Finance for Humans

Canadians Say They Need $1.7M to Retire. We Calculated How to Get There

But there are some ways to make it easier. (Like starting now: hitting that goal gets a LOT harder the longer you wait to invest.) We did the math.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Note: This story first ran in TLDR, Wealthsimple’s weekly, non-boring newsletter about money, markets, and crypto.

Here’s a really big number: $1.7 million. According to a recent BMO survey, that’s how much Canadians believe they need to kiss their nine-to-five goodbye and retire to Acapulco or whatnot. Which, again, is a lot of money! So what’s a person to do if their mother was not a Spice Girl or if their father doesn’t run a hedge fund and can give them a high-six-figure fake email job? Well, we did the math to figure out how much you’d have to sock away to hit $1.7 million by retirement, and, turns out, you don’t necessarily have to be a nepotism baby to pull it off (though of course it would help). Read on:

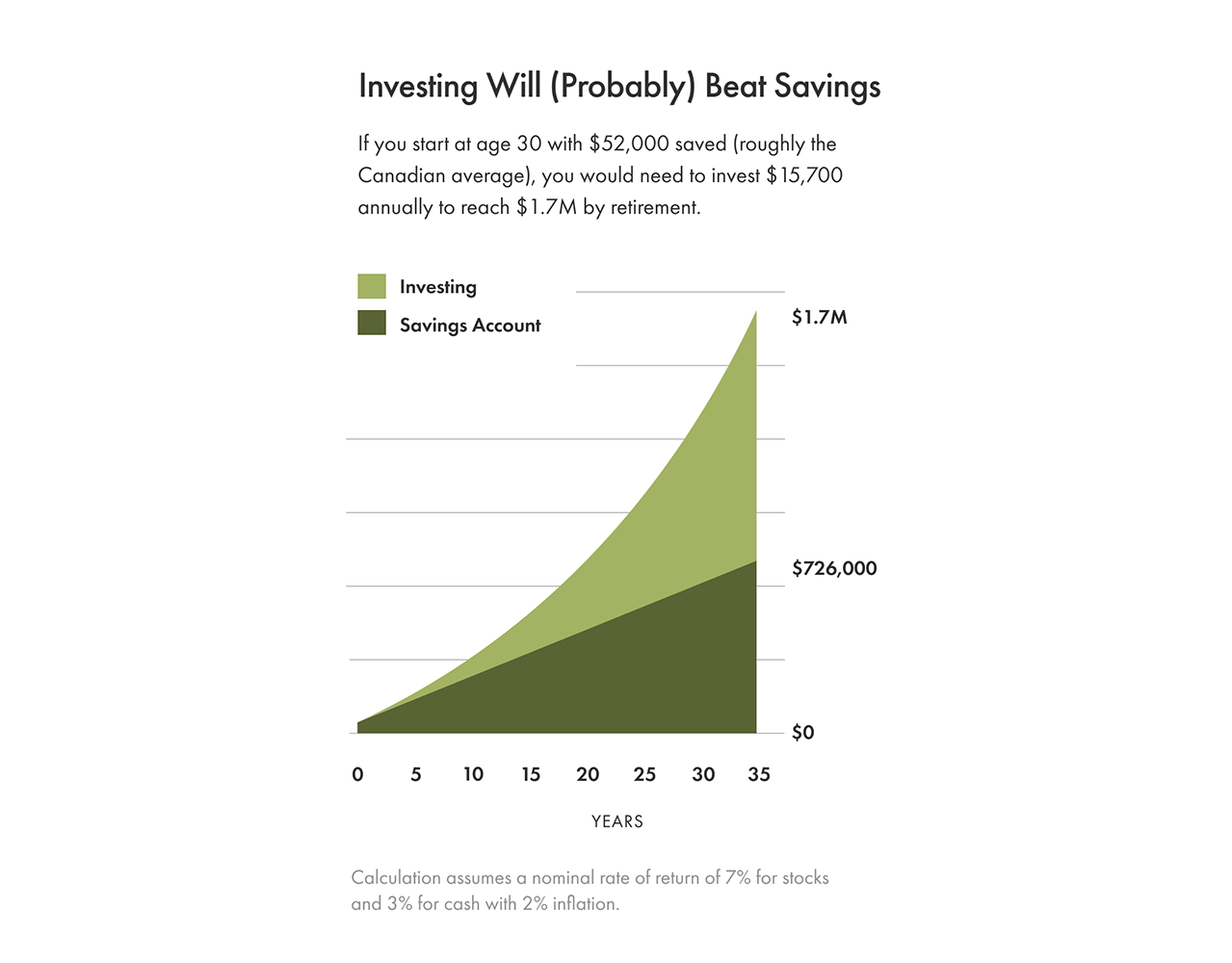

If you want to sock away enough money for retirement, investing, rather than sticking your cash in a savings account, is probably the way to go. That’s because, though no future outcome is certain, the stock market has historically grown 7% a year on average, while high-interest savings accounts tend to return 3%. So, going back to our $1.7 million benchmark: you could reach it by contributing $15,700 into a retirement account each year. We calculated that based on a 35-year investment horizon, since that’s how long folks in their early 30s have; we also assumed a $52,000 savings baseline, since that’s about average for that age group. Don’t get us wrong: $15,700 is a lot.* But it’s a lot less than the $31,560 you’d need to contribute annually to hit $1.7 million if you kept all your money in a savings account.** And, as the chart shows, if you saved, rather than invested, $15,700/year, you’d retire with $726,000 — a million short of your goal. No dice.

Recommended for you

*Our chart accounts for inflation, so you’d actually end up with more than $1.7M when you retire, but you’d have the equivalent of $1.7M in buying power today. **To be sure, there’s a time and place for savings accounts, as we covered last week. And investing carries risk, so know that going in.

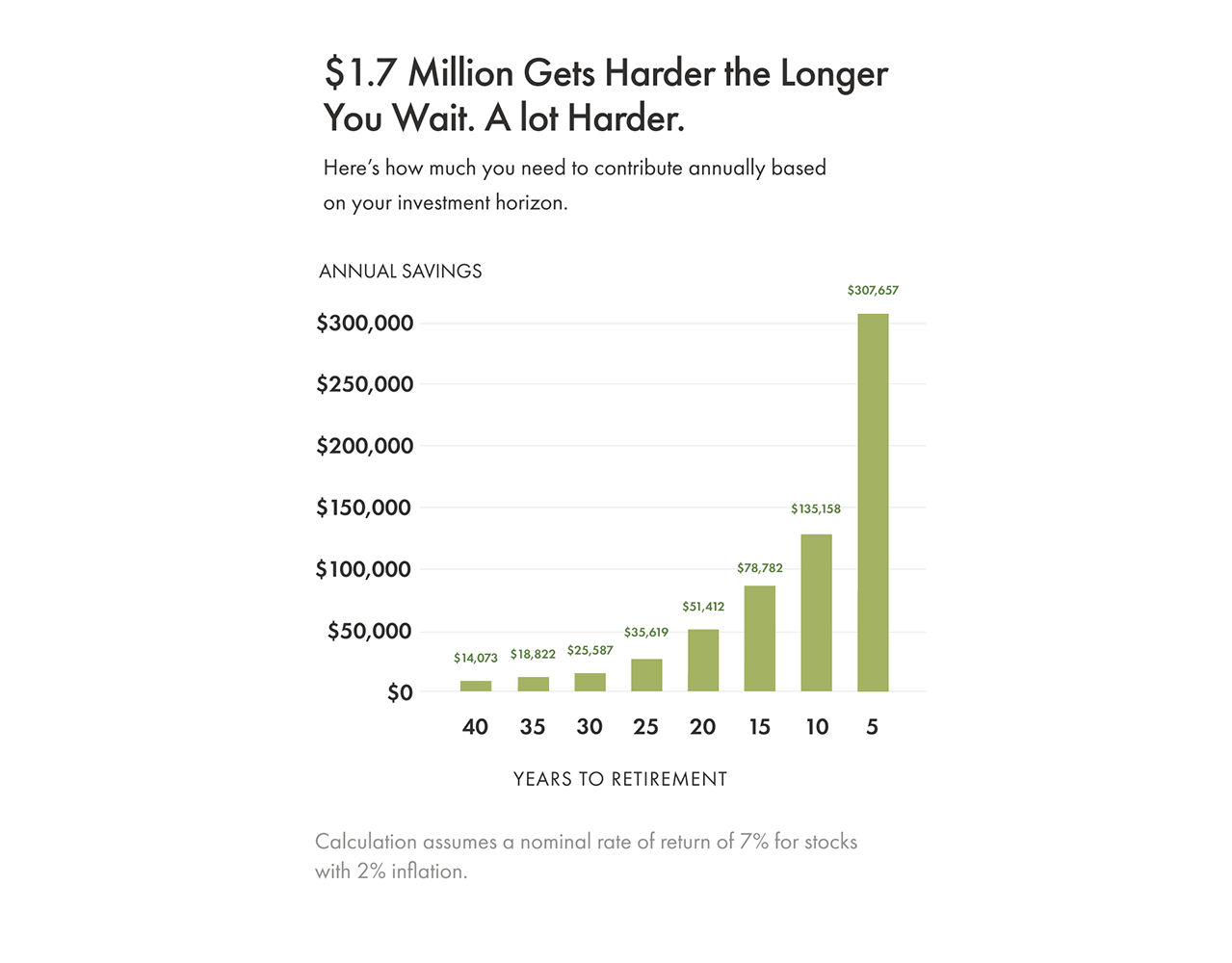

OK, so what if you’re not 30, as the first chart assumes? And what if you don’t have any savings, much less $52,000? How can you reach $1.7 million then? The answer hinges largely on time. If you’re 25, the power of compounding returns is definitely on your side: if you want to retire at age 65, an annual $14,073 contribution over the next 40 years should get you to $1.7 million. (Congrats!) With every year you put off investing, though, your goal gets a lot more, let’s say, ambitious.

The point being: it’s crucial to invest as early as you can, since the money you invest now will earn more over time than money you invest later. And, if you’re panicking about not having enough time or money to save for retirement, remember that how much you need really depends on how much you expect to spend. You can use a retirement calculator to get a better picture of where you are and how much you might need.

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

Jared Sullivan is an editor for Wealthsimple Magazine and author of the book "Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe".

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.