The chequing account that beats your bank

Get everything you need and more from your everyday account — like no monthly fees and up to 2.25% interest on your cash.

$0 fees

No monthly fees, and no everyday fees, like FX, ATM, or Interac e-Transfer® fees.

Up to 2.25%

Interest on your entire balance as of day 1, with no minimum requirements.

$1 million

In CDIC coverage for eligible deposits — that’s 10 times the average.

The (Un)real Deal

Get up to a 3% match and win a $3M home? Unreal.

Don’t miss out on our biggest promotion ever. Ends March 31. T&Cs apply.

Every feature you need from your everyday account

- Pay no FX or transaction fees

- Use your physical card or add it to your digital wallet

- Link your card to any of your chequing accounts

- Schedule recurring or one-time payments for payees like utilities, credit cards, taxes, and more

- Easily import your payees from a different account in a few clicks

- Get a notification when payments are complete

- Withdraw cash from almost any ATM in Canada

- Get ATM fees reimbursed for withdrawals from anywhere in the world

- Automatically move money to your investing accounts

- Set up auto-buy for stocks, ETFs, or crypto

- Choose the amount and schedule that works for you

- Earn an extra 0.5% interest as a Core or Premium client when you deposit your pay of $2,000+ per month

- Get paid up to a full day earlier

- Automatically add a portion of your pay to your investments or chequing accounts

- Easily deposit cheques in the app using your phone’s camera

- Get instant access to your funds, up to your personal instant deposit limit

- Send and receive Interac e-Transfers of up to $25,000 per day for qualifying clients

- Easily import existing Interac e-Transfer contacts from external accounts

- Automatically deposit money sent to your personal email when you set up Interac e-Transfer Autodeposit

- Send wire transfers throughout Canada and the US with some of the lowest, flat-rate fees in Canada

- Use our integration with Wise for quick, secure and low-cost international transfers

- Get bank drafts securely delivered to your door with next-day delivery

- We’ll deliver to your home, work, or any other address in Canada

How we measure up to the banks

Wealthsimple helps you save, grow, and keep more of what’s yours.

Wealthsimple | Digital banks | Big banks | |

|---|---|---|---|

| Account fees | $0 | Up to $22 | Up to $30 |

| FX fees | $0 | Up to 2.5% | Up to 2.5% |

| Interest rate | Up to 2.25% | 0.1–3.5% | 0% |

| ATM fees | Free — we'll reimburse fees charged by the ATM provider | Up to $3 | Up to $5 |

| Daily Interac e-Transfer limits | Up to $25,000 for qualifying clients | $5,000 | $10,000 |

| Maximum CDIC coverage | $1 million | $100,000 | $100,000 |

We put more money in your pocket

We’ve calculated the average amount Wealthsimple chequing clients save and earn just by being with us.

$365

The average interest our chequing account clients have earned since the launch of Wealthsimple chequing (formerly Wealthsimple Cash).

$180

The yearly amount you could save with no account fees, compared to the $15/month many banks charge.

Direct deposit

Switch your pay, get paid earlier

Deposit $2,000 or more of your paycheque per month to your chequing account and get 0.5% more interest (and other benefits!) as a Core or Premium client.

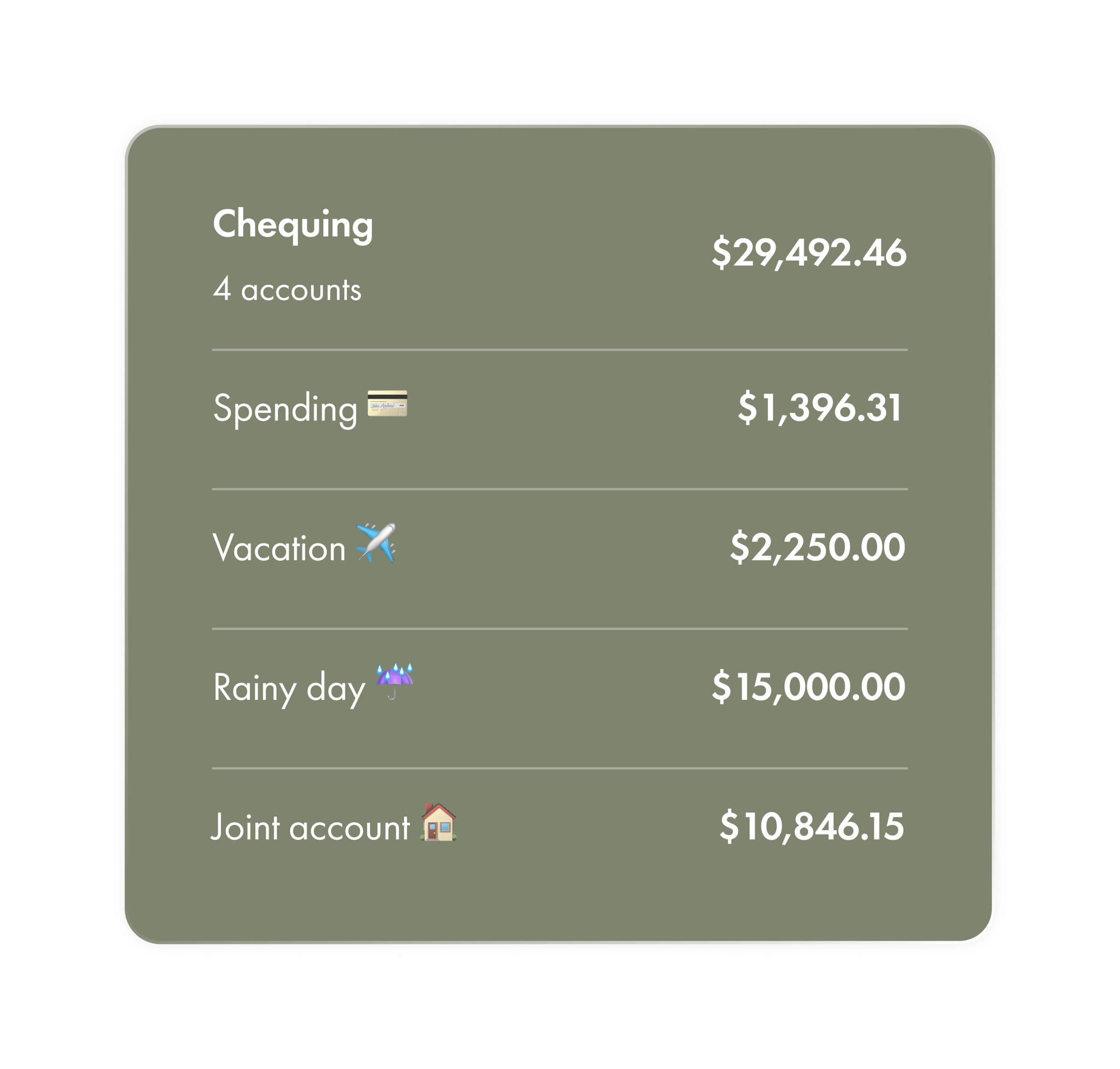

The smart way to sort your savings

Open up to 8 individual and 8 joint accounts, then give them nicknames to categorize your spending and savings, all in one place.

wealthsimple credit card

Get 2% cash back on everything

Unlimited cash back, no complicated categories, and zero fees for qualifying clients. Simple.

Ready to break up with your bank?

Open an account in minutes. You can start spending, saving, and earning right away — no branch visits required.

FAQs

How can I earn 2.25% interest on my chequing account?

How can I earn 2.25% interest on my chequing account?

To unlock 2.25% — the highest-interest rate for a chequing account in Canada — you need to have at least $500,000 in assets with Wealthsimple.

If that’s not you, you’ll still get a great interest rate depending on how much you have with us:

- Less than $100,000 in assets:1.25% interest

- Over $100,000 in assets in assets: 1.75% interest

Our interest rates have no set end date and don't end after a limited promotional period, but there’s always a chance the Bank of Canada might change its rates, and if they do, we follow suit. Your interest is an annualized rate that's calculated daily and paid out monthly, subject to change. See here for details.

Our data was collected as of May 13, 2025.

How is the prepaid Mastercard different from a credit card? Will it affect my credit score?

How is the prepaid Mastercard different from a credit card? Will it affect my credit score?

First off: there are no annual fees! And unlike credit cards, the prepaid Mastercard doesn’t require a credit check or any other qualifications.

And no, you’ll never need to worry about this card impacting your credit score.

No monthly or everyday fees, really? Are there any fees involved?

No monthly or everyday fees, really? Are there any fees involved?

We don't charge any monthly account fees or minimum balance fees.

We also don't charge a foreign transaction (FX) fee. Usually, banks charge you around 2.5% to use your Canadian credit card in another country. We, on the other hand, don't do that. There is still a currency conversion rate charged by the payment network (not us) when you make a purchase in another currency.

We also don't charge ATM fees. The ATM might though, so we'll even reimburse any eligible fees charged by any ATM provider, worldwide. You can find more about that here, and learn more about using your prepaid Mastercard card here.

In terms of Interac e-Transfer fees, we don't charge those either. You can read more about that here.

If you are sending wires anywhere in Canada, Wealthsimple charges a flat fee of $20 – that’s the lowest, flat rate fee for outgoing domestic wires in the country. Plus, we don’t charge you anything to receive wires, no matter where they are coming from. The ability to send international wires is coming soon. You can read more about that here.

Does this mean Wealthsimple is a bank now?

Does this mean Wealthsimple is a bank now?

No, but we are a FINTRAC-registered money services business, and we work closely with banking partners to keep deposits safe. This means we can offer a lot of the same perks and conveniences of traditional chequing and savings accounts.

Does the account have everything I need from a chequing account?

Does the account have everything I need from a chequing account?

The account comes with both a digital and physical prepaid Mastercard that you can manage right from the Wealthsimple app.

The app lets you manage your benefits and spending preferences, or lock your card if something happens to it. Your balances are all updated in real time, too — even if you’re using the physical card.

If you need a chequebook, you can get one for free when you set up your paycheque to land in your Wealthsimple chequing account. And if you need to deposit a cheque, you just need to take a photo of the front and back in the app and the funds will be processed in ~6 business days. Instant access to part of your deposit is coming soon. You can learn more here.

You can order bank drafts from your chequing account too. Just go to the “more” section when in your chequing account in the app. Once you fill out all details, you can submit your order for a draft. Our team will then carry out a security check and ship the draft to wherever you are with a secure tracking link. Find more information about that here.

How is my money protected?

How is my money protected?

The balance in your Wealthsimple chequing account is held in trust for you with members of the Canada Deposit Insurance Corporation (CDIC), a federal Crown corporation. CDIC protects eligible deposits held at CDIC member institutions in case of a member institution’s failure.

Note: Wealthsimple isn’t a bank, and we are not a CDIC member. That said, we’ve partnered with a number of CDIC-member, federally regulated Canadian Financial Institutions to effectively extend CDIC deposit protection to Wealthsimple chequing account holders for a combined amount (up to $1 million CAD) in the unlikely event the CDIC members were to fail.

Coverage is free and automatic. Learn more here.

Where can I use my prepaid Mastercard?

Where can I use my prepaid Mastercard?

You can use your card online and in-store everywhere Mastercard® is accepted.

And since Mastercard is accepted all over the world, you can use your prepaid Mastercard while traveling (with a few exceptions and fees from Mastercard).

You can also use the physical card to withdraw cash at ATMs Canada-wide. We don’t charge any fees for withdrawing cash, but you might get charged a standard ATM fee (usually about $3.00) that we'll reimburse up to $5 per eligible fee charged by a Canadian ATM provider. You can find more about that here.

How are the average interest on the chequing account and the average yearly savings calculated?

How are the average interest on the chequing account and the average yearly savings calculated?

We've collected data as of May 13, 2025 and calculated the average chequing account interest based on the total interest paid to clients and the number of active chequing account holders.

The fact that we don't charge any monthly or everyday fees, and that clients get their paycheques up to a day early when they direct deposit, means they have more money, and more time, to earn more interest.

Keep in mind, your actual interest earnings may differ.

Unlike most big bank chequing accounts that charge on average $15 per month, Wealthsimple’s chequing account charges no monthly fees, with no minimum requirements, either. By not charging any monthly fees – or any everyday fees, for that matter – we’re saving our clients the $15 per month, or $180 per year, that they would otherwise have to pay at most banks.

Who is eligible to earn the 0.5% interest increase?

Who is eligible to earn the 0.5% interest increase?

All Core and Premium clients are eligible to earn an increased rate of up to 2.25% interest with direct deposits. To qualify and continue earning the 0.5% boost, you’ll need to direct deposit at least $2,000 into your Wealthsimple chequing account within a 30-day period. This can be your paycheque or any other type of direct deposit. Generation clients won’t be eligible for an additional 0.5% boost since they're already earning our highest interest rate of 2.25%.