Get instant help from AI

Call 1-647-584-1344

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

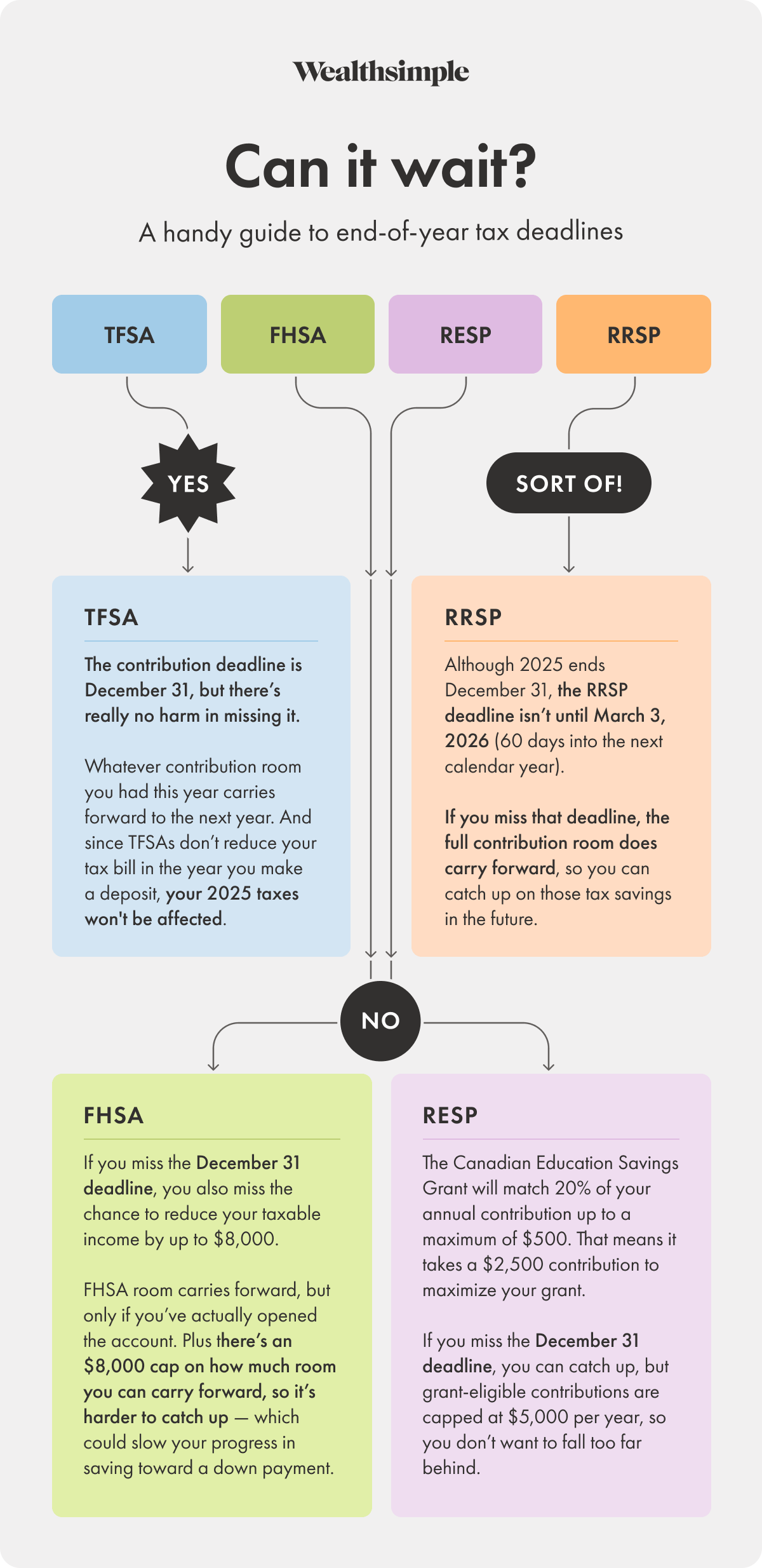

One of the best ways to minimize taxes is to make as much of your income as possible un-taxable — or at least taxed to a lesser extent. Not by hiding it in an offshore account, but by taking advantage of RRSPs, FHSAs, and other registered accounts. The challenge with doing this is balancing all of the different contribution deadlines — and knowing which to prioritize. Fortunately, we made a chart.

Wealthsimple’s Learn pages are meant to be educational. Every story is sourced from and vetted by subject matter experts, and produced by journalists with decades of media experience — people whose primary goal is to teach you something, rather than sell you something. While there may be links included in the article about products that are offered by Wealthsimple Investments Inc. (“Wealthsimple”) or one of its affiliates, these articles are not investment advice, a recommendation to buy or sell assets or securities, or any other kind of professional advice. If you are interested in learning about how Wealthsimple products or features work, please visit the Help Centre. If you are interested in knowing which products are offered by Wealthsimple and which are offered by affiliates, we’ve got a page to help you with that, too.