If you’re like a lot of people, you find budgets intimidating. Who wants to track every penny in a spreadsheet? Who wants to give up their favorite luxuries?

Nevertheless, in order to be financially responsible, we have to track our spending somehow. If you want to actually retire someday, you have to take a hard look at how you spend your money.

Does that mean you have to give up your morning coffee or break your addiction to scented candles? Not necessarily. You can spend some fun money, but there has to be a limit.

What does the 50/30/20 rule mean?

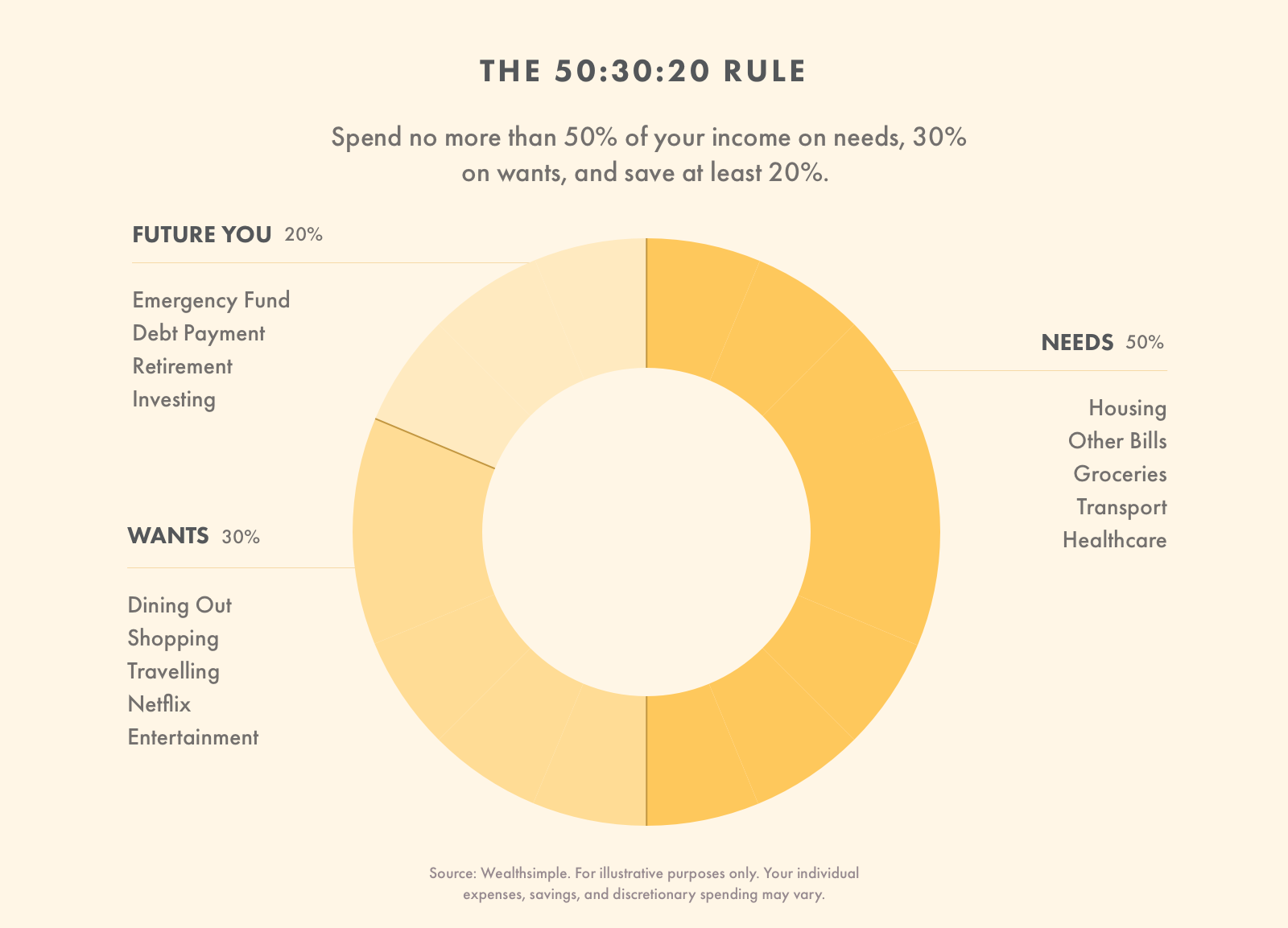

The 50/30/20 rule is a way to budget your money by dividing your spending into three categories. It was popularized by U.S. bankruptcy expert Senator Elizabeth Warren and her business executive daughter, Amelia Warren Tyagi. It breaks down like this:

50% of your income should go toward your needs. This includes housing expenses, food, transportation, child care, etc.

30% of your income should go toward things you want, like travel, restaurants, entertainment, and luxury products.

20% of your income should serve your financial goals. This includes debt reduction, cash savings, and investments.

You don’t have to adhere to those percentages exactly (because real life is messy), but you should use them as guidelines. The 50/30/20 percentages often bend under the real pressures associated with the cost of living in major cities. While they can bend, they should not break.

The 50/30/20 rule works because it’s simple. You don’t need complex spreadsheets or tools, which means you’re more likely to follow it. It’s a great starting point for people who are new to budgeting.

This budget also gives you some flexibility. For example, if you live in a high-cost-of-living area, you may need to spend 55% of your income on needs and reduce your wants to 25%. (But don’t get crazy here!) It's smart to treat your needs and wants as limits and your savings as a target. If your needs cost more than 50%, find ways to reduce them. If your wants cost more than 30%, spend less.

But if you save more than 20% — great! There’s no limit to how much you should save. If you have substantial debt, consider shifting some of your wants to your savings to reduce that burden and save on interest fees.

How to budget your money using the 50/30/20 rule

To budget your money using the 50/30/20 rule, first calculate your after-tax income. Plan to spend 50% of your income on needs, 30% on wants, and 20% on savings and paying down debt.

Step 1: Calculate your after-tax income

Your after-tax income is what’s left over after your employer deducts your taxes, Canada Pension Plan, and Employment Insurance costs. You can find this total on your pay stub. If your employer deducts retirement contributions, add those back. (Those expenses belong in the needs category.)

If you’re self-employed, your after-tax income includes your gross income minus business expenses and what you set aside for taxes. Hopefully you’re making those quarterly payments!

If you mingle your finances with a partner, add your after-tax income together to design a budget for your household.

Step 2: Limit your needs to 50% of your income

Your first step is to reduce your expenses so your needs are less than 50% of your after-tax income. Your needs are expenses you have to pay, which include:

Rent or mortgage payments

Auto loans and transportation costs

Insurance premiums

Food and household supplies

Utility bills

Cell phone bills

Essential clothing and shoes

Minimum credit payments

You’ll have to use some discretion to separate your needs and wants, but it’s best to stick to a strict definition of needs. It should only include things you can’t live without.

Step 3: Limit your wants to 30% of your income

Your next step is to reduce your spending on wants. Wants are expenses you could forgo without affecting your quality of life. They include convenience and luxury items, or items you could acquire through cheaper means. Here are some examples:

Cable/internet bills

Luxury clothing and shoes

Restaurants and take-out meals

Travel and vacations

Upgraded phone plans

Spa, nail, and personal care

Gadgets and toys

You may be thinking, “Wow, I can spend 30% of my income on the things I want!”

That’s not entirely accurate. Since we’re using a strict definition of need in the previous category, more of the things you buy every day fall into your want column than you think.

For instance, you might include coffee beans in your need category, but coffee runs every morning certainly wouldn’t. The unlimited data plan, gym membership, and lobster tail don’t count either, even though you could make an argument that they fill a need to some extent.

Step 4: Allocate 20% of your income to debt and savings

The final portion of your after-tax income should go toward paying down debt, cash savings, and investing. Since your minimum debt payments are handled in the needs category, it's important to build an emergency fund as quickly as possible. Keep cash on hand until you have three-to-six months worth of expenses covered.

Once you’ve established an emergency fund, use this 20% of your income to whittle down your debt obligations. Credit card debt is especially important to eliminate quickly, but you may also have personal loans.

Once your debt is gone (mortgages and car loans notwithstanding), resist the urge to spend this 20% on more wants. Continue saving in a low-risk investment savings account or a diversified investment account.

Step 5: Stick to it!

The most important part of any budget is to stick to it. You can’t realize the value of a budget if you don’t abide by its rules.

An easy way to stick to a budget is to separate your money the moment you earn it. Once you receive your paycheque, use it to immediately pay your needs (the 50% portion of your income) and your savings (the 20% of your income). What’s left is for your wants, but of course you don’t have to spend it all.

Sample 50/30/20 budget

Let’s say your household of four earns $5,000 each month. According to the 50/30/20 rule, you can only spend $2,500 on your monthly needs and $1,500 on your wants. Use the remaining $1,000 each month to pay down debt or save.

This means that a $2,000 rent or mortgage payment isn’t affordable, especially if you have to pay for other needs, like your car, utility, and cell phone bills. Oh, and your family probably wants to eat each month!

If your needs exceed 50% of your income, it’s fine to shift some of the cash from your wants column, but only temporarily. Take steps to reduce your needs to fit into the 50% category. You might relocate to a less expensive living situation, get a car that uses less fuel, or transfer credit card debt to 0% interest cards.

The 50/30/20 rule is a great plan for people who don’t want to budget, but the key is to stay consistent. Each month you spend responsibly will give you freedom to enjoy yourself later in life.