Call options let you take a position on a stock, essentially declaring how you think it will perform by a certain point in time. They give you the right to buy a fixed number of shares at a specific price (the “strike price”) by a specific date (the “expiration date”).

But before you can really understand calls, you need to understand options trading.

What are options?

Options are a financial instrument known as a derivative. Their value is based on the value of a particular stock (called the underlying stock), and they don’t give you any actual ownership in the stock. Options are traded separately on exchanges and will have their own valuation based on several factors, including the price of the underlying shares, supply and demand, and the time remaining until the expiration of the options.

The price of an option is called the premium. It’s quoted in dollars per share and typically covers 100 shares. For example, buying a call option with a $5 premium would cost you $500, or $5 x 100.

When you buy an option, you get the right to buy or sell the underlying stock in the future. Whether or not you do that (the process is called exercising your option) is determined by the performance of the stock.

Why would you want that right? Options are flexible investment tools that can serve several strategic purposes, like hedging against losses or generating extra income. You can use options to protect yourself against potential price drops in a stock you own, or to lock in a price of a stock you don’t own to ensure you don’t miss out on future gains. And you can sell options to generate income from the premiums.

Why would someone buy a call option?

You would buy a call option in the hope that the price of the underlying shares of stock will rise in value to a level above the strike price, which would let you purchase the shares at a price that is below the market price. For example, if the price of the stock is rising, and the call option offers the opportunity to buy the shares at a strike price that’s significantly lower than what other people are paying for it, that’s a pretty attractive deal.

Call options are also used in a number of settings beyond stocks. There are call options on exchange-traded funds, as well on bonds, indices, and some types of commodities. In all cases, a call option is a bet that the underlying price of the security in question will rise within the period of time prior to the expiration of the option. This makes buying call options a bullish strategy.

Why would someone sell a call option?

You can also sell (or “write”) a call option. If you’re selling a call option, you’re agreeing to sell the underlying stock at your strike price if your buyer decides to exercise the option. If the stock price rises above your strike price before the expiration date, the person who bought your option may exercise it, forcing you to sell those shares at the strike price — meaning you’re missing out on gains. If the stock price stays the same as or goes below the strike price, then the option likely expires worthless. The buyer won’t exercise the option and you won’t have to sell. But you do get to keep your premium.

The main reason for selling call options is to generate a little extra income from the premium received for writing a call option contract, which you collect whether or not the buyer exercises the option. Some investors also sell call options as a hedging strategy. If you think the value of the underlying stock is headed for a downward turn, the premium from selling options helps you offset some of the loss in value.

How call options work

Here’s what a call option could look like in practice:

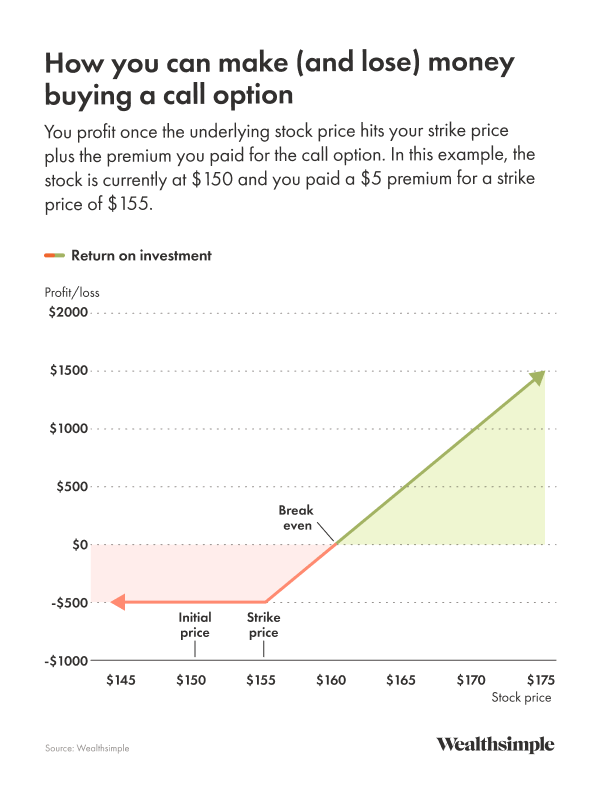

You’re eyeing a stock, $KALE, that’s currently trading at $150 per share. You’ve got a hunch that it might rise to $175 later this year, so you decide to buy a call option with a strike price of $155 and an expiry of 30 days. The premium for the call option is $5 per share ($500 total for 100 shares).

A month later, the stock is at $175. You decide to exercise your right to purchase 100 shares at $155 each, for a total of $15,500, with plans of immediately selling them (for $17,500) and collecting your profit or $1,500. But $15,500 isn’t chump change, so you might decide to sell the option instead, and let someone else take advantage of the opportunity to buy those stocks for less than market price.

But what if $KALE never hit $175? Let’s say it fell to $145. This is where the part about options not obliging you to buy the stocks is so important. You can either try to sell the option to a more optimistic investor, likely at a loss, or you can just let it expire, worthless. The maximum amount of money you can lose is the $500 premium you paid.

Call options vs. put options

A put option works the opposite way a call option does: it provides the option holder with the right — but not the obligation — to sell a number of shares of a stock at a specified price within a specified period of time.

Where buying call options takes a long position (meaning you’re betting that a stock’s price will increase), buying put options takes a short position: you’re betting that the stock’s price will decline.

Types of call options

There are many different kinds of call option strategies, all used for different reasons. Here are two of the most common.

Covered call options

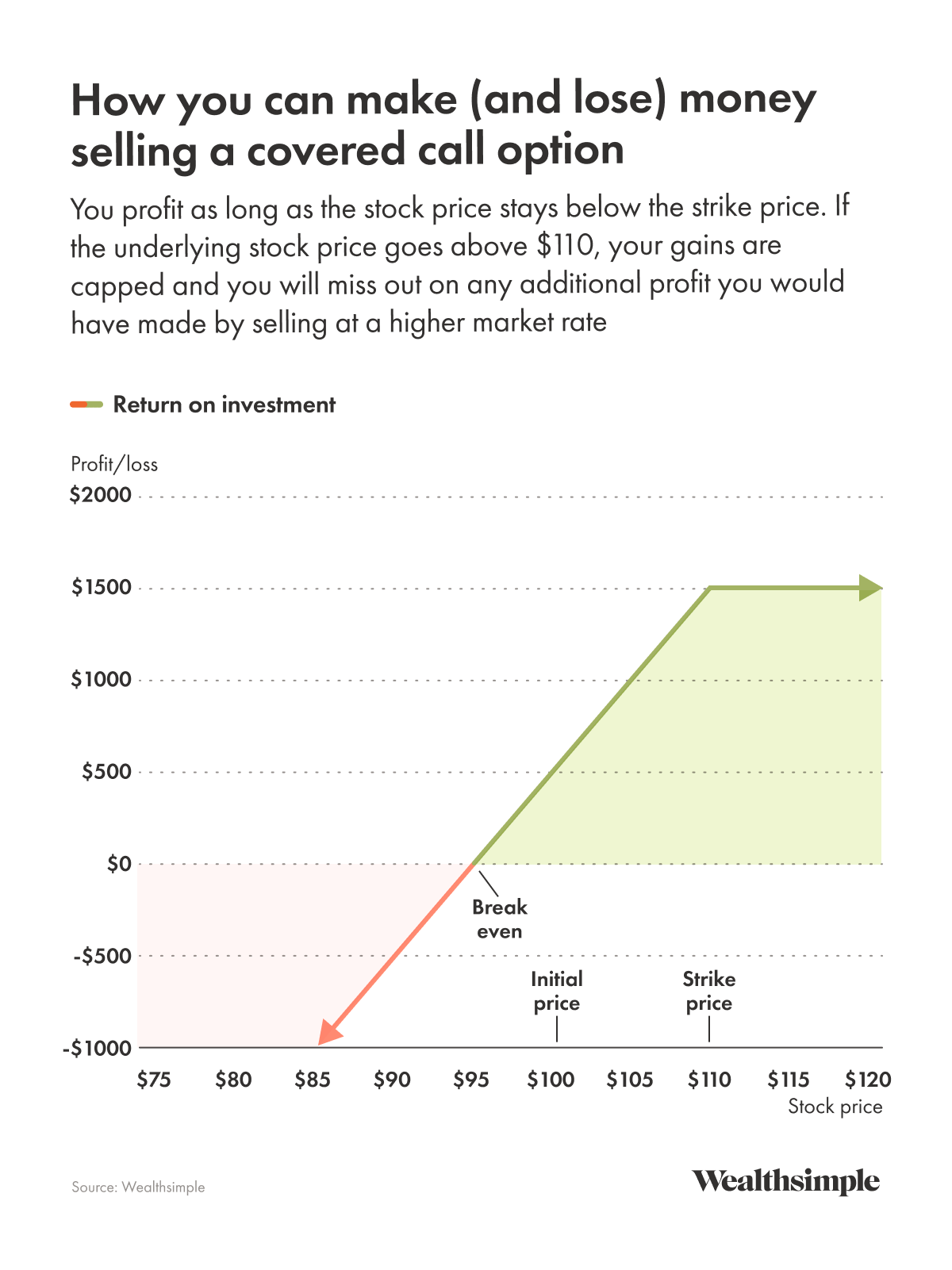

With covered calls, you sell (or write) call options against the underlying stock you own. If the option is exercised, you sell your shares to cover the call. Here’s what that can look like in practice.

You own a large chunk of a stock, $KALE, in your Tax-Free Savings Account (TFSA), which you’ve profited from over the last couple of years. It’s currently trading at $50, and you think it could rise a little more over the long term, but want to earn some additional income while you wait. You write a covered call option with a strike price of $55, expiring in 30 days. You make a premium of $5 per share for selling the call option. From here, one of two things could happen:

The stock price stays below $55 The call option expires worthless, because the stock price didn’t hit the strike price. You keep your $500 premium and any appreciation on your shares. For example, if the stock hits $52, you would gain $200 of appreciation (the $2 change in stock price multiplied by 100 shares).

The stock price goes above $55 The stock price has surpassed the strike price, so your buyer decides to exercise the option. You keep your premium and you sell your shares for $55 each, missing out on any additional profit above $55. But you still made a profit of $1,000 based on the additional $500 appreciation (the $5 change in stock price multiplied by 100 shares) and the $500 premium you earned from selling the call option.

Naked call options

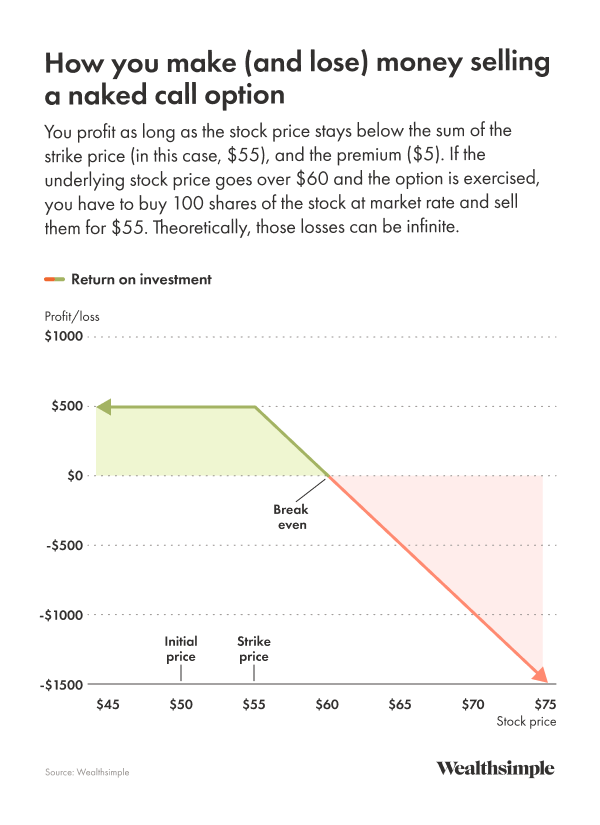

If you’re selling a naked calls option, you’re selling an option on shares you don’t own. As with covered calls, you’ll earn a premium from selling the option, but there’s always the chance the option will be exercised, and that means you’ll have to buy the shares needed to cover the call — no matter how much they cost. (And remember, there’s no limit to how high a stock price can go.) This is a very risky practice with virtually unlimited loss. Here’s what it can look like.

Let’s go back to $KALE. It’s trading at $50 per share. You don’t own any Kale stock, but you think the price is going to go down any day. You write a naked call option with a strike price of $55, expiring in 30 days. You make a premium of $5 per share for selling the call option. Now what?

The stock price stays below $55 The call option expires worthless, because the stock price didn’t hit the strike price. You keep your $500 premium and you don’t have to buy any shares.

The stock price stays goes above $55 The stock price has surpassed the strike price, so your buyer decides to exercise the option. You keep your premium, but now you have to go out and buy the shares at the current price and sell them to the options buyer at the strike price, resulting in a loss. If the price had risen to say, $75, you would have to buy 100 shares at $75 for $7,500, then sell them to the option holder for $5,500. After deducting your original premium of $500, this would result in a $1,500 loss.

How to buy and sell call options

Like buying and selling stocks, you can access call options within a basic trading platform or online broker. Many account types can be enabled for options, including margin accounts, TFSAs, First Home Savings Account, and even Registered Retirement Savings Plans.

Opening an account to trade options is sometimes a bit more involved than opening a regular brokerage account. Because options trading is considered to be riskier (more on that next) than many other types of investing, brokerage firms are looking to protect themselves and their users in the case that an inexperienced trader were to suffer major losses from trading options.

Firms may screen applicants, looking at things like:

their investing experience (with options and other types of financial instruments)

their financial information (including their liquid, or cash, net worth)

their investing objectives (both generally and specifically around options trading)

Once you’re ready to buy or sell call options, you can choose the parameters of the call option, including:

strike price

expiration date

number of contracts (the quantity of call options available to buy or sell; each contract represents a standardized number of shares of the stock)

From here, you’ll watch the price of the stock and decide to exercise (or not) your option to buy your calls before the expiration.

Risks of call options

Options trading can be very lucrative — and very risky. There's no guarantee of returns. Inexperienced or under-educated options traders could face pretty significant losses if they don’t learn how to manage and mitigate risk.

As we covered above, as the buyer of a call, the only money you stand to lose is your premium. But if you sell a covered call option, there’s a risk that you’ll have to surrender the shares you own if an option buyer exercises the option.

If you sell a naked call option, there’s a risk that you’ll have to go into the market and purchase enough shares of the stock at a price much higher than the option’s strike price in order to cover the exercise of the option.