The butterfly spread is a defined-risk options strategy that targets a specific price range. It’s one of the most versatile tools in an options trader's toolkit, offering a unique blend of high potential reward and strictly defined risk. This makes it a favourite for traders who prefer strategy over speculation.

What is a butterfly spread?

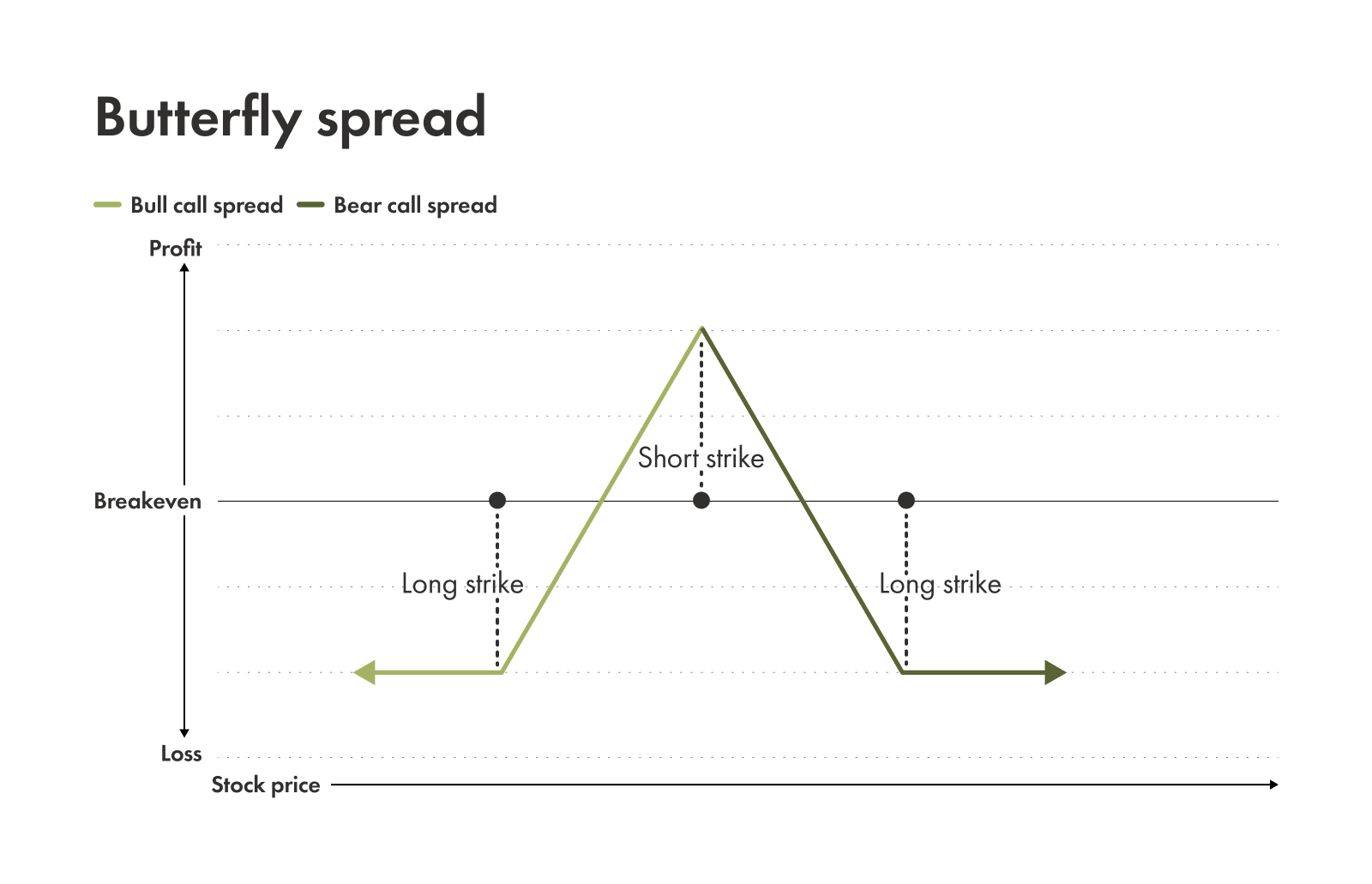

Let’s get right to it: a butterfly spread combines two vertical spreads (one bullish, one bearish) sharing the same centre strike price.

When you map out the potential profit and loss on a graph, it creates a triangle shape that looks a lot like a camping tent centred on a target price at expiration.

There are three main reasons why traders use it:

Defined risk: You know exactly how much you can lose the moment you enter the trade. It’s usually cheaper to take a position in a stock using spreads than buying the same quantity of the underlying outright.

Target pinning: It’s a spread designed for when you think a stock will land near a specific price by a specific date. It’s like a dartboard approach to trading, which some investors love.

Flexibility: You can build it for either a debit (you pay to enter) or a credit (you get paid to enter). Also, you can tilt it to be bullish, bearish, or neutral!

Within butterfly spreads, there are two main types you should know about: the standard butterfly and the broken-wing butterfly. This is how they compare:

Feature | Standard butterfly | Broken-wing butterfly (BWB) |

|---|---|---|

| Structure | Symmetrical wings; Equal distance from the centre | Asymmetric wings; One side is farther out |

| Cost | Usually a net debit; You pay cash | Often a net credit; You collect cash |

| Goal | Max profit at the centre strike | Directional bias with a "safety net" |

| Risk | Balanced on both sides | Risk is tilted to one side |

How to build butterfly spreads

Let’s look at the components of the two most common variations.

Standard butterfly spread (debit)

This is the classic setup. It’s a neutral strategy, meaning you want the stock price to stay right in the middle.

The structure (1-2-1):

Buy 1 option on the lower wing.

Sell 2 options at the target price (the body).

Buy 1 option on the upper wing.

Note: All options must be the same type (all calls or all puts) and have the same expiration date. The wings must be equally distant from the body.

Example:

The long call butterfly spread

Let's say stock KIWI is trading at $100. You think it will stay exactly at $100 for the next month, so you make these trades, all with the same 30DTE:

Buy 1 $95 call — This becomes the lower wing of the butterfly.

Sell 2 $100 calls — This becomes the body of the butterfly.

Buy 1 $105 call — This becomes the upper wing of the butterfly.

Since the options you buy (the wings) are usually more expensive combined than the two options you sell (the body), you pay a net debit to open this trade.

The result of this standard butterfly spread is usually a small debit or cost, which is why it’s normally called the debit butterfly spread.

Also, while we used calls in this example, you can also do this with puts. It mirrors the calls and is the same in payoff if the strikes are aligned.

Strike selection guidelines:

Wing width: Traders typically look for wings that are 2% to 10% away from the underlying asset’s price. Wider wings cost more but give you a wider "profit tent."

The pin: Place the body strike exactly where you think the price will be at expiration.

Liquidity: Only target assets with high volume or liquidity and a tight bid-ask spread.

Days to expiration (DTE):

21 to 45 DTE: This allows for smooth time decay (theta) and makes adjustments easier.

7 to 14 DTE: These are aggressive pin plays. They move fast, but gamma risk (rapid price sensitivity) is high.

Variations of the standard butterfly spread

Credit butterfly spread (short)

You can also sell a short butterfly. This flips the graph upside down.

In this case, you want the price to explode away from the centre so you can keep the credit.

It’s less common for beginners to use a credit butterfly spread because the chance of profit is lower at the centre.

Iron butterfly spread

You may have also heard about the iron butterfly. This spread uses both calls and puts to create the same tent shape.

It’s essentially a short straddle with wings for protection. The wider the wings, the wider the profit range.

While this is a great strategy, in this article, we are focusing on the all-call or all-put variations to keep things simple.

Broken-wing butterfly (BWB)

Now we’re getting fancy. The broken-wing butterfly spread is used when you have a directional opinion.

You think the stock is going to move a little bit, but you want insurance in case it doesn't move at all, or moves too much.

The structure (1-2-1):

Buy 1 option on the lower wing.

Sell 2 options at the target price (the body).

Buy 1 option on the upper wing.

What makes a BWB different from the standard version is that you "break" one wing by moving it farther away from the body.

This usually transforms the trade from a debit spread (paying money to enter) to a credit spread (collecting money upon entering).

BWBs are also versatile. They can be built as either calls (bearish-to-neutral) or puts (bullish-to-neutral).

Why traders choose BWBs:

Credit: You can often enter a BWB for a net credit. This means that even if the stock goes completely in the wrong direction, you still keep that small credit.

Risk: This spread reduces or removes risk on one side, keeping risk defined on the other side.

Directional bias: You can be bullish or bearish while still having defined risk. Even if you’re off by a little bit, there’s a certain amount of forgiveness built in.

Examples:

Bullish put BWB

Let’s say stock PLUM is trading at $100. You’re thinking it will drift up, but you’re also worried about the possibility of a crash. So you make these trades, all with the same 30DTE:

Buy 1 $95 put — This becomes the lower wing that’s “broken” or farther away.

Sell 2 $105 puts — This becomes the body that will be where you expect the stock to settle.

Buy 1 $110 put — This becomes the upper wing that’s not broken and is closer.

Notice the difference? The lower wing is $10 (aka points) away from the body, but the upper wing is only five points away. That asymmetry changes the math completely.

Bearish call BWB

Let’s say a friend of yours thinks the opposite of you about stock PLUM. They see it trading at $100 and think the price will drift down.

But after hearing your thoughts, they’re worried that it could also shoot up in price. So your friend makes these trades, all with the same 30DTE:

Buy 1 $105 call — This becomes the upper wing that’s “broken” or farther away.

Sell 2 $95 calls — This becomes the body that will be where you expect the stock to settle.

Buy 1 $90 call — This becomes the lower wing that’s not broken and is closer.

Your friend is using the same asymmetrical spread, but with a bearish outlook and strikes.

Strike selection guidelines:

Place the body: Put the body strikes just beyond where you think the price might drift.

Break the wing: Move the wing out on the side you think is less likely to be tested. This is your "risk" side.

Wing width: A good starting point is to make your wings 25 to 50 points wide if you’re trading on large indexes. If you’re trading on another underlying asset, you can adjust accordingly based on the volatility of the asset in comparison.

Payoff: max profit, max loss, and breakevens

OK, let’s talk numbers: how do you actually make money with butterfly spreads?

Here’s the breakdown by type:

Standard butterfly spread (debit) payoff

| Max profit: This is the dream scenario. You get max profit if the underlying asset closes at the body strike price. | Max profit = (wing width − net debit) × 100 ; Note: The ×100 assumes a standard contract multiplier. |

|---|---|

| Max loss: The beauty of this spread is that your loss is capped. You can never lose more than what you paid to enter the trade. | Max loss = net debit paid |

| Breakeven points: You have two breakeven points: one on the left leg of the tent, and one on the right. | Lower breakeven ≈ lower strike + net debit; Upper breakeven ≈ upper strike − net debit |

| Behaviour before expiration: The profit tent’s full height is only reached at expiration. This strategy benefits from theta (time decay) and generally likes stable or falling implied volatility (IV). | The profit curve is flatter. ; As time passes, the curve lifts upward toward the peak (assuming the price is near the body). |

Broken-wing butterfly payoff

| Max profit: Centred near the body, but because you often enter for a credit (or a very small debit), the max profit calculation shifts. | Max profit = (width of narrow wing + net credit) × 100 or: Max profit = (width of narrow wing − net debit) × 100 ; Note: The ×100 assumes a standard contract multiplier. |

|---|---|

| Max loss: This is where you have to be careful. Because you "broke" a wing, you left a gap in your protection. If opened for a credit, the credit cushions adverse moves and can allow a small profit even if the price doesn’t hit the body. But if the price crashes through your broken wing, your loss can be larger than a standard butterfly. | Max loss = (difference in wing widths − net credit) × 100 or; Max loss = (difference in wing widths + net debit) × 100 ; Note: The ×100 assumes a standard contract multiplier. |

| Breakeven points: If you entered with a credit, your breakeven point on the risky side is pushed farther out. This gives you a slightly higher probability of success compared to a standard vertical spread. | If you entered with a net credit: Breakeven ≈ (short strike + narrower debit spread width) + net credit. If you entered with a net debit: Lower breakeven ≈ lower strike + net debit; Upper breakeven ≈ (upper strike + width of the narrower debit spread) − net debit |

| Behaviour before expiration: The profit tent’s full height is only reached at expiration. This strategy benefits from theta (time decay) and generally likes stable or falling IV. | The profit curve is flatter. As time passes, the curve moves toward the peak (assuming the price is near the body). |

When to use a butterfly

Not every market is a butterfly market. Here is your cheat sheet to identify when and how to spread those wings.

The setting for standard (debit) butterflies:

You expect the price to gravitate toward a specific level and stick there. Think of it as a magnet.

Some key events that can lead to this are:

Earnings aftermath: After a big move happens, stocks often stay within a limited range.

OpEx (or Options Expiration) pinning: Market makers often try to pin prices to large open interest strikes at expiration. Large open interest strikes are large totals of not-yet-exercised or expired options contracts at specific strike prices.

Stuck support/resistance: If a stock is stuck at a major moving average (e.g., the 200-day), you may consider a butterfly centred in that moving average range.

Stable/declining volatility: This spread works best during stable or mildly declining volatility. If volatility explodes, the value of your short body options might hurt you initially.

Choose a standard butterfly when:

Cost control and defined risk are key.

You have a precise target.

You’re OK with a narrower probability of max profit.

The setting for broken-wing (credit) butterflies:

You have a mild directional bias (e.g., "I think the market will grind slowly higher"), but you’d hate losing money if the market stays flat.

Some key events that can lead to this are:

Drift markets: These are perfect for a slow grind up or down without sharp reversals.

Volatility: Look out for moderate to high volatility levels.

Skew advantage: Sometimes, out-of-the-money (OTM) options are priced expensively by "skew." A BWB lets you sell those expensive options to finance your trade and prevent or lower your losses if the market goes flat.

Choose a broken-wing butterfly when:

You want a higher probability of a small to moderate gain, with a bias.

You don’t have a precise target.

You want to adjust risk levels on the spread where you’re more comfortable.

Underlying asset selection

Look for:

Liquidity: You need high liquidity and tight bid/ask spreads. If the spread is $0.50 wide, you are giving away profit before you even start. Sticking to highly liquid exchange-traded funds (ETFs) or mega-cap stocks can be a good place to start.

Clarity: Seeing clear reference levels while doing technical analysis of a potential asset is a green flag. These levels are crucial for having informed outlooks, deciding on strategies, and selecting strike prices.

Consistency: Butterflies get crushed by wild moves that blow past both wings, like on some stocks that might move 20% in a day.

Practical rules of thumb

Debit butterflies: Target a profit of 25% to 50% of the maximum potential amount. It rarely pins exactly at the strike, so you should avoid being greedy. Exit if the value drops to 50% to 75% of your debit or a set dollar loss.

Credit BWBs: Target 30% to 60% of the initial credit. If the price breaches the body early, or reaches two to three times the initial credit risk on the broken side, get out.

Risk management and position sizing

Even though the risk in a butterfly spread is defined, you can still get hurt if you aren't careful. Here are some things to consider:

1. Position sizing. This is non-negotiable. Because butterflies have a narrow profit range, they have a lower probability of max profit than a simple vertical spread. Don’t load the boat. Keep any single butterfly position to a very small fraction (1% to 2%) of your portfolio risk.

2. Timing risk (the gamma trap). As you get closer to expiration (seven days or less), gamma risk explodes. This means small moves in the stock price cause huge swings in your profit or loss calculations. When this happens, consider taking profits early.

3. Volatility shifts. Credit BWBs can be more tolerant, and usually a crush in IV helps you reach profit faster. Debit butterflies prefer falling volatility. If IV spikes, the wings you bought gain value, but the body you sold gains more value, hurting the trade temporarily.

4. Liquidity traps. We mentioned this before, but it bears repeating: underlying assets with tight spreads are preferable. Wide spreads can distort your entry and exit prices. If you can't get a fair price to close the trade, your theoretical profit doesn't matter.

Adjustments: how to manage butterflies when price moves

The market rarely does exactly what we want, so here’s how to fix a broken trade yourself.

Early and proactive adjustments

Rolling the body

If the stock price drifts away gradually, you can close your current butterfly and open a new one re-centred on the new stock price. It’s important to note that this will likely increase your cost basis.

Converting to a vertical

If the price runs through one side of your tent, the trade is effectively dead. You can close the "far" wing and one of the "body" shorts.

This leaves you with a simple vertical spread on the active side, potentially allowing you to salvage some value.

Unbreaking the wing (for BWBs)

If risk builds toward your broken side, buy back one of your short options and resell it further out, or buy an extra long option on the risky tail. This limits your exposure.

Defensive adjustments under stress

Add a hedge

If the price is threatening your upper breakeven, you can buy a small OTM debit spread on that side. It costs money, but it offsets the losses from the butterfly.

Time roll (calendar rescue)

This is complex but effective. You can close the losing side of the trade and reopen it in a later month.

This gives you more time for the trade to work out, though it changes the risk profile entirely.

The last resort fold

If the price is sitting way beyond your wing with only a few days left, just close it. Redeploy your capital into a fresh setup.

Common mistakes to avoid

Now that you know what to do and how to pivot, here are some things to avoid when it comes to butterfly spreads:

Forcing a pin in a trending market. If the market is ripping higher every single day, don't stand in front of the train with a neutral butterfly. You will get run over.

Oversizing into weekly expirations. Weekly options are volatile. If you put too much money into a four-day butterfly, a single news headline could wipe out the position.

Ignoring liquidity and slippage. Paying $0.10 of slippage on a $0.50 trade is a 20% loss right off the bat. Make sure to check the volume before you click buy.

Getting greedy. Greed can cause you to let a profitable butterfly revert to zero because you wanted that last $5 of profit and held it too far into expiration. If you have 50% of the max profit, that might be a good time to consider your exit.