Money & the World

History of Finance Proves: Your “Gut” is Mostly Wrong

Your gut tells you to buy when you're feeling good about the market and to sell when you're not. Your gut is wrong. Here's why long-term investing works.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our “Data” series, where we dig into the numbers to learn more about how the world of money works.

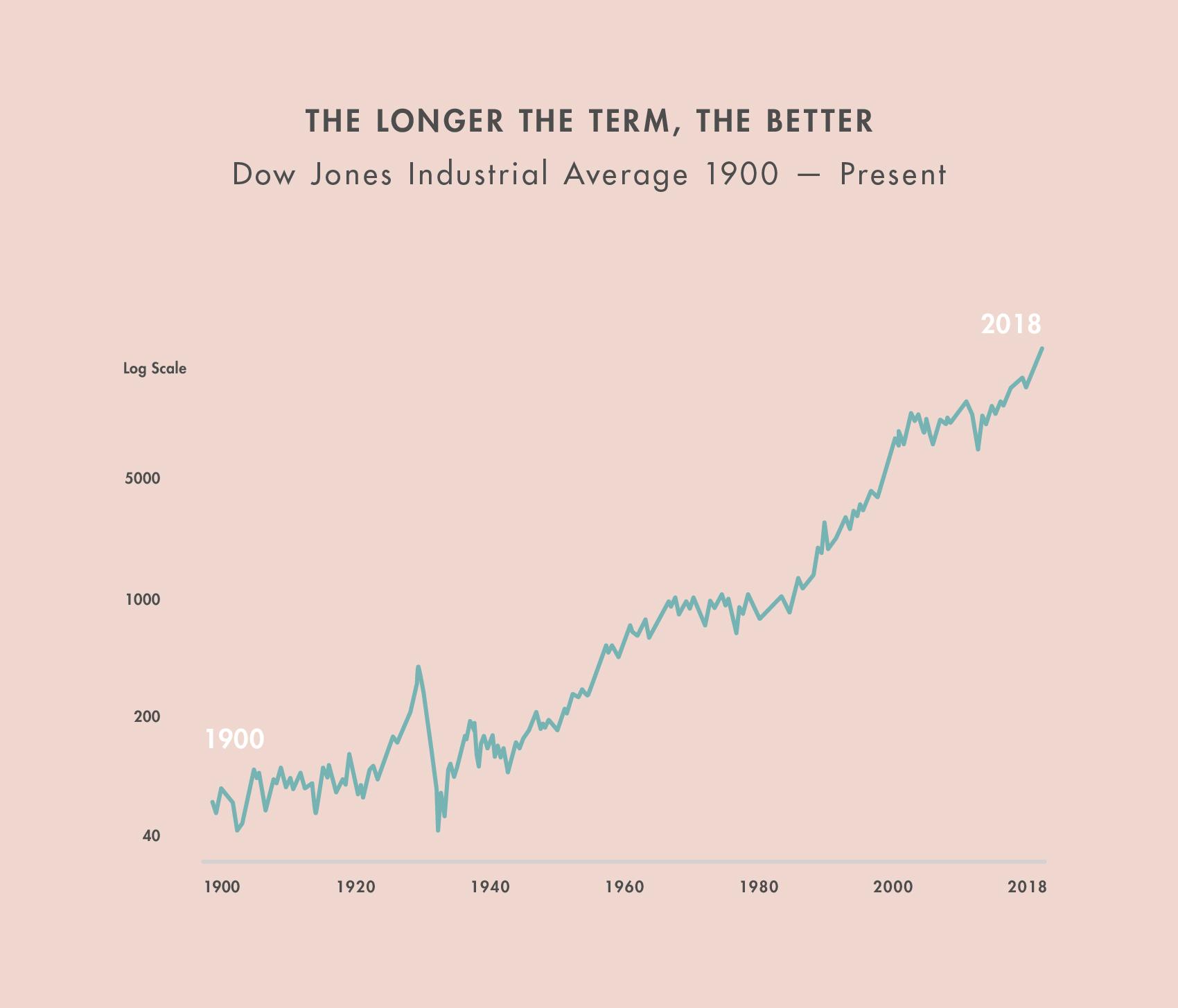

The history of investing looks like a long, smooth, steady ascent. But only if you look at it through a long-term lens. In the short term, it looks a lot more like the Himalayas — jagged peaks and terrifying descents. Which is why people like Warren Buffett think the smartest way to invest is for the long term. Asked about how long to invest for, he famously said “My favorite holding period is forever.”

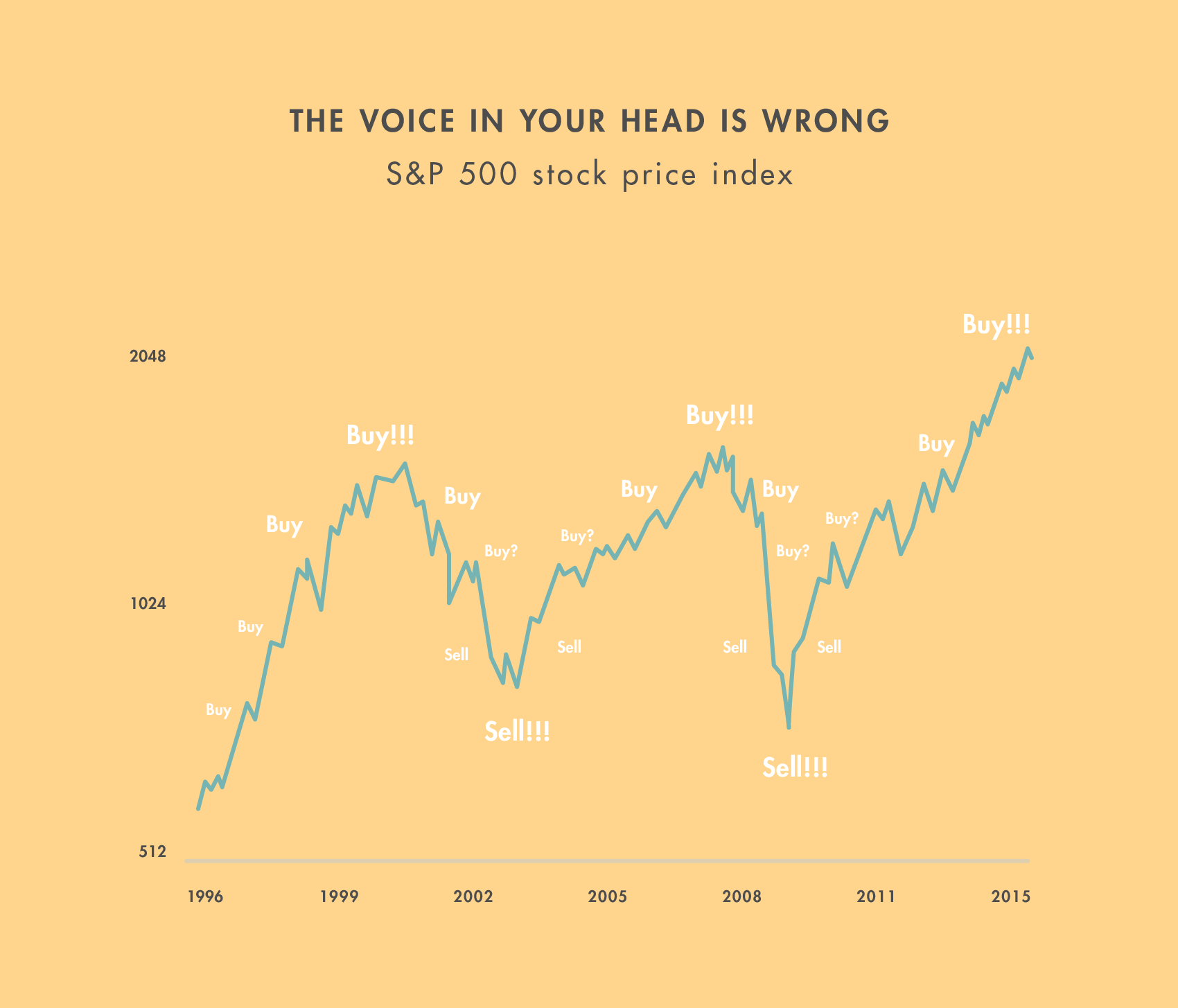

Our advice to investors has always been: expect rough patches in the market, don’t be surprised by them. And stick to your plan. But we also know it’s hard not to panic when the market moves erratically. You’ll want to buy more when it skyrockets — I’m gonna be rich! And you’ll want to sell everything when it goes down — I’m losing everything! Which is exactly the wrong way to think. It’s like being on a flight to somewhere wonderful and tropical with great fruity cocktails:a little turbulence isn’t fun, but it’s the price you pay for getting somewhere at five hundred miles an hour.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

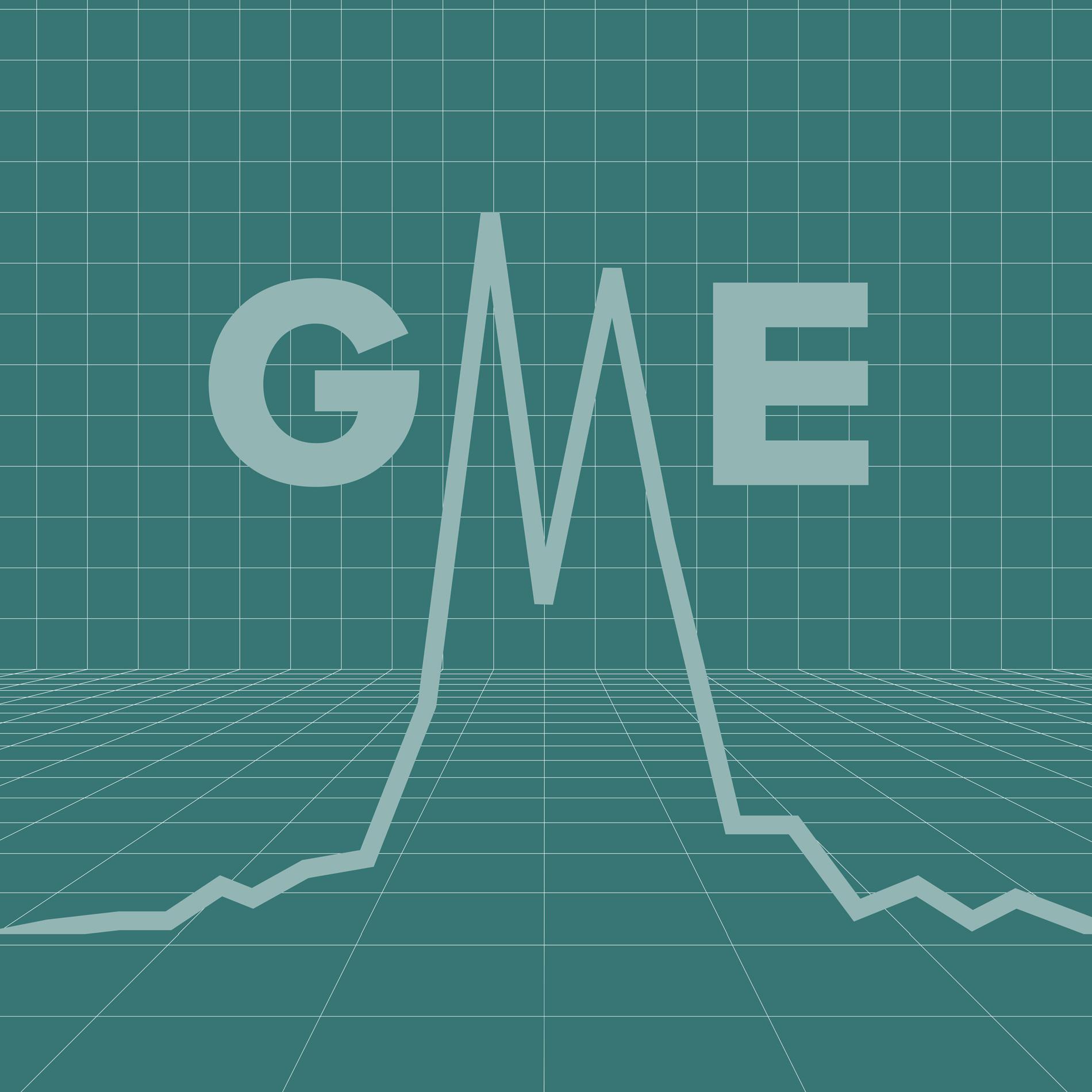

Here are a few graphs that show how people want to behave when the markets get erratic, and how smart investors should behave.

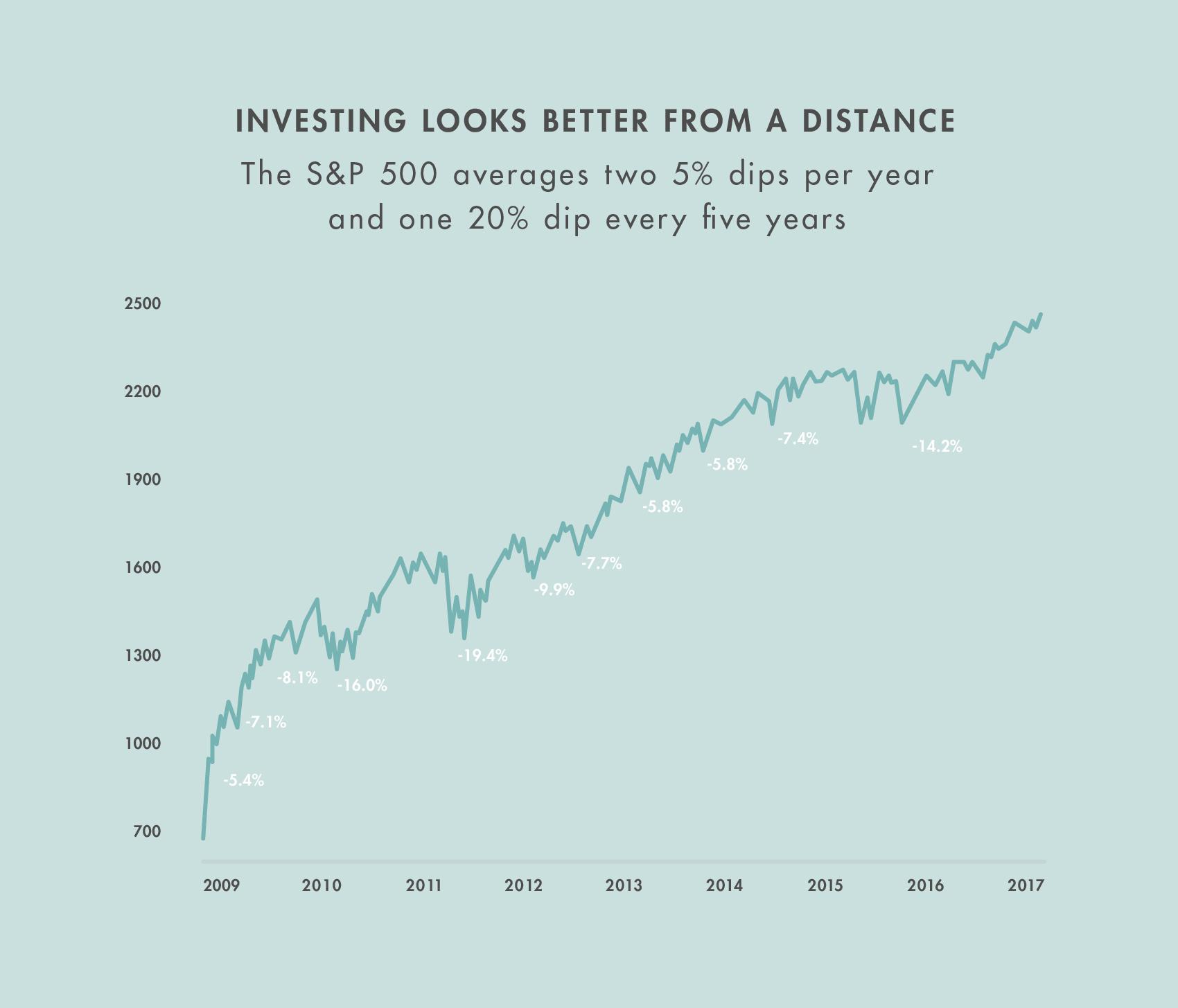

Check out this graph depicting the S&P 500 for the last eight years. If you look at it from across the room — or just take off your glasses if you’re farsighted — the line looks like a steady climb upward. But if you take a closer look, you’ll see that the ascent has been punctuated by some pretty significant hiccups along the way. In fact, historically there have been downturns of around 5% twice a year, one of about 10% every two years, and a big one circa 20% every three to five years.

If you think that human progress will cease you should pull everything out of the stock market and invest in your bunker. Otherwise keep your eye on the long term.

We hope by now that you know the idea behind a Wealthsimple portfolio. It’s to track the entire market instead of betting on stocks, stay perfectly diversified and continually balanced (something we do automatically), and do it for the long term. We recommend investors be committed to investing for a minimum of three years because the markets have a good probability of performing well over that period of time (historically in the US, for instance, there’s been a 15% chance of negative returns in stocks over any three year period). And, if you want to take advantage of graph number one, hopefully a lot longer than that. Don’t believe us? No figure has been a bigger proponent of staying the course than The First Earl of Super Rich Investors, Warren Buffett.

Why? Because markets, in the long term, have proved to be quite predictable. Check out this depiction of the last hundred years of the Dow Jones Industrial Average.

Emotions can be helpful. Like when your house is on fire — good time to panic! But they’re not useful in investing. Because emotions tend to make you panic at all the wrong times.

When the market is riding high, people tend to want to buy more, increase their risk profile, and generally mistake a short-term fluctuation for having a “hot hand.” And when it goes down? SELL SELL SELL! Sure, it's technically possible to time the market perfectly — get out on the way down and come back in on the way up. But chances are you won’t. People who try to time the market eventually realize that market movements are truly impossible to predict.

There’s actually a psychological term for people like this who believe they can recognize a pattern where there is none — it’s called apophenia. As Warren Buffett says: “Why scrap an informed decision because of an uninformed guess?” Don't panic because you think you'll know what's going to happen next week — stay in because you know what’s going to happen in the long term.

Downturns are Healthy for Long-term Investors. Markets correct themselves over the long term — to reflect changes in the economy, changes in the fortunes of certain companies or sectors. And that's important. And when markets pull back, it provides opportunities for long-term investors to buy shares in robust companies and a less expensive price.

You can buy more stuff when it's less expensive. Buffett again, this time with the Hamburger Rule:

“Should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the 'hamburgers' they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”

—Warren Buffett in 1997 Shareholders letter

Buying stocks when they're on “sale” is smart; but you don't always know when that is. One of the smartest ways for long-term investors to put their money to work is to invest a portion of their income every month. That way you minimize the risk of buying everything at its peak. It's a strategy called dollar-cost averaging and one way to do that is to turn on auto deposits.

You'll also want to make sure to maintain the target balance of investments in your portfolio. When stock prices are up, you shift to other investments; when stocks are down and bonds are up, you should shift some money back to stocks — all to make sure that your investments are properly diversified. At Wealthsimple we automatically rebalance all portfolios to maintain the desired mix of equity and bond ETFs. The perfect balance will help investors stay focused on their long-term goals, and hopefully get there a little faster.

Wealthsimple makes smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.