A covered call is an options strategy that lets you sell (or “write”) call options against the underlying stock you already own. A call option lets you take a position on a stock, giving you the right to buy or the obligation to sell a fixed number of shares at a specific price (the “strike price”) by a specific date (the “expiration date”). Selling a covered call gives someone the right - not the obligation - to buy your shares at a specific price, by a specific time.

You can use covered calls as part of an options trading strategy to try to earn extra income, specify a future selling price for your shares, or offset losses from a drop in share prices. As with any trading strategy, covered calls come with their own risks that are important to keep in mind (more on all this further down).

How covered calls work

Generally speaking, you write a covered call option because you believe the price of the stock you’re holding is going to increase by a modest amount or stay relatively flat for a period of time. This is a method of earning money on those stocks during these periods. You should be selective on which stocks you try to write a covered call against though, as depending on the premium and value of the underlying share, it may or may not be enough to offset a loss on the stock or a missed opportunity if the stock price rises further than you anticipate.

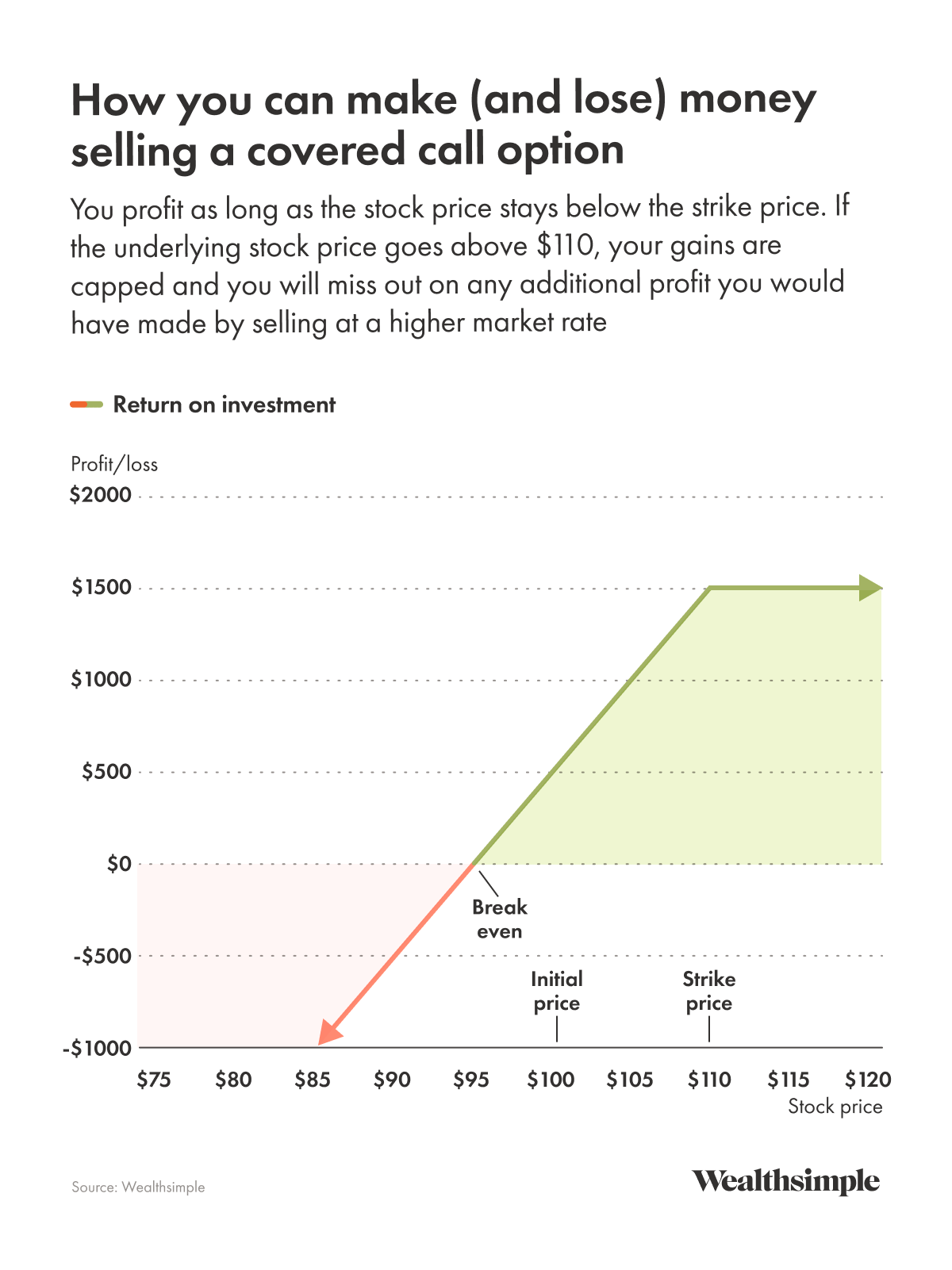

For example, you own shares of a stock that’s currently selling for $100 per share. You set your strike price at $110 per share with a 45-day expiry and earn a $5 premium by selling the call against your existing stock. Most options contracts are for 100 shares of stock, so you'd make $500 selling this call.

If, when the option expires 45 days later, the stock is now trading at $115 per share, the buyer might choose to exercise the option (they might also see the benefit of exercising the option if it hits anywhere above $110.01 or if there is an upcoming dividend payment they hope to benefit from). When this happens you will keep the original premium earned from selling the option (and you might make a small profit on the stock appreciation, depending how much you initially bought them for), but you will be obligated to sell the shares to the call option buyer for the strike price. This process is known as assignment.

If the stock price stays the same or drops, the option will expire worthless. You keep your premium and your shares.

Covered call example

The best way to understand how covered calls work is to look at an example.

Let’s say you hold a large bunch of $BANANAS stock in your TFSA. You’ve got a pretty good feeling that the stock price will rise in the next few months. You’d like to earn a little extra money while you wait, so you decide to write a covered call option. You set the strike price at $110 — $10 higher than the current stock price of $100 — on an option that expires in 45 days. For writing the call option, you make a premium of $5 per share.

What happens if the stock price hits the strike price

Turns out, your hunch on the bunch was correct. The price of $BANANAS stock rises to $110. If the option is exercised, meaning you sell 100 shares at $110 per share to the option buyer, you make a total profit of $15 per share. Here’s how the math checks out: $110 (the strike price) minus $100 (the original stock price) plus $5 (the premium per share for writing the option) equals $15 per share. And remember that, since options generally represent 100 shares, then your total profit becomes $1,500 ($15 x 100).

What happens if the stock price exceeds the strike price

If $BANANAS go bananas and the stock prices rises to $115, assuming the option buyer exercised the option (because why wouldn’t they?), your profit is capped at $15 per share because you have to sell at the strike price of $110. You still make a profit based on what you initially bought the shares for, but you miss out on any additional gains. Just like if the stock hits the strike price on the button, you still made a profit of $15 per share based on the additional $10 appreciation and the $5 premium you earned from selling the call option.

What happens if the stock price stays the same

If $BANANAS stay steady at $100 per share, then the option expires worthless. You walk away with your $5 per share premium and you keep your shares without having realized any gains or losses.

What happens if the stock price goes down

If the price of $BANANAS stock falls a little bit, let’s say to $90 per share, the premium you made for writing the option will help offset your losses (a $10 unrealized loss per share plus a $5 premium per share brings the potential loss down to $5 per share). Of course, if the stock price goes down you don’t need to sell your shares and realize that loss, you could hold onto them in the hopes $BANANAS start to grow again.

Risks of selling covered calls

As with any investment strategy, covered calls come with their own set of risks. The biggest:

Stock prices can fall. As you are writing a covered call against an existing stock holding, it might be worth remembering that stock prices can fluctuate, and owning stocks comes with its own set of risks.

You could miss out on significant share value increases. This is the biggest risk of a covered call strategy. If the price of your stock increases in value, you only benefit up to the strike price. That means that if the price skyrockets above your strike price, you have to sell your shares at that preset strike price, which means you miss out on major profit. That’s why it’s important to think about whether you’d be compensated enough through the covered call premium to accept the risk of potentially capping future income.

Benefits of selling covered calls

A covered call strategy usually hinges on three key benefits:

You make money for the premium. No matter whether the call is exercised or not, you’ll receive a premium for writing the option. If you’re selling an option of 100 shares with a premium of $0.75 per share, you’ll make $75 per contract.

Your premium can potentially offset small losses. If the price of your stock drops in value in the period between writing the option and the expiration date, the premium you made will help offset that loss in value.

You can potentially secure a future price for your shares. Let’s say you’ve been considering selling your shares, but only for a certain price. You could set a limit order (which just means your shares would be sold as soon as a buyer could be found above a certain price) at that price every day until it fills. Or you could sell a covered call at the same price. If the price you picked is reached, your stocks are sold. Same outcome, but you get to pocket the premium.

Covered calls vs. naked calls

A naked call is another option strategy. The key difference between a covered call and a naked call is whether or not you own the underlying stock. When you sell a covered call, you’re writing an option on shares you own. When you sell a naked call, you’re writing an option on shares you don’t own. That means that if the strike price is reached and the option is exercised, you have to go to the market and buy the shares in order to fulfill the call option.

If the price of the stock skyrockets, your losses can be huge because you need to buy the shares at the market price. Investors who write naked calls usually do so to generate income from premiums, but it’s a higher-risk strategy due to potentially unlimited losses as the stock climbs in price.