News

Introducing Overflow: Put Your Extra Cash to Work Automatically.

Overflow invests excess money from your bank account. You tell us how much you want to keep in there and we'll put the rest of it to work automatically.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

You're smarter when you don't have to think about it.

Maybe that's not true for calculus or quadruple bypass surgery performed on a whitewater raft, but it's definitely true when it comes to putting money to work for you. Saving money is easier when it's automatic because you don't have to put yourself in the agonizing situation of choosing between planning for the future or living in the moment. That's one of our core beliefs at Wealthsimple and it's why we'll proselytize about automatic deposits if you give us even the glimmer of a chance.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

We want to make saving easier for all Canadians. And it's why we invented Overflow — another way to use powerful technology to make building wealth easier and more accessible, for everyone.

So how does Overflow work?

Most people want to keep a chunk of money in their chequing accounts to use in the short term — for rent, groceries, and overpriced movie tickets. That's a great idea. What's not great is when you've got more than you need sitting in there doing absolutely nothing for you. (It's worse than that, actually: Thanks to inflation, it's actually losing value over time.)

We're not saying, don't save for a rainy day — or a very rainy day — we're saying, don't keep that money in a chequing account. Put it in a savings account. Remember that you can withdraw from most savings accounts whenever you need; the difference is that the money you keep there is collecting interest. Overflow is built to automatically take what you don't need from your chequing account and sock it away in one of our investing accounts or Wealthsimple Save accounts.

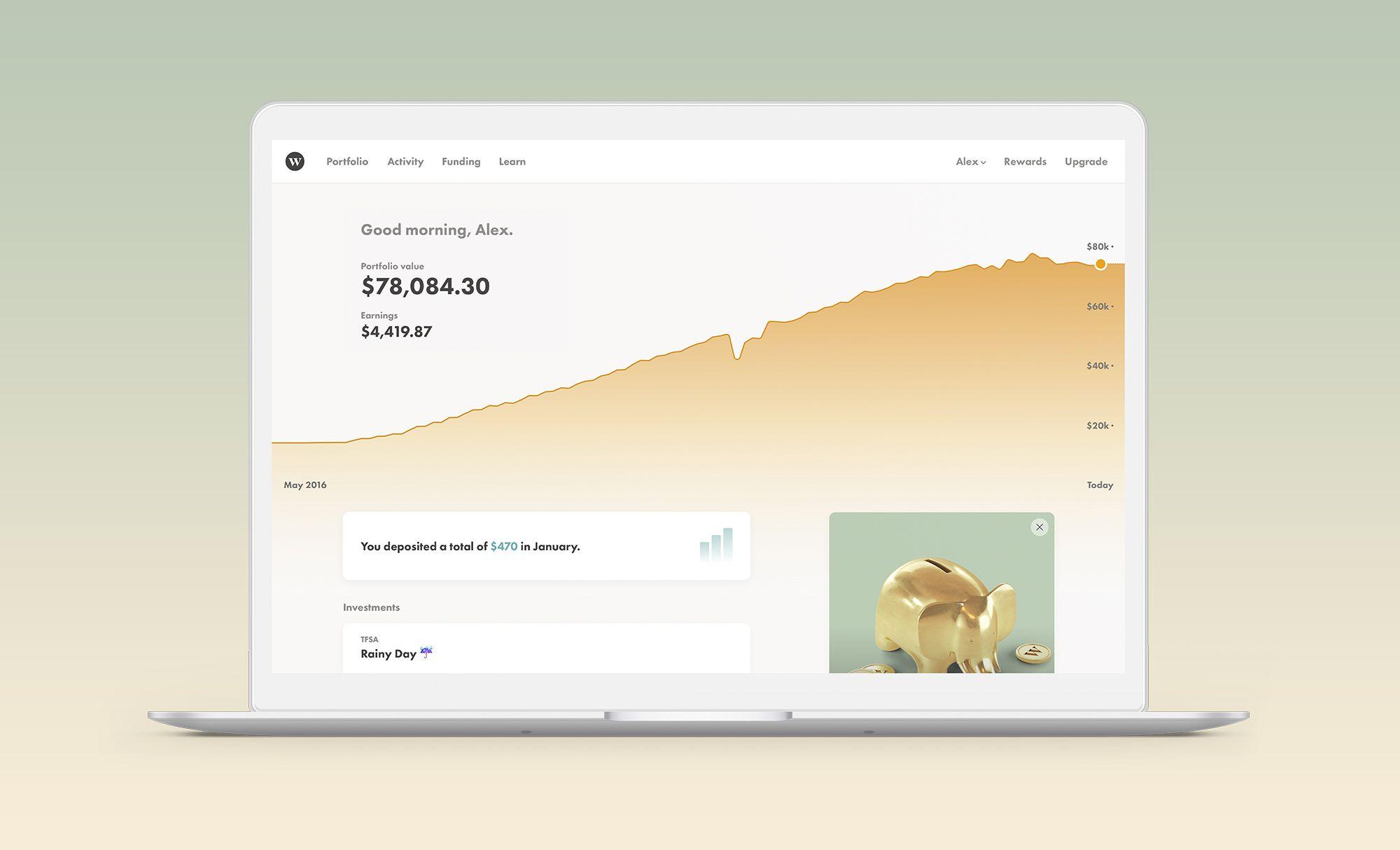

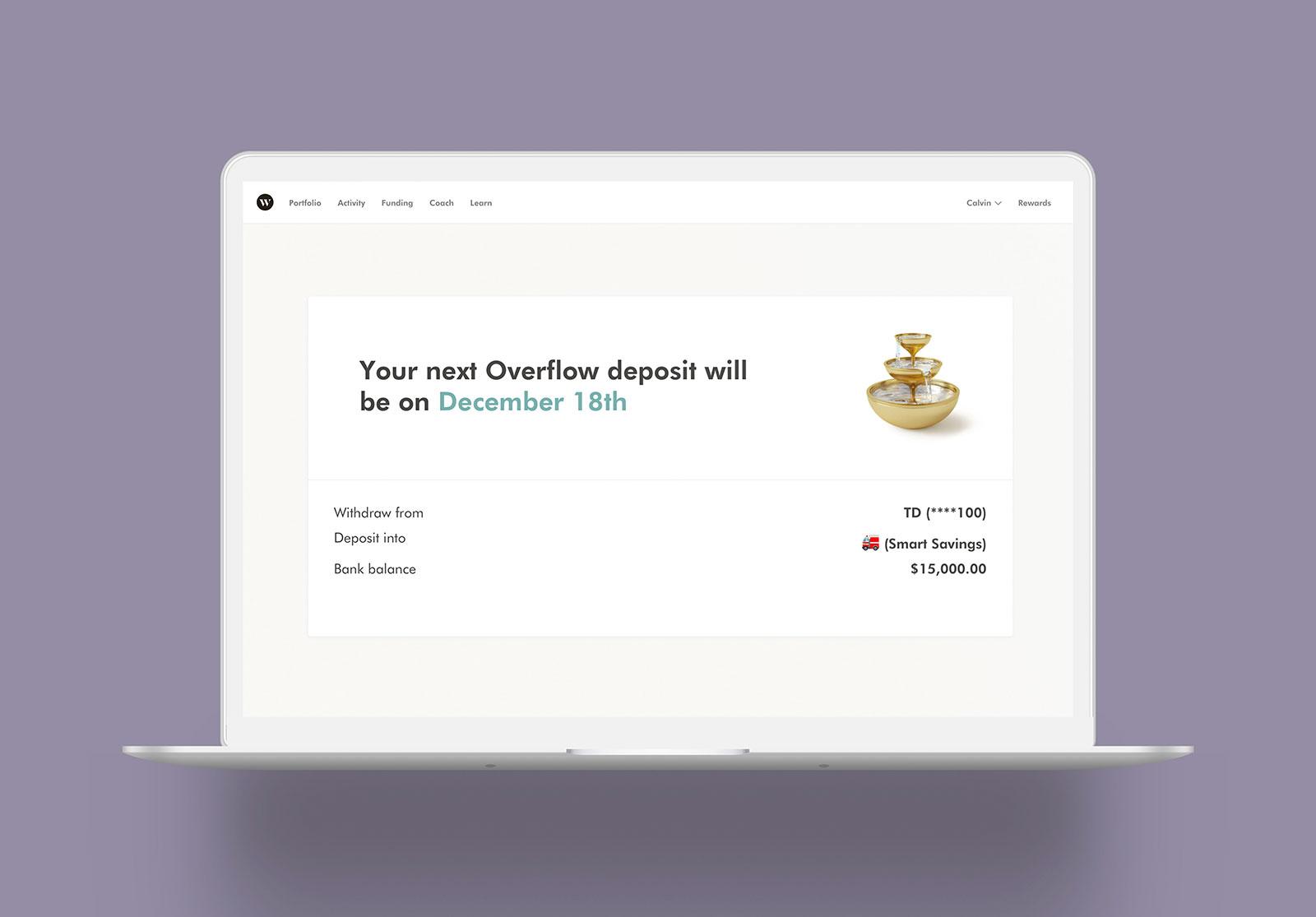

Using it is easy: First, pair your chequing account with Overflow by locating the “Automated” tab found on the “Funding” page (only on the web app for now). Then set the dollar amount that you want to keep in your chequing for day-to-day spending, and pick the Wealthsimple account you want anything more than that to go into. Good? Then, once a month, when Overflow sees you've got extra money in your chequing, we'll automatically transfer the extra money to your Wealthsimple account. Want an example? Let’s say you’ve set your chequing account level at $5,000; and then the direct deposit from your job hits and you’re sitting at $5,300. Overflow will automatically invest that extra $300. Without you having to think, or calculate, or even remember to do it.

And then your money makes more money, and you love us more, and tell everyone how great we are. If you want.

Is there some proven behavioural psychology at play here to help me save more?

Funny you should ask. Do you know why employer-based investment accounts work so well for Canadians? Because they take that money out of your paycheque before it ever touches your chequing account. Turns out you save more when you never see that money as discretionary income, and, like a normal person, start imagining the millions of ways you could spend it. An extra $239? Why, that’s exactly the cost of this amazingly well-reviewed hoverboard!

It’s a useful psychological trick. It’s easy to overspend if your chequing account is bursting at the seams and harder if that money has already been moved to a savings account or investing portfolio.

What if I don't know how much money I need in my account?

Every situation is different — which is why we always have Portfolio Managers on hand to help answer questions and find what works best for you. Generally, you want to move up the ladder of saving: have enough money in your chequing account to cover current expenses — that should be your Overflow number. The next bucket to fill is the trusty emergency fund — portfolio managers recommend keeping 3-6 months of living expenses there in case you lose your job or can't work — which should be kept in a savings account. And if you're building that, we recommend directing the overflow to our Wealthsimple Save account; where it'll be safe enough for emergencies but still earning a good interest rate.

And if you've got an emergency fund covered, it's time to move to longer-term investments that work best if you don’t need to touch that money for five years, or more. Like an optimized portfolio of low-fee, diversified ETFs — the perfect place for Overflow money if you're building wealth for the long term.

Why would this be better than scheduled auto-deposits?

Automated scheduled deposits and Overflow work in different ways to achieve the same goals. Instead of pulling the same amount every time, Overflow instead adjusts to your spending and income, which we know can change from week to week and month to month — especially for the increasing number of us who no longer get paid in the traditional bi-monthly paycheque.

Overflow adjusts as your income and spending fluctuate. Save more when you have more and save less when you have less. It's almost like a budget, except this budget reacts to your behaviour.

And what if I want to pause a week or get a crazy bonus or need more money?

On the day of your scheduled deposit, we'll shoot you an email with details about the withdrawal. We make it easy to skip it if you need the extra money.

Overflow deposits can be capped if you like. So if you land a nice year-end bonus, and forget to skip your deposit, you won't accidentally invest any more than the amount you set (if you choose to set a maximum). Though we do have some advice on making the most of that bonus.

What other awesome ways do you have to put my money on autopilot?

Gosh, great question — it's like we're making these up ourselves! Besides overflow, we have Automatic Deposits — just set the amount you want us to invest, which Wealthsimple account you want the money to go to, the frequency, and the date you want those investments to recur, and we'll do the rest.

Roundup is another new feature we’re excited about, too. Link any or all of your credit and debit cards to your Wealthsimple accounts and every time you buy something, we'll round up to the nearest dollar and invest your spare change. $3.57 coffee purchase? That’s also a $.43 investment. Nice work!

What if I have more questions?

Check out our FAQ here: link. And we're always here at support@wealthsimple.com if there's something else we can help with. Ask away!

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.