News

Our New Round of Investment Means Smart Financial Services Are Coming for Everybody

Can a $100 million investment help change the financial industry?

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

If you happen to have a savant-like knack for identifying Canadian tech founders, it’s possible that in the last months you spotted Wealthsimple CEO Mike Katchen sprinting through any of a number of the world's major airports. Because Mike’s been jetting around a lot these last months, wrapping up a new, $100 million investment in our company, which we're proud to announce is completely and totally finished. The investment — we see it as an endorsement of the work we've already done and of the plans we have for the future — comes from the digital investment arm of a European financial company called Allianz, as well as from the Power Financial group, a longtime Wealthsimple partner. Together they're two firms who know a thing or two about the financial world.

After we gave him time to unpack his suitcase and do a load of laundry, he sat down with Wealthsimple writer Andrew Goldman to talk about why we raised all that money and what we hope to do with it.

I gather you have some good news, Mike.

Yes, it’s a pretty meaningful milestone for Wealthsimple. I went on a road show around the world trying to find the right partner. The big news is we've raised a new round of capital, and it’s one of the largest in history for a Canadian fintech company. It's also the first outside round we've done in four years. This round included a substantial investment from Allianz X, the digital investment arm of Allianz — as well as a substantial investment from the Power Financial group. This gives us the capital to grow, to add more people, to launch more products.

Oh, you pronounce it AH-lee-onts. I’ve seen that name spelled out but never had the slightest idea how to say it. Who are they?

They're based in Munich, Germany. They may not sound that familiar to some folks, but it's one of the largest financial companies in the world. They also have a big presence in Europe and in the U.S. where they own PIMCO, one of the largest bond investors in the world.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

You’re being a little coy, Mike. How much did those folks invest in Wealthsimple?

100 million Canadian dollars.

Is it hard to say that and not sound a little like Dr. Evil?

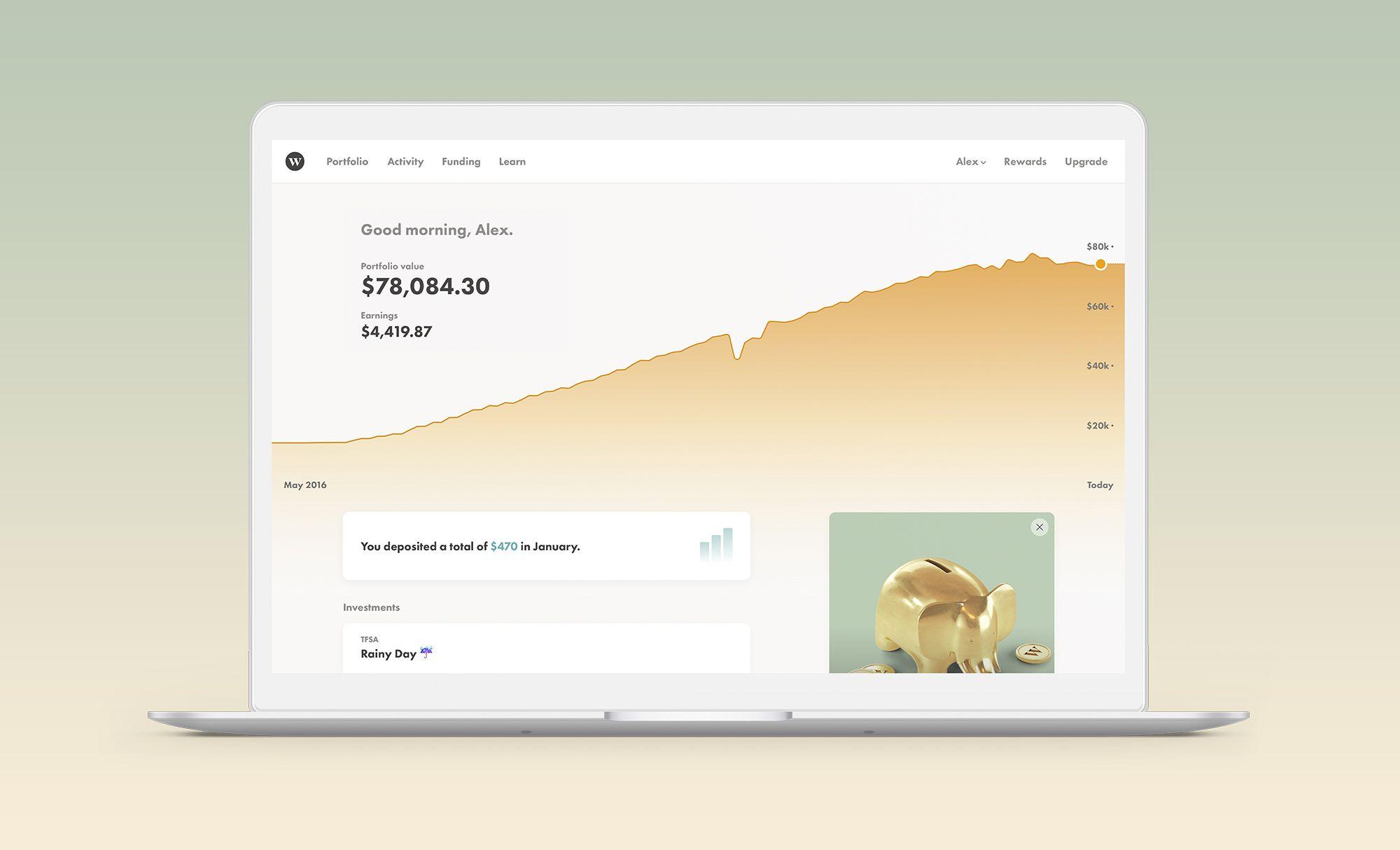

It's a lot of money. But our vision is to build a crazy, successful, huge company, and really change the lives of millions of people. I see it as an innovation fund — to make more and better products, to do what we do better and more efficiently, to bring powerful financial products to people who've never had them before. We've already helped our clients save $4.5 billion — young people, old people, wealthy people, people who'd never invested a penny in their lives. And we've already saved those clients $45 million in fees.

And we've done that in Canada, but also around the world. And that’s what’s particularly great about partnering with Allianz. They have a really strong presence in two of the markets where we're trying to grow — the U.S. and the U.K. And they obviously figured out how to scale up a global financial services firm. They've got 1.5 trillion Euros in assets under management.

Wealthsimple has rolled out products lately, like Wealthsimple Trade and Wealthsimple Save. Is this investment going to go toward more stuff like that?

It will go toward making our business better, our software better and simpler and more powerful, toward growing our team, and getting more clients. But we also have this vision about becoming a financial institution of choice for our clients that can help them over the course of their lifetimes. Ultimately, I'd love to replace banks as our clients' primary financial relationship. It's going to take us a long time to get there, but that's our vision. It's the next generation financial institution.

Like are we talking Wealthsimple mortgages?

Think about this. If I'm a bank customer today and I sign up for a mortgage, the first thing they do is they pull out a piece of paper that asks me for my name and address. It's just like they've never met me before even though they have all my money. Why isn't there a financial partner who is always there to make my life easier? Shouldn't I just be able to click a button and get a mortgage seamlessly? Why do you have to apply for them? Couldn't a company like Wealthsimple be a place that knows me, my spending history, my income, all the stuff that they need to price a mortgage, so they could just give it to me? That's what I envision.

So after all that travel and the whole process of securing that funding, you must feel like you can relax for a moment.

If anything, I think it's important for us at the company to work even harder. There's enormous potential in that investment, and it's on us to make good on it. This is one of the largest rounds in Canadian fintech history, after all. It's probably the opposite of "take something off the table and step back." It's "double down and work even harder." That's probably a boring answer but that's how I feel.

Inevitably after companies have a few big rounds of financing, people say “Oh, when is this company going to go public?” Is that part of the plan?

We do want to go public. Our plan is to be an independent, global, public company — and hopefully one that people associate with innovation and being a force for good in their lives. We're a few years away from being ready, I think. But we’ll get there. And this funding round is going to help us build the kind of company we hope the public will really want to invest in.

When investors give you that kind of money, do you need to commit to a certain date that you'll be turning a profit?

Yes, there's a timeline for that. But listen, we’re a five year old company and securing investment means building these 10 year business models. And so far, a lot of assumptions we've had about the business have just been wrong.

What's been the assumption that you've been most wrong about?

In one aspect we keep outperforming our plans. The cost of acquiring clients keeps going down, and faster than we anticipated. Which means that we're able to grow with less money than was originally planned in the business model.

We've had a record-breaking bull market in stocks which would seem like an ideal time to start a company like Wealthsimple. What happens to all those projections if the market suddenly goes south?

We will wake up to a massive recession and market pullbacks someday. It's not a question of if, it's when. We try to coach our clients and our team to expect it. And we bake it into our business plan. When it happens, it'll suck for everyone. But it's only going to suck for the short term and we actually think that coming out of it we'll be a stronger business. And if we can be successful and help our clients fix their plans, they'll be successful too, and then we'll live up to our mission.

Here's why we're built for it: for 10 years, everybody's been making money, and when people are making money, nobody asks hard questions, like “How much am I paying in fees? Am I happy with my advisor?” In tougher times, these issues become more important.

OK, this is just my own personal curiosity. But does that money actually go in a bank account? Are you, like, hitting refresh until suddenly 100 million dollars shows up?

Yeah, that actually happens. It's a pretty surreal feeling. We will actually receive the funding over the next couple weeks. I'm looking forward to refreshing and seeing the $100 million show up. I think there's a lot of really interesting — and important — work we can do with that money.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.