Finance for Humans

Five Simple Rules To Be the Absolute Worst Stock Picker

Anyone can be a lousy stock trader. (In fact, the majority of us probably are.) But to be a true money-losing machine, you need discipline and strategy. And a five-point plan.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This article is part of Slow Money, a column by Wealthsimple’s investment team about growing wealth over time.

Let’s say you want to be an awful stock picker. Not just a slightly reckless trader, or an ineffectual one (which studies show many of us are destined to be). But a truly terrible one — a Bad Trader™ who behaves as if he has dog chow for brains and wants to find ways to throw handfuls of cash out a window. So how would you do it? Well, for those who are curious, we’ve made a definitive list of the five most surefire ways to ensure your money would be way better off in a bank account earning .001% interest than under your management. And, for those who don’t want to be awful stock pickers, this also works as a list of behaviours never to engage in.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Rule #1: Go deep on one or two stocks

To reach the upper echelons of terrible trading, you’ll want to avoid diversification at all costs. Instead, you need to become obsessed — absolutely obsessed — with a tiny handful of stocks. Or, better yet, pick a single stock that you’re certain will rise forever, then pour all your money into this sole investment. How to find such stock(s)? Just trawl r/wallstreetbets, or ask your cousin Larry what he’s buying. Because odds are Larry is wrong. The U.S. stock market, as a whole, has marched steadily upward since 1900, and Canadian stocks have done much the same. But only a tiny fraction of individual stocks — about 4%, according to one study — have earned investors more money than banks pay in interest, meaning most stocks really aren’t worth buying. That also means that, though betting on the whole market generally results in long-term gains, concentrating your bets on one or two stocks significantly ups the odds that you won’t pick a moneymaker — your entire goal as a lousy stock picker.

The stock market, as a whole, has marched steadily upward since 1900. But only a tiny fraction of individual stocks have earned investors more money than banks pay in interest.

And, when choosing stocks to obsess over and bet big on, don’t sleep on the big guys! Since the market’s best-performing companies change all the time, you can easily overinvest and lose money on popular blue chips. For instance, if you’d put all your money in General Electric back in 2000, when the company had the single largest market value of any S&P 500 company and its stock was going for $480 a share, you’d be swimming in a sweet, delicious sea of losses now that GE stock costs about $109 a share, and it’s the 75th most valuable S&P company and will soon be splitting into three separate entities.

Rule #2: Bet on all the same stuff

A slightly more crafty way to avoid diversification, beyond investing in a few individual stocks, is to build what’s known as a thematic portfolio, in which your positions are concentrated on a single industry or region. That way, you’re entirely exposed to sector- and country-specific downturns. If you go all in on Canadian energy stocks, for instance, and the Canadian energy sector has a rough year (while the U.S. and Chinese energy sectors do just fine) great! You’ll be all in on the losses.

A terrific thing about thematic portfolios is that you can build one unwittingly, by having investments that might appear diversified but aren’t in reality, and thereby unintentionally negate the benefits of holding broad-based index funds. If you’re invested heavily in, say, U.S. tech companies — Apple, Google, etc. — and the rest of your money is in S&P 500 index funds, you aren’t really diversified, since the biggest companies in the S&P 500 are U.S. tech companies. Which means, if the U.S. tech sector suddenly craters, a lot of your investments will nose-dive at once. And that’s the sort of devastating shock Bad Traders live for. Thematic tech ETFs can also serve up huge helpings of hurt.

Recommended for you

You Probably Shouldn't Panic Sell to Avoid Drawdowns

Finance for Humans

Nervous About Overheated Stocks? Let’s Revisit Four of Our Best-Ever Insights

Finance for Humans

You May (Still) Have to Pay Taxes on COVID-19 Benefits

Finance for Humans

The Perfect Guide to Every Little Tax Question You Have

Finance for Humans

Rule #3: Trade all the freaking time

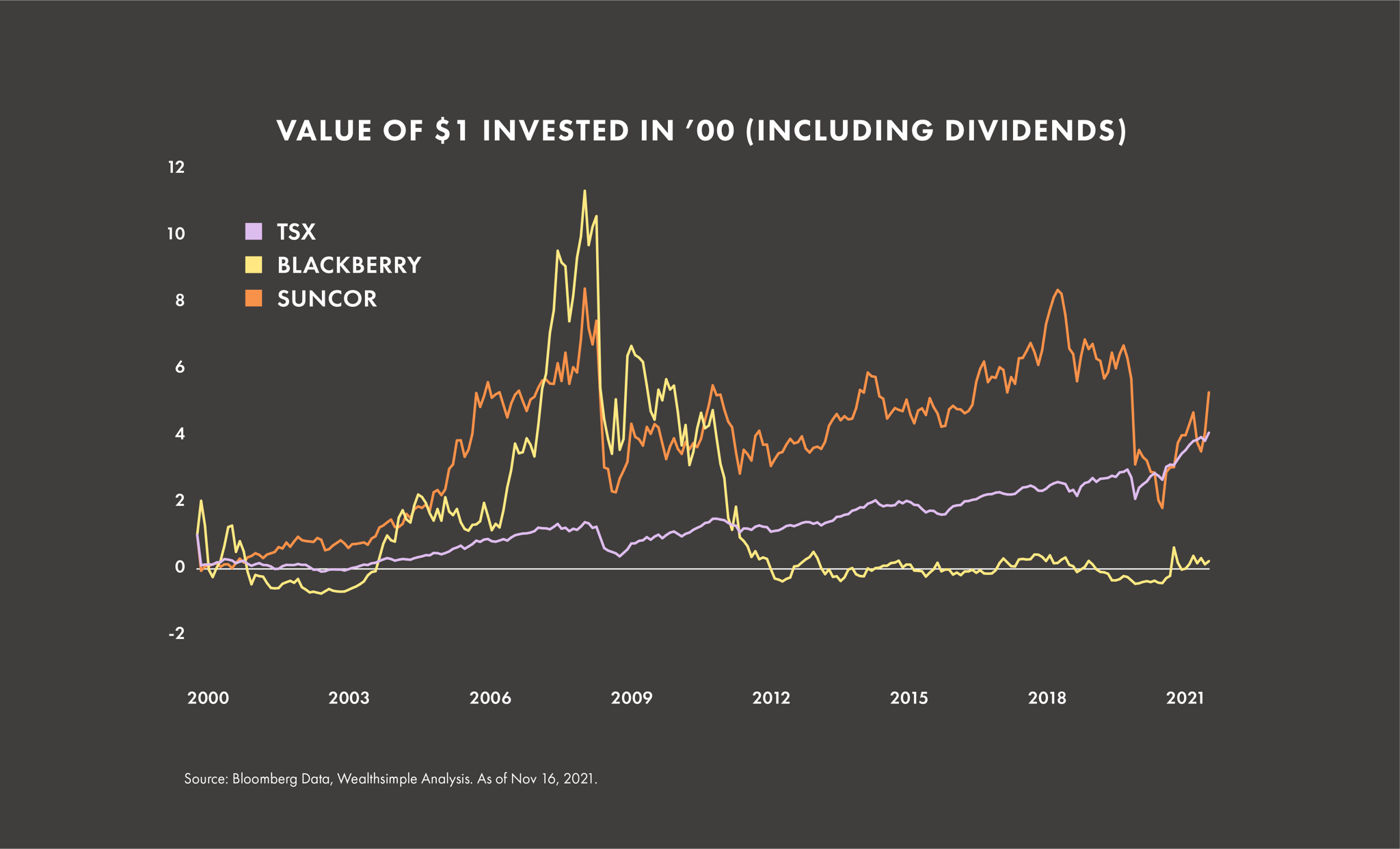

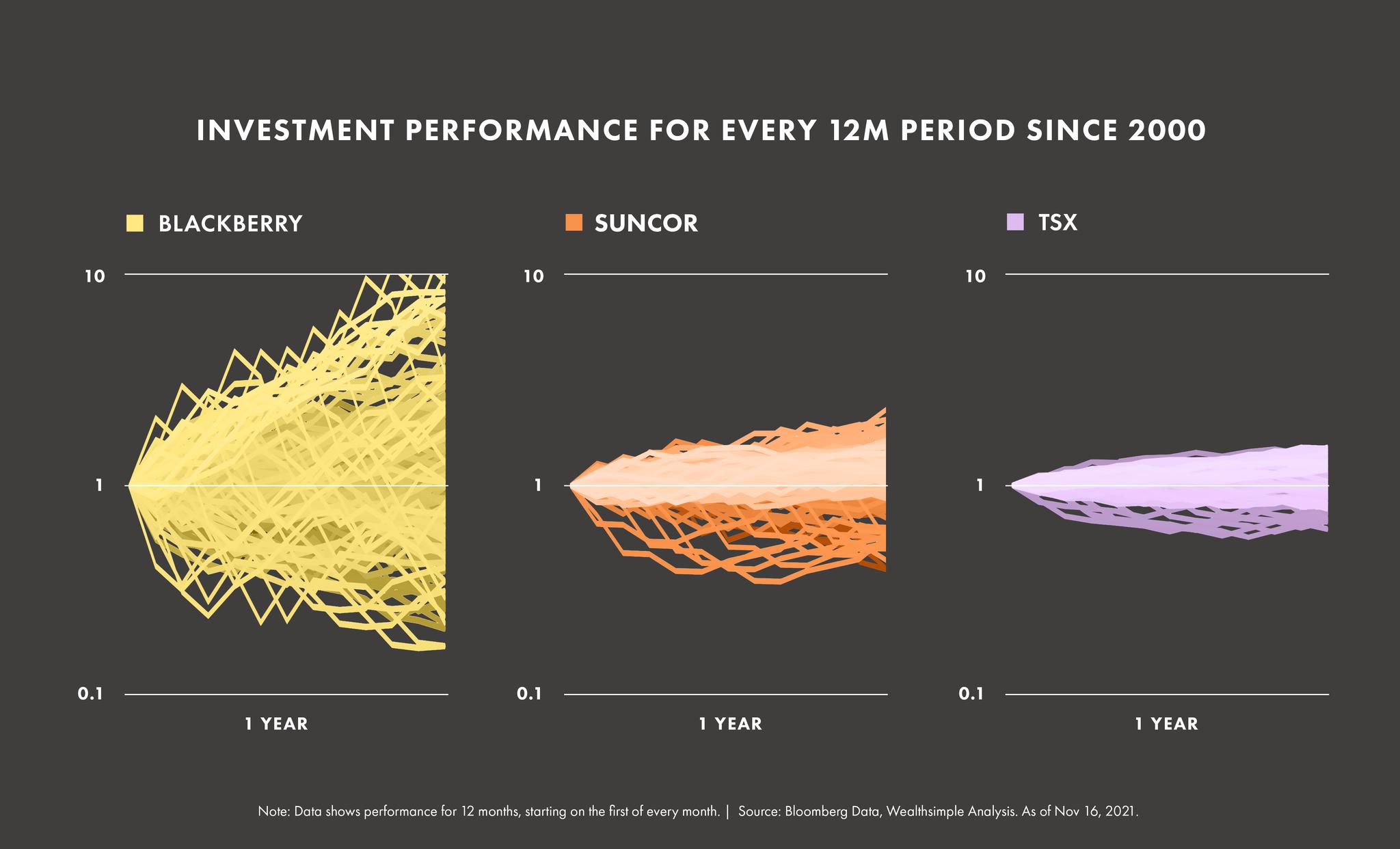

So you’ve picked a few stocks that you truly, madly, deeply believe in and you’ve built a thematic portfolio. Next, make sure you’re trading All. The. Time., trying to time the market. The charts below shows the performance of three Canadian equity investments: Blackberry, Suncor, and the overall market (TSX). Suncor’s stock is the winner, given its rise over the past 20 years. But! Individual stocks, even the ones that do well over time, like Suncor, experience far bigger swings in value than the boring diversified TSX index. Check out the spaghetti chart: each squiggle represents one year’s performance; the wider and more squiggly the range, the more volatile the stock. Suncor stock hasn’t swung as much as Blackberry’s, but it’s still done some serious rollercoastering compared with TSX. And actively trading in reaction to these swings creates opportunities to bungle your timing — by selling during a downturn, say, and missing the rebound — which can turn a decent investment into a regrettable one. Frequent trading also racks up fees that cut into your profits, which Bad Traders love to see.

Rule #4: Chase winners, buy high, YOLO

As a committed Bad Trader, you want to chase extreme performance at every turn. So, once you’re comfortable trading on a whim, keep a close eye on stocks that shoot up dramatically, especially ones that gain 100% or more in a given year. The more speculative and hyped, the better (for doing worse, that is). The truly world-class Bad Traders embrace every FOMO-driven frenzy; it’s the best way to ensure that you pay a lot more per share for chancy stocks than any sane person ought, often long after savvy traders have already made piles of money and cashed out. Unfortunately for Bad Traders, moments of frantic, terrible-trading splendour, like the GameStop frenzy, don’t come along every day. But, with enough Twitter and Reddit scrolling, you’ll be ready to pounce whenever the next meme stock takes off, so you can YOLO yourself straight into the red.

Rule #5: Panic like a pro and sell low

The timing of your exit from the market needs to be as ill-considered as your FOMO-fueled entry into it. One reliable, particularly ruinous way do that is to trust your gut and bail whenever things get a wee bit scary out there in stockmarketland. Echoing the Suncor example above, one study found that, during big market drops, households have lost more money panic selling than they would have staying put, especially since these same households tend to delay reinvesting, missing rebound opportunities and then buying again after prices have already climbed back up a bunch. A huge number of households made this mistake after the 2008 financial meltdown and after the early-aughts sell-off, and presumably after the 2020 Covid crash, too. But, as a Bad Trader, you relish selling low and missing rebounds. And here’s a bonus tip: if you want to be a first-rate panic seller, it helps if you’re a male over the age of 45, have dependents/kids/etc., are married, and think you’re a super-awesome stock picker. Research shows that investors with that profile are more likely to freak the heck out and lose money when the market goes sideways compared with other investors.

GOOD JOB! Congrats on completing our five-point course on being a terrible trader! You’re now ready to steadily do worse than folks who just invest in a well-diversified portfolio of ETFs and forget about them. Which has proved to be an investment strategy that beats even hedge funds over the long term. Just ask Warren Buffet. Or don’t if you’re a true ride-or-die crappy trader.

Spencer Gaffney is a writer based in New York.

Matthew Karasz is Director of Investment Research at Wealthsimple.