There’s often a difference — sometimes a big difference — between the mortgage that you qualify for and the mortgage you can actually afford. The bank’s number is usually going to be higher. That’s not because banks are out to get you. They just don’t know you, especially in the preapproval phase. They have no idea if you’re a penny pincher or someone who was legitimately tempted by the thought of buying a $150,000 Svalinn dog. But you do. And this is not the moment to delude yourself.

How banks determine your pre-approval amount

Banks base their pre-approval on what’s known as the five C’s:

Capital: how much money you can put toward a down payment

Collateral: the value of the home you are borrowing against. When it’s time to turn your pre-approval into actual approval, the bank requires an appraisal to make sure the home you’re buying with all this money they’re lending you is actually worth it.

Character: your job history and job security, along with your track record when it comes to paying back past debts

Capacity: how much income you have coming in to help you pay your mortgage each month. This is also known as your TDSR, or total debt servicing ratio.

Conditions: everything from the interest rate of the loan to the state of the economy

Your credit score doesn’t factor in nearly as much as you might imagine: as long as it’s above 650, you won’t get dinged. Anything below 650, however, results in a higher interest rate and, if you need it, more costly mortgage insurance. More critical is your TDSR: the Canada Mortgage and Housing Corporation restricts that ratio to a maximum of 44%.

How you can get a figure that’s more appropriate for your budget

You need to determine just how much money you’ll feel OK forking over to your mortgage lender each month without forcing yourself to reuse paper towels. You need breathing room, preferably big gulps of it. You need, in other words, a detailed budget.

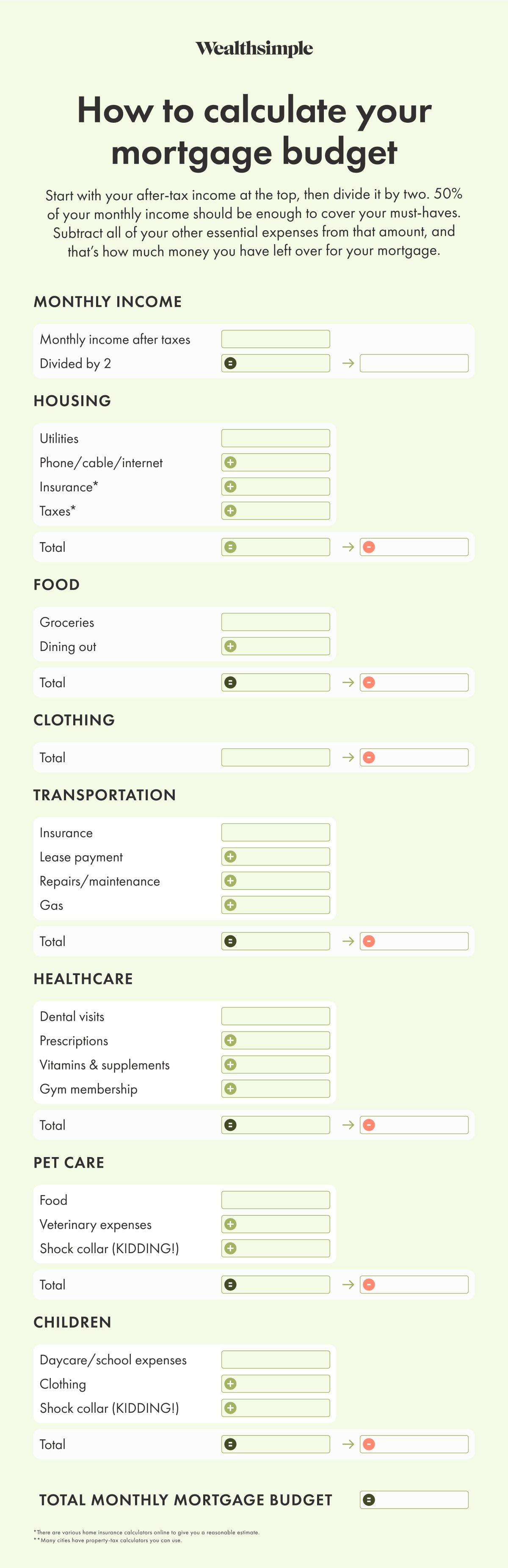

One classic budgeting approach is the 50/30/20 rule. Fifty percent of your after-tax income (the after part is important) goes to your needs — things like food, utilities, clothing, and … housing costs, i.e., that mortgage you’re applying for. Thirty percent is for wants (vacations, Spotify, an occasional meal not served from a drive-thru window), and 20% is for paying down other debts — student loans, credit cards — and saving for the future.

Since the “needs” column is what your future mortgage will go under, you can focus on only that part to help minimize the math. Here’s a template to help you figure things out.

Congratulations! You now know what your optimal mortgage payment is! Unfortunately, you’re not quite done yet. Experts recommend lowering that number by at least 5% in order to give yourself wiggle room in the event of a spike in interest rates. It’s called “payment shock.” Depending on the size of your loan, a rate change from the central bank can add several hundred dollars to your monthly payment.

You also may want to add a little extra cushion in case your income goes down (maybe you get laid off) or your expenses go up (twins!). And don’t forget closing costs (that land transfer tax can be a doozy) and any possible renovations you might want to make. Those are one-time fees, but if you’ve forgotten to consider them and your down payment wipes out your savings, you can’t actually afford the home.

To find out what kind of mortgage that payment will cover, you can pull up a home affordability calculator online. It'll work backward to calculate the total mortgage for you.