Portfolios

Our portfolios will beat your mutual funds

If you're interested in saving on fees and retiring up to 47% wealthier, our pre-built portfolios are for you.

We do the research (and the work)

Expertly designed and researched portfolios with automatic tax-loss harvesting, dividend reinvestment, and built-in rebalancing that keeps you aligned to your goals.

Diversified performance

Smarter diversification, stronger performance. Our portfolios are designed to keep you ahead of the curve, with assets, strategies, and risk tolerances built for your goals.

Keep more of your money

Lower fees mean higher net returns for you — and our fees are actually low, starting at 0.5%. Plus, transparency means you always know where you stand.

Different ways to invest

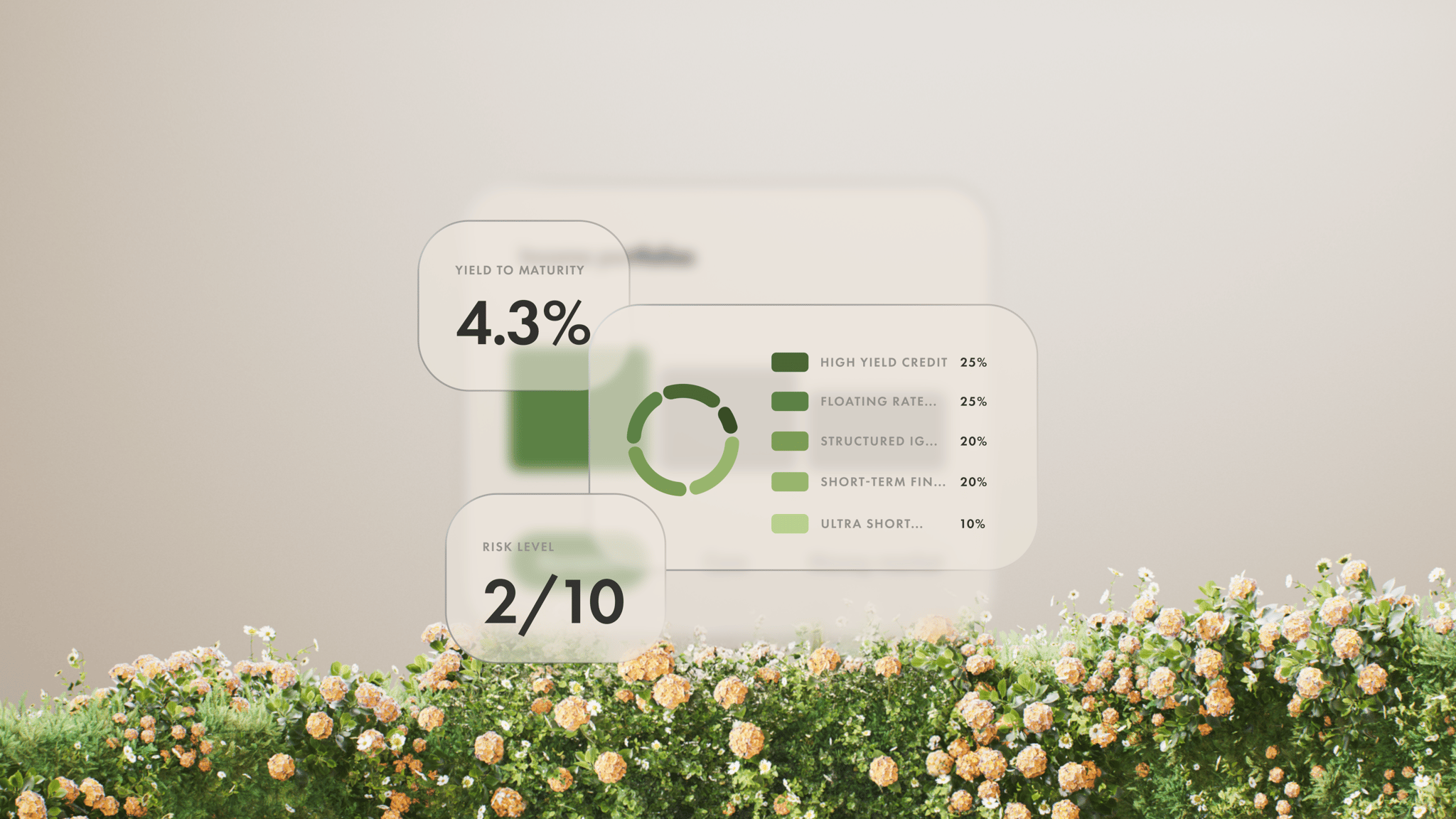

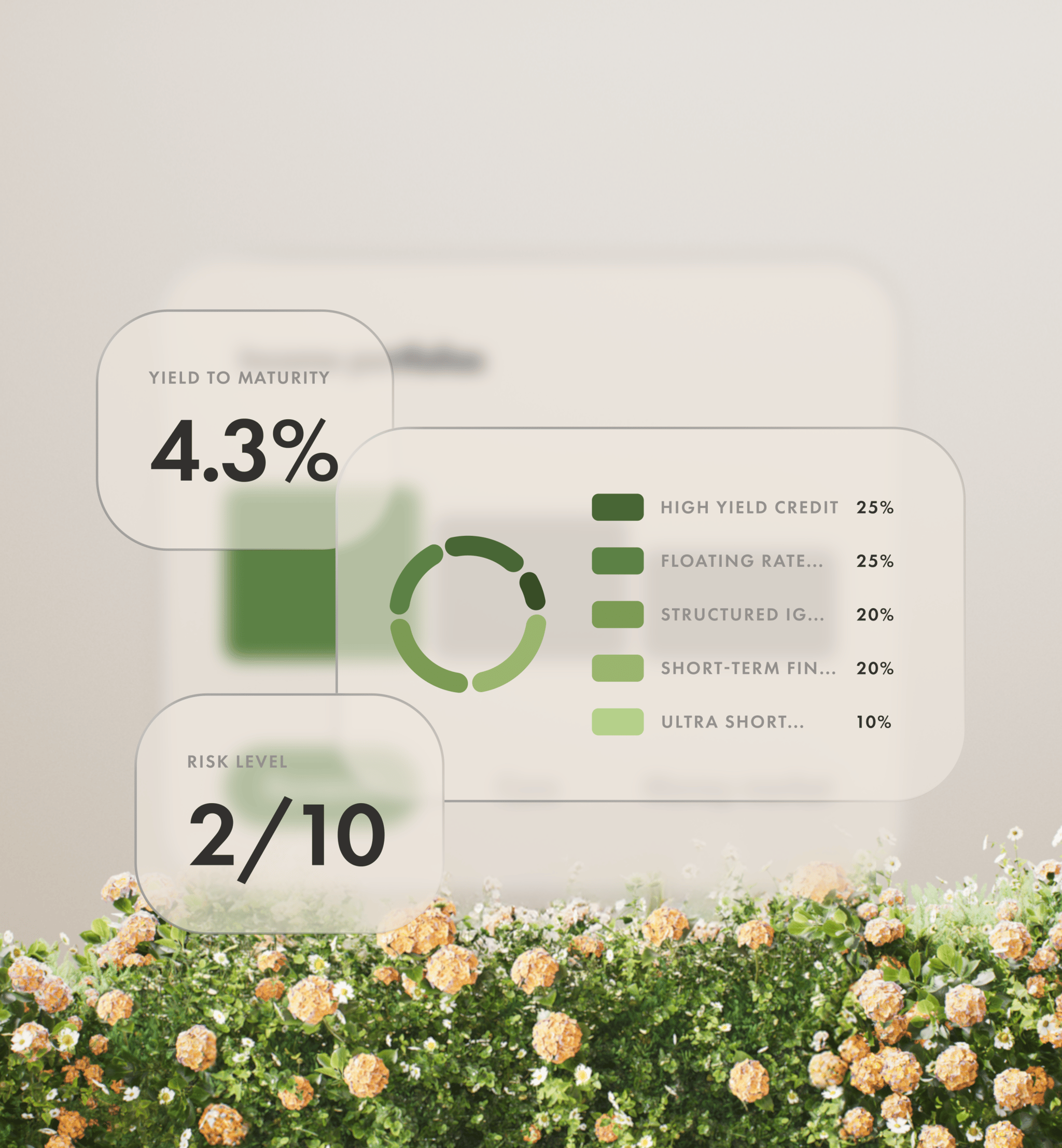

No matter your risk tolerance or how long you want to have your money in the market, we have a portfolio (or portfolios!) to help you reach your goals.

Choose what's right for you

Each of our portfolios offers a unique strategy to meet your goals. Find out which works for you below.

Summit | Classic | Income | Direct Indexing | |

|---|---|---|---|---|

| What it is | A combination of public equities and private market funds | Expertly researched portfolios made up of low-fee ETFs across asset classes and geographies | Professionally managed portfolios with low to moderate risk profiles | Unlock higher after-tax returns with customizable index investing |

| Who it's for | Long term investors looking to enhance returns beyond public markets | Everyday investors looking for great returns and diversification | People looking to build up emergency funds or work towards a short-term goal | Index investors looking for additional tax benefits in non-registered accounts |

| Net returns | Up to 10% expected returns | Up to 8.2% | Up to 4.1% | Historical returns Canadian index: ~9.9% US index: ~14.3% |

| Fees | Public equities: 0.2%–0.5% Private market funds: starting at 2.25% | 0.2%—0.5% | 0%—0.5% | 0.15% |

| Minimum investment | Unlock full portfolio with $10,000+ | $0 | $0 | $1,000 |

Access private market strategies and top-tier funds

Diversify your investments with opportunities typically reserved high-net-worth and institutional clients.

The proof is in the portfolio

Join over 3 million Canadians who choose Wealthsimple to reach their goals.

FAQs

What is Wealthsimple’s investing strategy?

What is Wealthsimple’s investing strategy?

We don’t believe in timing the market. We build portfolios of assets that are low-fee, broadly diversified across markets, and expected to perform well long-term. For most people this is the best way to invest in public stock and bond markets. Outperforming the market is difficult, and the data shows that very few active managers do it consistently, especially when considering their fees. While some managers are able to consistently outperform the market, predicting which ones will in advance is equally difficult.

The two most important determinants of wealth for investors are their savings rate and their ability to stick with an investment strategy. That’s why we’ve designed an experience to help you invest long-term, including advisors to answer questions and help you stick to your plan, and a variety of portfolios that align with your goals.

What kinds of returns should I expect?

What kinds of returns should I expect?

Returns depend on the portfolio. Riskier portfolios (like those focused on equities or alternatives) are expected to deliver higher, but more variable, long-term returns, while more conservative portfolios (with more bonds or cash equivalents) are designed to provide lower, but steadier returns.

Over long time horizons, a helpful rule of thumb is that our riskiest portfolios may earn around 4–5% above inflation, while less risky portfolios will earn somewhat less. Short term results can vary widely from year-to-year, but consistently saving and investing in low-cost, diversified portfolios is one of the most reliable and proven ways to build wealth over time.

When you set up an account you will receive a personalized projection based on the chosen portfolio, risk level, and contribution amounts.

How do I know which portfolio is right for me?

How do I know which portfolio is right for me?

The best portfolio is the one you can stay invested in through market fluctuations — that’s what drives long-term success. We’ll recommend personalized options based on your goals (what you’re saving for), your timeline (when you’ll need the money), and your risk tolerance (how comfortable you are with market ups and downs).

You also don’t have to put everything into one portfolio type and many people choose different portfolios for different goals. For example, you might have a more conservative portfolio for short-term savings and a growth-focused option for long-term wealth. Your portfolios will always be personalized to your situation, but in general, the longer your timeline, the more risk you can take since you’ll have time to recover from short-term swings.

Does Wealthsimple charge me a fee for taking money out of my account?

Does Wealthsimple charge me a fee for taking money out of my account?

No. We don't charge anything for withdrawals, transferring out, or leaving your account open with a zero balance.

Are my investments at Wealthsimple protected?

Are my investments at Wealthsimple protected?

Our affiliated custodial broker, Wealthsimple Investments Inc., is a member of the Canadian Investment Regulatory Organization.

Customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at their website. In the extremely unlikely event that Wealthsimple were to go out of business, your account would remain safe. All securities are beneficially held under your name, and if we were to close, you could choose to keep your money with Wealthsimple Investments Inc. or transfer it to a new advisor or your bank account.

Wealthsimple Inc. is a registered Portfolio Manager in Canada. Securities in your account may be protected through Wealthsimple Investments Inc. See www.cipf.ca for more details.

Will Wealthsimple reimburse me for the transfer fee my current insitution is charging to move my money out?

Will Wealthsimple reimburse me for the transfer fee my current insitution is charging to move my money out?

Yes! Your bank or brokerage might charge a transfer-out fee (usually somewhere between $50-$250 plus tax) to cover the administrative costs of moving your account. If you transfer over $25,000 to Wealthsimple, we'll automatically cover those fees. Note that if you transfer more than once from the same account at the same institution, you'll only be reimbursed once. Learn more about how we reimburse transfer fees.

How can I access the 0.2% management fee?

How can I access the 0.2% management fee?

Our management fees for Generation clients range from 0.4% for clients who have $500,000 with us, to 0.2% for clients who have $10,000,000 with us. Premium clients with $100,000 in assets with us have 0.4% management fees, while Core clients — with more than $1 in assets — have rates at 0.5%.

To learn which rate you qualify for, reach out to our team of advisors.

What types of accounts can I open for Managed Investing?

What types of accounts can I open for Managed Investing?

At Wealthsimple, you can open a non-registered TFSA, FHSA, RRSP, spousal RRSP, RRIF, LIRA, LIF, RESP, and corporate account as a managed investment account.

What is active investment management?

What is active investment management?

Active investment management is when a professional acts on your behalf to buy and sell the holdings within a portfolio in an effort to outperform the market.

Are investment account management fees tax deductible?

Are investment account management fees tax deductible?

Yes, you may be able to claim the management fees charged on managed non-registered investment accounts, including individual, joint, and corporate accounts. Learn more about claiming your management fees.

You’ve mentioned retiring up to 47% richer. How did you calculate that?

You’ve mentioned retiring up to 47% richer. How did you calculate that?

Great question. We’ve calculated that stat as of October 21, 2025. Here’s how: The fee savings estimate is based on comparing our Summit portfolio annual management fee of 0.44% to a leading mutual fund annual management fee of 1.85% that has similar market exposure. That portfolio’s coming soon.

It’s modelled on an initial investment of $10,000, assuming a 10% gross pre-fee return over a 30 year period for both funds, assuming constant returns and monthly compounding. Taxes, trading costs, loads/transaction fees, and additional account fees are not modelled. Actual outcomes vary with pre-fee returns, fees, contributions, and time horizon.

Also: this is a hypothetical scenario and not a guarantee of future costs or returns. It’s for illustration purposes — illustration purposes! — only, and all investments involve risk. To get more information on our products, investment decisions, fee schedules, user testimonials, promotions and more, visit our legal disclaimers page.