Private equity is an alternative investment that involves buying into private companies (as opposed to shares of public companies traded on the stock market). Most people access private equity by investing in funds with professional managers who identify, improve, and later sell companies, ideally for a profit. These managers add value by improving the operations of companies and by optimizing financial structures.

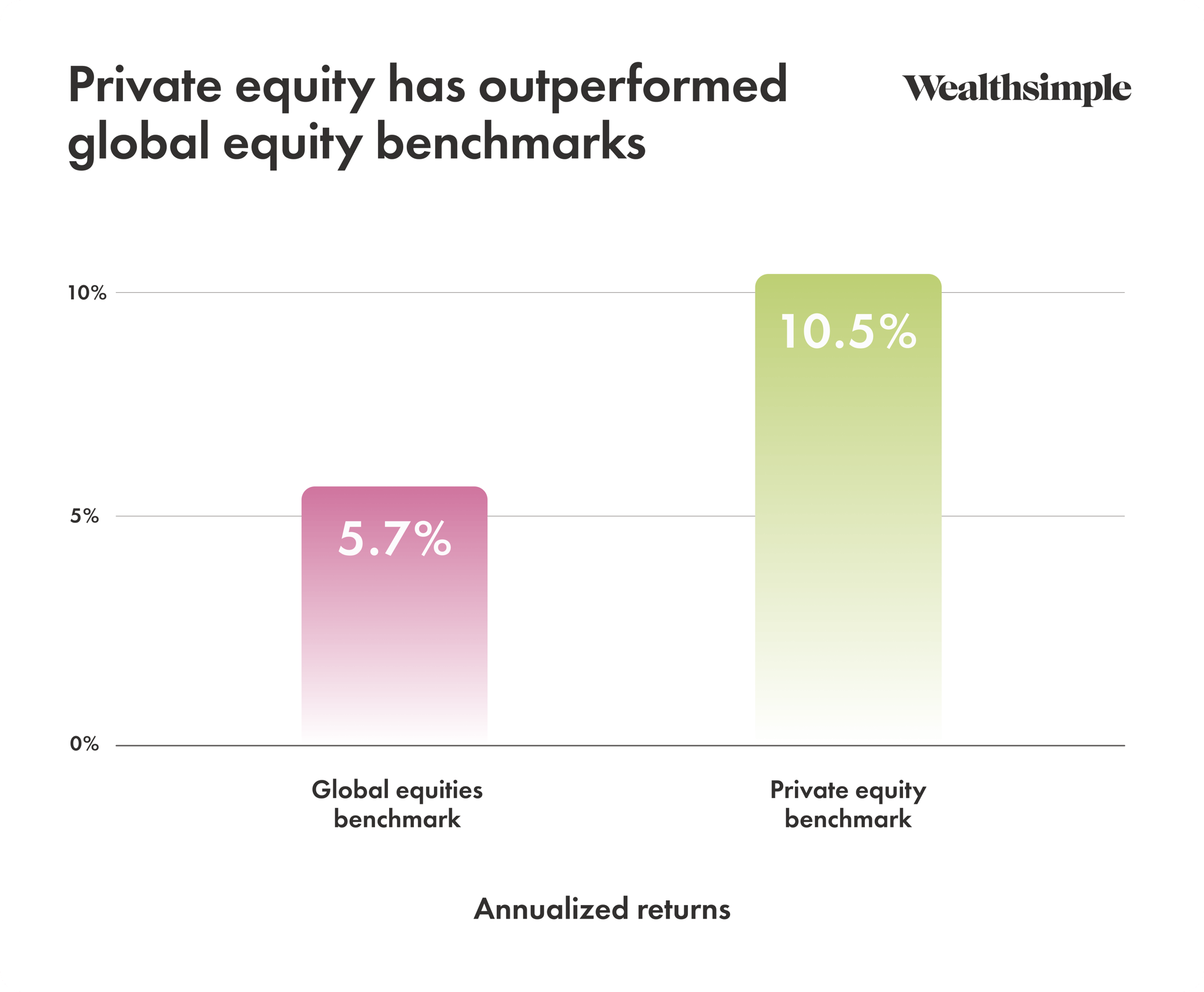

Over the last 20 years, private equity has earned returns well in excess of the public equity markets. From 2001 to 2023, private equity returned 10.5%, compared with the global stock market at 5.7%.*

To help you understand private equity, we’ve gathered some of the most common questions about it and answered them below.

What is private equity?

Private equity is when investors, usually through a fund, buy stakes in privately owned companies that aren’t listed on public stock exchanges. Fund managers try to improve those companies and sell them for profit.

Once an investment is made in a company, private equity fund managers try to steer it toward a path of greater profitability. They may pursue new operational strategies to make the company run more efficiently and cut costs. They may also take a more aggressive sales strategy, for example by buying similar companies to make a larger, more efficient company. Private equity companies tend to take controlling stakes in the companies they purchase, which means that the actions of management are tightly aligned with the interests of shareholders, which is not always the case in public companies.

Once the investors are satisfied with the improvement in profitability and the resulting higher value for the company, they look to sell their investment for more than they paid. The process is not a quick one, however: making an investment and seeing a return on that investment typically takes 5-10 years or more.

Who is private equity for?

Private equity is for people who have an investment horizon of greater than four years, the capacity to take on significant risk, and the ability to invest in an illiquid asset. Given the risk and required time horizon, it is mainly suited to wealth building, retirement saving, and other long-term financial goals.

Historically, access to private equity has been limited to institutional investors — think pension funds, endowments, and insurance companies. That’s because alternative assets are illiquid, tend to be complex, and have high minimums. But that limited access is changing as more retail investors are realizing the outsize returns that private equity offers — and as more financial institutions create new products to expand private equity’s reach.

Why has private equity historically outperformed global equities?

Private equity companies tend to buy smaller companies, which historically have higher risk (and return) than the broader market. Also, managers have successfully improved the profitability and growth of companies. This may be due in part to the incentives of the private equity firm and the company’s management team tending to be more closely aligned versus the incentives of public equity investors and company management, which creates an environment prime for profitability improvements. Finally, private equity companies use more leverage than is typically used in public companies, which increases returns (and risks).

What kind of returns can you expect from private equity?

Although past performance does not guarantee future success, historically, private equity has delivered about 5% more than public markets. According to a study done for Norges Bank Investment Management, returns have been consistently positive relative to public markets over the last 30 years.

*Sources: Preqin and Bloomberg. Returns are based on the Preqin Global Private Equity Index and the MSCI World Index from January 2001 to March 2023. You cannot invest in indices. The past performance of private equity or any other security or investment strategy is not an indicator of future performance, and past performance may not be repeated. All investments involve risk.