If you are looking to own a small piece of a public company listed on a stock exchange, you’re in the right place. We’ve prepared a big steaming bowl of valuable info for you.

Once you decide to invest in something, though, what do you do? You can’t just show up at a corporation’s headquarters waving a mitt full of money. That’ll just get you weird looks. The majority of companies require you to go through a brokerage (any entity, online or otherwise, that’s authorized to buy and sell stocks) or a registered individual broker.

Also important to know: stocks are, by nature, fluctuating. They can rise and fall precipitously. There’s a good reason every stock or mutual fund prospectus includes the disclaimer, “Past performance is no guarantee of future results.” It’s 100% true! The reason that stocks historically perform better than safer, conservative investments like government bonds is because investors are rewarded for taking on more risk.

How to start investing in stocks

Investing in stocks requires just three things: an idea of what you want to buy, money to purchase the investment, and a brokerage to make the trade. And what you want to buy will vary based on your goals and risk tolerance.

Finding a place to trade — or an advisor to help you do so — is often the easier part of investing. (We’ll get into that next.) The hard part is deciding exactly what you should be buying. Should you invest in a bunch of individual stocks? A mutual fund? Or an ETF? We’ll get into that below, too. But only a little bit! This is an article about stocks, so we’ll focus mostly on those.

Where to start investing in stocks

If you already know what stocks you want to buy, online discount brokerages tend to be easy and inexpensive. If you’re going that route, it’s smart to make sure the brokerage has the features you want, and a commission fee you’re comfortable with (some offer zero commissions).

One important consideration is the minimum investment required to open an account. While you can find some that don't, many brokerages charge you a fee for each trade you perform. Most will assess a flat per-trade commission — for any stock purchase, big or small, no matter the number of shares in the transaction — that generally ranges from $5-$10 per trade.

If you don’t want to pick your own stocks, automated services are a reasonably priced, user-friendly way to invest. Financial advisors and human brokers offer the highest level of customized service, but they are also often the most expensive option.

How to reduce risk when investing in stocks

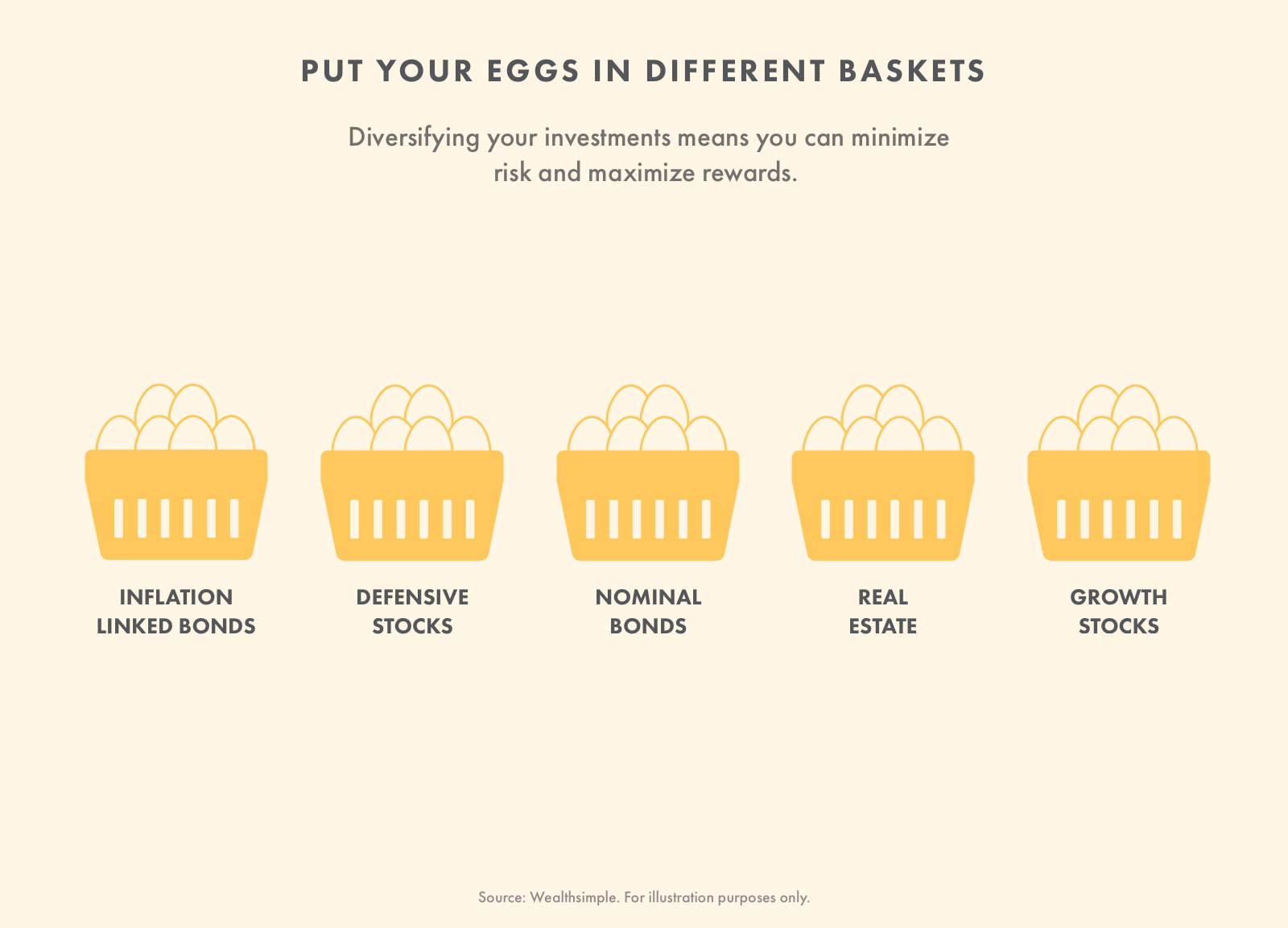

When you’re talking about risk in the investing sense, you’re talking about the risk of loss in the short and medium term. There is one primary way to reduce it: diversification, which means holding groups of stocks that have different reactions to market events (e.g., from different countries or industries) and combining them in a portfolio with other asset classes, such as bonds or even gold. The advantage of diversification is that you can often reduce risk without sacrificing expected return.

One simple way of receiving broad exposure to markets is by purchasing a mix of domestic and international low-cost ETFs. Though ETFs trade on exchanges just like individual stocks, many contain dozens or even hundreds of stocks. You can also have an automated investing service do this for you. With one single purchase, you can track some or all of a country’s entire stock market rather than putting all your eggs in one stock basket.

How to make money on stocks

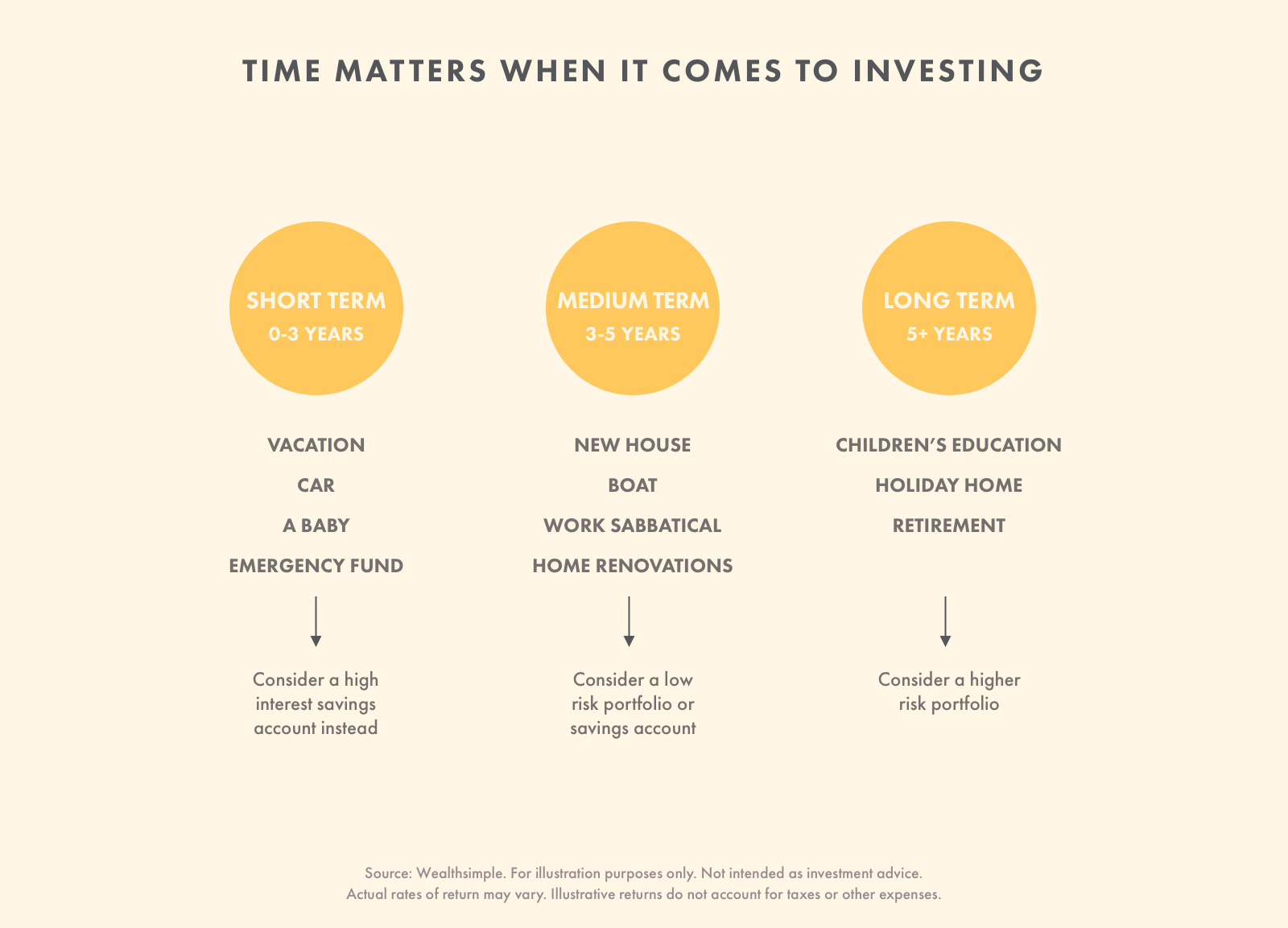

There’s no sure way to make money in stocks, short of inheriting a magic pig that sniffs out tomorrow’s big winner. But a reliable option has been to hold them for a long period of time (especially if you’re holding a diversified group of them, as we mentioned above). This period is often referred to by the Star Trek-sounding term “time horizon.”

If you need money for a specific purpose in the near term, natural stock fluctuations mean it may not all be there when you need it. If you have more than you need to spend in the short term, investing in stocks or other assets that are higher-risk and higher-reward than cash can be a good way to try to grow your wealth and keep pace with inflation.

Historically, those with the patience to hold stocks for 10+ years are more likely to be rewarded with positive returns that offset short-term risks - assuming the company is fairly stable. It’s a pretty simple lesson on how averages will eventually wash out the stock price outliers (which might be either good or bad). Generally, the longer you hold a stock, the less variable its price will be on average.

When should I invest in the stock market?

There is no perfect time to enter the stock market, but the longer you’re invested, the likelier it is that you will experience higher returns.

How to buy a fractional share of a stock

Many high-profile, well-publicized stocks in tech and other rapidly growing industries may be out of reach for all but the richest investors. Some stocks trade for well above $1,000 per share, but some trading platforms, allow you to buy part of a single share — a fraction of a share for… a fraction of the price.

While some services have started to offer fractional shares (and even gift cards!), one of the easiest ways to get fractional shares is through an ETF. ETFs are investments comprising a variety of investments, including stocks, bonds, real estate, etc. Since ETFs trade on the stock market, buying a unit is as simple as buying a share in a company. Some ETFs are more niche with holdings in a specific sector or asset class, while others can be more broad and track certain markets.

Beginner tips for investing in stocks

If you’re just getting started, it may be worth looking at ETFs, which have built-in diversification. If you would like to buy individual stocks, it’s wise to keep the exposure low (some experts recommend keeping it under 5% to 10% of your overall portfolio) so that you won’t suffer too much if the stock experiences poor performance. The odds of any particular stock doing well are low, but the odds of a portfolio of stocks gaining in value increases over time.

What to look for when buying a stock

Picking stocks can be difficult. So difficult that Warren Buffett has spent decades discouraging pretty much everyone not named Warren Buffett from trying to make money picking individual stocks. He says as much:

Furthermore, most professionally managed funds underperform the market. So, what are you supposed to do? Instead of picking individual stocks or giving your money to someone who is paid to do so, you can invest in index funds, which spread investments across a bunch of companies and try to mimic the performance of the market as a whole.

There are two main ways you make money on a stock. The first is if the company outperforms the market’s expectations. The second is through what’s called the “equity risk premium” — what you make over the current interest rate you could get by putting your money in very stable investments, like government bonds. Over the long term, investors will be rewarded for taking on risk, and any increased risk must go hand in hand with increased potential reward. This concept keeps stocks viable. If a stock wasn’t expected to outperform the risk-free rate, investors would stick with the safe money and the stock price would drop.

One easy way to test your stock-picking talent? Write down your reasons for buying a stock, but don’t actually buy it. Wait for a predetermined period of time, and, if the stock moves the way you predicted for the specific reasons you predicted it would, you might be ready to put some real skin in the game.

Stock market terminology (abridged)

Here are a few basic concepts that you should understand before you even consider buying your first stock:

Revenue growth: If a company is public, it means it must publicly share its financial status on a quarterly basis. Is it bringing in more money than it did last quarter? Graphing historical revenue numbers will show if a company is on an upward, downward, or flat trajectory. A steady line upward is a decent indication (but not a promise) of future performance.

Historical price: This might seem obvious, but the longer a company’s been around, the more information you have to use to assess its general health. If it has been able to weather lousy economic conditions, sector downturns, and other business calamities and its stock has still managed to move up, the company is doing something right.

Earnings per share: Earnings are the amount of money left over after all of a public company’s bills have been paid. Earnings per share (EPS) is simply that dollar figure divided by however many shares the company has sold. Higher EPS can be better and can drive a stock price upward, but it can be tricky because companies have been known to buy their own stock to reduce the number of outstanding shares, thereby artificially inflating their EPS numbers.

Price/earnings ratio: Since so-called P/E ratio is a number that can be computed for any public company, it’s an important way to assign relative value to stocks. It’s an apples-to-apples comparison. Simply divide the current stock price by the earnings per share value of the last four quarters. That number reflects how many dollars investors are currently willing to pay for every dollar of annual earnings. For this reason, it’s often called the “price multiple.” The average P/E ratio of a company on the TSX is 18 or so. A much lower number might suggest a company with lower expectations, and a higher one a company with higher expectations. It’s up to you to decide how to use that number in your decision-making process.

Dividends: Some companies offer dividends, a kind of profit-sharing program for investors, who receive a specific dollar figure on a quarterly basis that has no direct relationship to the stock price (though a company board may decide to increase or decrease future dividends based on its financial health). Researching dividend programs can be valuable because, in some cases, the dividends a company offers can equal as much or more than one might expect to earn from a savings account. (Of course, unlike bank accounts and interest, stocks can fall and dividend programs can go away altogether.) Tracking if companies have consistently provided dividends, or even raised them, is one indication of a company’s health and possible future stock performance.