For most of us, investing means buying stocks and bonds. But there’s an entire universe of other options out there that may offer higher returns and greater diversification. They’re called alternative investments, and they’ve largely been reserved for professional investors and super-rich people. Recently, however, brokerages have realized that normal folks make up a huge market, so they’ve come up with ways for more people to invest like one-percenters.

Here’s how to understand some of the more popular alt-asset types.

What are alternative investments?

Alternative investments are any investments that don’t fit into the category of stocks, bonds, or cash and aren’t priced or valued in a way that is directly correlated to any of these things. Alternative investments may invest in one of these traditional categories, but in a non-traditional manner, such as shorting or arbitrage (a fancy term for taking advantage of a price difference in two markets for the same security).

Real estate, commodities, hedge funds, and private equity are considered alternative investments. So are art, wine, and antiques, as well as Beanie Babies, Pokémon cards, and a lock of Mick Jagger’s hair.

As with everything else, not all investments are created equal. The vast universe of alternative investments provides almost limitless opportunities for losing a fortune, so you should proceed with plenty of caution when investing.

How do alternative investments work?

As a group, alternative investments are kind of like the characters in heist movies — an unruly crew thrown together with nothing in common but the desire to make a lot of dough. This makes it difficult to generalize about how they “work.” As with any investment, do your homework, invest your money, and hope for the best.

What are the benefits of alternative investments?

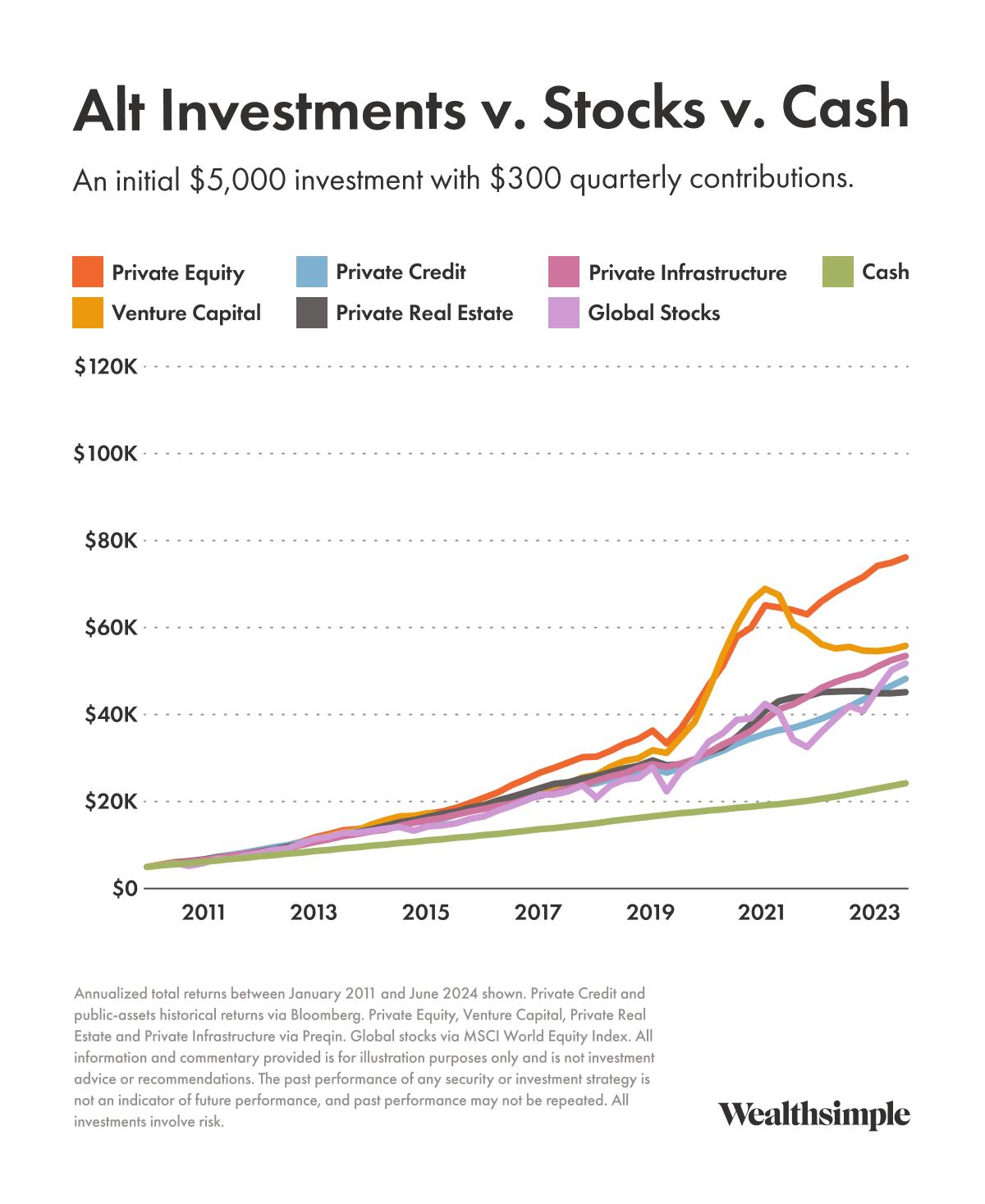

One potential benefit of alternative assets is that they may offer higher returns than global stocks and cash. Here’s a chart comparing the performance of all three between January 2011 and June 2024.

Another benefit is diversification. During those inevitable periods when some of your investments are performing poorly, a diversified portfolio helps balance things out, since (ideally, at least) other assets you hold can make up some of your losses. It’s hard to predict what’s going to do well in any given year, so many investors spread their assets beyond just stocks, bonds, and cash.

What are the drawbacks of alternative investments?

Though these certainly don’t pertain to all alternative investments or strategies, the main drawbacks are:

Higher minimum investments and fees. Alternative assets require specialized knowledge to manage, and that expertise can come at a cost for investors.

Higher risk. Alternative investments tend to be riskier than traditional investments. Their prices rise and (more importantly) fall more dramatically than other investments.

Illiquidity. Because alternative investments aren’t listed on public exchanges, it can be difficult to sell them quickly if you find yourself in a pinch and need your money back.

Barriers to entry. Some alternative investments just cost too much for most investors. Want to start investing in van Goghs? Great! Got $81 million lying around?

What are the most common types of alternative investments?

Four of the biggest alternative investments are venture capital, private equity, and private credit.

Here’s a quick chart to help you understand the differences.

Venture capital | Private equity | Private credit | Infrastructure | |

|---|---|---|---|---|

| Description | Equity investments in early stage companies and small software companies. | Equity investments in mid- to large-size enterprises in stable industries that aren’t listed on public exchanges. | Loans to mid- to large-size enterprises in stable industries that aren’t listed on public exchanges. | Loans or equity investments in projects that might have cash flows tied to inflation, like toll roads, parking meters, or energy transmission. |

| Nature of returns | Appreciation in the value of a company, realized when it is sold to another buyer. Historical returns are above the public equity market. | Appreciation in the value of a company, realized when the company is sold to another buyer. | Interest payments from borrowers to the fund that are distributed monthly, with the potential for some appreciation in value. | Appreciation in the value of the investments and/or interest payments, depending on the structure of the investment. |

| Historical risk | Higher than public equities. The main risk is that small companies may not grow into much larger companies. | Higher than public equities. Main risk is that the company operations and value do not improve as forecasted. | Lower than public equities (similar to high yield bonds). The main risk is that a borrower may not repay the fund. | Similar to public equities. The main risk is that the projects may not be as profitable as forecast, for macroeconomic or operational reasons. |

| Added diversification | Low. Similar to public equities. | Low. Similar to public equities. | Medium/high. Provides diversification to rising interest rates. | Medium. Provides diversification to rising inflation. |

And here’s a more in-depth breakdown:

Private equity is an investment in a private company (as opposed to a public one listed on the stock market). Fund managers typically buy a big chunk of an underperforming private company, then attempt to turn it around and sell it for a profit. This can be risky, since PE investors don’t always succeed at revamping companies. But, as the graph above (“Alt investments vs. stocks vs. cash”) shows, the risk can pay off: from 2008 to 2022, private equity returned about 12% per year, outperforming stocks globally by 5.7%.

Private credit funds work like bonds, in that they loan money to companies in exchange for interest payments — which is a nice way for investors to earn consistent income. But unlike bonds, private-credit funds offer returns more in the ballpark of stocks, returning 9% per year over the past 15 years. Yet they’re considered lower risk than stocks.

Venture capital also involves investing in private companies, but venture capitalists focus on startups, giving them cash to grow and getting rich if they do. Venture funds are risky, too, since they often bet on companies that are developing unproven tech (or have unproven leadership — remember Theranos?). However, over the 15-year period shown above, venture funds returned almost 10% per year, outperforming global stocks by about 4%.

Infrastructure and real assets involve financing big projects that make the world work. Think train tracks, docks, pipelines, or highways. Because the cash flows associated with these projects are both stable and closely tied to economic activity, some of these funds can provide diversification and resilience to inflation in your portfolio.