For employers

The group savings plan your team actually wants

We’ve changed the way Canadians do personal finance. Now we’re doing the same for retirement and group savings plans, too.

Get a 1% match on your group transfer

Now’s the time to bring your group account to Wealthsimple — and help your whole team unlock financial freedom. Ends March 31. T&Cs apply.

Some of our clients

Get the Wealthsimple experience at work

Fully personalized

Unlike pre-built mutual funds, we create customized portfolios for your employees based on their needs and risk level, and they can adjust their profile whenever their situation changes.

Low fees

Our portfolios are built around Exchange Traded Funds (ETFs), rather than traditional mutual funds, so most of your employees will pay less than 1% in management fees.

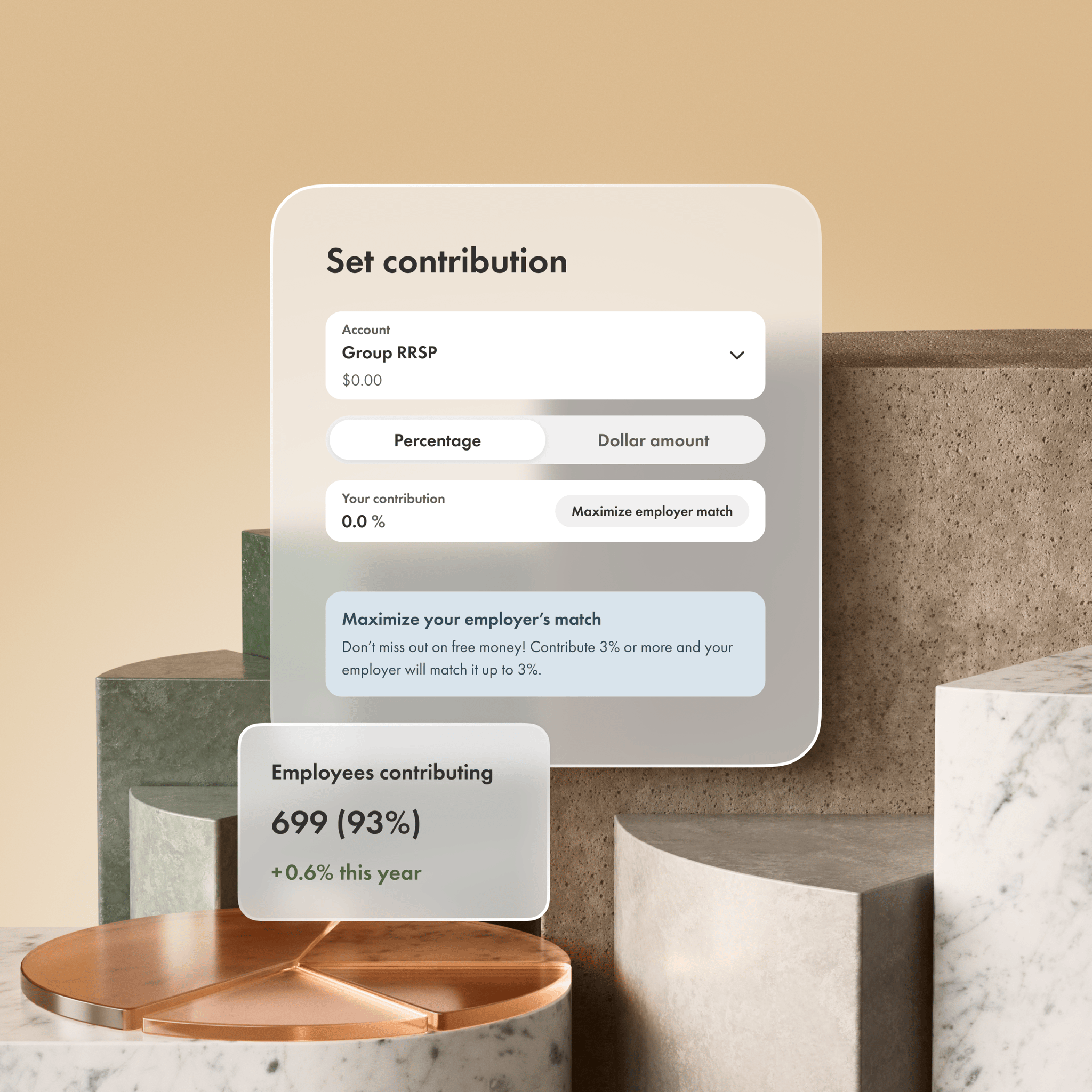

Effortless automation

Our technology integrates with your existing HR and payroll system and has a user-friendly dashboard that delivers efficient admin and seamless onboarding.

80%+

average matching plan adoption

1 in 2

plan members already use Wealthsimple

3M+

Canadians trust us with their finances

What our clients are saying

Courtney Lee, VP of People, Humi

“By selecting Wealthsimple for Humi's GRSP, we were able to enhance our benefit program while saving on plan costs and management fees.

Our employees now benefit from low management fees, access to diverse investment options, as well as great perks to support their financial wellness. The plan transfer required a minimal time investment from our end, and the administration is simple!"

More for you, more for your employees

Extra money in everyone’s pockets

Plan members pay low fees with Wealthsimple, meaning your team can reach their savings goals faster.

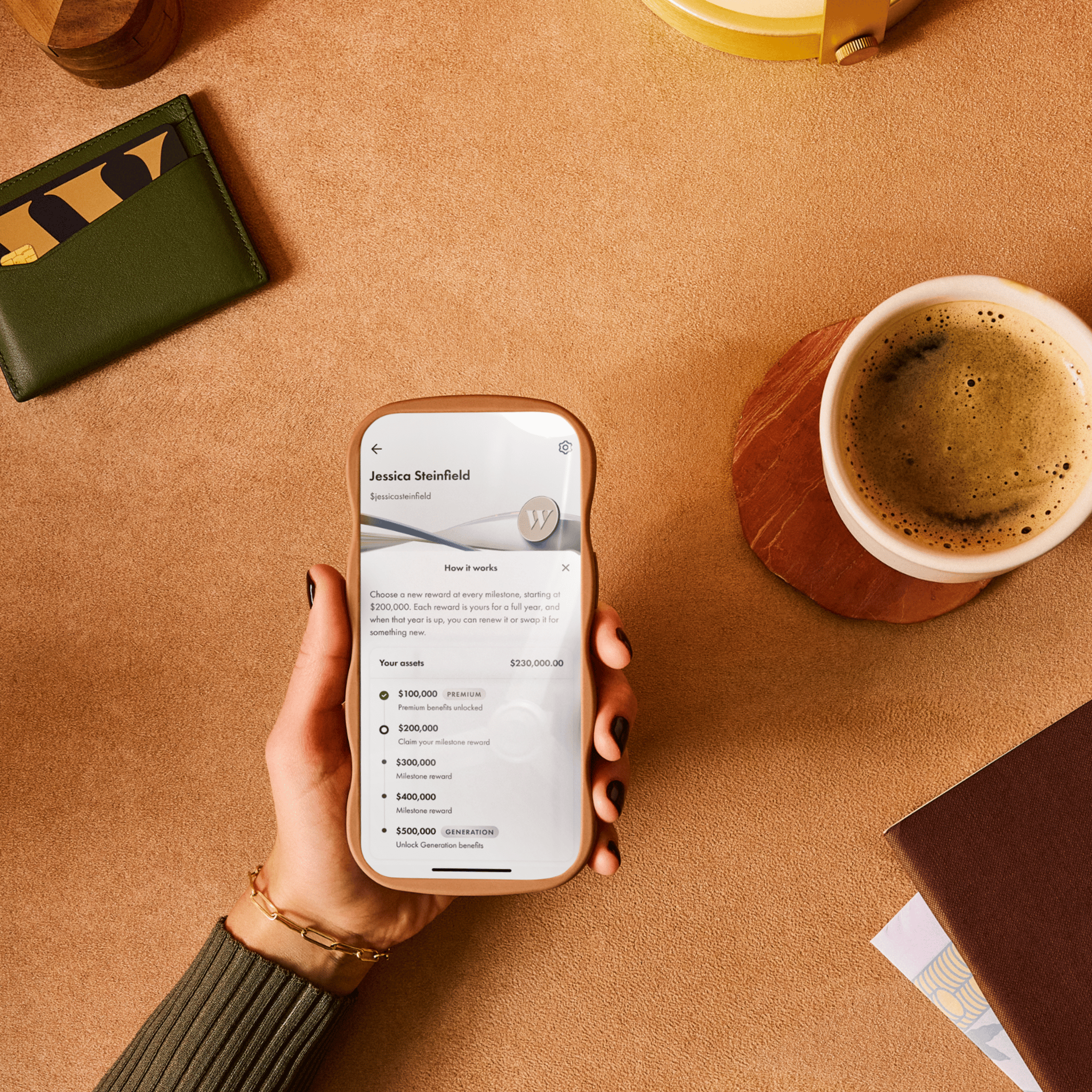

Access to Premium benefits

Employees with over $100,000 with Wealthsimple unlock added benefits, like even lower fees, rewards from our partners, and 1.75% interest on your chequing account balance.

Financial education at their fingertips

From our TLDR newsletter to helpful content, like our retirement guide, we make staying on top of all things finance more accessible for your team.

Save time with easy integrations

Seamless and secure

We fit right into most current HR systems to streamline your payroll process, while keeping your employee data fully secured and up to date.

Supports your major platforms

We offer integrations with Rippling, Dayforce, Workday, Humi, BambooHR, and more.

For brokers

Let's work together

We partner with brokers and consultants to make sure we’re offering the best possible service to our shared clients. If you’d like to work with us, someone from our team would love to talk to you.

Set your team up for financial success

Share a few details about your company and we’ll be in touch.

FAQs

What types of group savings plans do you offer?

What types of group savings plans do you offer?

We currently administer GRRSPs, GFHSAs, GTFSAs, DPSPs and group non-registered accounts. These account types allow you to offer your employees access to tax-efficient, employer-sponsored group savings for any goal.

Who uses Wealthsimple for Business?

Who uses Wealthsimple for Business?

We work with clients of all sizes and from a variety of industries. This includes employers just setting up a group savings plan for the first time, to organizations with an existing plan that they have transferred to Wealthsimple.

Can I transfer my existing group plan to Wealthsimple?

Can I transfer my existing group plan to Wealthsimple?

You are able to transfer your existing plan to Wealthsimple as long as your company has over 50 employees, and we currently support your group plan account type. We have a transfer team that will work with your current provider to make it a fast and painless experience. Transfer times depend on your current provider, but can take an average of 4 to 6 weeks.

In most cases, Wealthsimple will cover any transfer fees incurred from moving out of your existing provider. Talk to our team to find out more.

What fees do you charge for a group savings plan?

What fees do you charge for a group savings plan?

Employees pay 1% and lower for our selection of portfolios.

For a detailed breakdown of all portfolios and to see what rates your employee might pay, get in touch with the team. There are no hidden fees for transfers, withdrawals or account changes. In fact we will cover the cost of any transfer fees you get charged when you move an existing plan to Wealthsimple.

What’s the onboarding process like?

What’s the onboarding process like?

Once sign off is done electronically, our team will ensure you are comfortable with the platform and performing all key actions. This may include integrating other systems into Wealthsimple for easy and fast data transfer.

With all administrators up and running, we will then invite the rest of your plan members to Wealthsimple where they can electronically set up their accounts.

Any members who are existing Wealthsimple clients will connect their existing account to their group savings plan.