Ever wish you had a crystal ball for your investments? While we can't promise guaranteed visions of the future, understanding technical analysis charts comes pretty close to giving you superpowers in the market.

They're essential sources of important data and tools that help investors make informed decisions and make progress toward achieving their financial goals.

What are technical analysis charts?

If you’ve ever seen a chart with a line that zig-zags up and down from left to right, you’ve probably seen a chart that could be used for technical analysis.

They show how a stock’s price has changed over time (a historical record of buyer and seller behaviour) that can include information like:

Opening price

Closing price

Highest price

Lowest price

Trading volume

Traders and investors use these charts to identify patterns, trends, support levels, and resistance levels (and if you’re not sure what these terms mean, there’s a glossary for that). There are a number of different chart types that show different kinds of data. Picking which one to use depends on two things: what you’re trying to figure out and the level of detail you need.

The three most common technical analysis charts are a great place to start: line charts, bar charts, and candlestick charts.

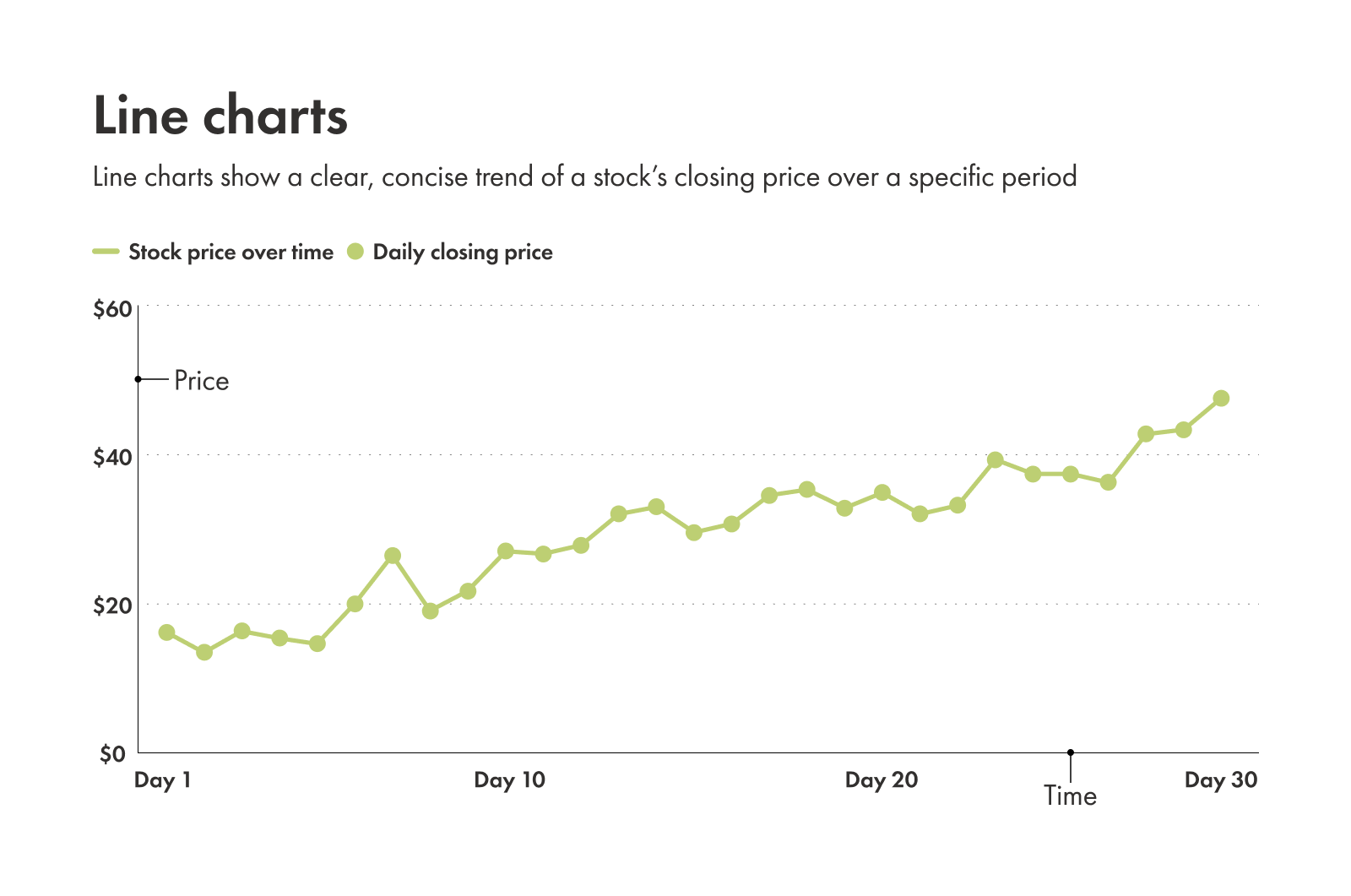

Line charts

The line chart is beautifully simple and gets straight to the point.

The x-axis represents time.

The y-axis represents price.

The points represent the closing price of the stock on that specific date.

The line connecting the points shows how the price changes over a period of time.

Goal: Show a clear, concise trend of a stock's closing price over a specific period.

Who it's for:

Long-term investors

Anyone looking for an overview of a stock’s price over time

What it's for:

A quick look at the overall direction of a stock

A simplified way to compare different companies

An easy way to spot long-term trends

Pros and cons of line charts

Pros:

Easy to read and understand

Clearly highlights the general trend

Less "noise" than more detailed charts

Cons:

Lacks detailed information

Can obscure short-term volatility

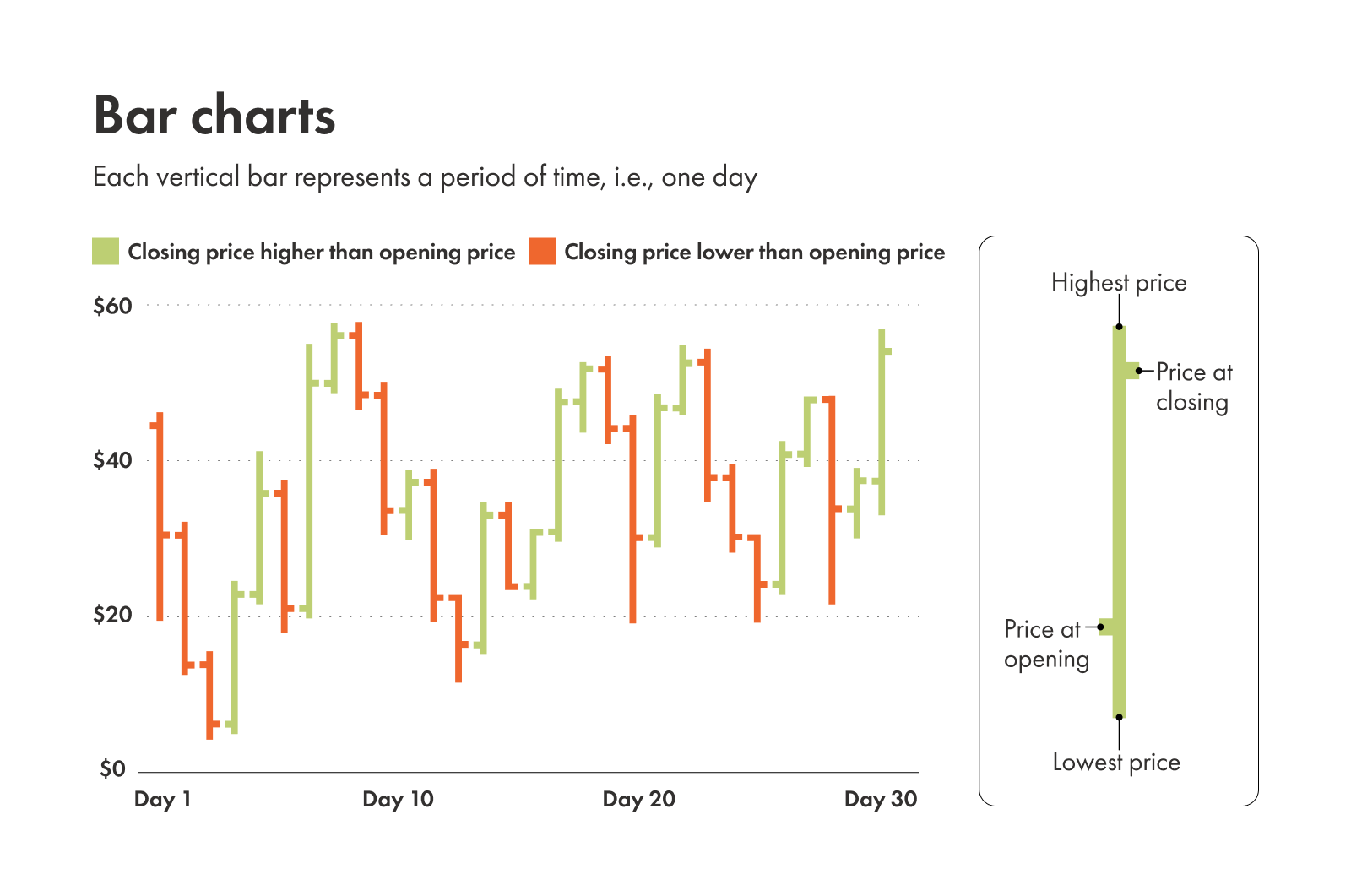

Bar charts (OHLC charts)

The next level of chart (in terms of detail), is a bar chart. Also called OHLC (open, high, low, close) charts, they have slightly more information than a line chart without being overwhelming.

Each vertical bar represents a period of time.

The small horizontal tick on the left shows the opening price.

The small horizontal tick on the right shows the closing price.

The top of the vertical bar is the highest price for that time period.

The bottom of the vertical bar is the lowest price for that time period.

Goal: To display the open, high, low, and close prices for a specific period.

Who it's for:

Anyone looking for more information than a line chart offers

Traders looking for the range of price movements over time

What it's for:

Helps traders spot trends for stocks over a longer period of time

A helpful tool for slightly more detailed short-term price analysis

Pros and cons of bar charts

Pros:

Provides more price information (open, high, low, close) than a line chart

Shows the range of price movement within a period

Cons:

Can be less intuitive to read than a line chart

Less visually engaging than a candlestick chart

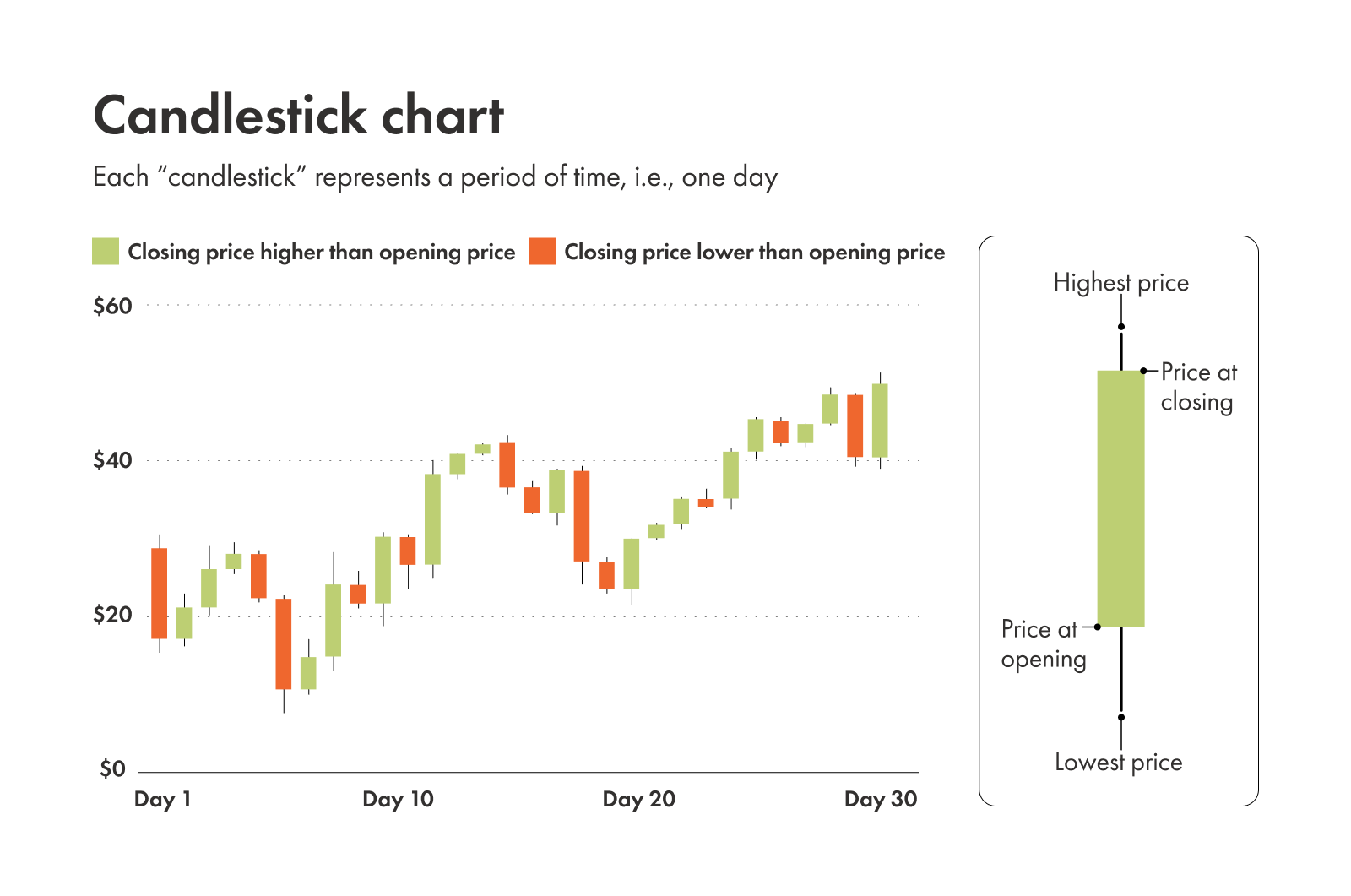

Candlestick charts

These are the real storytellers of the three and are a popular choice for technical analysis. Here’s how to read candlestick charts:

Each "candlestick" represents a period of time.

The wide part of the candle (the "real body") shows the difference between the opening and closing price.

The thin line that extends above the real body (the wick) shows the highest price during the time period.

The thin line below the real body (the shadows) shows the lowest price during the time period.

Green or white candles mean the closing price was higher than the opening price, showing it went up in value.

Red or black candles mean the closing price was lower than the opening price, showing it went down in value.

Goal: Show price movement in a comprehensive way (including the open, high, low, and close), while also using colour coding and a thicker candle "body" to show trends at a glance.

Who it's for:

Anyone who wants a wealth of information at a glance

Investors timing when to buy or sell a stock

What it's for:

Helps identify price patterns, potentially signalling reversals or continuations of trends

Can support with planning when to buy or sell a stock

Pros and cons of candlestick charts

Pros:

Visually rich, with colour coding and lots of data points

Easy to interpret once you know the basics

Helps with identifying trends and reversals

Cons:

Can appear overwhelming to new users

Learning is required to understand trends and find them

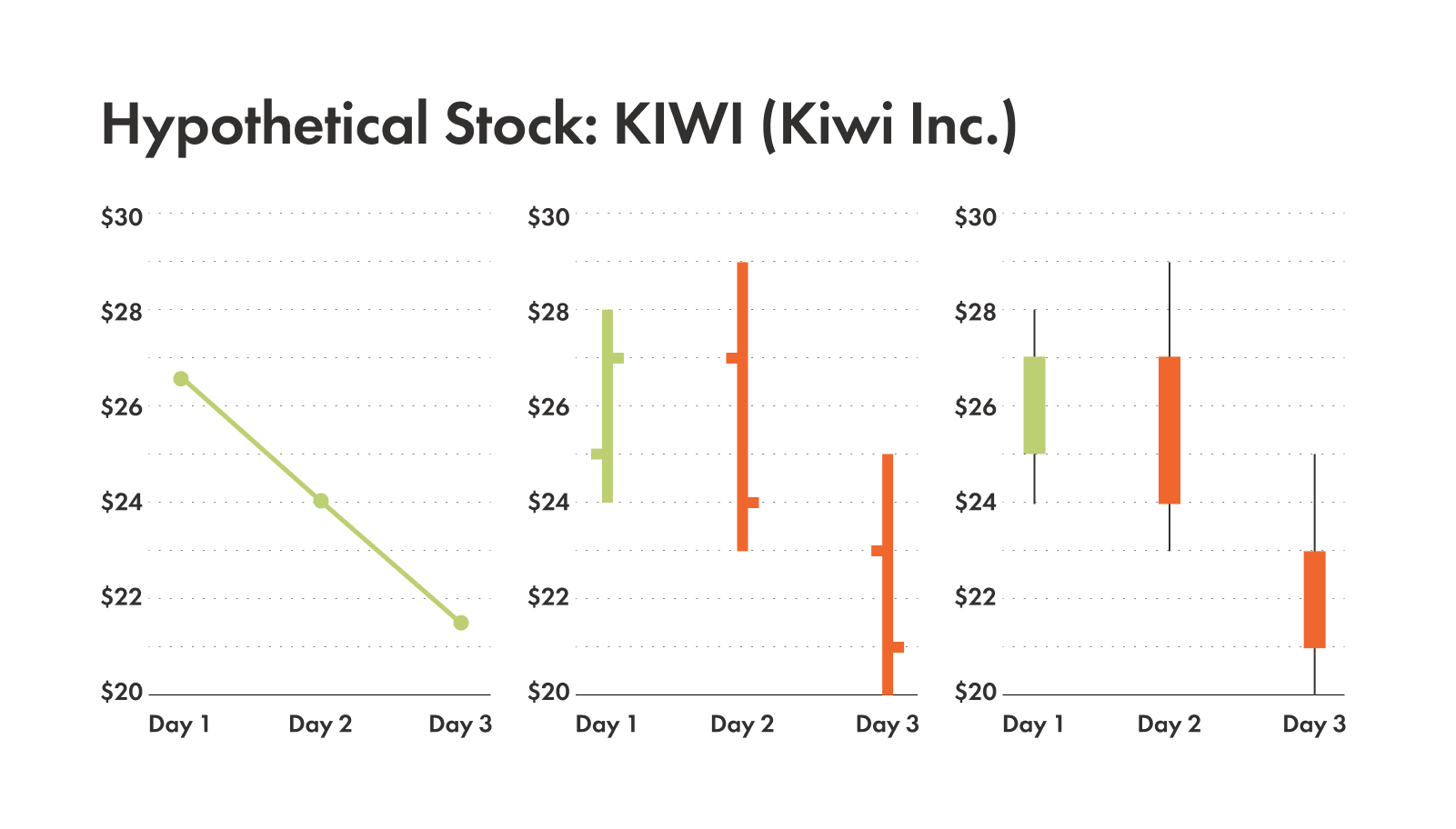

Compare technical analysis charts

Putting these three chart types side by side really shows their individual strengths — especially when it comes to candlestick charts versus bar charts. You can also see a visual example below.

Line chart | Bar chart | Candlestick chart | |

|---|---|---|---|

| Data | Closing prices | Open, high, low, and closing prices | Open, high, low, and closing prices; Buying and selling pressure |

| Best for | Long-term trend spotting; Comparing multiple stocks; Seeing overall market direction | Medium-term analysis; Intraday (within the day) analysis; Identifying trend strength; Understanding price range within a period | Short- to long-term analysis; Pattern analysis; Timing entries and exits; Identifying price patterns and market sentiment |

| Pros | Simple; Clean | Shows full OHLC | Visual; Widely used |

| Cons | Lacks detail | Can be hard to read | Steeper learning curve |

How to pick a timeframe for charts

Selecting a timeframe is how you zoom in or out of different sections on the chart you’re analysing. You can customize technical analysis charts over different time periods depending on what you’re looking for. Here are some examples:

Daily: each point, bar, or candle represents one trading day. Great for swing traders who typically own stocks for a few days to several weeks with the intention of profiting from short-term trends of price swings.

Weekly: each point, bar, or candle represents one trading week. Ideal for long-term investors to identify major trends, as weekly charts tend to filter out daily "noise" and show clearer signals.

Hourly (or less): each point, bar, or candle represents one hour (or even less, at every minute or every five minutes). Made for very active traders, like day traders, who need to see minute-by-minute price action.

Because the timeframe you choose heavily influences what you see and how you interpret the chart, it's crucial to align your timeframe with your investment goals.

But you’re not just limited to one timeframe! Analysts can use multiple timeframes (for example, looking at a daily chart for the overall trend, then a one-hour chart for entry/exit points) to get a comprehensive view.

Understanding different types of technical analysis charts and how to read them is a huge step in becoming a more informed investor. Charts can't predict the future with absolute certainty, but they can give you a great sense of the market's pulse. Happy charting!