Money & the World

What Does Warren Buffett's $1m Bet Have to Do With Your Wealthsimple Account?

Ten years ago, Warren Buffett bet that passive investing would beat sophisticated hedge funds. He just won. Here’s how that can help you be a better investor.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our “Data” series, where we dig into the numbers to learn more about how the world of money works.

What does Warren Buffett winning a $1 million bet with a hedge fund guy have to do with your retirement account?

So it's a decade ago, and Warren Buffett is surveying the investment landscape. He thinks he sees the forest for the trees, which is, after all, his profession. We're in the era of peak hedge fund. The hedge fund cast (and they still do) a mythological spell over the broader culture. Young hedge fund managers were becoming billionaires by manipulating algorithms in the hinterlands of Connecticut; the rich, who are the only people who are legally allowed to invest in hedge funds, were getting richer; wealth inequality was accelerating. Hedge funds wereDavos-ifying the world.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Warren Buffett said something counterintuitive: hedge funds aren't worth it, I'd be better off with an index fund.

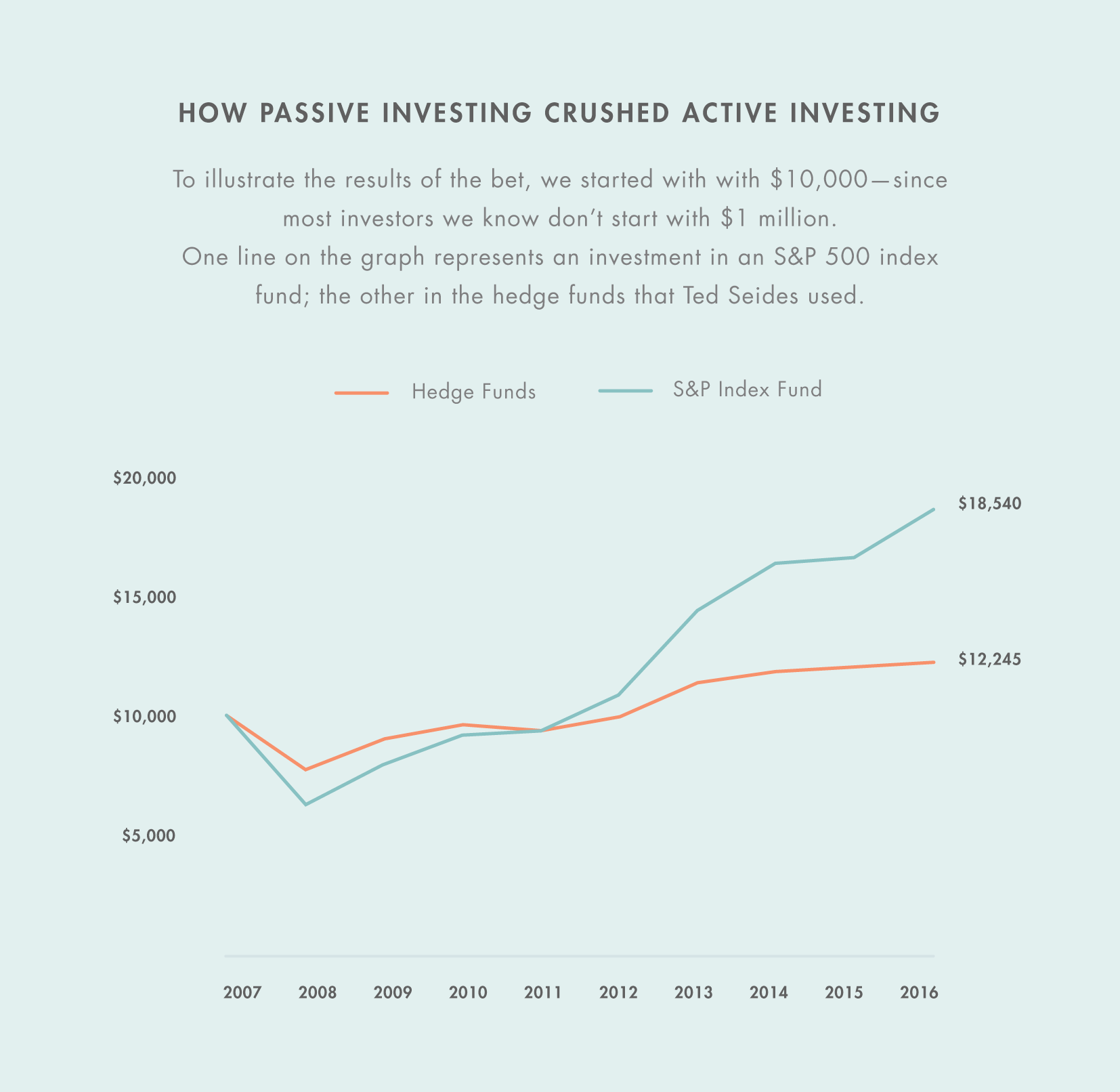

So he makes a wager. He saidthat a simple fund that tracks the S&P 500 would perform better than a hedge fund over the course of the next decade, and he’d bet a whole lot of money that he was right.So a hedge fund guy named Ted Seides took him up on it.

Before we go on let's drill down on the principle behind the bet, and the one thing we believe all investors should know about.

Passive Investing.

What is it? Well, active investing is paying someone to pick stocks, bonds, or any other kind of investment. It involves paying not only this person and his or her team — in this case a hedge fund manager, but for most of us it's a mutual fund manager — to pick these investments, but paying for lots of expensive trading when the manager decides to buy and sell things. The principle behind active investing is that these people are smarter than the market as a whole, and that will make it worth the extra cost for paying the manager and the extra trading.

Passive investing is different. Operating on the principle that people are actually mostly very bad at picking winners when it comes to stocks, bonds or other investments (which vast quantities of research proves), passive investments track entire swathes of different markets. Whether those swathes happen to be all the companies that make up the S&P 500 — like the one Warren Buffett invested in — or stocks from one part of the world, certain types of bonds, real estate, or what have you. Instead of trying to pick winners, you diversify. And the costs are a fraction of what they are for active funds.

So who won and by how much? The result for Buffett's bet: $1 million invested in the hedge funds selected by the hedge fund guy would have made $220,000. The same $1 million invested in the fund tracking the S&P 500 would have made $854,000.

The point isn’t to put all of your money into an S&P 500 Index Fund and then start yacht shopping. Warren Buffett would never do that, and neither should you. Investing in only the S&P 500 isn’t very diversified. It’s a risky way to invest in the long run, because every economy and sector has its downturns eventually. The key to taking advantage of Buffett’s lesson is to apply his theory — passive investing beats active investing for most investors — to build a smarter, more diversified portfolio. The S&P holds 500 stocks; a portfolio at Wealthsimple holds 4000 stocks across different economies. In the long-run, a globally diversified passive investing portfolio can achieve similar returns with less risk than any single index fund could. Especially if you can keep it perfectly balanced, tax efficient and have the opportunity to talk to a real human financial advisor whenever you have a question.

We believe using a service like Wealthsimple is a way to improve on Buffett’s formula. And since Buffett himself advised his heirs to put their money into passive investments — we'd like to think he'd agree.

Wealthsimple makes smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.