A bond is essentially a formal IOU. When a company or a level of government needs to borrow money, it will issue bonds to institutional and individual investors with a promise to make interest payments on the principal amount for a fixed term, which can be anywhere between a few months to 30 years or more. The rate of interest paid on the bond is the bond’s yield. Once the bond reaches its maturity date (the end of the fixed term) the principal, or face value, is repaid to the investor. Bonds are issued by corporations, provincial or state and municipal governments, and the federal government.

Bonds are typically considered lower-risk investments for individual investors. In the traditional 60/40 balanced investing portfolio, bonds are meant to provide a stabilizing effect relative to the volatility of the stock market. However, not all bonds are low risk, so it’s important that you understand what you’re holding in your portfolio.

Investing in bonds

Buying bonds is a little different than investing in the stock market, but there are several ways you can access them.

Bond exchange-traded funds (ETFs) and mutual funds can be the most straightforward way for individual investors to invest in bonds. Some bond funds and ETFs are actively managed, while others track an index. There are funds that invest in short-term (a month to two years), intermediate-term (two to 10 years), and long-term (10 years or more) bonds, and some invest in a mix of terms. These funds may invest in a specific type of bond — including government, municipal, T-Bills, and corporates — or a variety of types for diversification purposes. But it’s important to keep in mind that, unlike individual bonds, bond funds and ETFs never mature.

Individual bonds can be purchased as a new issue or on the secondary market, in both cases through a broker or online brokerage. Purchasing new-issue bonds can require a minimum investment, and it’s worth keeping in mind that the minimum could be costly for an individual investor.

Bonds bought on the secondary markets are “used” bonds, along the same lines as shares of stock that are already issued and trade on exchanges. But unlike purchasing stocks, there is a spread between the price you will actually pay for bonds and what the broker obtains the bonds for. That spread is the broker’s profit and can be pricey for smaller investors.

Bonds vs. stocks

Put simply, when you buy a stock you’re buying an ownership stake in a company, but when you buy a bond you’re becoming a financier of a loan.

Stocks and bonds offer different benefits to their investors. While stock owners aren’t guaranteed a specific payback, their ownership stake allows them to benefit when the company does well financially or the business grows, which typically increases the company’s share price. Some companies also pay quarterly or annual dividends — a distribution of their earnings — to stockholders. Meanwhile, the primary way bond investors are compensated is through the guaranteed interest payments on the bonds, and much of the appeal of the asset is the expectation that your money will be returned to you in full, with interest.

Stocks have a higher historical and expected returns than bonds, even risky long-term bonds. But, because of compounding, adding to diversifying assets can add value even for a return-maximizing investor.

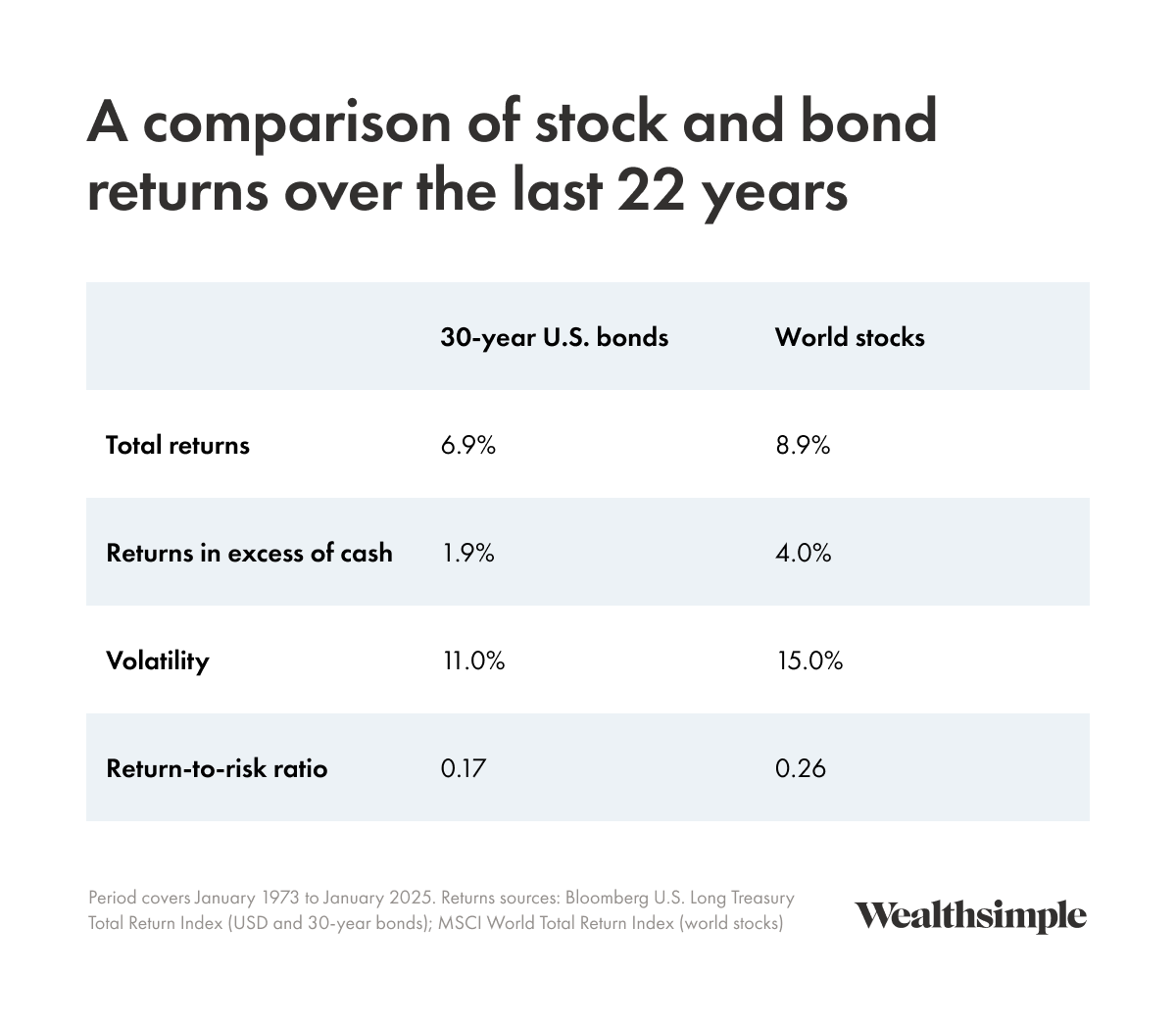

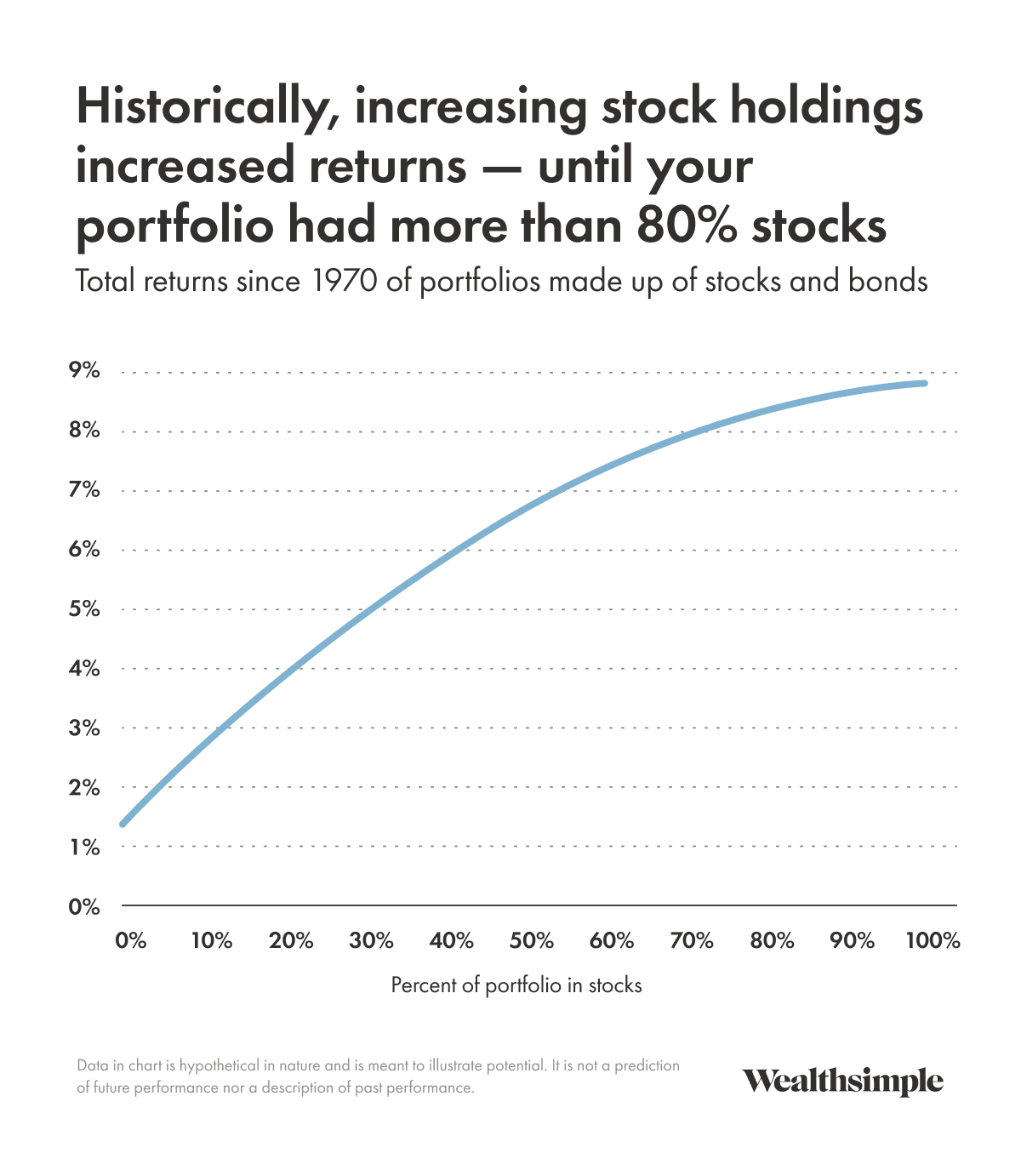

Safe to say, most people already know that stocks outperform bonds over the long term. In the chart below, we’ve constructed portfolios that are combinations of long-term bonds, which are very risky, and stocks, starting with all bonds at the left to all stocks on the right, and mixes of the two in between. Looking at the returns of the assets, and average monthly returns of the portfolios, the lesson seems clear: the more stocks you have, the higher your return. In the charts below, we show the returns over the last 50 years of these portfolios. In the table, excess returns means total returns less the returns from holding in cash, in order to measure the returns from putting money at risk in the asset over the time period.

However, as investors, we shouldn’t care about average monthly returns. We should focus on performance over longer periods of time. So let’s look at the compounded returns of these portfolios, not just the average monthly returns. The picture changes. The benefit of owning stocks declines significantly after 60% stocks, and rounds to zero after 80% stocks. Because diversification reduces volatility and having lower volatility helps compound returns, the benefit from owning stocks declines as the stock concentration of the portfolio increases.

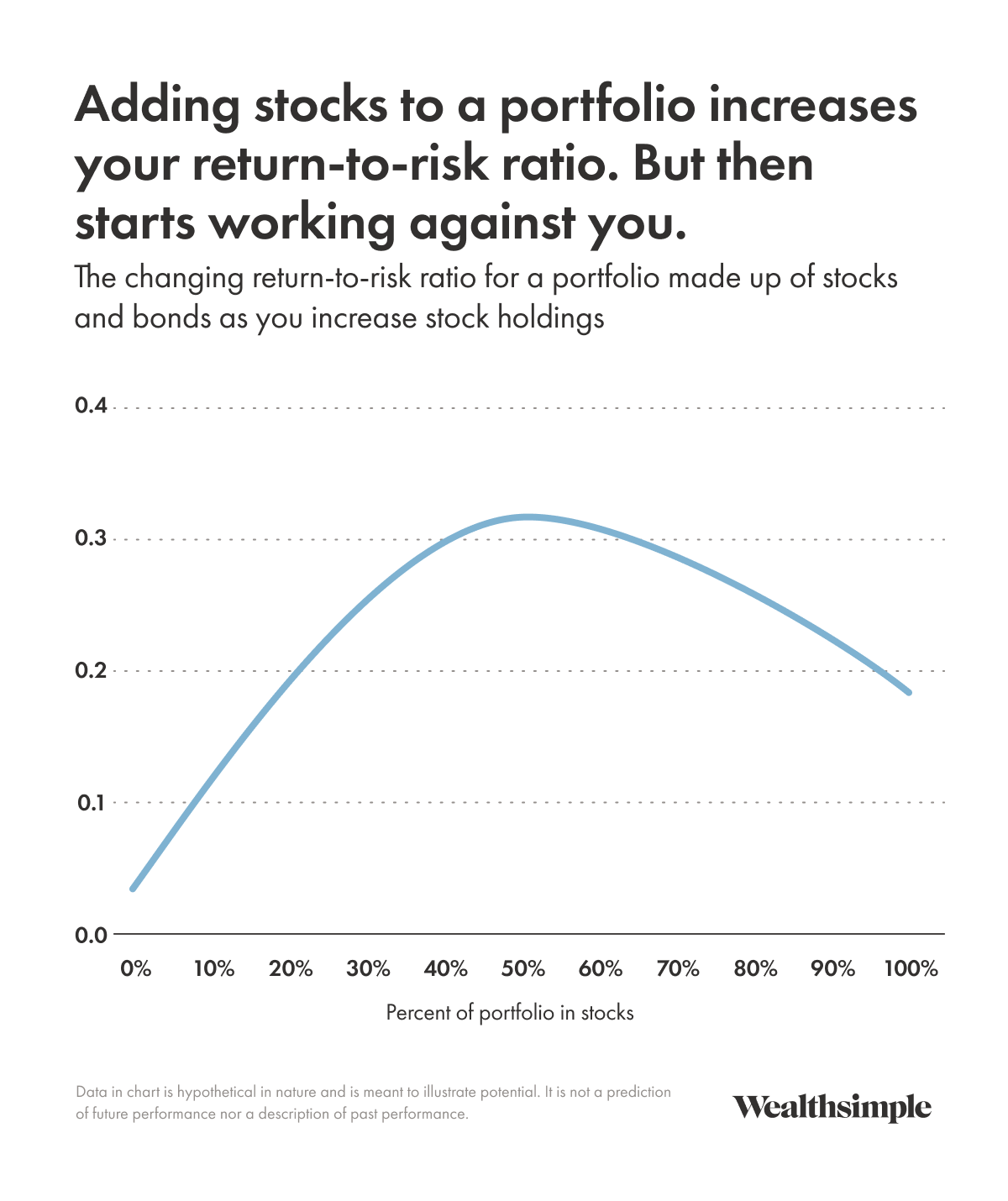

Another way to look at it is in terms of return to risk ratio. The return to risk ratio peaks around 50% to 70% in stocks. After that point, the portfolio gains less and less from adding stocks and taking on more risk.

The main point is that the benefit of taking on more stocks declines as stock concentration increases, and flattens after the portfolio reaches 70-80% stocks. Assets that provide diversifying returns help portfolios significantly. This is why we believe it is better to have some diversifying assets like government bonds and gold compared with owning more stocks for growth investors. Even if you reduce your return expectations for bonds below the returns from the past fifty years, the basic dynamics hold: each marginal dollar of stocks has less benefit because of compounding and diversification.

These general patterns are consistent with the math of how portfolios and compounding work, not simply one case study. They also hold up under stress tests with lower returns from bonds and different correlations between bonds and stocks. There are good arguments that bonds will underperform in the next 20 years (though those kinds of arguments, and we, are often wrong). There are also good theoretical reasons that stocks might offer better returns per unit of risk than bonds. Bonds often offer high returns in hard economic times, and stocks perform poorly in those same hard times, right when people might want to draw on savings. Because investment returns are compensation for taking on risk, it makes sense that the asset with insurance-like qualities would have lower returns.

Benefits of buying bonds

Bonds give you a predictable income stream in the form of regular interest payments. And if you hang onto the bond until its maturity date, you’ll get the principal back — making the security a way to preserve your capital while investing.

Bonds also tend to be less volatile than stocks, and act as a portfolio cushion during moments of equity market volatility. Much of 2022 and 2023 deviated from this general rule, when interest rate hikes in the United States and Canada pummelled bond prices (more on interest rate risk below) at the same time as equity markets were experiencing turbulence.

But it’s important to note that even when bond prices drop, the losses you experience are only on paper if you don’t intend to sell them. The bond will continue to pay out interest and return the principal amount upon maturity. A bond’s price only reflects what the market is willing to pay for that stream of income.

Another benefit of being a bondholder: if an issuer goes bankrupt, bondholders are first in line to get their money back.

Risk of buying bonds

Bonds are generally considered a lower-risk asset class. However, they are exposed to several risks.

Interest rate risk

Interest rate risk is one of the primary risks associated with bond investments. It refers to the potential for a bond's market value to fluctuate due to changes in prevailing interest rates.

Imagine you have a $1,000 bond paying 5% interest annually. If new bonds start offering 7% interest, your 5% bond becomes less attractive. To make someone want to buy your bond, you'd have to lower its price. This also means that your expected return has increased to 7%, so unless the issuer defaults your loss is temporary.

Longer-term bonds generally have more interest rate risk than shorter-term bonds.

Default risk

Default risk is the possibility that the issuer of the bond may not be able to pay back the face amount of the bond upon maturity. While there is no default risk for bonds and other debt securities issued by the U.S. Treasury and the Government of Canada, all other types of bonds and bond issuers do carry this potential risk.

Default risk varies based on the strength of the borrower and what happens in the economy in general. Large corporations may have a high probability of paying you back, while riskier companies may have a lower probability of paying you back. Investors are generally compensated for taking credit risk in the form of higher returns.

Inflation risk

The amount received upon the bond’s maturity is fixed, as are the periodic interest payments received. If inflation rises drastically, it cuts into the purchasing power of the bond payments. Other types of investment assets like stocks, real estate, and some others offer better protection against inflation in many cases. There’s a special kind of bond, inflation-linked bonds, that offer inflation protection. Also, floating-rate bonds offer some protection against inflation because their price varies with short-term interest rates, which often risk during periods of inflation.

Examples of bonds

As mentioned above, bonds are issued by governmental and corporate issuers, and range in risk level and yield. Bonds that are longer in duration will have higher yields, as will bonds from issuers at higher risk of defaulting, to compensate investors for taking greater risk.

Some examples of bond types include:

Government bonds

Bonds issued by the U.S. Treasury and Government of Canada are considered risk-free assets thanks to both institutions’ AA+ credit ratings. But investing in a sure thing comes with the tradeoff of lower yields.

The U.S. Treasury issues a number of different types of debt securities, including:

Treasury bills, or T-bills, are very short-term bonds issued by the Treasury with a maturity of one year or less.

Treasury notes are debt securities with a maturity ranging between one and 10 years.

Treasury bonds are longer-term securities with maturities ranging from 10 to 30 years. They are a form of longer-term funding for the federal government.

TIPS are bonds designed to help protect the investors in these bonds from inflation. The bonds are indexed to inflation, meaning that the principal value of the bond is increased based on the consumer price index, a major indicator of the level of inflation in the U.S. economy. The interest payments are calculated on the new principal value of the bond, and the payment upon maturity reflects this as well.

Provincial bonds

Provincial bonds are issued by provinces and are considered pretty safe because provinces have steady income from taxes and other sources. However, they're not quite as safe as bonds issued by the Canadian government. People and companies buy these bonds to earn interest on their money while helping provinces pay for things like schools, hospitals, and roads.

Corporate bonds

Corporate bonds are debt securities issued by companies to raise money for various purposes, such as expanding operations, funding research and development, or refinancing existing debt. They vary in riskiness based on the quality of the companies’ earnings and future outlook.