Mutual funds have been the dominant player in the personal investment world for decades. Here's a primer on what they actually are and how you can invest in them if you choose to.

What are mutual funds?

A mutual fund pools money from a set of investors in order to invest in a portfolio of asset classes like stocks and bonds. Unlike the stock market, in which investors purchase shares from one another, mutual fund shares are purchased directly from the fund or a broker who purchases shares for investors.

How do mutual funds work?

Mutual funds include:

Equity funds, which invest in stocks, including Canadian equities and small- or large-cap businesses

Money market funds, which invest in short-term fixed-income securities such as government bonds or treasury bills

Fixed income funds, which focus on investments that pay a fixed rate of return, including government bonds, investment-grade corporate bonds, and high-yield corporate bonds

The price of the mutual fund, also known as its net asset value (NAV), is determined by the total value of the securities in the portfolio, divided by the number of the fund's outstanding shares. This price fluctuates based on the value of the securities held by the portfolio at the end of each business day.

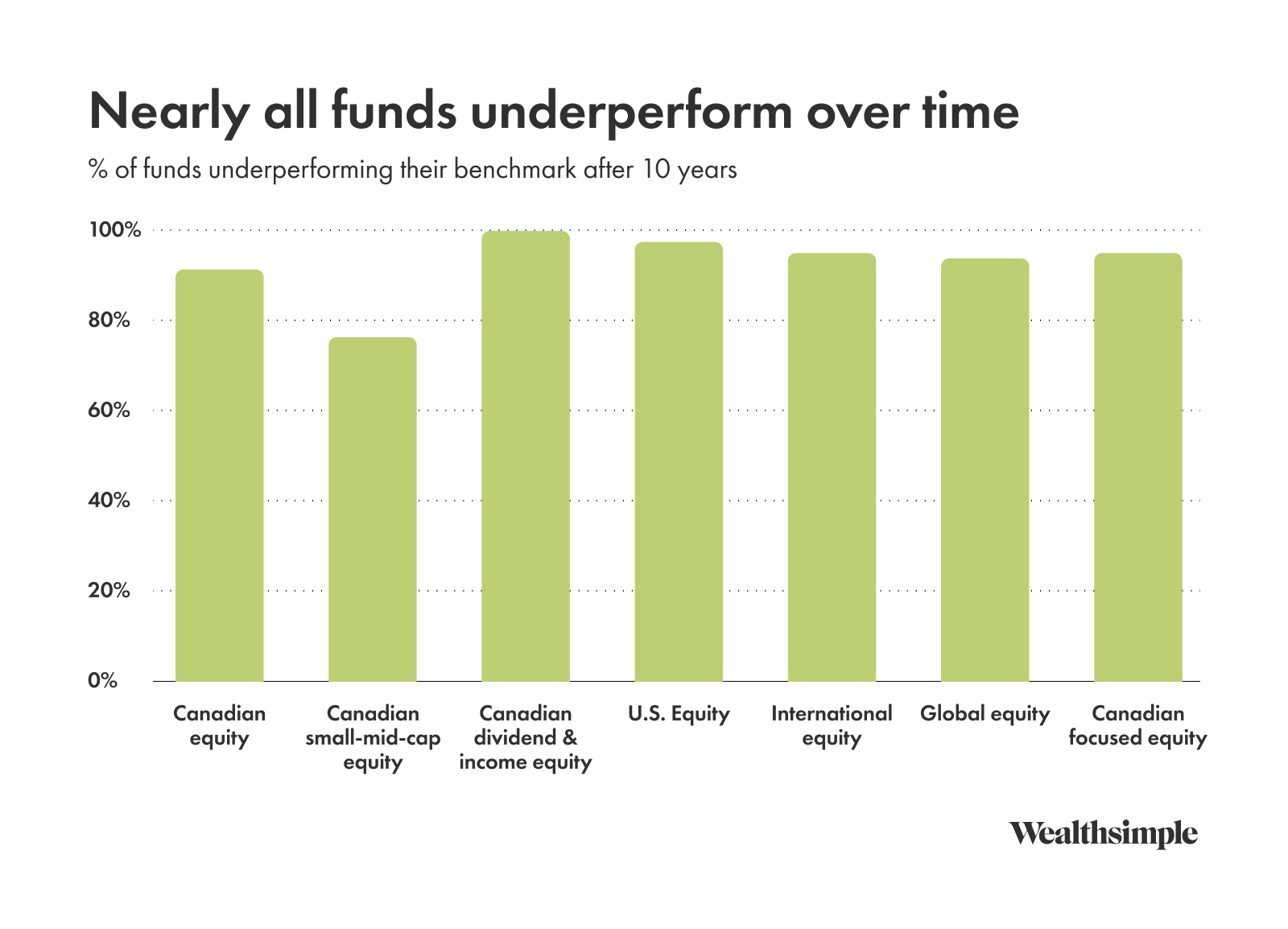

In the case of actively managed mutual funds, the decisions to buy and sell securities are made by one or more portfolio managers, supported by researchers. A portfolio manager's primary goal is to seek out investment opportunities that help enable the fund to outperform its benchmark, which is generally an index such as the S&P/TSX Composite. One way to tell how well a fund manager is performing is to look at the returns of the fund relative to this benchmark. While it may be tempting to focus on short-term performance when evaluating a fund, always keep in mind that any past performance is no guarantee for future performance. It's also worth comparing the alternatives to mutual funds that often have similar performance and lower fees.

What are the different types of mutual funds?

Mutual funds are divided into two main types — closed-end and open-ended funds. Within open-ended funds, there are two divisions: load and no-load.

Closed-ended funds: This type of fund has a set number of shares issued to the public through an initial public offering. These shares trade on the open market. This approach, combined with the fact that a closed-end fund doesn’t redeem or issue new shares like a normal mutual fund, subjects the fund shares to the laws of supply and demand. As a result, shares of closed-end funds normally trade at a discount to net asset value.

Open-ended funds: A majority of mutual funds are open-ended. Basically, this means that the fund does not have a set number of shares. Instead, the fund will issue new shares to an investor based on the current net asset value and redeem the shares when the investor decides to sell.

Load vs. no-load: In mutual-fund terms, a load is a sales commission. If a fund charges a load, the investor will pay the sales commission on top of the net asset value of the fund’s shares. No-load funds tend to generate higher returns for investors due to the lower expenses associated with ownership.

How do you invest in mutual funds?

1. Select the mutual funds you want to invest in

Before you buy a mutual fund, make sure it's the investment product you absolutely want to buy. They often charge higher fees than other investments, including exchange-traded funds (ETFs), and then often don't come with advice. (We’ll get into that below.)

The biggest decision you'll make in buying mutual funds is choosing the sector that the mutual fund will invest in. Small-cap Canadian startups? Large American companies? Or perhaps you're looking to focus more on emerging markets? You should also think about your investment goals and what kind of risk you're willing to take on. If you're risk-averse, then a more conservative portfolio is probably right for you. If you're working with a long time horizon, then you may be more enticed to add some riskier funds.

Once you've figured out what kinds of mutual funds you want to buy, make sure they're good quality in comparison to other funds that do the same thing. Many fund companies will provide ratings from Morningstar, the investment research agency, next to all of their offerings. These range from one to five stars, five being the best. As Morningstar explains, these are unbiased assessments of how well a fund's past returns have compensated shareholders for the amount of risk the fund has assumed.

However, there are perks for buying all your mutual funds from one company — or “family” of funds — which might include no-fee trading and possible lower management fees of individual funds after you reach a certain investment level. Performance changes by the day and sometimes fees change, too. You'll be well served doing some further research about funds before investing.

2. Pick the right investment provider

Unlike stocks, which aren’t generally marketed and sold by a company itself, you can go straight to the mutual fund issuers and buy their wares. Financial institutions sell these funds, too. Just be aware that, when you use one company to buy another’s fund, you may be charged a fee that you wouldn’t pay if you bought the fund directly from the issuer.

3. Watch out for fees

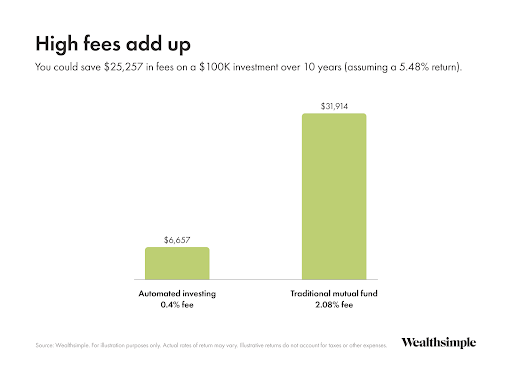

Fees, an important consideration, are normally listed online and in the mutual fund's "fact sheet." Fees are like investment termites — they'll eat into your returns — and over time, they can have a big impact on your returns. Let's say you put $100,000 into a mutual fund that charged the average fee in Canada. You’d be a whopping $25K worse off in 10 years than if you had invested that money in passive ETFs that charged a fraction of the fees and achieved the same return.

4. Rebalance your portfolio

Trading mutual funds should never be undertaken for emotional reasons. If the American stock market experiences a big tumble one day, you might be tempted to move your money to cash or foreign stocks. According to the first rule of investing (buy low, sell high) this may not be a wise thing to do.

That said, you should plan to periodically adjust your investments to maintain a consistent asset allocation. Plan on rebalancing your portfolio annually.

How do mutual funds make money?

Mutual fund issuers charge fees in the form of trading fees, management expense ratios (MERs), and loads. Here's an overview of each type of fee.

Trading fees: Online platforms will generally assess a one-time trading fee to buy most mutual funds. While trading fees, or commissions, can vary by platform, the amount you’re investing can influence how much of your investment goes to fees rather than funds. Increasingly, platforms offer pretty substantial lists of no-trading-fee (NTF) funds. If you’re dealing with the industry giants, there shouldn’t be any hidden fees associated with these — other than MERs of course. So what the devil are MERs?

Management Expense Ratios (MERs): These reflect the fees charged to run a fund. Mutual funds are run by fund managers, who are entrusted with trading the contents of the fund based on whether they foresee the value of the fund's investments going up or down. MERs are expressed as a percentage, and one that might look quite small, like 1 or 2%, but it’s important to understand this percentage is shaved off the value of the entire fund annually, whether or not the fund made or lost money. Over time, these innocent-looking MERs add up.

Loads: It’s not uncommon for trading platforms to “waive” trading fees for mutual funds that come equipped with loads. Considering that load is just a fancy term for sales commission, there’s no waiving going on at all; they're just putting the fee in a different place. Loaded mutual funds are named based on when the fee is charged. Class A shares are “front-loaded,” meaning they assess the fee when you buy the fund; B shares are “back-loaded,” meaning they'll charge a fee when you sell it; C shares spread the fee over some (or all) of the time you own the fund, usually a period of a year.

Disadvantages of investing in mutual funds

Here are five of the main disadvantages that can come with mutual funds:

Cost: As we described above, management fees of mutual funds can be high. This eats into your returns.

Fees: May include built-in “loads”, which are essentially sales commissions.

Liquidity: Other investments may be traded throughout the trading day, whereas mutual funds can be traded only once per day.

Financial advice: Most mutual funds do not come with financial advice.

Spotty returns: Over the long term, the vast majority of actively managed mutual funds have failed to outperform benchmarks. Though many fail to outperform the market, you still pay for "active" management.

The alternative to mutual funds, aka active investing, is passive investing. Passive investing is basically leaving your money alone for a long period of time in a low-fee account that seeks to mirror, rather than outperform, a market. This can be accomplished through a particular kind of mutual fund called an index fund, which tends to have significantly lower fees than actively managed funds because it simply maintains holdings in proportion to indexes — e.g., the S&P/TSX Composite.

Advantages of investing in mutual funds

Despite the downsides, mutual funds have advantages — at least if you’re comparing them to picking individual stocks. (When it comes to picking multiple assets, these advantages can disappear.)

Flexibility: Able to react quickly to changing market conditions since they are actively managed.

Diversification: A single mutual fund may contain dozens or even hundreds of separate stocks or issuers.

What does the letter at the end of a mutual fund name mean?

You've probably noticed there's a single letter listed in the name of many mutual funds. This refers to the fund’s series or class. Each series has different benefits and a different cost structure. Here’s the rundown:

A series: Mutual funds with "A" in the name are typically sold by a financial advisor or bought directly by an individual. They typically have a lower minimum investment requirement compared to other mutual funds. Advisors that sell A series funds may receive a commission for selling them to you.

D series: The "D" series is built for self-directed investors who buy the funds through a brokerage. No advice comes with D series funds; as a result, they generally have lower fees than other mutual funds.

F series: The letter “F” stands for fee-based mutual funds. The fees are paid through the advisor, rather than through the fund, and advisors often charge in the region of 1-2%.

I series: The "I" can mean a variety of things. In most cases, it stands for institutional. It can also stand for "income" or "investor" series. Some I series funds have a high investment minimum, making them suitable only for high-net-worth individuals.

O series: The letter "O" doesn't actually stand for a word beginning with O. Generally O refers to institutional mutual funds.

T series: Mutual funds with the letter "T" at the end will be tax-advantaged most of the time. These funds often have some portion of the returns that are not taxable.

How to make money from mutual funds

When you invest in a mutual fund, the value can increase in three primary ways:

Dividend payments: Income is earned from dividends on stocks and interest on bonds held in the fund’s portfolio. A fund pays out nearly all of the income it receives over the year to fund owners in the form of a distribution. Funds often give investors a choice to either receive a check for distributions or to reinvest the earnings and get more shares.

Capital gain: When a fund sells a security that has gone up in price, this is a capital gain. When a fund sells a security that has gone down in price, this is a capital loss. Most funds distribute any net capital gains to investors annually.

Net asset value (NAV): If fund holdings increase in price but aren’t sold by the fund manager, the fund's shares increase in price. This is similar to when the price of a stock increases — you don’t receive immediate distributions, but the value of your investment is greater, and you would make money if you decide to sell.

Investors in a mutual fund share equally in losses and gains. If one of your investments within the mutual fund goes bad, at least this does not drag down your entire investment portfolio. While investing in mutual funds does help to spread the risk, it doesn't eliminate it. It’s possible you could make money from investing in mutual funds, but you could also lose it.