Investing is all about getting a return on your money, and one of the best ways to assess how well you are doing is to calculate the yields of your investments. That is, find out how much income each of your investments promises to earn relative to its value in the market and how much you invested in the first place.

What is yield?

Yield is the income you gain from an investment, which does not include profit you make from the price of your initial investment rising — called capital gains. Calculating your yield percentage allows you to tabulate how much income you can expect to earn each year in relation to the market value and the initial cost of your investments.

Yields vary by type. For example, if a stock offers a dividend, that is a type of yield. A typical stock yield on the S&P 500 is 2% to 4%.

Yield comprises just part of the total return you get on an investment. The other component of your return is the actual price of the investment security or property, which will fluctuate with the market. If the investment goes up in value, you profit from capital gains.

Yield vs. return

Do yield and return mean the same thing? Many people conflate the two terms, thinking they both signify the money you get back from an investment. But this is a misconception. These are two distinct calculations that tell you different things about your investments.

Yield is specific to income, so it does not take capital gains into account. Yield looks at what you will make in the future; it is called a prospective measure.

Return assesses all the gains you’ve made from a certain investment over a particular period of time. This includes both income (such as interest or dividends) and capital gains. Return only looks at what has happened in the past; it is called a retrospective measure.

When assessing your investment portfolio, consider both your rates of return and yields. Together they can provide a good picture of the health of your investments.

Types of yield

There are three types of yields:

Dividend yield, aka yield on stocks: yields from stocks come in the form of dividends, which usually arrive on a quarterly schedule, but may be monthly, semi-annual, or annual.

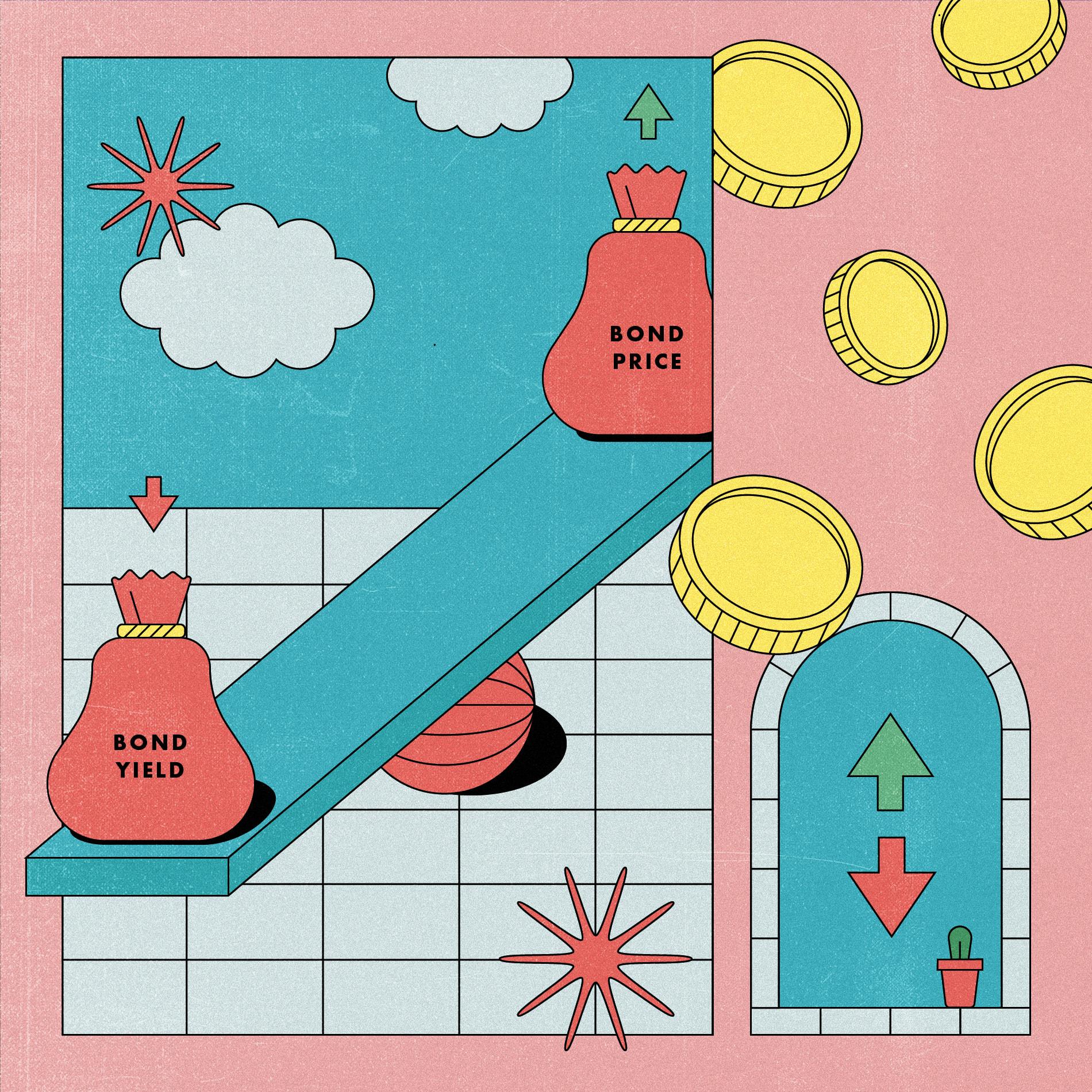

Interest yield, aka yield on bonds: yield from bonds comes in the form of coupon payments, which are usually distributed semi-annually.

Rental income yield, aka yield on real estate: yield from real estate investments is defined by the amount of rental income received from a property, minus all operating expenses — otherwise known as net income.

As the price of an investment increases, the yield from that investment decreases. And vice versa: as the price goes down, the yield from that investment goes up. We’ll show you how below.

How to calculate yield

You can calculate yield using a simple formula: take whatever form of yield you have (dividends, coupons, or net rental income) and divide it by the investment’s value. This will give you a number less than one, which you will then multiply by 100 to get the annual percentage of yield.

It’s important to note that these are all backward-looking yield calculations; if dividends get cut or interest rates change, future yields can be very different from the recent past.

With that in mind, let’s look at some examples of how you might calculate the yield for different types of investments.

Stocks

To calculate the yield on your stock investment, use the following formula:

Dividends per share / stock price x 100

Let’s say that you are thinking of buying a share of Acme Computer Company and want to figure out your yield. The dividend for Acme is $0.25 per share for a total annual dividend of $1.00 per share, and the price per share of the stock at the moment is $38.75. You do the following calculation:

$1.00 / $38.75 = 0.0258 x 100 = 2.58% yield

The yield calculation tells you what percentage of the initial investment you will recoup each year.

The next day, the price per share of stock is higher. You calculate how much lower your yield would have been if you had waited one more day and paid the higher price for the stock:

$1.00 / $40.17 = 0.0249 x 100 = 2.49% yield

Bonds

To calculate the yield on your bond investment, use the following formula:

Coupon price / bond price x 100

You want to earn fixed income payments while you save aggressively for your son’s college education. You buy some Big Bank corporate bonds that have a price tag of $102.93 and come with a coupon of 4.65%.

The first step in this equation is figuring out the coupon’s annual price. Do this by multiplying the coupon percentage by 100:

4.65% = 0.0465 x 100 = $4.65 per bond per year

Next, divide the coupon price by the bond price and multiply by 100:

$4.65 / $102.93 = 0.0452 x 100 = 4.52%

The yield calculation tells you how much you will be getting back each year based on the size of your coupon and the price of the bond.

Real estate

To calculate the yield on your real estate investment — also called the “cap rate” — use the following formula:

Net rental income / real estate value x 100

You own a condo that you rent to your friend. You bought the one-bedroom unit for $560,000 and are renting it for $2,350 per month. The costs for the condo, including taxes, homeowner’s insurance, and association fees, total $850 per month.

To calculate your yield, the first step is to figure out your net annual rental income:

$2,350 – $850 = $1,500/month x 12 months = $18,000/year

Next, divide your annual rental income by the cost of his property and multiply by 100:

$18,000 / $560,000 = 0.0321 x 100 = 3.21%

This yield calculation tells you how much of your initial investment you’ll be getting back each year by renting out the condo. Since yield does not include capital gains, this number does not include any amount you will recoup when you sell the condo, if the property value has gone up.

Pay attention to real yields

As with so many financial calculations, inflation rears its ugly head in the process of figuring out yields. Since a dollar’s purchasing power — its real value — declines over time, it’s important to factor that into your calculation for whether your investments are yielding sufficient funds. Would it be better just to put your moolah under the mattress?

Say you need $8,000 a month to live on this year, and your stock dividends have paid you $2,000 (2% return on a $100,000 investment). If inflation is at 3%, then next year the same lifestyle will cost you $8,240/month — an additional $2,880 over the course of the year, compared to the previous year. With your investments yielding 2%, you’ll still get your $2,000 return. But instead of the $2,000 gain you had the previous year, now you’ve got an $880 loss. Your real yield is a negative 1% — not nearly as rosy a picture as it seemed at first.

It’s important to pay attention to real yield and real return when setting up and managing your investment portfolio.

Watch out for high dividend yields

High dividends can seem too good to be true, and that may mean that they are. Investors should beware of stocks that show extremely high yields, especially if the company doesn’t have a decades-long record of maintaining and successfully paying such yields.

During the 2007-2008 subprime mortgage disaster, some companies had yields of 10% to 20%. While that may seem great, the high yields were only the result of the stock price tumbling, making the dividend high in relation to the suddenly devalued price of the stock.

Other companies pay high dividends, but instead of financing those dividends through profits, they sell stock to pay them out. This is a form of financial engineering meant to appeal to dividend investors, and is likely a sign that the underlying business is desperate for shareholders.

Before investing in a high-yield dividend stock, it is essential to analyze why the yield is at that level and understand if it’s sustainable or not. The answer may be more of a red flag than a reassurance.

Don’t be afraid of yield calculations

Figuring out yields is a fairly straightforward process. The fundamental question is: what percentage of the money you put in will you be getting back each year?

That’s a useful thing to know when you’re tying capital up in investments. Knowing your expected yield — and your real yield — can help you avoid making costly mistakes and keep your investments in the black.