Corporate accounts for physicians

Join thousands of medical professionals like you who invest back into their practices with Wealthsimple.

Growing returns for your practice just got easier

Open an account online

No need to visit a branch or call an 1-800 number. 80% of accounts are opened in 7 days or less.

Save big on fees

Keep more of your money with commission-free self-directed investing and fees as low as 0.2% when you invest more than $1M in managed portfolios.

Financial advice at every stage

No matter where you are in your medical career, Wealthsimple has advice or products to help manage your finances and maximize tax savings.

Ways to invest with a corporate account

Trade stocks and ETFs

A corporate self-directed investing account gives you total control over where your money is invested. Buy and sell stocks and ETFs commission-free and automate your investments.

Portfolios built and managed for you

With corporate managed investing, you tell us your goals and timeline, and we’ll build you a portfolio that matches your risk tolerance. We’ll also help optimize your portfolio for tax loss harvesting and rebalancing.

Earn interest on cash deposits

With corporate savings, earn up to 2.25% interest on any deposits and grow your capital without the risk.

Physicians already with us

Rohit Gandhi, Emergency Physician, MD, CCFP-EM, HBA

"Since moving my corporate accounts to Wealthsimple, I’ve realized just how valuable great customer service, no-fee trading, and a powerful, intuitive platform can be... I’m always excited to see what’s next!"

Ayaz Kurji, Consultant Psychiatrist, BScH, MD, FRCPC

"In addition to providing a self-managed corporate account, Wealthsimple charges zero fees for trades, offers incredible perks and bonuses multiple times per year, and has excellent customer service. I've been very happy with my experience since joining Wealthsimple last year."

How corporate accounts work for you

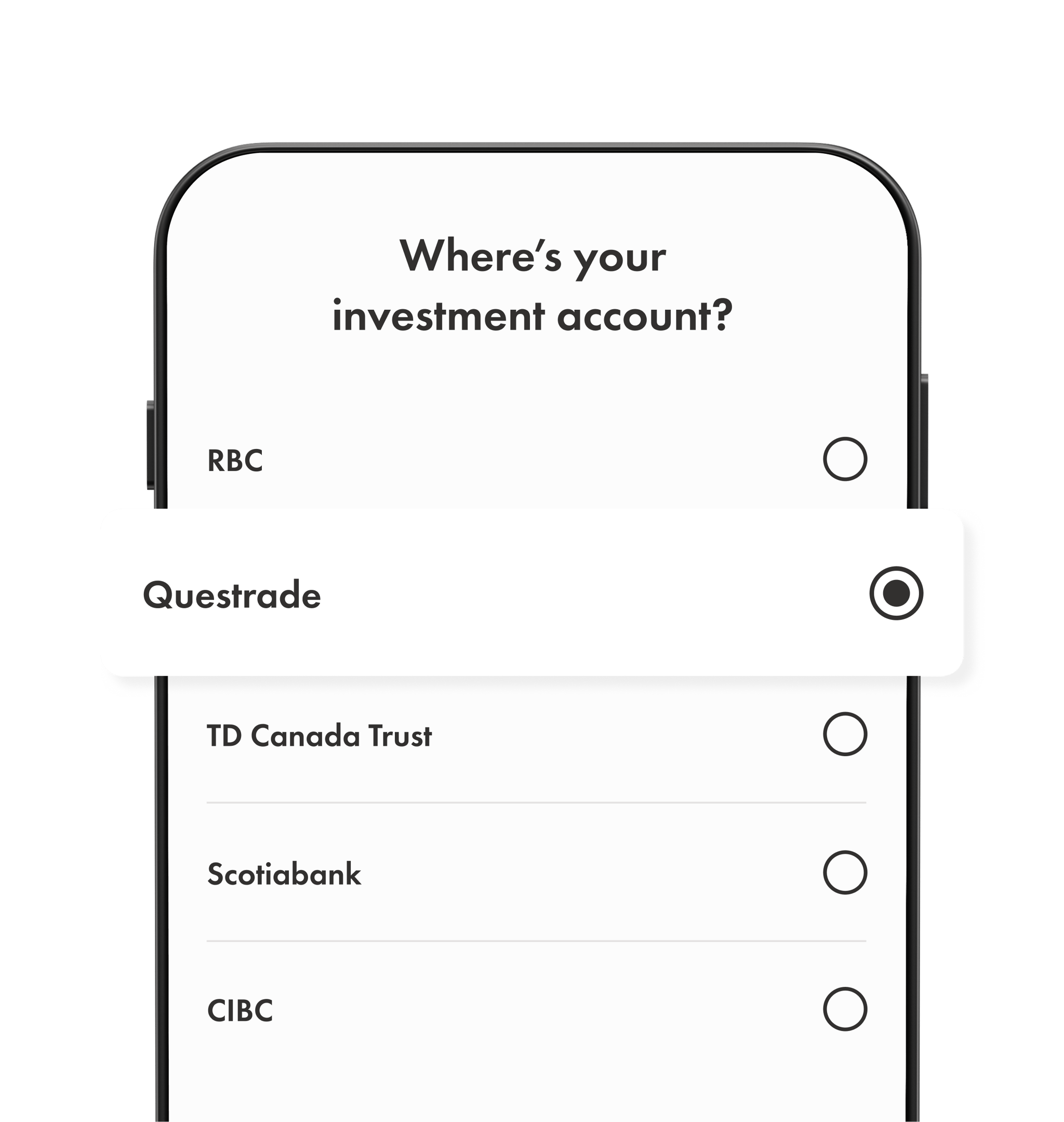

Setup and fund your account online

We help doctors run their businesses, unlock tax benefits, and grow capital, quickly and easily. Set up your account from anywhere, and transfer funds from Wealthsimple or another institution.

Invest for the short or long term

Whether you're just starting out or nearing retirement, we offer investment options to match your goals. Choose one that suits you, or mix and match, with support from our expert advisors.

Our business is supporting yours

Built in security

Depending on your investment mix, your deposits could be eligible for CIPF protection as well as CIDC deposit insurance. Ask our team for more details based on your needs!

Reach out to us for support

Questions about your corporate account? We have lots of client support options to suit whatever your business needs. Get in touch with us to learn more.

Everything in one place

Between our mobile application and web platform, we help doctors and physicians like you manage all personal and corporate finances in one place.

Move your investments and we'll cover the fees

We automatically reimburse transfer fees charged by your financial institution when you move at least $25,000 to Wealthsimple. Conditions apply.

Ready to make the move?

Discover why thousands of doctors and physicians trust Wealthsimple with their finances.