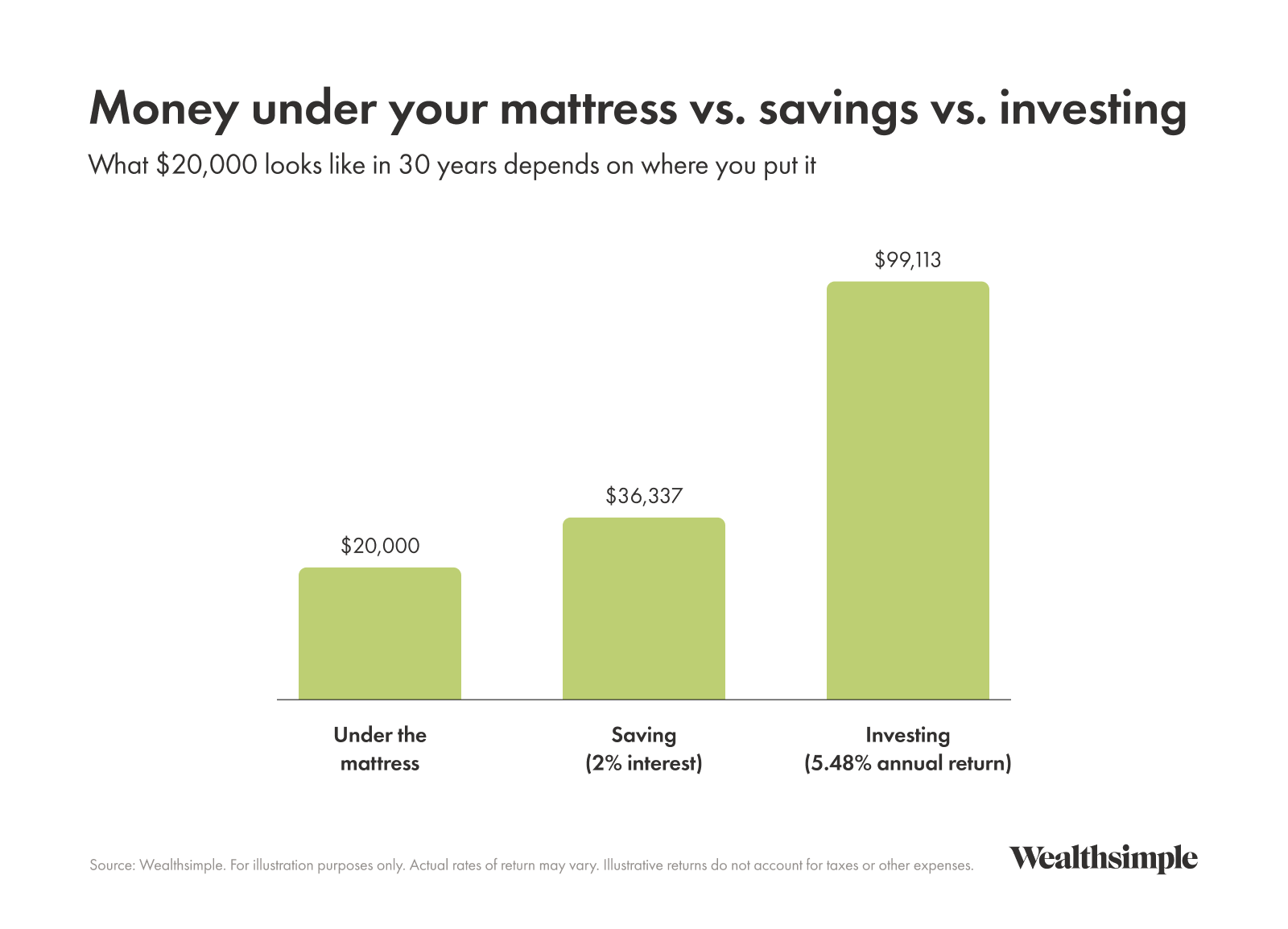

Investing is different from saving or trading. Generally, investing is associated with putting money away for a long period of time rather than trading stocks on a more regular basis. Investing is also riskier than saving money. Savings are sometimes guaranteed, but investments are not. However, if you were to keep your money under the mattress and not invest, you'd never earn more than that amount.

Things to consider before investing

Before you start investing in anything, you should ask yourself a couple important questions to determine whether you’re in good enough financial shape to do so.

1. Do you have a lot of credit card debt?

Very few investments will consistently outperform the 20% or so in interest that you’re likely forking over to a credit card company to service your debt. So do everything you can to pay that off before you start putting money aside to invest.

2. Do you have an emergency fund?

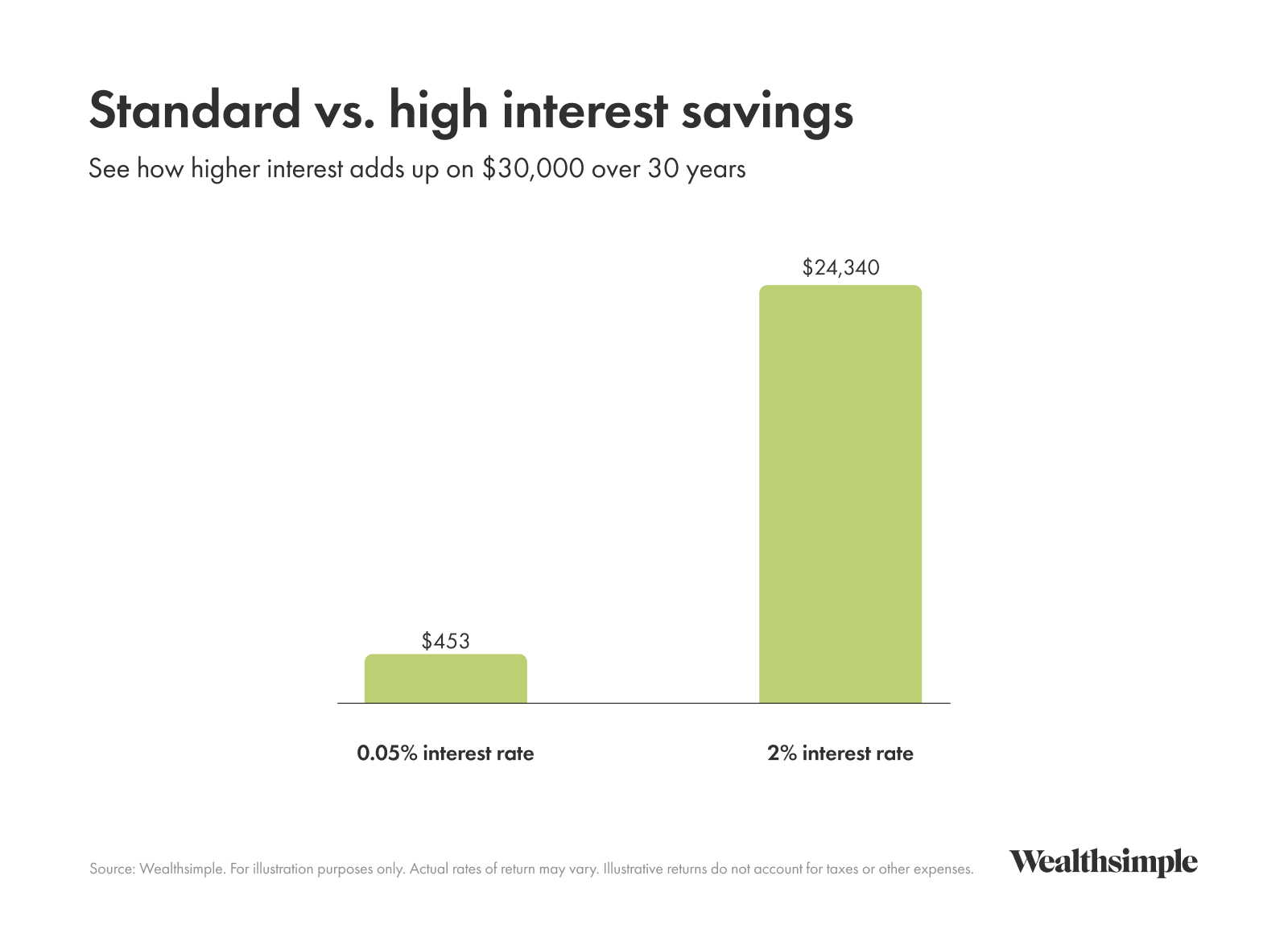

In polite terms, poop happens. Layoffs, natural disasters, illness — let us count the ways in which your life can be turned upside down. Any financial advisor will tell you that in order to avoid total ruin, you should have between six months and one year of total living expenses in cash — or in a savings account. If you don’t, bookmark this article, start saving, and come back as soon as you’ve got that emergency fund squared away.

Beginners investing tips

Before we go over the specifics of what you should consider investing in — stocks, bonds, or your cousin Brian’s yak farm — let’s first go over the basics of how one invests.

Investing is what happens when, at the end of the month, after the bills are paid, you’ve got a few dollars left over to put toward your future. No investing happens without putting money away. How are you supposed to find those elusive extra dollars to save? Here’s how.

Avoid lifestyle creep

In all likelihood, you’ll earn more in your thirties than you did in your twenties, and even more than that in your forties. The key to saving is to do your absolute best to avoid what’s called “lifestyle creep.” Lifestyle creep means that as you make more money, what once seemed like luxuries become necessities. Whole roasted pigeon and oyster concassé may be sublime, but just because you have the $600 to cover the tasting menu at Guy Savoy doesn’t mean you should. Instead, do your best to live the same way you’ve always lived. Then put away the extra money you’re making from your raises rather than increase your spending. Skip the pigeon, get yourself a croque monsieur, and invest the 600 bucks you saved.

Start investing — even a little at a time

Investing is not just for the Warren Buffetts of the world. If you are finding it tough to put away some investing money each month, try using a spare change app. These services round up your purchases, allowing you to invest small amounts of money that you'd hardly miss. For example, if you spent $3.39 on a coffee, then $0.61 would be invested automatically.

Investing small amounts of money is a great habit to develop, and your money does actually add up over time. Here are some other easy ways to invest with a little money:

Set up small, monthly transfers from your checking account

Use a low-cost investing service

Build a budget

Immediately invest any tax refunds

Invest any raises instead of altering your lifestyle

Instead of birthday or holiday gifts, ask relatives for investing money

Know what you're investing for

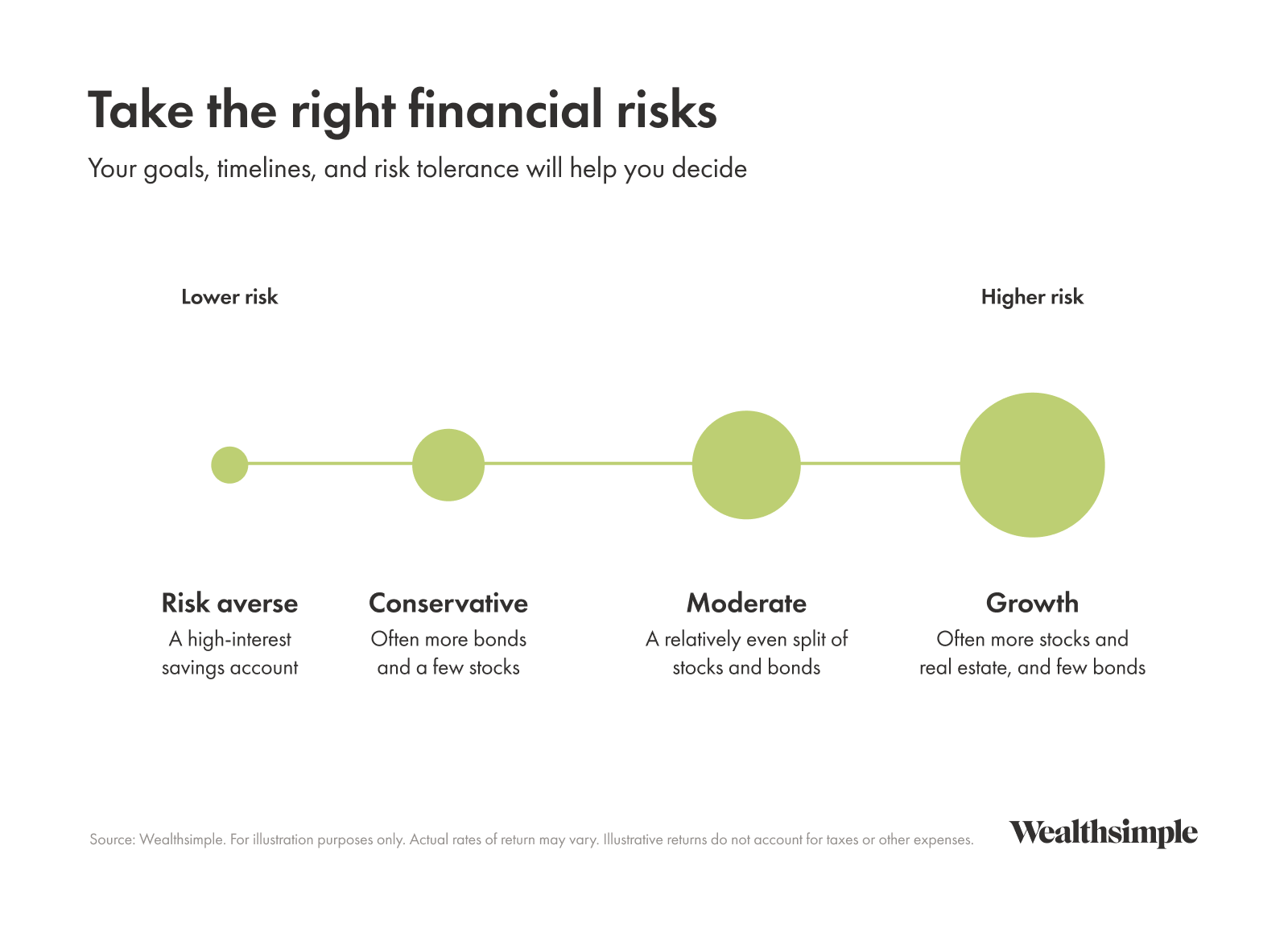

How you invest depends on what you're investing for. You might be investing money to help your teenager with her upcoming university tuition, or you might want to invest money to live off when you retire in 30 years. The “time horizon,” or the point at which you need your money, on each of these investments is very different. Those with shorter horizons should invest more conservatively. Those investing money they don't need for a long time can choose riskier investments.

Understand the risk you are taking

Good investors know their risk tolerance. This is a fancy way of saying how much of your investment you can really afford to lose. If you need money for next month’s rent, you have a very low risk tolerance. If your life wouldn’t be materially affected even if you set your money on fire, your risk tolerance is through the roof. Risk tolerance is often dictated by your time horizon.

Diversify your investments

Rather than picking a specific stock you think will perform well, diversify your investments. That way, if one part of your investment doesn't do well, you haven't lost everything. Diversifying your portfolio means investing in many different geographies, industries, and asset classes (stocks, bonds, real estate, etc).

Fluctuations aren't necessarily the biggest risk for investors in it for the long haul. A potentially bigger risk is how you react to those fluctuations. Many investors find it difficult to stick to their investing plan, particularly during market movements. If stocks are outperforming other assets, for example, it can be easy to think you should add more stocks to your portfolio. But then when stocks fall, you’re going to take a much larger hit than you would have had you stuck to your original plan. A diversified portfolio is a great tool to help manage your emotions and maintain your investment plan.

Invest for the long term

Many studies demonstrate that investors who hold stocks for more than ten years will be rewarded with higher returns that offset short-term risks. That's not to say this trend will continue, or that risk is ever totally eliminated. Risk never disappears, but you might say it mellows with age.

If you can put money away for a long time, then you can afford to have investments that are typically more susceptible to rising and falling. Your portfolio can contain a mix of stocks and equities, which are typically more volatile compared to bonds.

Another big benefit of investing for a long time period is the power of compounding. This is the process by which the money you make earns interest on itself over time. The earlier you start investing, the more compounding you get.

Watch out for high fees

Investing involves fees; you can’t control that. But you can control how high your fees get. Higher fees cause a significant drag on your returns. If you are paying 1-2% in fees, you could lose up to 40% of your expected investment returns over time (see the chart below). When you choose a place to invest, you need to consider the value you're getting in exchange for those fees.

Here's how fees impact gains on a $10,000 initial investment with a $300 monthly contribution for thirty years (assuming a return of 5.48%).

Investment Type | Average Mutual Fund (2.08% fee) | Automated Investing (0.5% fee) |

|---|---|---|

| Starting Amount | $10,000 | $10,000 |

| Year 10 | $56,311 | $62,508 |

| Year 20 | $120,471 | $147,851 |

| Year 30 | $209,265 | $286,563 |

Source: Wealthsimple. For illustration purposes only. Actual rates of return may vary. Illustrative returns do not account for taxes and other expenses.

It can be well worth paying a fee for a professionally designed investment portfolio that can be adjusted as your life changes. It's also handy to have features like automatic rebalancing, which ensures that your portfolio always contains the correct mix of assets.

Make an investing plan and stick to it

One of the biggest reasons many investors have low returns is because they sell at the wrong time. They often base decisions on recent performance. Many investors tend to buy things that have appreciated in value and sell things that have declined in value.

Instead, you should create a plan you think will help you reach your goals over the time period you have to invest. Don't stop investing because of bad performance. Stick to your plan without buying or selling based on your opinion of what will happen in the near future.

Types of investments

There are many different types of investments, including real estate, ETFs, bonds, and stocks.

Investment | What it is | How to invest |

|---|---|---|

| Bonds | A loan (kind of like an IOU) with interest. They are often issued by governments. Interest rates normally exceed the interest rate of banks, but you do assume more risk than a standard savings account. You have all your eggs in one basket if you only invest in bonds. | They can be purchased directly through the government, a brokerage, or trading platform. They are often included in managed portfolios, too. |

| Stocks | A tiny piece of a company that anyone can buy. Stocks are volatile, and while you could make a lot, you could also lose a lot. When you pick individual stocks, you lack diversification. | Through a broker or automated investing platform. Stocks are often a large part of managed portfolios. |

| Real estate | Purchasing real estate such as apartments or houses. There can be a high barrier to entry, as property is expensive. Real Estate Trusts allow you to invest in a sliver of property. | Directly from a property owner. Real Estate Investment Trusts (REITs) can be purchased through a broker. Managed investment portfolios often contain some real estate. |