Earn up to 2.25% interest with Wealthsimple Chequing, plus get a $25 bonus

New to Wealthsimple? We'll give you a $25 cash bonus when you open your first Wealthsimple account through this page and fund at least $1 within 30 days. T&Cs apply. Get up to 2.25% interest on your cash today.

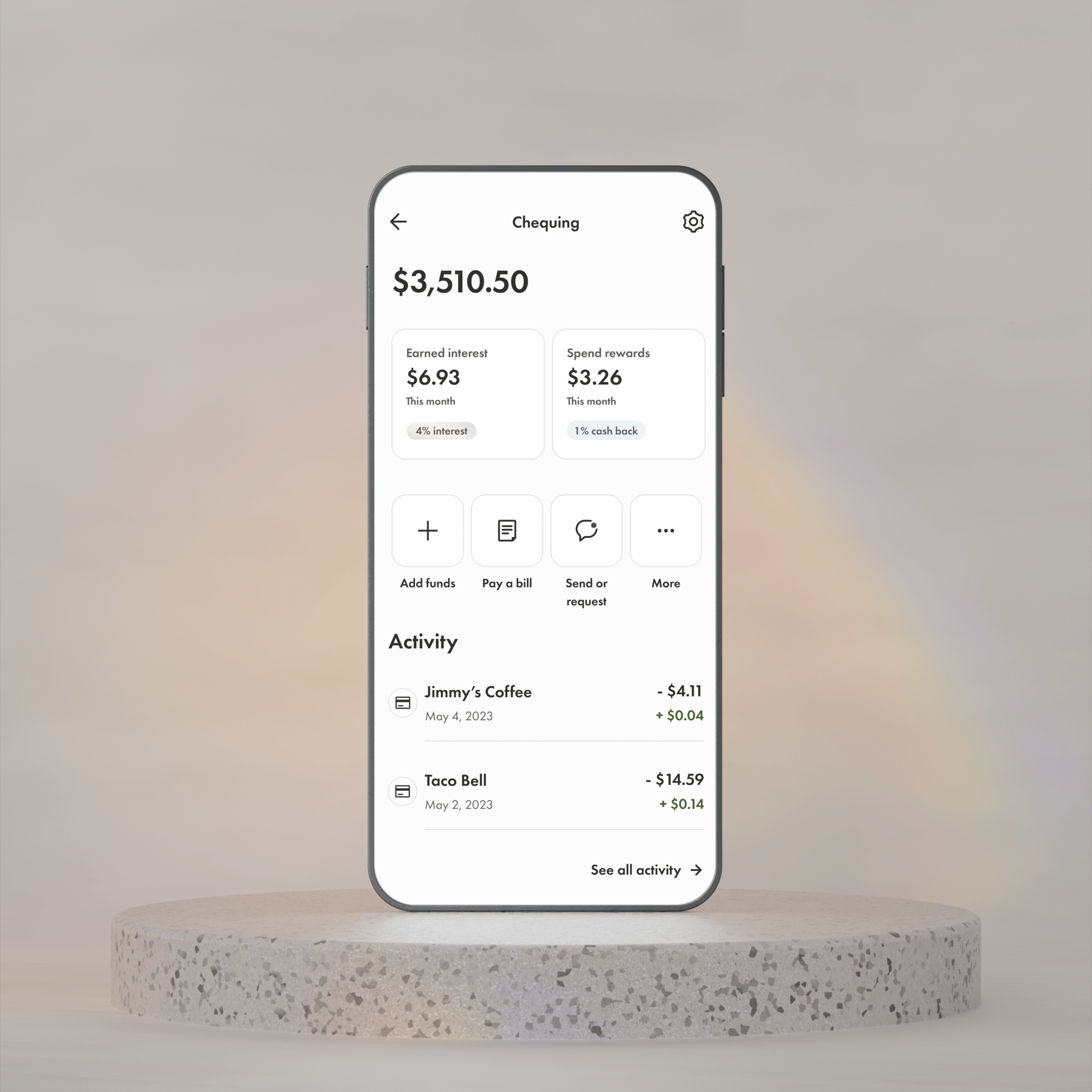

Interest rates that grow with your wealth

Better than a bank? You decide.

No monthly fees

All the flexibility of a chequing account. None of the monthly fees.

Steadfast interest rates

Our rates aren’t promotional or subject to opening additional accounts. Instead, we follow the Bank of Canada’s rate. If it rises, we rise too (and vice versa).

Direct deposit perks

Get extra perks — like auto-investing, faster access to your paycheque, and 0.5% more interest (up to 2.25%) — with qualifying direct deposits. T&Cs apply.

New feature

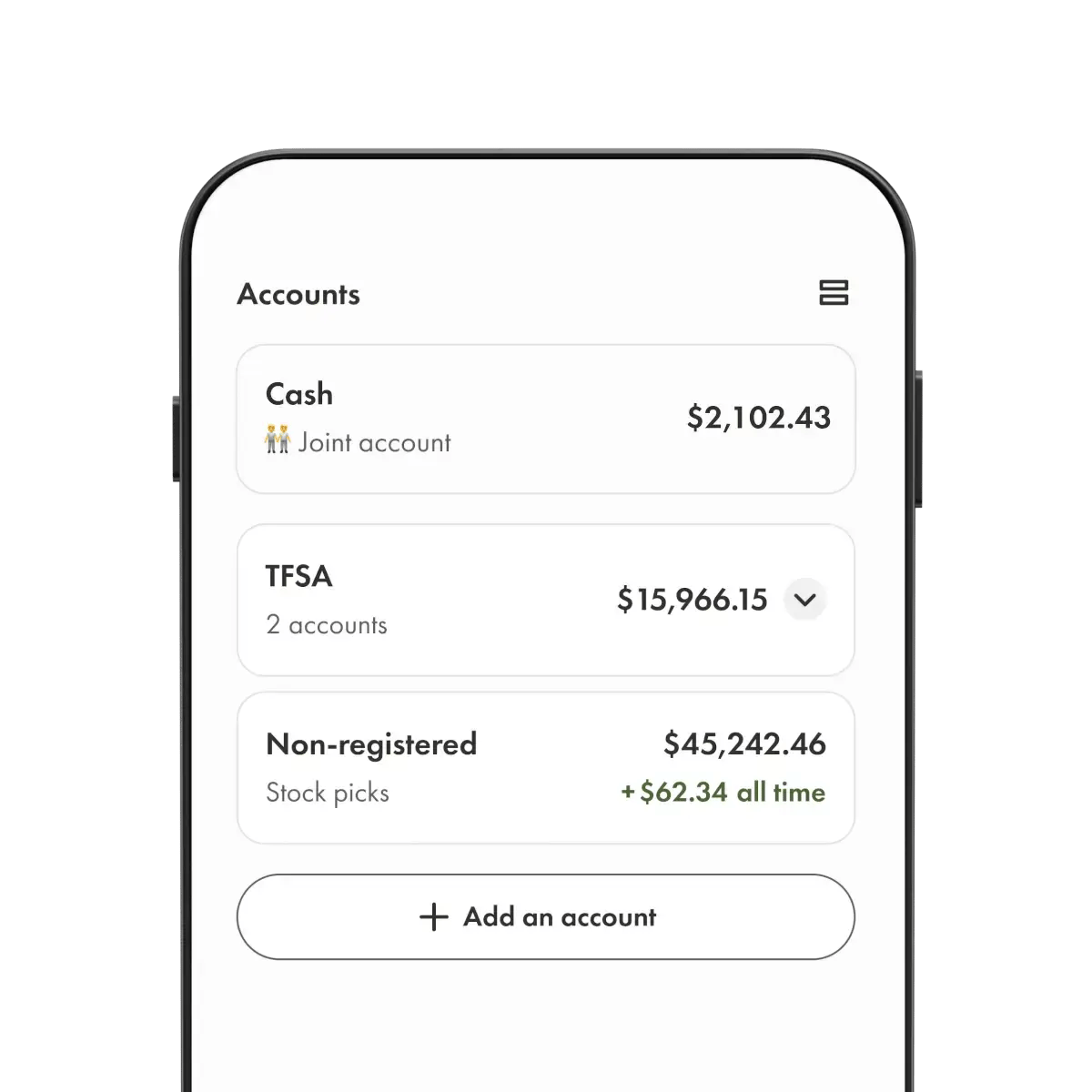

Manage your money with more accounts

Save for a house, a solo vacation, or keep your tax money separate. Whatever your goals, open multiple Cash accounts, by yourself or with someone else.

Ready to break up with your bank?

Open an account in minutes. You can start spending, saving, and earning right away — no branch visits required.

FAQs

Who is eligible for this $25 Bonus?

Who is eligible for this $25 Bonus?

New Wealthsimple clients who open a Wealthsimple account using an affiliate link and fund at least C$1 to the account within 30 days of account opening will receive a C$25 cash bonus. Limit one (1) bonus per client. Must be age of majority and resident of Canada. Additional conditions apply. Wealthsimple will pay the affiliate a one time fee when the new client signs up for a Wealthsimple account through the affiliate link. Full referral details and offer terms.

What are the conditions for maintaining the cash bonus?

What are the conditions for maintaining the cash bonus?

Customers who receive a bonus payment must keep the $25 bonus in their Wealthsimple account for 180 days from the initial funding date. If this condition is not met, the bonus payment will be deducted from the final withdrawal amount or otherwise recovered by Wealthsimple.

How are the average interest on the chequing account and the average yearly savings calculated?

How are the average interest on the chequing account and the average yearly savings calculated?

We've collected data as of May 13, 2025 and calculated the average chequing account interest based on the total interest paid to clients and the number of active chequing account holders.

The fact that we don't charge any monthly or everyday fees, and that clients get their paycheques up to a day early when they direct deposit, means they have more money, and more time, to earn more interest.

Keep in mind, your actual interest earnings may differ.

Unlike most big bank chequing accounts that charge on average $15 per month, Wealthsimple’s chequing account charges no monthly fees, with no minimum requirements, either. By not charging any monthly fees – or any everyday fees, for that matter – we’re saving our clients the $15 per month, or $180 per year, that they would otherwise have to pay at most banks.

How is my money protected?

How is my money protected?

The balance in your Wealthsimple chequing account is held in trust for you with members of the Canada Deposit Insurance Corporation (CDIC), a federal Crown corporation. CDIC protects eligible deposits held at CDIC member institutions in case of a member institution’s failure.

Note: Wealthsimple isn’t a bank, and we are not a CDIC member. That said, we’ve partnered with a number of CDIC-member, federally regulated Canadian Financial Institutions to effectively extend CDIC deposit protection to Wealthsimple chequing account holders for a combined amount (up to $1 million CAD) in the unlikely event the CDIC members were to fail.

Coverage is free and automatic. Learn more here.

How is the prepaid Mastercard different from a credit card? Will it affect my credit score?

How is the prepaid Mastercard different from a credit card? Will it affect my credit score?

First off: there are no annual fees! And unlike credit cards, the prepaid Mastercard doesn’t require a credit check or any other qualifications.

And no, you’ll never need to worry about this card impacting your credit score.

Who is eligible to earn the 0.5% interest increase?

Who is eligible to earn the 0.5% interest increase?

All Core and Premium clients are eligible to earn an increased rate of up to 2.25% interest with direct deposits. To qualify and continue earning the 0.5% boost, you’ll need to direct deposit at least $2,000 into your Wealthsimple chequing account within a 30-day period. This can be your paycheque or any other type of direct deposit. Generation clients won’t be eligible for an additional 0.5% boost since they're already earning our highest interest rate of 2.25%.

Affiliate referral program legal disclosure

Affiliate referral program legal disclosure

You are being referred to Wealthsimple Inc. (“WSI”) and its affiliates including Wealthsimple Payments Inc. (“WPI”) and Wealthsimple Investments Inc. (“WSII”) by the owner of this promotion that is directing you to this page (the “Sponsor”). The Sponsor may receive compensation in the form of a referral marketing fee of up to $1,250 when you participate in this Promotion by clicking through this page. WSI (operating Managed Investing products) is registered as a portfolio manager in each province and territory of Canada. WSII (operating Self-directed Investing and Crypto products) is a registered investment dealer in each province and territory of Canada, and is a member of the Canadian Investment Regulatory Organization. WPI (operating Cash product) is registered with FINTRAC as a money services business in Canada. The Sponsor is not registered in any capacity. All activities under this referral arrangement with the Sponsor requiring registration will be performed by Wealthsimple, WPI, WSII, or a registered affiliate. The possibility of a conflict of interest may arise in any paid referral arrangement. In this case, the Sponsor is receiving a fee for referring you to Wealthsimple and the fee may have impacted their decision to refer you. However, neither the Sponsor nor Wealthsimple are aware of any actual or potential conflict of interest as a result of your referral.

All investment involves risk. The value of your portfolio with Wealthsimple and its affiliates can go down as well as up and you may get back less than you invest. Past performance is no guarantee of future results. For more information about Wealthsimple’s products, investment decisions, fee schedules, user testimonials, promos & more, visit wsim.co/disclaimers. By using this website, you accept Wealthsimple’s Terms of Use and Privacy Policy.