The faster, easier way to invest for your business

Build your own corporate portfolio, let us build one for you, earn high interest on your cash — or a mix of all three. Whatever you choose, we're here to help.

The smart choice for corporate investing

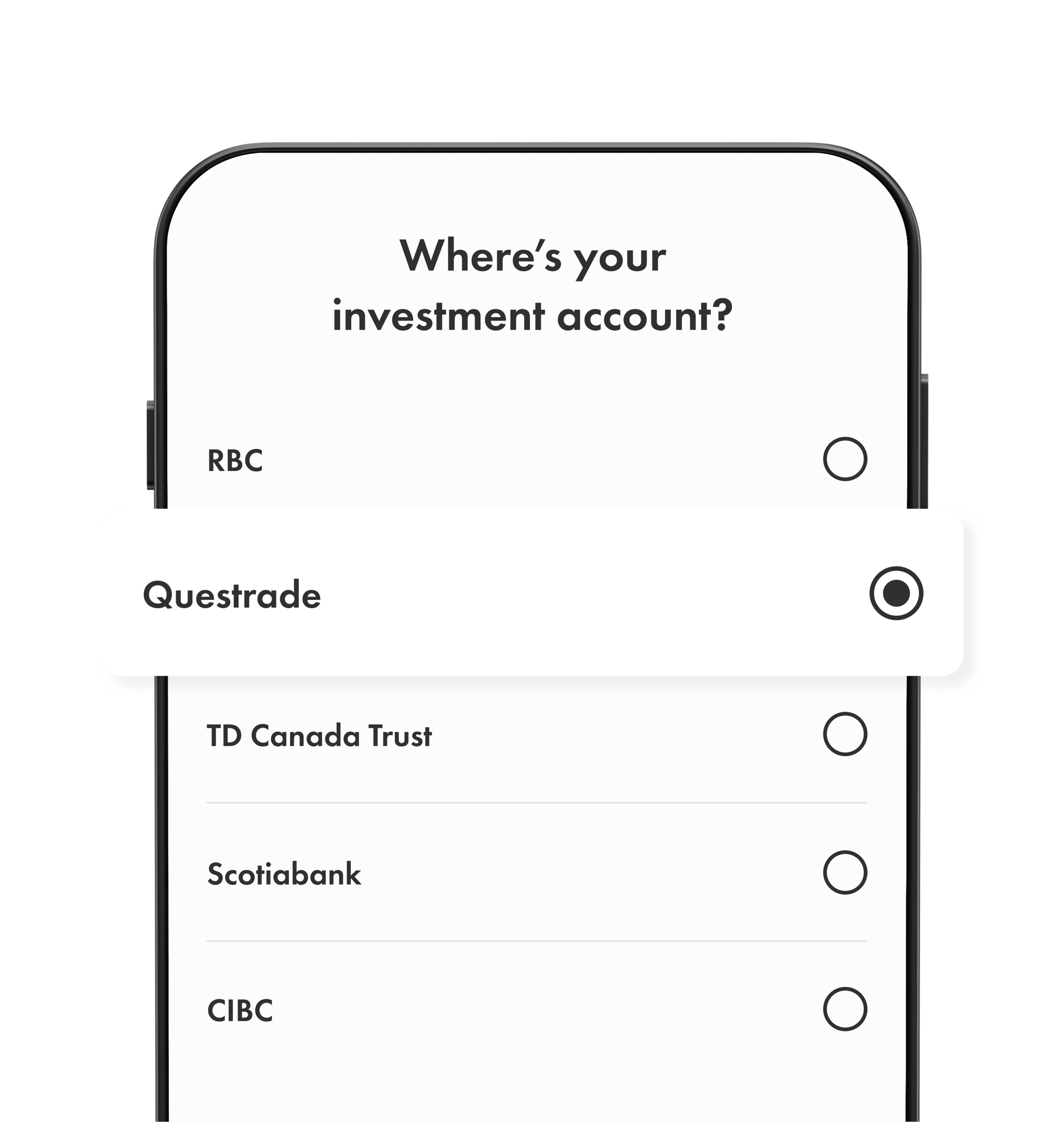

Get set up in no time

Our onboarding process lets you easily open an account and get verified online. 80% of them are opened in 7 days or less. No branch visits, no phone calls. Just a few clicks, and you're in business.

Invest on your terms

With no contribution limits or carry-over required, you can deposit as much (or as little) to your account as your cash flow allows. And keep as much as you like in it, too, with no account minimums.

Keep more of your money

Watch your savings add up with 0.5% fees or lower on managed portfolios, $0 commission trading, and up to 2.25% interest — and zero monthly or everyday fees — on your savings account.

APPLY TODAY

Introducing Corporate margin

Get more flexibility and use out of your corporate investments with corporate margin. With rates as low as prime -0.5%, leverage your portfolio how and when you need it.

Accounts that work as hard as you do

Whether you want a hands-on or hands-off approach (or a bit of both) we’ve got options for every kind of investor.

- $0 commission trading on over 14,000 stocks & ETFs

- Trade 24 hours a day, 5 days a week, full shares or fractional, desktop or mobile

- Set up auto-investing for your preferred investments on whatever schedule works best for you

- Fully managed portfolios built and maintained by our experienced investment team

- Fees starting at 0.5% that can lower as you grow your assets with us

- Choose your risk tolerance and invest in unique investment portfolios like Income portfolios, Direct Indexing, and more

- No monthly fees or minimum balances, you earn up to 2.25% interest on every dollar you deposit

- Instantly transfer funds to any connected Wealthsimple account — as much as you want, as often as you want, with no transfer fees

- Get up to $100,000 in CDIC coverage on eligible deposits

Why Wealthsimple? It’s in the numbers

You decide how to invest in your business. We’ll help you save, grow, and keep more of what’s yours.

Wealthsimple | Other major competitors | |

|---|---|---|

| Max trading commission fees | $0 | Up to $10 |

| FX exchange fees | 1.5% to 0% | Not always transparent |

| Corporate savings interest | 2.25% | 0%–3.2% |

| Interest offered | On any amount | Usually with a minimum balance or lock-in period |

| Same login as personal account | Always | Sometimes |

What our clients are saying

Mark Biner, Family Practice Anesthesia MD, CCFP-FPA

"I really like the app and manage 99% of my finances on my phone which allows me to complete transactions during regular business hours during breaks versus trying to rush to the bank after work or being unable to when working late."

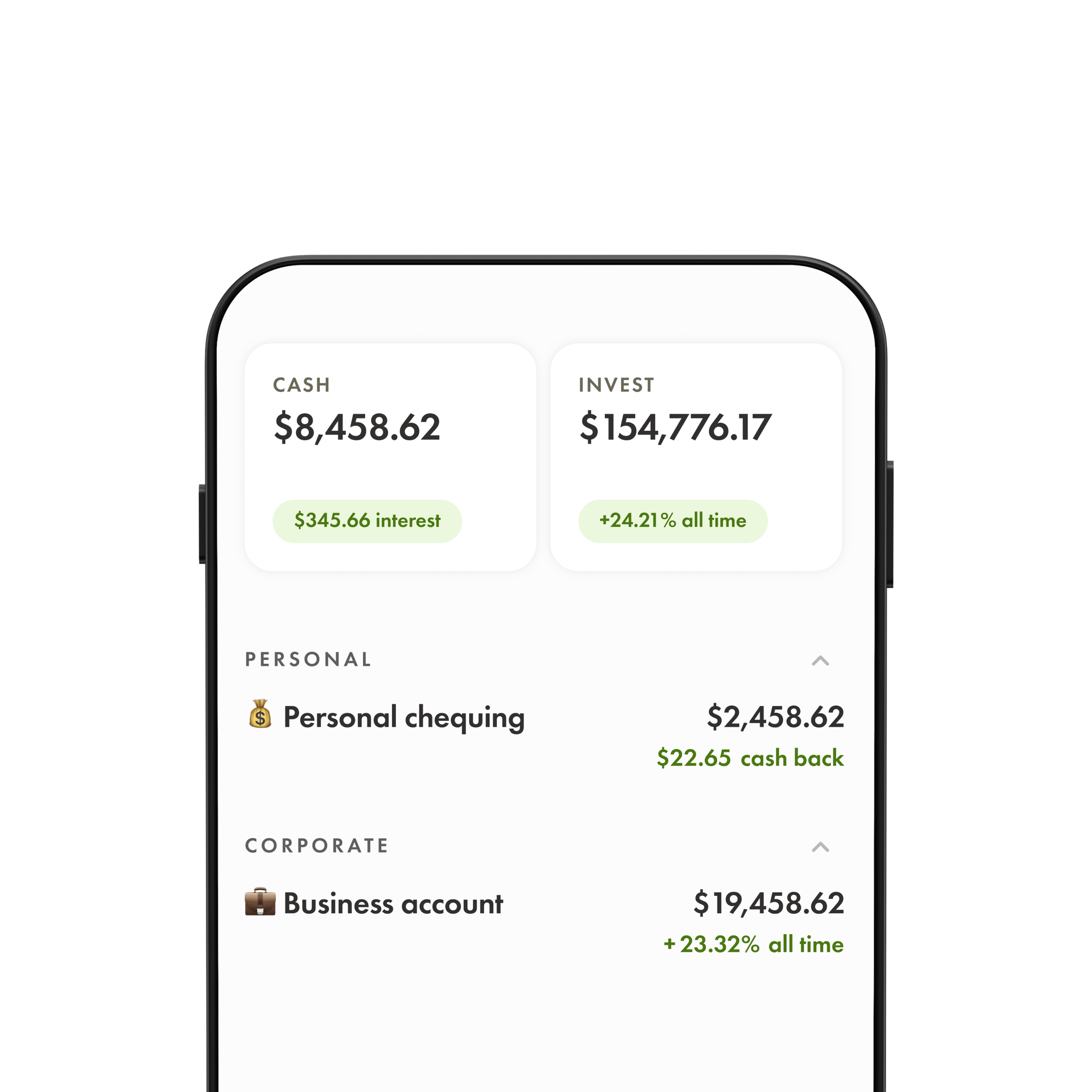

Where business meets personal

Manage your corporate and personal accounts all in one place, and move CAD or USD between them instantly, with no limits. It’s your money, so you should be able to keep it wherever you want.

Better protection for your assets

You’ll get up to $100,000 in CDIC coverage on eligible deposits for your corporate savings accounts, and up to $1 million CIPF coverage for your investments.

Transfer your account and we’ll cover your fees

We'll automatically reimburse the transfer fees charged by your brokerage when you move at least $25,000 to Wealthsimple. Conditions apply.

Make your investments even more rewarding

Get access to personalized financial advice, even lower fees, plus rewards from our partners like Uber, Strava, Headspace, and more — all unlocked when you have $200,000+ with us.

Ready to start investing back into your business?

Open a corporate account today. No excessive red tape, time-wasting bank visits, or sneaky fees.

FAQs

Is there a minimum amount required to open a corporate account?

Is there a minimum amount required to open a corporate account?

Nope, there's no minimum amount to open an account. We'll even cover any transfer fees charged by your current financial institution if they meet a minimum threshold. You can find the terms & conditions here.

How long does it take to setup a corporate account?

How long does it take to setup a corporate account?

Today, 80% of our accounts are opened in 7 days or less. As part of the application process, you'll need to provide your corporate documentation which can take us some time to verify. You can read more about that here.

How does the personal self-directed account compare to the corporate account?

How does the personal self-directed account compare to the corporate account?

With a corporate self-directed account, you'll have access to the same 14,000+ stocks & ETFs as you would with a personal self-directed account. We're still working on bringing some features, like options and margin trading, to the corporate account. You can always reach out to our team if you'd like more information about when they will be available.

Can I use the same login for my corporate and personal Wealthsimple accounts?

Can I use the same login for my corporate and personal Wealthsimple accounts?

Yes! That's one of the nice benefits to consolidating — you can use the same login for all your Wealthsimple accounts.

Does Wealthsimple offer business banking?

Does Wealthsimple offer business banking?

We don't offer business banking at the moment, but we are always looking for new ways to support businesses, so stay tuned.

My business has multiple proprietors — can they get access to the account, too?

My business has multiple proprietors — can they get access to the account, too?

Right now, other owners of your corporation can view the account(s), but any changes like transfers, trades, etc. can only be made by the person who set up the account.

Can I access an advisor with Wealthsimple?

Can I access an advisor with Wealthsimple?

If you have over $500,000 in assets, you can gain access to a dedicated advisor to help you work towards your goals. Learn more here.