Finance for Humans

Stocks Are at Record Highs. Is It Time to Sell?

You might be thinking: Hmm, the stock market has been going up and up, and now prices are at record highs, so it’s probably a good time to get out. But if that’s what you’re thinking, you might also need a lesson in long-term investing. This is that lesson.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This article is part of Slow Money, a column by Wealthsimple’s investment team about growing wealth over time.

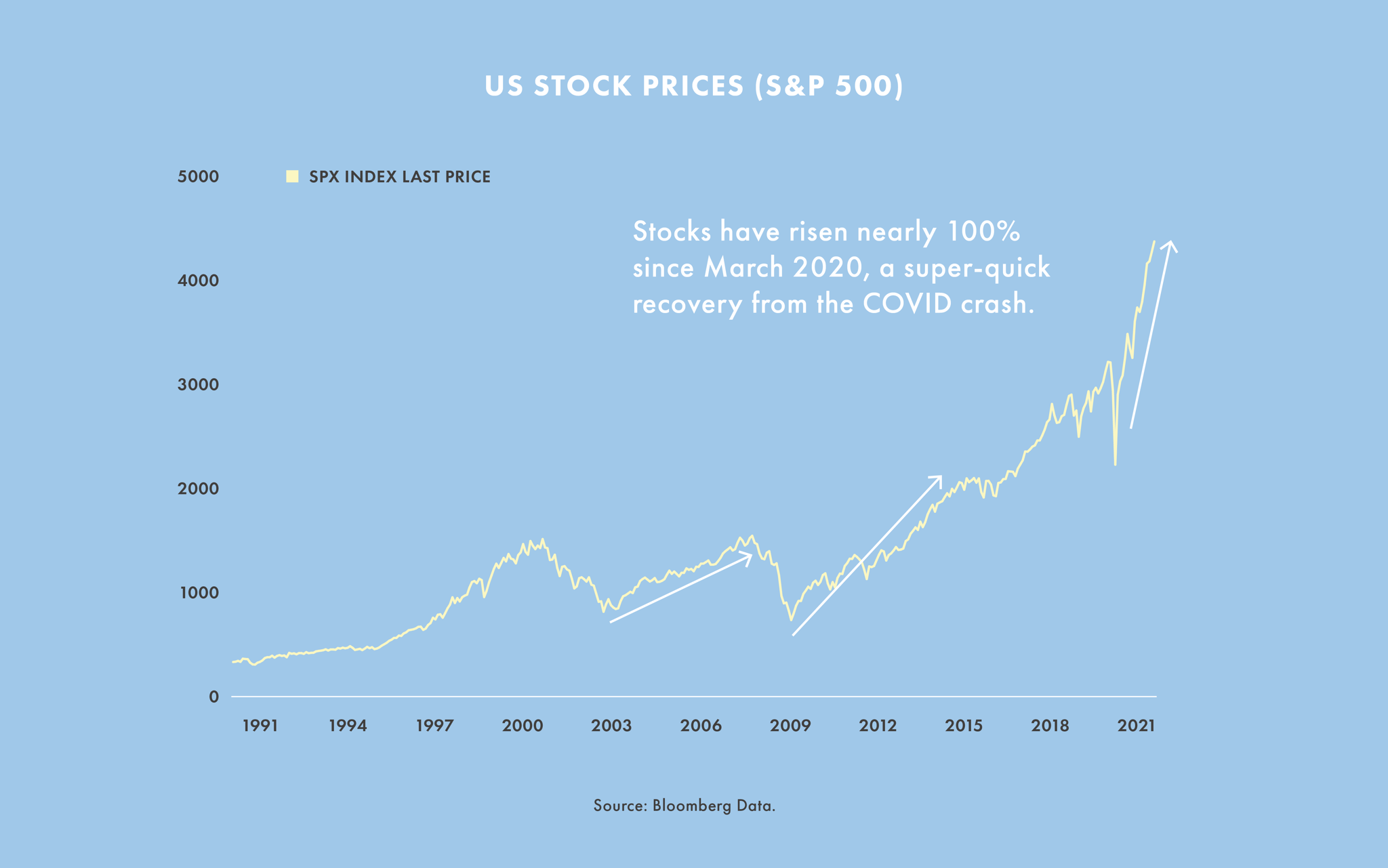

High prices make people nervous, especially when it comes to stocks. If I buy at these prices, people wonder, am I making a bad deal? And right now stocks are on a tear, with U.S. prices up nearly 100% from their lows during the March 2020 COVID crash; Canadian stocks have also never been higher. Stocks are so hot right now that some famous investors, like Richard Bernstein, of Richard Bernstein Advisors, and Jeremy Grantham, of GMO, have been fretting that they’re overpriced, or even in a bubble. As stocks hit new high after new high, a lot of other investors, big and small, are now wondering the same thing. And if stocks are overpriced, is it time to dump them and invest in something else before the bubble pops?

The short answer is that no one can predict the future. The longer answer is that expensive stocks aren't necessarily terrible deals or signs of economic doom. But, in either case, the thing you need to understand is value.

How do you know if a stock is overpriced?

The big thing serious investors are grappling with right now is value, which is different from price. Think of it like this: $20 is expensive for a share in a company that makes no money and is generally lousy, while $20 is cheap for the stock of a company that’s killing it. The prices are the same; the values are different. That’s why, when you’re thinking about whether a stock is overpriced, value matters more than price.

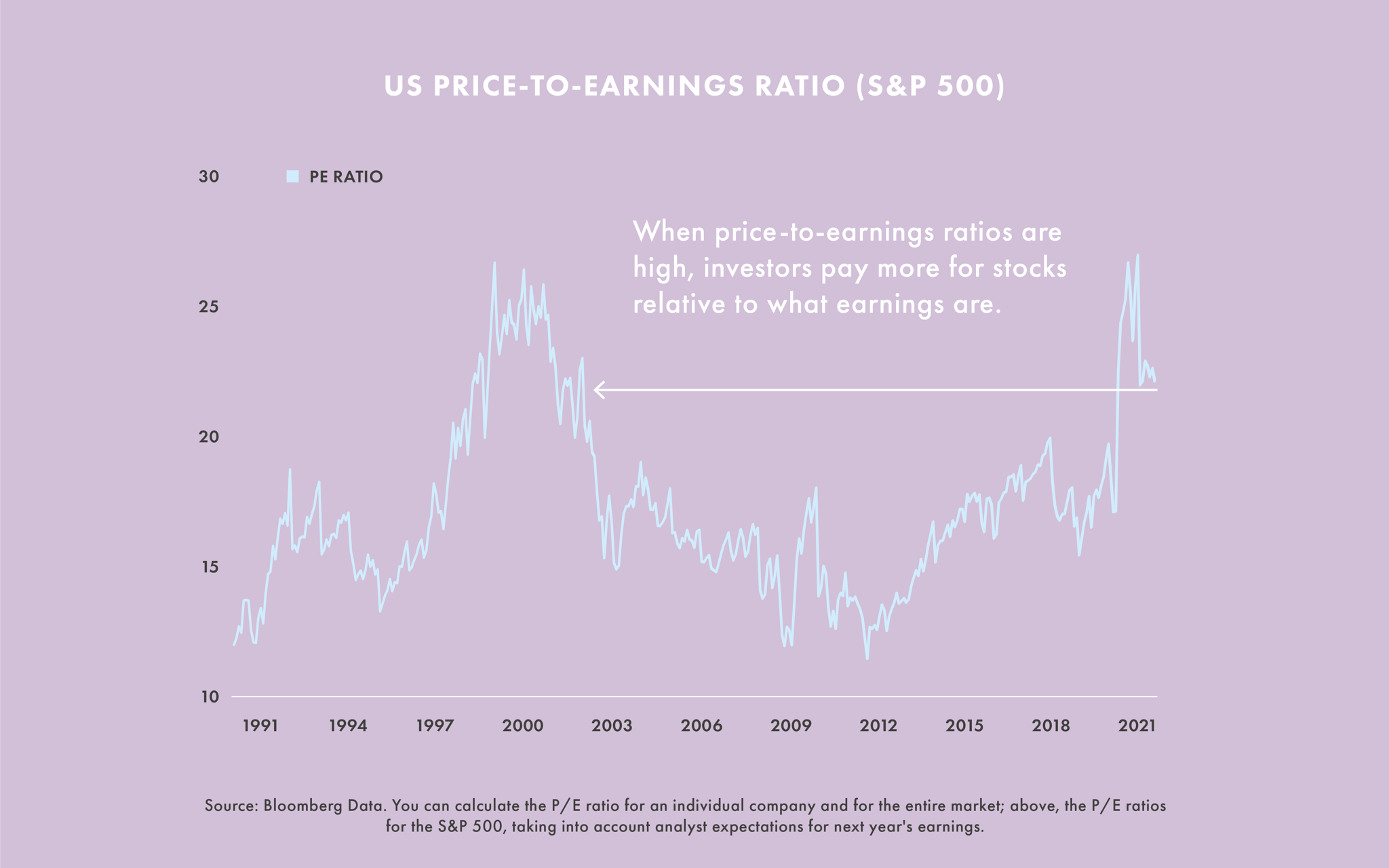

The trouble is that price is easy to know — it’s listed for each stock — whereas value is more elusive. One of the first ways veteran investors go about determining a stock’s value is by looking at its price in relation to the company’s recent earnings. What do finance people call this relationship, between a stock’s price and a company’s earnings? They call it, very cleverly, the price-to-earnings ratio, or the P/E ratio. Here’s a primer if you want to know more. But the main thing to remember is that when a stock’s P/E ratio is high, a stock is relatively expensive; when it’s low, it’s relatively cheap — which is obviously the better situation if you’re holding or looking to buy a stock.

Recommended for you

So the important question to ask about the current stock market is whether stocks are expensive or cheap relative to their value, or P/E ratios. And the answer is that they look somewhat expensive.

So if P/E ratios are high, is it time to sell?

Probably not, actually. The P/E ratio offers only a rough picture of a stock’s value, since it's a backward-looking measure. It takes into account what a company has earned, not what it will earn in the future, which is what ultimately determines whether a stock is a good or bad deal. Many major North American companies — the Googles and Apples of the world — have recently reported record-breaking quarterly profits. And right now there’s reason to believe that earnings will continue to rise, owing, in part, to pent-up consumer demand from COVID lockdowns, record-low interest rates, and a bunch of other related factors. Some forecasters expect corporate earnings could grow as much as 20% by the year’s end.

The upshot? Stocks are expensive and P/E ratios are high, yes. But stocks might be worth buying anyway, because earnings growth might continue to be strong, if not grow stronger than it already is. If this proves true, investors might pay high prices for really fast earnings growth, which could make expensive-seeming stocks today look like bargains six months or a year from now.

The other big consideration when trying to determine whether a stock is overpriced is whether you have better places to put your money. And for most investors, few alternatives look particularly appealing at the moment. Bank accounts are paying close to 0% interest, so you don’t want tons of cash sitting in savings. Bonds are expensive now, too, as is nearly every other asset, from houses to collectibles.

But what if I’m super sure that there’s a bubble? Should I try to time the market?

Odds are, no. As long as you’re well-diversified and invested according to your timeline and risk tolerance, history suggests that the best thing to do is nothing and stay put — especially given the other largely meh investment alternatives right now. Trying to time the market or call the top of a bubble is tough sledding, hence why even the best stock pickers are typically wrong more than they are right. (One researcher found that a whopping 85% of large hedge funds underperformed the S&P 500 over a decade.) And you don’t want to pull out and miss the markets’ best days. For instance, if you would have dumped your stocks when some bold-name investors (again like Jeremy Grantham) were calling the top the top of the market back in 2017, you would have missed out on years of strong returns, including a 15% gain over the next twelve months.

That said, though trying to time the market is ill-advised, now might be a good time to look at whether you’re in the right portfolio for your goals. If you need cash for a big purchase within the next few years, say, you might want to hold more conservative allocations — aka fewer volatile assets, like stocks, and more safe assets, like cash or bonds — in case the market does tumble. Or you might want to be more geographically diversified to help you weather country-concentrated downturns. But, again, staying in the market is typically the best strategy, nervous-making stock prices notwithstanding.

Spencer Gaffney is a writer based in New York.

Matthew Karasz is Director of Investment Research at Wealthsimple.