Transfer to Wealthsimple

We're nothing like your bank — and that's a good thing

Cut the fees, skip the fine print, and switch to Wealthsimple today to start growing your money the smarter way.

3 million

Canadians trust us to manage and grow their wealth

$70+ billion

Assets under administration, and growing every single day

$1 million

Eligible coverage with CDIC for chequing and CIPF for investments

Final week

Move money. Get AirPods.

Just register then move $25,000+ to any account within 30 days of registering. Offer ends July 2. T&Cs apply.

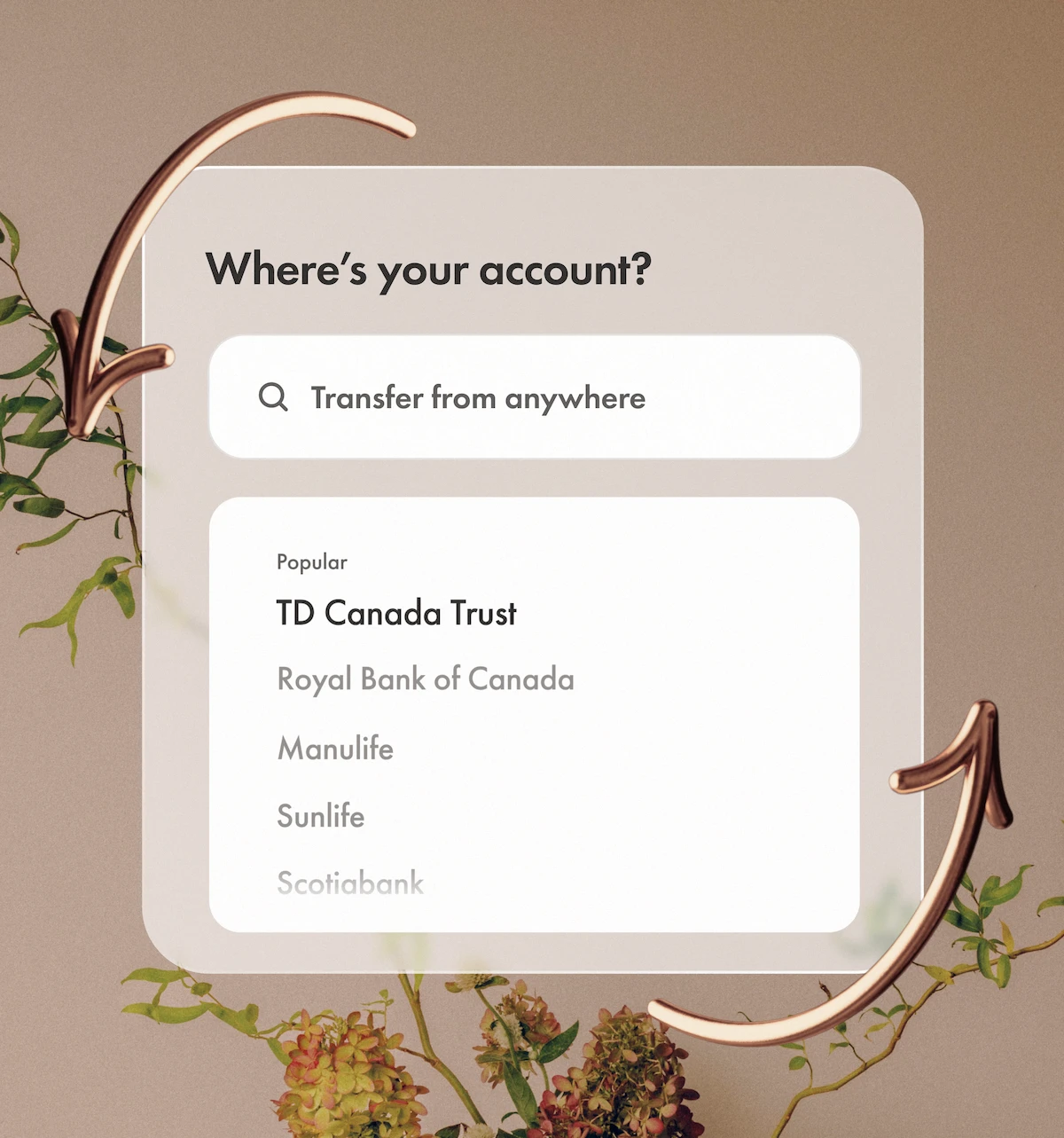

Your bank’s fees are holding you back

Wealthsimple helps you save, grow, and keep more of what’s yours.

| Attribute | Wealthsimple | The blue bank | The green bank | The red bank |

|---|---|---|---|---|

| Monthly account fees | $0 | $6.00 | $6.45 | $3.95 |

| Chequing account interest | 1.75%–2.75% | 0% | 0% | 0% |

| Max trading commission fees | $0 | $9.95 | $9.99 | $9.99 |

| Management + MER fees | 0.64% | 1.87% | 1.93% | 2.04% |

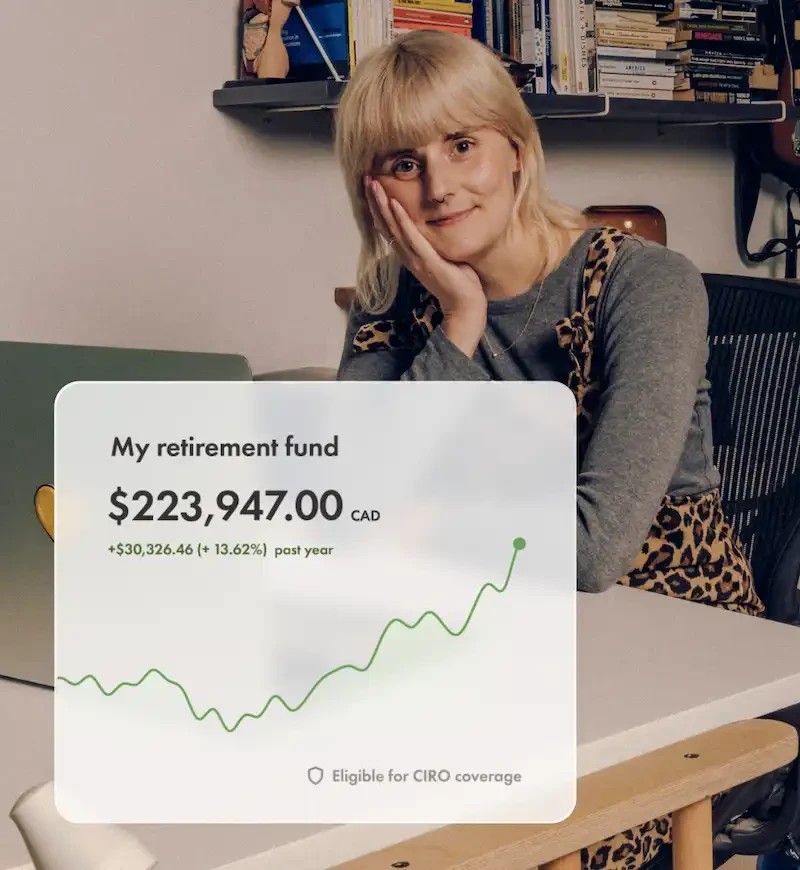

Do more with your money, your way

The tools you need to spend, save, and invest smarter — all in one place.

Cut the fees and keep more of what's yours

See how much you could save and earn with Wealthsimple.

This will help us calculate your rates and your client status — either Core, Premium, or Generation.

$30,000

We’ll calculate what you could be earning with our 0.2%–0.64% MER compared to other banks’ 1.87% MER.

$75,000

We’ll calculate what you could be saving with our $0/trade rate compared to other banks’ $9.95/trade fee.

5

You could keep an extra $1,152 per year by switching to Wealthsimple.

Calculated by comparing the trade fees and MER rate associated with your expected client status against the most competitive rates from other banks ($9.95 trade fees and 1.87% MER), over one year.

In 5 years, that’s up to $5,760 back in your pocket!

Calculations are based on the rates associated with your expected client status. This calculator provides estimates for illustrative purposes only and is not financial advice.

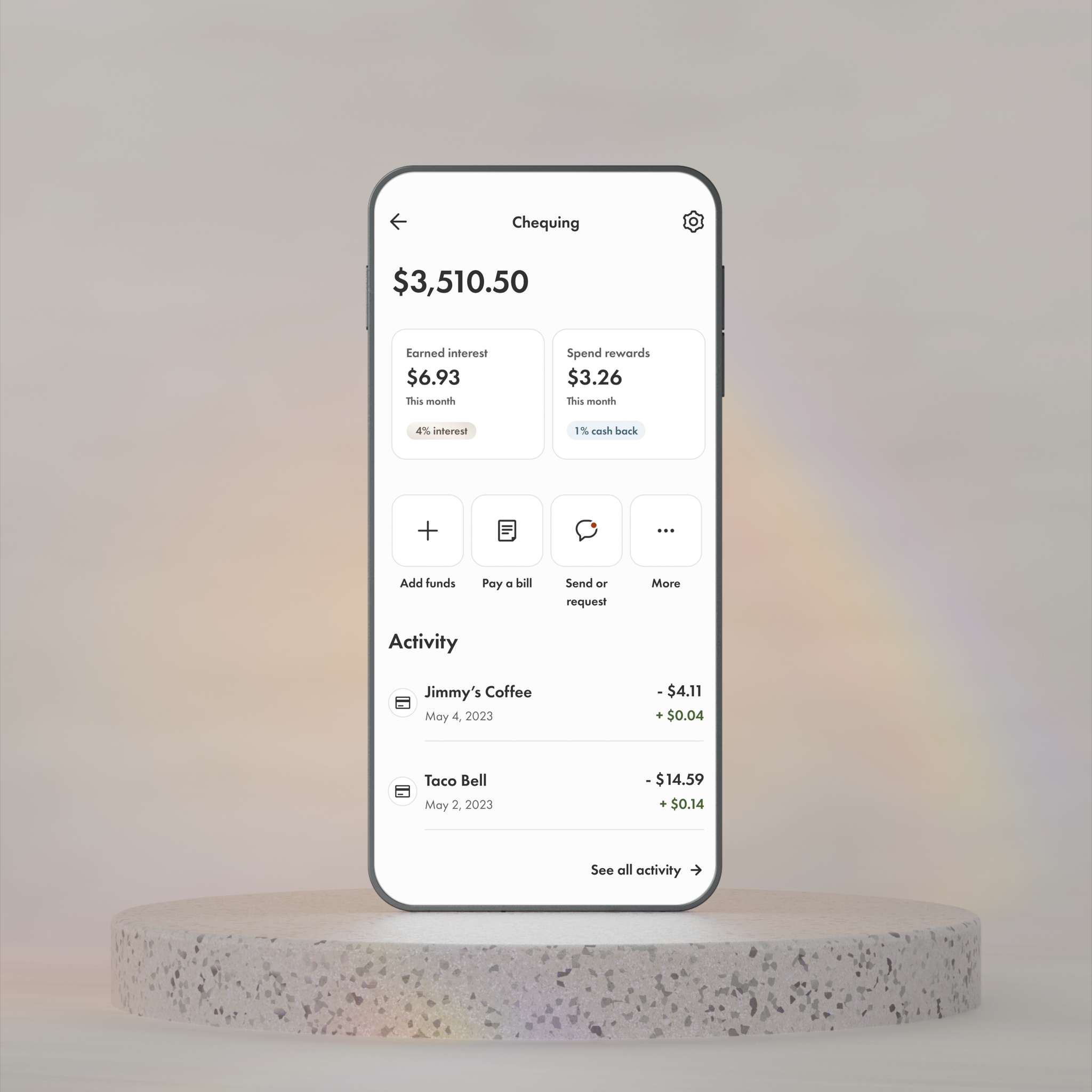

Switching is simple, fast, and totally free

1. Open your account in minutes

Download the app or join online, then set up the accounts you want to move.

2. Start a transfer

Choose an in-kind or cash transfer. We’ll guide you every step of the way.

3. Let us cover the fees

Bring over $25,000 and we’ll reimburse any transfer-out fees once your money lands. Conditions apply.

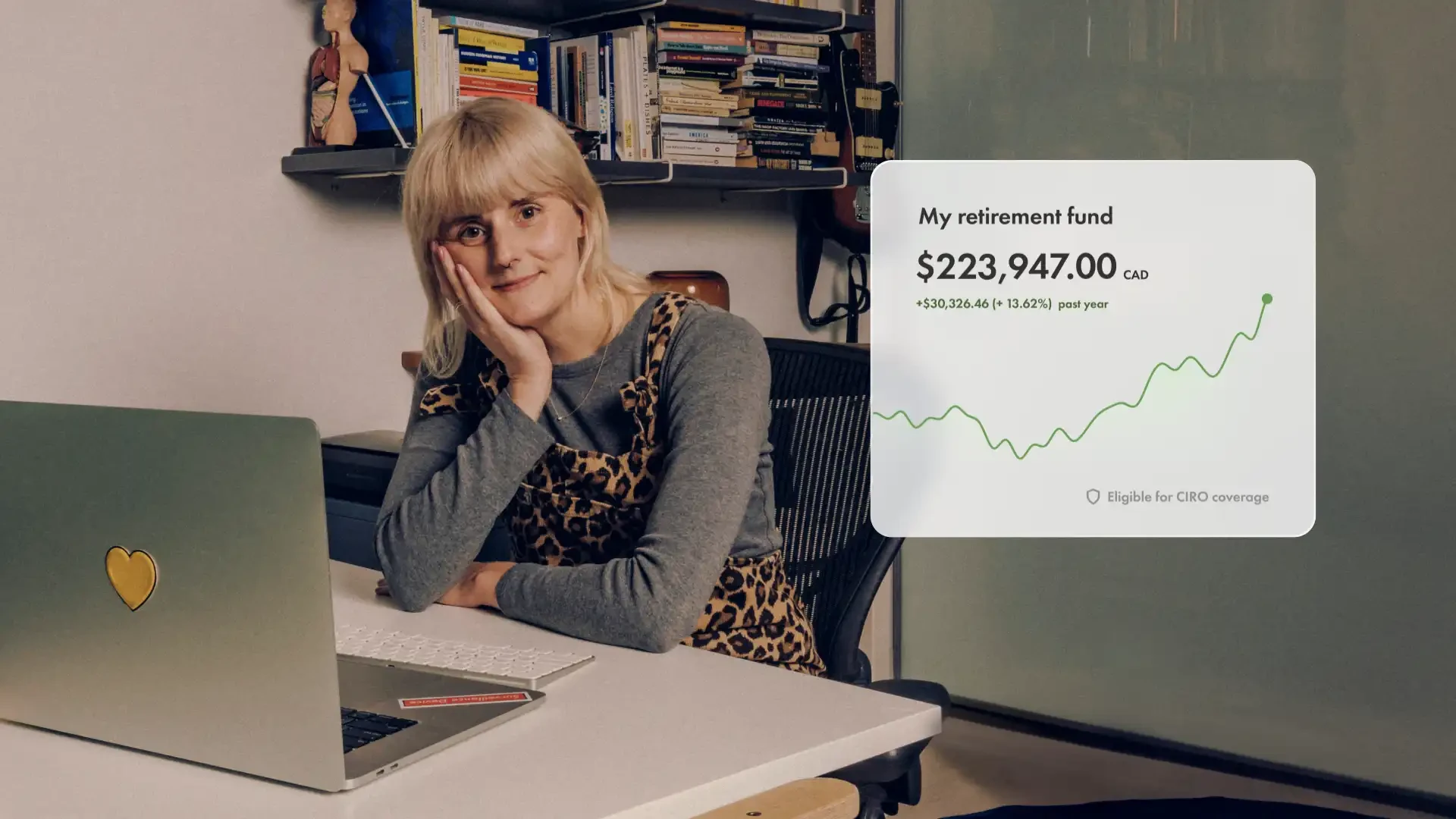

Perks you'll actually use (and love)

Because you deserve more from your bank.

Ready to make the switch?

Give your money the personal attention it deserves with Wealthsimple.

Got questions?

We know how important it is to feel confident in the security of your investments — it’s a big deal, and we don’t take your trust lightly.

Wealthsimple Investments Inc., our affiliated broker, is a member of the Canadian Investment Regulatory Organization (CIRO) and your accounts are protected by the Canadian Investor Protection Fund (CIPF), within specified limits. In the extremely unlikely event that Wealthsimple were to go out of business, your accounts would remain safe. Learn more about how we safeguard your money.

Plus, with bank-level encryption and advanced security measures, your personal information and login details stay private and secure. Read our Privacy Policy.

We want you to feel confident about your money and we’re grateful you’re choosing Wealthsimple.

You can transfer a wide range of account types to Wealthsimple. Check if the account type you want to move over is on our transfer list and see how long it usually takes. You can even transfer multiple accounts to Wealthsimple at the same time!

Transferring an account is simple and stress-free. First, decide how you want to transfer your account:

-

Move everything as is (in-kind)

-

Transfer only part of your account (in-kind or as cash)

-

Sell investments and transfer as cash

-

Or mix and match

Next, log in to Wealthsimple:

-

In the mobile app, tap the arrows at the bottom of your screen, select Move an account to Wealthsimple, and follow the prompts to complete your transfer.

-

On the web, click Move at the top of your screen, select Move an account to Wealthsimple, and follow the prompts to complete your transfer.

That's it! For more detailed instructions, check out our step-by-step guide.

We believe in helping you keep more of what’s yours. Unliked Wealthsimple, most institutions typically charge a $50–$150 administrative fee to transfer your account. For transfers of $25,000 or more, we’ll automatically reimburse the administrative transfer-out fees charged by your institution. Conditions apply. Read our transfer fee reimbursement policy.

There are no tax implications for transferring tax-sheltered accounts, like your RRSP or TFSA. Just make sure you’re transferring into the same type of account.

However, if you’re transferring a non-registered account and need to sell your investments, you may need to report gains and losses on your next tax return.

Absolutely! You can set up direct deposit or pre-authorized debit with any of your individual and joint chequing accounts. With direct deposit, your paycheque goes straight into your chequing account for everyday spending, paying bills (like your mortgage), and investing in managed or self-directed accounts.

Plus, when you set up direct deposit from your payroll into a chequing account, you’ll earn an extra 0.5% interest. You can even get paid a day earlier! Learn more about direct deposit.

Switching is simple and stress-free! If you still have questions, you can visit our Help Centre to learn more about transfers, or contact us to get started today.