Money & the World

A Deep (But Not TOO Deep) Explanation of What We Mean by 'Diversification'

Maybe you know that everyone's investments should be diversified, but... well, maybe you don't really know what diversification is. Or how it works. Here's an easy guide.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

What is diversification?

Diversification is a term so common in the world of money and investing that people can sometimes forget that they don't know exactly what it is, how it works, or whether they're doing it right. Like the word “ironic,” it's a concept everyone uses and few people really understand. (Yes, we're talking to you, Alanis.)

Let's start with an agricultural metaphor: Investing is a little bit like being a farmer.

Imagine a (not super-smart!) farmer thinking about how to run his business. “I know what to do!” he thinks to himself as he's making his yearly farmer plan. “I’m going to go all in on wheat!” Maybe wheat has been doing really well and he figures: “Wheat, wheat, wheat! Nothing but sweet, delicious wheat! I can’t lose!”

And then our less-than-wise farmer is struck by that plague that strikes all people who think they know the future: uncertainty. Maybe it comes in the form of wheat blight, or really bad wheat weather, or an international gluten hysteria. What happens to him?

Like all gamblers, he's screwed. But let's explore why: He planted only one crop, so he exposed himself to a lot of risk. Anything wheat-related goes wrong and he's in real trouble. Whereas the wiser farmer who planted some wheat, some soybeans and some super-trendy ancient millet would be a little more protected. The wheat market stinks? That's OK, maybe the market for soy is fantastic.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

And that farmer who also owned some rental properties, and a great portfolio of low-fee passive investments? She would be even more protected. If there's a drought and nothing grows all year, she has other ways to making money.

Investing’s no different. As you plant your seeds (sorry!) of financial growth, you want them in as many fertile places as possible. We call this “diversification.”

What does this mean, practically? It means you shouldn't just put your money in one place — say, your home — and hope that the gamble pays off. What if a new trash-processing facility moves onto your block, or a fizzy cocktail of government policy and opportunistic investors creating arcane classes of investments causes an artificial housing bubble that inflates values meteorically until the whole thing collapses? Not that anything like that could happen.

Does diversification really work?

“If you had the ability to predict what the best stock or the best sector or the best country was going to be, then diversification would be a terrible idea,” says Wealthsimple advisor Dan Tersigni. “All you'd have to do is buy as much as possible of whatever's going to do the best. Sadly, nobody has that crystal ball.”

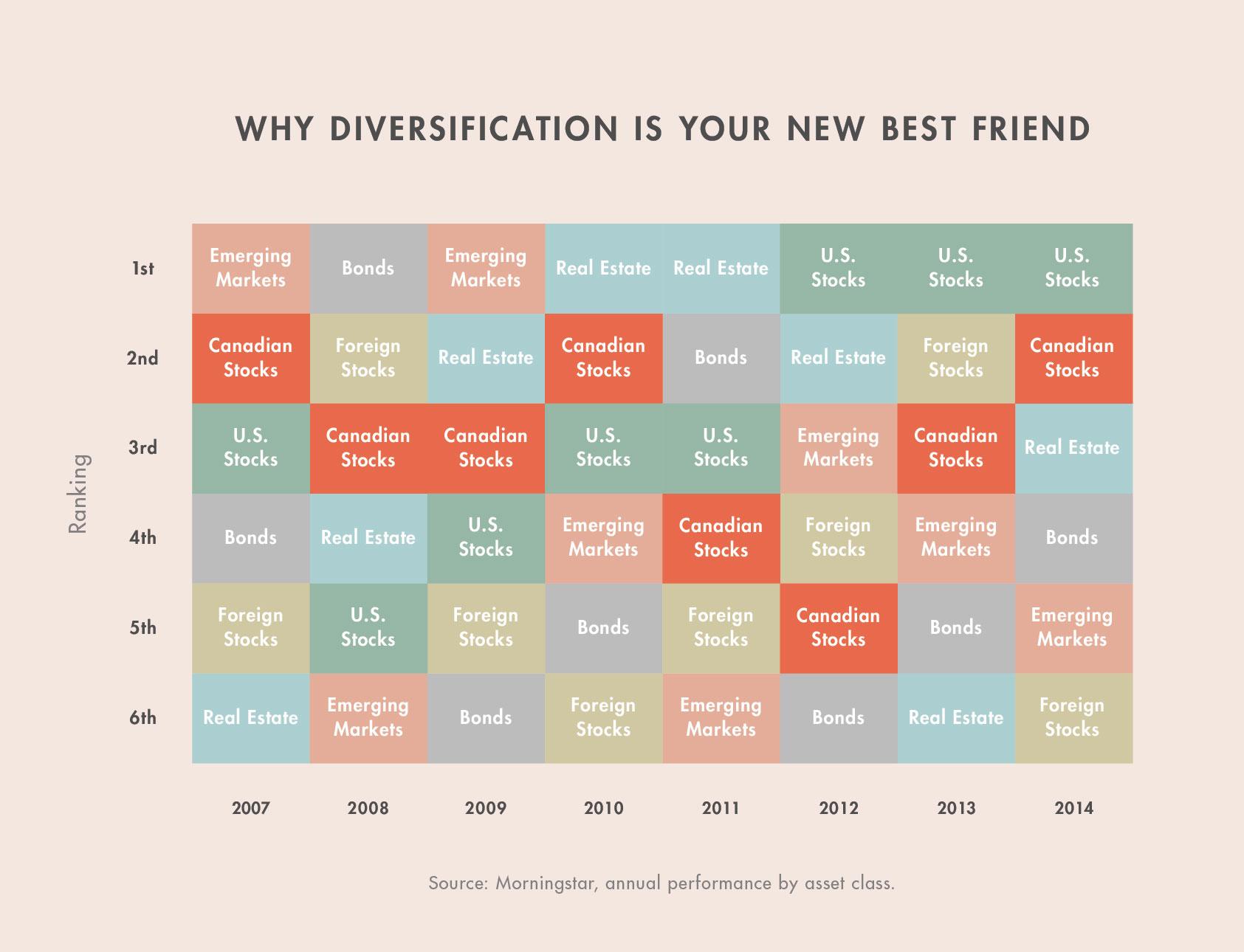

If you think it's easy to pick the winning investment — or even class of investment — we have a graph for you to check out.

Take a good look at that graph. Each of those boxes represents a sector of the market in a given year. The Y-axis is the how well a certain type of investment performed, ranked from first (best) to sixth (worst). The X-axis represents each year from 2007-2014.

Even if you had invested in all the stocks in the world, you would have still exposed yourself if you hadn't added a mix of bonds to your portfolio. Check out how having a stake in bonds would have lessened the impact of the great recession (especially if you wanted to take your money out and use it for something, like retirement, and didn't have time to wait for stocks to bounce back).

As you can see, bonds outperformed stocks during the 2008 recession, though in more recent years, the two have switched.

Recommended for you

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

This Is Not Normal: A Letter From the Toronto Real-Estate Forever Boom

Money & the World

The Racial Wealth Gap Is a Problem

Money & the World

The bottom line is that investing in stocks and bonds is risky. Everyone who says they can predict the future is usually wrong. That's why investing can be lucrative, too — you're often paid handsomely for the risk you take. But smart investors find ways to mitigate the risk. One important tool is time. Over the long-term, markets behave much more predictably — and tend to go up. That's why we think long-term investing is so smart. The other really important way to mitigate risk is to put your eggs in lots of different baskets. If you invest in all kinds of companies in different countries that do different things in different industries — not to mention investing in both stocks and bonds in a cocktail designed for you — you insulate yourself from the more nauseating gyrations of markets.

But you can't just throw your money into random places. You have to find the perfect balance

One way to diversify is to buy lots of different stocks and bonds instead of trying to pick a few winners. That's what exchange traded funds (ETFs) and mutual funds do, only in different ways. Mutual funds are groups of stocks and/or bonds picked by a person who thinks they are good at picking stocks (and are, statistically, usually wrong about that). ETFs don't select stocks individually but invest in all the companies across different sectors or markets or countries — one popular ETF, for instance, tracks the American S&P 500, which means it buys all stocks in the S&P 500 instead of trying to pick and choose. The fees for mutual funds are higher than for ETFs because you're paying the team of people who pick the stocks, and paying to trade stocks as the managers pick new ones and get rid of old ones. But they don't perform better than ETFs — in fact, on average they perform worse.

That's why Wealthsimple uses ETFs — better performance, lower fees... no brainer.

OK. So using an ETF or mutual fund is one way to diversify. But you can't just invest in any collection of funds and think you're all set. Most funds focus on a particular category of investment — like tech companies, or energy companies, or companies in emerging markets. If all the companies you're investing in are similar, you're still taking on too much risk – it's like diversifying simply by planting different types of wheat.

“Say you own Apple, Google, Facebook, and Amazon,” says Tersigni. “That's not really a diversified portfolio. They all have some of the same risk factors, so if something goes wrong for one of them, it may go wrong for all of them. Wealthsimple's basic philosophy is to track the broadest measure of the stock indexes for various countries.”

And that's not even getting into the fact that you should have a mix of stocks and bonds that changes over time depending on what you want your money for, how old you are, and when you need to take money out of your portfolio.

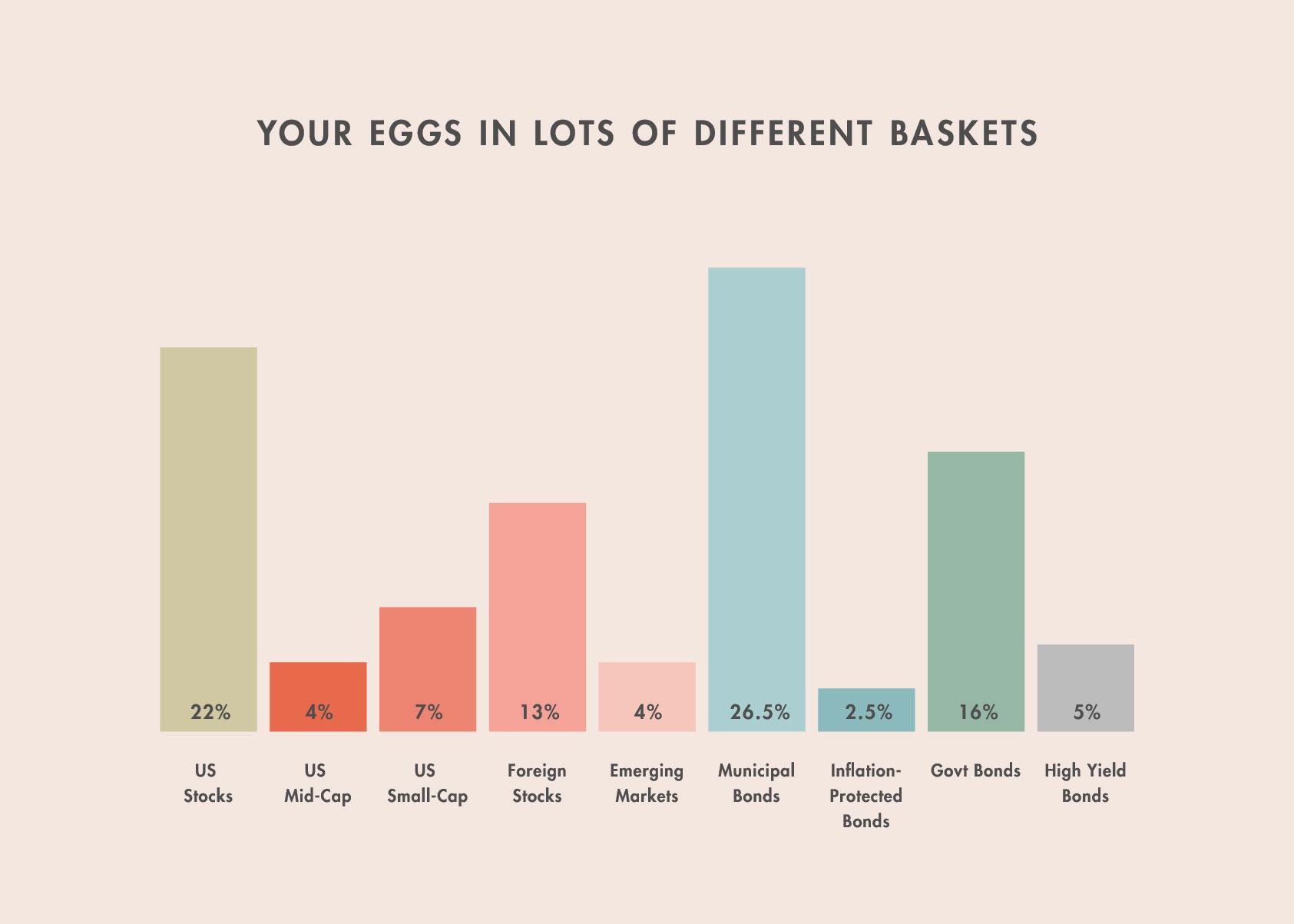

Wealthsimple's approach is to use technology and a team of crack financial and math wizards to build portfolios that fit a person's individual financial needs. First, we get to know your personal situation in order to target an appropriate amount of risk in your portfolio. Then, we buy a basket of ETFs that make sure you're not overly exposed to any particular market or currency. When we're tinkering with our portfolios we try to balance two things: 1) we need risky assets, because risky assets perform better over time; 2) we need to make sure we're not putting too many resources into any single bet – like that the US stock market will outperform other markets. By giving you an internationally diversified set of stocks with different return profiles, we believe we can reduce your risks and give you better returns over time, like with a portfolio that's balanced.

Check out the above graph. That’s the breakdown of what a Wealthsimple portfolio geared for folks who want to take on a moderate amount of risk invests in. It, of course, changes for those who need more — or less — risk.

One final point: It's all well and good to invest in a perfectly diversified portfolio. But portfolios don't stay perfectly diversified. When one part of the market skyrockets, it starts to represent an outsized portion of your investment. Same thing happens when some sector tanks. Then you'll be in trouble when things adjust. You'll either need to stay on top of rebalancing your portfolio or use a service that does it for you (like Wealthsimple does for the 0.5% we charge).

Are you interested in riding every up and down of the market? Sweating out the wild fluctuations in price of a given stock? That’s great — and there are some really cool day-trading sites you should check out. But for most of us, a broadly diversified portfolio is probably a better idea.

“Being diversified just makes it a gentler, smoother ride,” says Tersigni. “You can sleep at night.”

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.