Canadians planning for retirement have some great accounts at their disposal, courtesy of the government: The Registered Retirement Savings Plan (RRSP) and the Tax Free Savings Account (TFSA). (There’s also a First Home Savings Account, but we won’t talk about that here.) Both accounts offer tax incentives when it comes to your retirement money, and give you the opportunity to grow your money long-term by investing in stocks, bonds, ETFs, and other assets.

But while they’re both useful retirement accounts, there are some key differences between them that make them more suited for certain goals and income levels than others. But when does it make more sense to choose an RRSP, and when should you choose a TFSA? We’ve broken down the key differences between the two and taken a closer look at what account might be best suited for your particular situation.

(P.S.: If you want to get a sense of how much you’ll need to save for retirement, check out our free retirement calculator.)

The difference between an RRSP and a TFSA

Before we look at what accounts are best suited for whom, let’s have a look at what the individual accounts actually stand for:

TSFA

TFSA stands for Tax-Free Savings Account. The gains you make from any investments and savings in the account are tax-free, i.e. all yours. It’s a great incentive for saving, and for maximizing any earnings you may get. But the name “savings account” is actually misleading — a TFSA functions instead as an investment basket. You can pick what to put in that basket from a wide array of financial assets: exchange traded funds, guaranteed investment certificates, stocks, bonds and yes, actual savings accounts. That means that you’re not limited to the measly interest rates (usually way under 1%) that traditional savings accounts usually offer.

TFSAs also have very few withdrawal rules associated with them. You’re free to withdraw at any time without penalty, but there are government-mandated limits to how much you can contribute every year. The maximum you’re allowed to put into a TFSA each year is known as the contribution limit and it varies from year to year.

The Canadian government introduced TFSAs in 2009 as a way to encourage people to save money. And since you already paid tax on the money you put into your TFSA, you won’t have to pay anything when you take money out.

RRSP

An RRSP, or Registered Retirement Savings Plan, is also a government-sponsored retirement plan with significant tax benefits, but it works a bit differently than a TFSA. An RRSP is what’s called a tax-advantaged account, meaning that the government created them specifically to provide tax breaks to those who invest money in RRSPs as a way to motivate them to put away money for their retirement. But instead of your earnings being tax-free, as is the case with a TFSA, any money you contribute to an RRSP will be exempt from income taxes the year you make the deposit, and will only be taxed years down the line when you withdraw it. RRSPs are therefore an effective way to cut down a current-year tax bill.

RRSPs also have contribution limits, which refer to the maximum amount a taxpayer is allowed to deposit into an RRSP annually. The contribution limit of your RRSP starts accumulating from the time you start earning income, and is unique to you: It takes into account this year’s deduction limit and any unused contributions from previous years.

An RRSP’s deduction limit, on the other hand, refers to how much you’re able to claim as a tax deduction on your income tax. Because contributions to an RRSP reduce the amount of income tax you must pay each year, the CRA sets an annual limit on the number of contributions each eligible taxpayer can make to RRSPs. The deduction limit is usually 18% of your income from the previous year or $32,490 for 2025, whichever is less.

What about GICs?

GIC stands for Guaranteed Investment Certificates and basically works like a savings account, except your money is generally invested by a bank for a certain period of time. So instead of directly investing your money, you’re lending your money to the financial institution where you’ve opened your account so that they can invest it.

While GICs are valued for being quite low-risk, they usually have a low rate of return (usually less than 1%). Your money is therefore not growing as much as it could be, and even runs the risk of not keeping up with annual inflation. Another major drawback of the GIC? Unlike an RRSP or a TFSA, you get no tax benefits whatsoever. Any interest payments you receive from a GIC account are subject to taxation, and you can’t write any deposits you make off your taxes. You can also choose to hold a GIC in your TFSA or RRSP.

When should you contribute to an RRSP vs TFSA

Now that we’ve covered some fundamental differences between RRSPs and TFSAs, the question is: Which one should you be using? The rule of thumb all depends on your income level, what you think you’ll be earning in the future, your spending habits, and your savings goals. In an ideal world, you’d be able to contribute to both an RRSP and a TFSA, and meet the maximum contribution limits each year. But that’s simply not financially feasible for everyone. So it becomes a question of identifying which account is better suited for your particular financial goals and situation. Here are some examples of when you might want to choose one account over the other:

You might want to prioritize an RRSP if…

Your income is over $50,000. It all boils down to what tax bracket you’re currently in versus where you expect to be in the future.

“When you put money into an RRSP, you essentially get to deduct whatever money you’re putting in from your income that year,” says Michael Craig, an advisor at Wealthsimple. “So you’re getting a tax refund based on your marginal tax rate, which is likely to be higher if you’re a high earner. Now, fast forward to your 70s. Ideally, you want to be taking the money out of your RRSP when you’re at a lower tax bracket.” That’s because “when you’re getting taxed on that money that you’re pulling out of your RRSP, you’re paying less than what you got back at the time you put the money into the RRSP.” So ideally, you’ll want to be putting money into an RRSP when you have a high income level, and then withdrawing it when you’re at a lower income level to really maximize those tax benefits.

Let’s say Amina is making about $90,000 a year, and she contributes $5,000 a year to her RRSP. With her current income, her marginal tax rate would be about 40%. But because that $5,000 a year isn’t taxed when she contributes it to her RRSP — she’d get it back as a refund — her investments can grow. By the time she retires, Amina’s tax rate will be lower and the value of her investments will be much higher, since they were able to grow with pre-taxed money. When she starts withdrawing that money during retirement, her tax rate will be lower and she’ll be able to keep more of her money. That’s a particularly nice feeling when you’re dependent on this money as your only source of income.

If you have available income for long-term savings goals.

The higher your income, the more likely it’ll be that you have a significant chunk of money you can contribute to your RRSP (while still keeping contribution room and deduction room limits in mind), which you’ll then get back as a tax refund. And you know what you can then do with all that extra money you get back? Put it into a TFSA and enjoy more tax benefits.

You want to invest heavily in foreign stocks.

You can and should invest in a wide variety of assets when it comes to TFSAs and RRSPs. In fact, using any of these accounts as a simple savings account would be a waste, since you wouldn’t be unlocking the full tax benefits that you could enjoy if you let your money grow through investments.

But if you want to invest heavily in foreign stocks, particularly U.S. stocks, then consider doing so through your RRSP. Why? That’s because the Internal Revenue Service in the United States doesn’t recognize the TFSA as a retirement account. So you’ll have to pay non-resident withholding taxes on any income, such as dividends, that flows from U.S. sources. With an RRSP, that’s not the case.

If you and your spouse/partner have significantly different income levels.

Let’s say Emily and Yasmin are married, and Yasmin is making $100,000 while Emily makes $40,000. Emily and Yasmin’s ability to contribute to their respective RRSPs is therefore significantly different. After all, 18% of $100,000 versus 18% of $40,000 differs significantly in terms of deduction limits. So Yasmin has $18,000 in available RRSP contribution room, but instead of putting that all in her RRSP, she might choose to put some of that money in Emily’s RRSP instead.

The benefit of that will be apparent during retirement: The goal is that by the time Emily and Yasmin hit their 70s, the amounts that have been saved into both RRSPs will be fairly equal, so that the couple has more flexibility about which account to pull from when they’re using the money for retirement. This is particularly relevant, since Yasmin’s marginal tax rate might be a bit higher than Emily’s, and the couple could choose to pull from Emily’s RRSP for bigger projects like a home renovation or a big vacation, and enjoy the lower tax benefits.

You might want to prioritize a TFSA if…

Your income is less than $50,000.

There are a couple of reasons why financial planners usually suggest that a TFSA is a good primary retirement vehicle for lower earners, starting with the fact that a TFSA isn’t conditionally linked to your income. Everybody gets essentially the same contribution room that keeps growing each year, starting from the moment they’re 18. So you’re not limited by that 18% rule that governs RRSPs.

You want no restrictions in accessing your money.

Unlike an RRSP, a TFSA has no withdrawal rules and no tax consequences when you take money out of the account. This makes a TFSA particularly appealing for investors who are hoping to grow their money for a specific goal, like buying a house or planning a wedding. Because that money is tax-free when you withdraw it and you can withdraw it any time, it allows for a lot of flexibility and high savings benefits. Just don’t forget to keep adding to your TFSA to enjoy tax-free income later on.

You don’t want a timeline attached to your account.

Another benefit of a TFSA is that it doesn’t expire. You can use it whenever you want, and keep your investments growing for as long as you want, while withdrawing from it any time you want. With an RRSP, the rules are a bit different. When you turn 71, your RRSP automatically converts into what’s known as a Retirement Income Fund (RIF). You’re then legally obligated to withdraw a minimum amount each year from that RIF, starting from the year you turn 72.

What should you hold in a TFSA versus an RRSP

As mentioned before, thinking of these accounts as run-of-the-mill savings accounts would really be a waste, since you’d be missing out on a lot of opportunities to grow your money. Both accounts are vehicles for holding cash, government and corporate bonds, stocks, ETFs, and mutual funds.

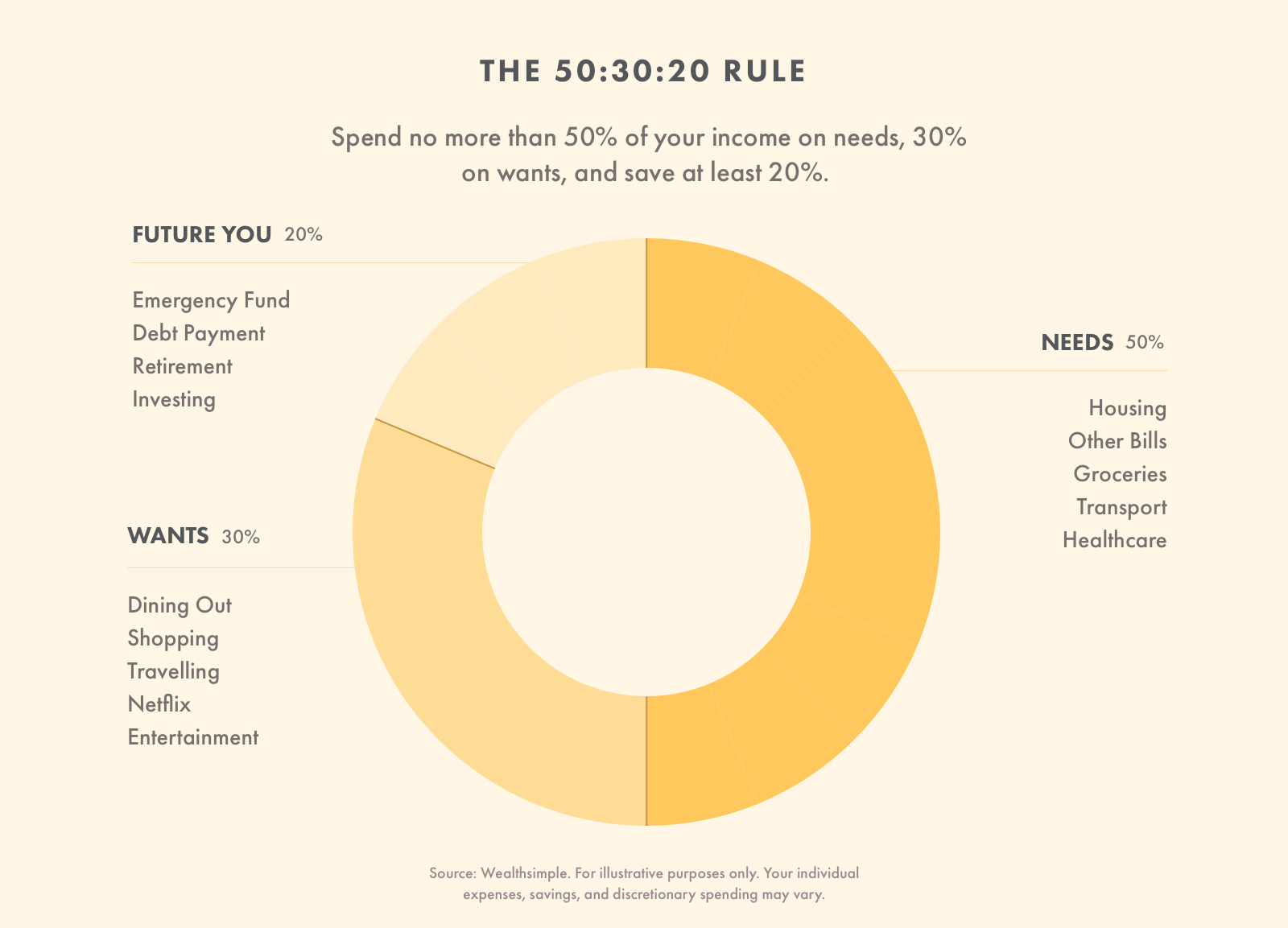

With TFSAs, any capital gains you earn from stocks are tax-free, but you’re also not able to claim a capital loss if your investments drop. And while RRSPs are often used exclusively for retirement savings, TFSAs can serve many savings purposes, which means that some investors might choose to put more aggressive, high-risk high-reward-type assets into a TFSA and earlier on in their RRSP, but choose more steady, less riskier assets for their RRSP as they near retirement. Either way, if you’re looking to focus on prioritizing your savings for retirement, regardless of account, you might want to consider saving about 20% of your income for future-you. The more you save, the better off you will be in the future.

As mentioned before, investors looking to diversify their investments with international stocks (particularly U.S. ones) may be better off putting those investments in an RRSP in order to continue to enjoy maximum tax benefits.

RRSP or TFSA based on personal circumstances

Whether you choose one account over the other and how much you choose to invest in each will, in large part, be determined by your own personal financial circumstances and goals. But there are some situations in which it might make sense to prioritize one account over the other.

RRSP or TFSA for low-income families

Families and individuals who are in lower tax brackets are perhaps better served by choosing to prioritize a TFSA over an RRSP. That’s because of the accounts’ inherent tax-saving qualities: An RRSP’s benefits really kick into high gear when you’re contributing while in a higher tax bracket and then withdrawing during a period when you’re in a lower tax bracket. Michael Craig explains it like this: “Let’s say you’re earning an income of $30,000, and you’re putting money into an RRSP. You’d have a correspondingly low marginal tax rate. If, down the line, you’re pulling money out of your RRSP in combination with other income, it’s actually putting you at a higher tax bracket. That’s not a good scenario. You’re now paying the government back more down the road than what you received [in the form of tax refunds] at the beginning, when you were contributing money into the RRSP.”

If that situation applies to you, then investing as much as you can into a TFSA after taxes and expenses is probably a more logical approach.

RRSP or TFSA for high-income earners

If you’re able to afford it, then the best-case scenario would naturally be to contribute to both of these accounts. However, for high-income earners who find themselves in a higher tax bracket, contributing as much as they can to an RRSP and then getting that amount back in the form of a tax refund might be an appealing solution, since that tax refund can then be re-invested in either a TFSA or an RRSP or a non-registered account, and you can later benefit from your RRSP when you’re in a lower tax bracket in retirement.

RRSP or TFSA for students

If you’re just starting out on your investment journey and don’t have a lot of savings to speak of, a TFSA might be a more appealing choice for students. The reasoning is, once again, related to income level: As a student, you’re unlikely to be making much money (if you are, please tell us your secret). In fact, you may not be making much in terms of income at all. And since RRSP contributions are tied to your income and your refunds are tied to your marginal tax rate, you may not be enjoying the maximum benefits of an RRSP yet. So choosing to grow your savings with a TFSA may be a more accessible choice. After all, it’s never too early to start saving and investing. And don’t forget: You can always withdraw penalty- and tax-free from your TFSA, which may certainly come in handy for medium-term savings goals.

However, there is an exception here: If you’re making over $50,000 a year but are thinking of getting a higher education degree, then you can potentially make use of your RRSP through the Lifelong Learning Plan (LLP). An LLP lets you take up to $20,000 tax-free out of your RRSP to pay for full- or part-time education and training. However, keep in mind that any money you withdraw will have to eventually be paid back into your RRSP: You have 10 years to pay back the LLP loan, starting right away, at least 10% of the amount withdrawn per year. And keep in mind that the LLP only really makes sense if you already have an RRSP you’ve been funding quite regularly while still being in a higher tax bracket.

RRSP or TFSA for a downpayment

At this point you’re probably tired of us telling you for the 100th time that RRSP withdrawals are taxed and therefore the account shouldn’t really be touched until you’re 71. But there’s another exception for RRSP holders: The Homebuyer’s Plan (HBP). If you meet the eligibility criteria, the CRA allows you to withdraw up to $60,000 tax-free to put towards the purchase of a new home. You have 15 years to pay the funds back and repayments start the second year after you withdraw the funds.

Similar to the LLP, it only really makes sense to consider the HBP if you’ve already been contributing regularly to your RRSP and find yourself in a higher tax bracket, benefiting from that higher refund you’re getting after your annual contributions. However, keep in mind that you’ll eventually need to pay that money back, and if you’re also combining that payment with a mortgage, then future-you might not be too thrilled.

If you’re earning less than $50,000, it might make more sense to use money from your TFSA, which is tax-free and doesn’t come with any restrictions attached, while continuing to grow your income and prioritizing your RRSP later on in life, when you’ve perhaps moved into a higher tax bracket.

RRSP or TFSA for retirement

The general consensus is usually that RRSPs are “strictly” for retirement, while TFSAs have more flexibility associated with them and are often used for medium-term savings goals as well. And while that’s definitely true and has a lot to do with the fact that the RRSPs' benefits really kick in once you move from a higher tax bracket to a lower tax bracket in retirement, it depends on your particular situation.

If you expect your RRSP to be your only source of income during retirement, then it would seem to make more sense to stick with that, since additional sources of income could put you in a higher tax bracket and screw with the tax benefits the RRSP is known for. Also keep in mind that you’ll be forced to start withdrawing from your RRSP when it automatically turns into a RIF when you hit 71, and you’ll be taxed on those withdrawals.

But what happens if you want to retire before 71? “If you don’t have any other sources of income, you may want to look at drawing out of your RRSP,” Michael Craig says. “You’re at a low tax bracket now and have the opportunity to pull money out and not get taxed too heavily.” But if you have other income streams, you may want to go for your TFSA instead, or even choose to prioritize your non-registered investment accounts instead. Says Craig: “Ideally, you want to push off the need to pull from your TFSA for as long as possible, and even add to it if you can.” That’s because there’s no point at which you’re forced to withdraw from your TFSA, and the longer your investments grow, the greater your tax-free returns will hopefully be.

RRSP or TFSA while paying into a pension

If you’re paying into a government pension plan in addition to paying into an RRSP, it’s important to keep in mind that the two might affect each other. When you eventually withdraw funds from your RRSP, it is treated as taxable income. And if your income is too high, it might impact some government benefits like Old Age Security (OAS) payments. If you’re a Guaranteed Income Supplement (GIS) recipient and withdraw money out of an RRSP, you may get less money from the GIS in the next year, or you may not get any money at all.

With TFSAs, on the other hand, the money you take out of the account is not considered to be income. This means that it will not impact the money you get from federal government benefits that are based on your income, such as OAS and the GIS. So if you think that you’re going to be relying on these government benefits more heavily in retirement, it might make sense to prioritize your TFSA instead.

RRSP or TFSA for continuing education

As mentioned before, if you’re making over $50,000 a year and are considering furthering your education or training, then an RRSP’s LLP might make sense for you. However, keep in mind that any money you withdraw will have to eventually be paid back into your RRSP: You have 10 years to pay back the LLP loan, starting from when you withdraw. If you find yourself in a lower earning position/tax bracket, then withdrawing from your TFSA might make more sense instead, since you’re not paying taxes on that money and don’t have to pay it back.

Moving TFSA Savings to an RRSP

Let’s recap for a second: Basically, a TFSA makes more sense if you find yourself in a situation where your income is on the lower side, while an RRSP makes more sense if your income is on the higher side and you expect to be in a lower tax bracket during retirement. However, life is long, and you surely have aspirations to move your income level up as you get promoted and gain more skills, right? So there may come a time where you decide that after years of investing into your TFSA, you want to graduate to an RRSP because you’re now earning more and would like to take advantage of those RRSP tax-breaks.

You cannot transfer investments directly between TFSAs and RRSPs, but since it’s easy and tax-free to withdraw funds from your TFSA at any time, you can just liquidate as much as you want from your TFSA and contribute it to your RRSP. Just be careful with your RRSP contribution room and make sure there’s enough space available for that year before you deposit the money.