Invest your way, commission-free

Build your own portfolio with thousands of stocks, ETFs, and options — all on our powerful, yet easy-to-use trading platform.

Self-directed trading that earns you more

Low fees, more value

The more assets you have with us, the better your perks. Pay lower option trading and FX fees as a Premium or Generation client.

Fast and flexible

Start trading on your terms and your timeline. With instant transfers and extended trading hours, you’ll always be ready for any market moment.

Everything you need to trade

Buy and sell all common stocks, ETFs, and options on mobile or on web, with multiple different accounts to choose from to help reach your financial goals.

ENDS DECEMBER 23

Choose iPhone, Mac, or both

Just register then transfer or deposit $100,000+ within 30 days. Terms and conditions apply.

Strategies to suit any portfolio

Trading on your terms

Get started in less than three minutes

Sign up and start trading right away — instantly deposit up to $50,000 as a Core client, or up to $250,000 as a Premium or Generation client.

24/5 Trading

Buy and sell eligible US stocks and ETFs 24 hours a day, 5 days a week — longer trading hours than anywhere in Canada.

Real-time fractional trading

Purchase a piece of a share instantly, and invest in the companies you want without a big upfront investment.

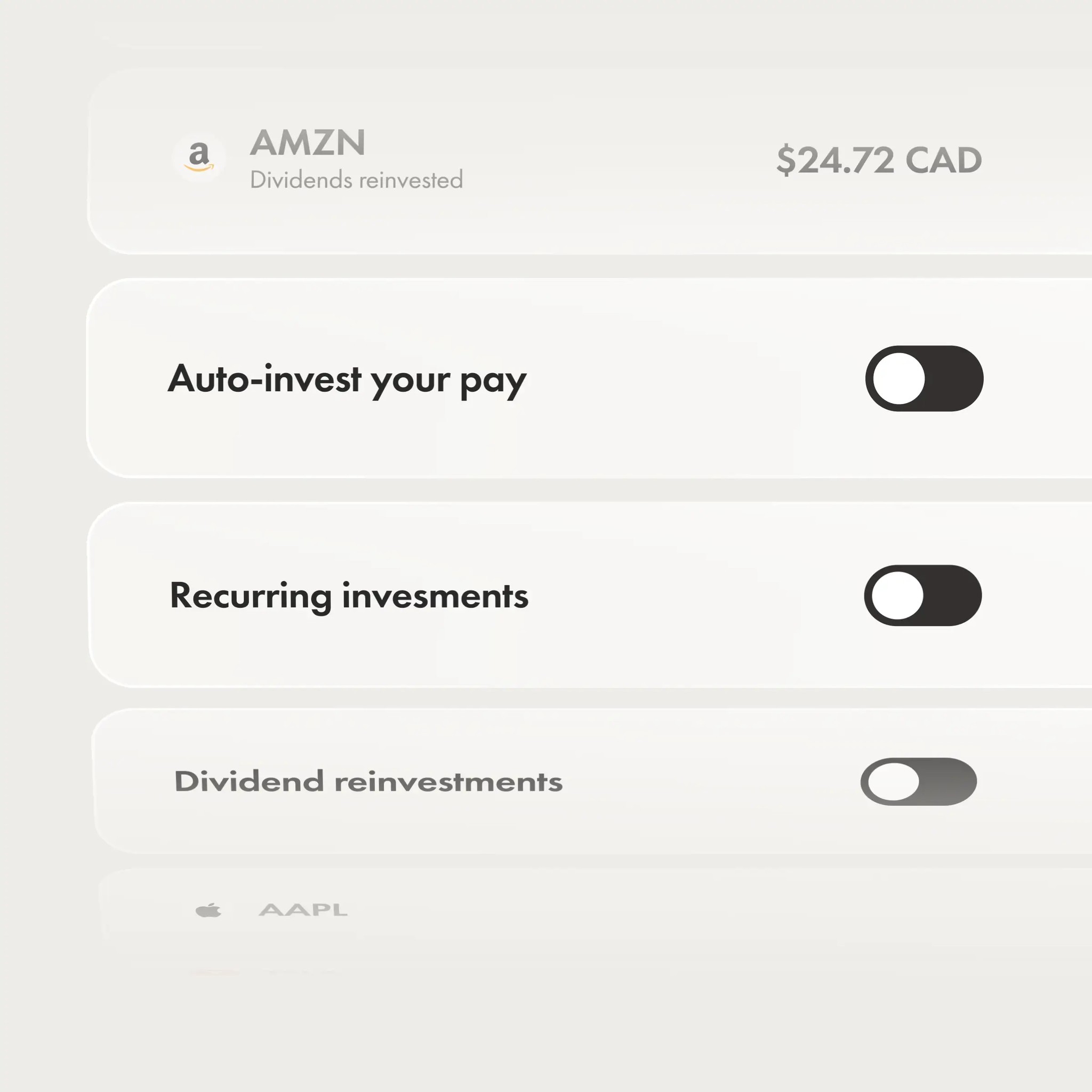

Automation for smarter investing

Recurring investments

Auto-buy your favourite stocks and ETFs. You choose the schedule and set the investment amount. We handle the rest.

Dividend reinvestment

Keep growing your wealth by reinvesting 100% of your dividend earnings — all with zero commissions.

Auto-investing

Have a portion of your paycheque automatically added to your investing account, or into specific stocks and ETFs.

Deeper insights for stronger results

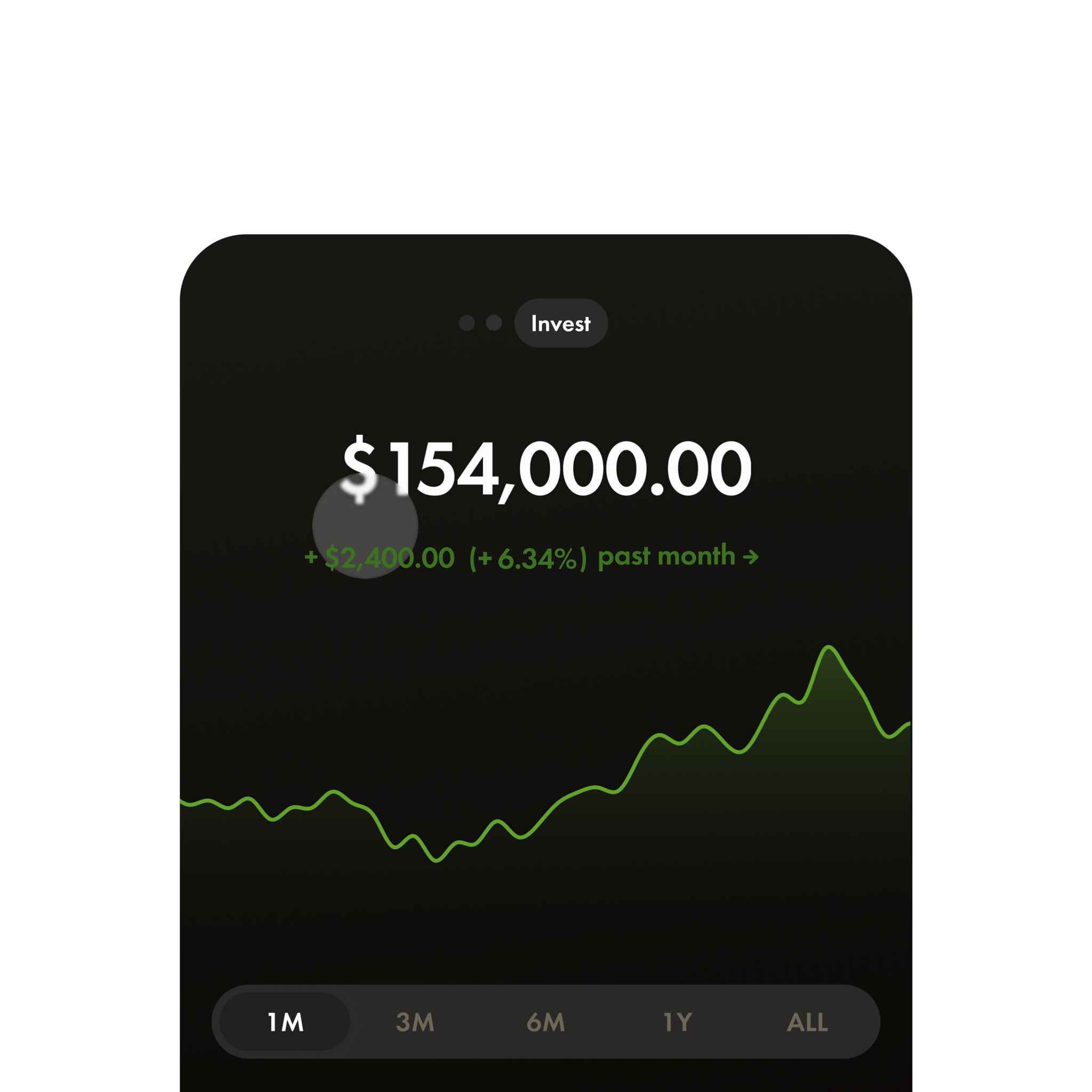

Performance insights

Get a full view of your portfolio’s performance, including realized returns, deposits, dividends earned, and more.

Real-time charting

With live, Level 1 streaming data you can easily spot trends and time your trades — free of charge, unlike at other brokerages.

Exportable holdings

Download a full snapshot of your portfolio so you can model strategies, build custom portfolio views, and track performance however you like.

Reach your goals with the right accounts

RESOURCE CENTRE

Read charts like a Bay Street pro

Technical analysis helps traders make sense of the market — and find their next move. It involves a loooot of charts, so we put together a very simple guide to understanding all of them.

We go beyond your regular broker

Make your investments even more rewarding

Unlock access to benefits and rewards from one of our trusted partners, like Uber, Strava, Headspace, and more, when you have $200,000+ with us.

Take your investing to the next level

Sign up for a better trading experience in less than three minutes.

Articles to help you learn and earn

FAQs

How does Wealthsimple have $0 commission on trading stocks & ETFs when other brokerages charge up to $10/trade?

How does Wealthsimple have $0 commission on trading stocks & ETFs when other brokerages charge up to $10/trade?

We’re able to offer commission-free trades because we’ve built a low-cost, digital-first brokerage powered by technology. And executing trades actually costs very little for brokerages, so we don't think it's fair to charge our clients big trading commissions.

For our list of fees, including foreign exchange fees for USD trades, see here.

What’s the difference between a Self-directed Investing account and Managed Investing?

What’s the difference between a Self-directed Investing account and Managed Investing?

Your Wealthsimple Self-directed Investing account is an account (offered by Wealthsimple Investments Inc.) that allows you to buy and sell stocks and ETFs with no trading commissions. Wealthsimple Investments Inc. offers a self-directed platform and doesn't offer any financial advice or recommendations.

Your Wealthsimple Managed account is an automated investing service offered by our affiliate, Wealthsimple Inc., that manages your investments for you — including your RRSP and TFSA — using a personalized portfolio of low-fee exchange-traded funds. Wealthsimple Inc. also provides financial advice. If that's what you're looking for, please click here.

Which exchanges can I trade on?

Which exchanges can I trade on?

Choose from thousands of stocks and ETFs across the TSX, NYSE, NASDAQ, NEO and CSE. There are also limited securities available on the BATS Exchange.

What times can I trade with Wealthsimple?

What times can I trade with Wealthsimple?

We’ve extended our trading hours to give you even more flexibility when it comes to your portfolio. Now you can buy and sell stocks and ETFs from Sunday 8:00 pm to Friday 8:00 pm ET.

And even though we can’t predict the market, our extended hours give you the convenience to trade within it on your own schedule. Currently, only a limited selection of US listed stocks and ETFs are available for trading during extended hours. You can browse eligible securities by searching for and selecting the “extended hours trading” category from the 'Discover' tab search bar in the Wealthsimple app.

If you place fractional trades outside of trading hours, they will be queued to fill instantly once the market opens again.

Have more questions? Check out this helpful article. For details about the risks and considerations — click here.

How do USD accounts work? Do they have FX fees?

How do USD accounts work? Do they have FX fees?

Clients using CAD accounts pay no commission fees when trading Canadian stocks. However, every time you trade US stocks, you will pay a 1.5% currency conversion fee (foreign exchange (FX) conversion fee) on top of the corporate exchange rate, which is a live rate including a spread which may vary due to market conditions.

With a USD account, you can hold US currency in your RRSP, TFSA, or personal account. So in addition to no commission fees, you’ll be able to transfer US dollars from another Canadian institution into Wealthsimple, then trade US stocks (or hold it as cash) without the worry of FX conversion fees. You’ll only pay an FX conversion fee and a corporate exchange rate when converting currency between CAD and USD, vice-versa (for example: if you deposit CAD into your USD account). The more you convert per transaction between your USD and CAD accounts, the lower your FX conversion fee.

- Core clients can access USD accounts for $10/month or by becoming a Premium or Generation Client.

- Premium and Generation clients have free access to open a USD trading account anytime.

You can find out more about USD accounts here.

Which stocks and ETFs are eligible for dividend reinvestment?

Which stocks and ETFs are eligible for dividend reinvestment?

Dividend reinvestment is only available for stocks and ETFs that support fractional trading.

Just note that when you turn on dividend reinvestments, it applies to your entire account. For example, you can turn it on for your TFSA account, but not for individual stocks and ETFs within that account.

How are instant deposit limits calculated?

How are instant deposit limits calculated?

Instant deposit is applied across your Managed investing, Self-directed investing, and Crypto accounts. The actual instant deposit limit is dependent on your deposit history, your net deposits, and a few other variable we use to calculate your limit. You can find your unique limit in the app.

What is level 1 streaming data?

What is level 1 streaming data?

This is the real-time market data feed that most trading platforms like Wealthsimple provide. It lets you track stocks and ETFs in real time, including the bid and ask prices, last traded price, volume, and price changes — and we offer it free of charge.

Keep in mind that you can track both USD and CAD securities during regular hours, but during extended hours, real-time charting is only available for USD securities.