A spousal RRSP is a special type of Registered Retirement Savings Plan (RRSP) that can be helpful to couples with meaningfully different incomes. (It’s also one of the few times it can strengthen a relationship to bring up the fact that one of you makes more money than the other.) Spousal RRSPs allow one partner to contribute to another’s retirement, maximizing both partners’ tax savings — now and in their golden years.

First, though, a quick RRSP refresher, since the basics are the same. When you contribute to an RRSP, there’s an immediate benefit of not being taxed on the money you put in. That allows you to invest more money, and (thanks to the beauty of compound interest) gives that money a chance to grow even faster. When it’s time to retire, you’ll be taxed on your withdrawals, but since many people make less in retirement than when they made the original contributions, they pay less in overall taxes.

Without spousal RRSPs, if you earn a lot more or less than your partner, it’s easy for one of you to end up with a much higher RRSP balance in retirement — and paying higher taxes because of it. With spousal RRSPs, however, the higher-earning person still gets the tax savings on their own income while boosting their partner’s retirement balance and lowering the couple’s overall tax burden.

There are a few basic rules to follow.

The spousal RRSP is owned by the lower-income-earning spouse, who makes all of the investment decisions and controls the account.

The higher-income-earning spouse contributes to the account, and they get the deduction on their tax return.

The total contribution counts against the contributing spouse’s cap, which means they need to have room in their own RRSP in order to contribute to their spouse’s account.

How does a spousal RRSP work?

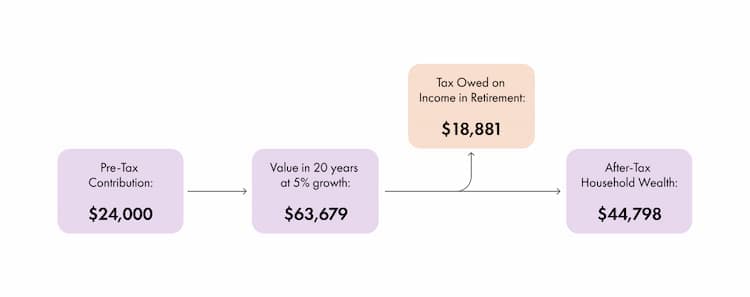

Imagine a couple with two partners. Partner A makes $134,000 per year, has a marginal tax rate of 43.41%, and expects that tax rate to drop to 29.65% in retirement. Partner B makes $40,000 per year and pays a marginal rate of 20.05%, which they expect to stay consistent in retirement.

Let’s look at the income generated from one year of savings. Partner A contributes the annual max of $24,000 (18% of their $133,000 salary) to an RRSP, where it grows at a rate of 5% for 20 years. (For simplicity’s sake, we’ll say Partner B does not contribute to an RRSP.) When Partner A retires, that $24,000 has grown to $63,679. When they go to withdraw this money, they’ll pay $18,881 in taxes, leaving them with $44,798.

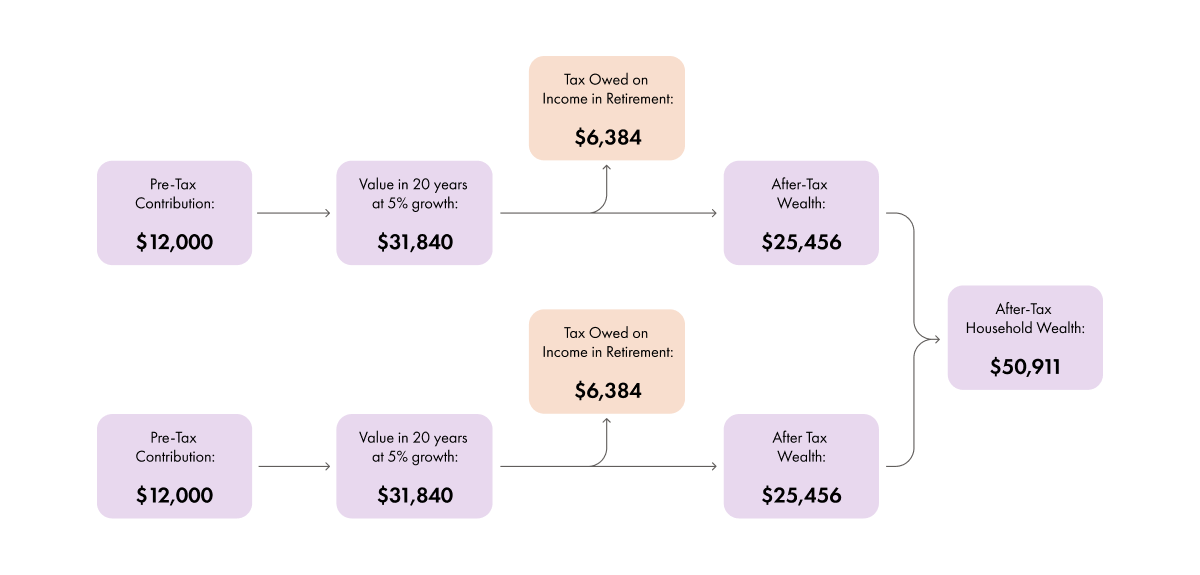

Here’s how that situation would look if the same couple took advantage of a spousal RRSP:

Partner A makes the same $24,000 annual contribution, but splits it evenly across both partners' accounts, so each person adds $12,000 to their RRSP balance. Partner A still isn’t taxed on the entire contribution, but now, when they reach the point in life that they’re never without hard candies, both partners have the same retirement income, saving them $6,133 (or nearly 14%) per year in taxes.

Other benefits of spousal RRSPs

Another advantage to these accounts is that you can use them to save on taxes if you’re over the age of 71, but your partner is not. You can also use them to save taxes on your estate after death, but that’s less fun to talk about.

When you open a spousal RRSP, you can make a contribution on behalf of your under-71 spouse and claim the tax deduction on that money. Likewise, if you die, your estate can contribute that money to the account in order to reduce the taxes on your inheritance.

Disadvantages of spousal RRSPs

Contribution limits get more confusing when you have to pay attention to two different accounts. If the partner making the contributions maxes out their own RRSP contribution for the year, they cannot contribute to their partner’s — unless they want to deal with a bunch of fines.

Also, spousal RRSP contributions cannot be withdrawn in the three calendar years following the year those contributions were made; otherwise, the contributor will be retroactively taxed. This is called the Three-year Attribution Rule. For example, if you contribute $5,000 to a spousal RRSP on Dec. 1, 2025, hoping that your income-less partner can withdraw it in January, think again. If that money is withdrawn in 2025, 2026, or 2027, it will be added to your income (and subsequent tax bill), not your partner’s.

FAQs

Is it better to start contributing earlier to a spousal RRSP, or closer to retirement once we have a more accurate idea of the difference in RRSP levels between each partner?

It’s better to keep your and your partner’s RRSP balances fairly evenly split as you save for retirement. Otherwise, one partner may end up with a very large RRSP and little time to help balance out the other partner’s.

How do you figure out the right split of RRSPs between each partner?

Couples should try to split their income evenly between them in retirement. A 50/50 split is ideal to avoid one person getting bumped into a higher tax bracket. Think through each partner’s overall incomes in retirement, considering things like work pensions, government pensions, and any income from rental properties. Then you can factor in RRSP withdrawals and work through the balance each partner would need to aim for in order to achieve equal incomes.

If we expect the higher-earning spouse's earnings to increase in the next couple of years, does it make sense to take advantage of spousal RRSPs now, or save some of the RRSP room for the future when their earnings are higher?

This is the same logic we use for recommending TFSAs vs RRSPs vs FHSAs. As a general guideline, if you make less than $110,000 but expect your income to go beyond that in the next three years, it makes sense to hold off and save up the contribution room.

Why use a spousal RRSP instead of just giving the lower-earning spouse money to contribute to their own registered accounts, using their own contribution room?

The lower-earning spouse usually doesn't build up much RRSP contribution room. If they're not working, they're not building up any contribution room. Furthermore, income attribution rules apply when giving your spouse money to contribute to their accounts (except for Tax-Free Savings Accounts, where gifting to your spouse is allowed).