News

You’ve Trusted Us with $2 Billion. And We’re Growing Faster Than Ever.

Today we announce that we hit the $2 billion mark in assets, and have secured an additional $65 million investment so we can grow better, faster.

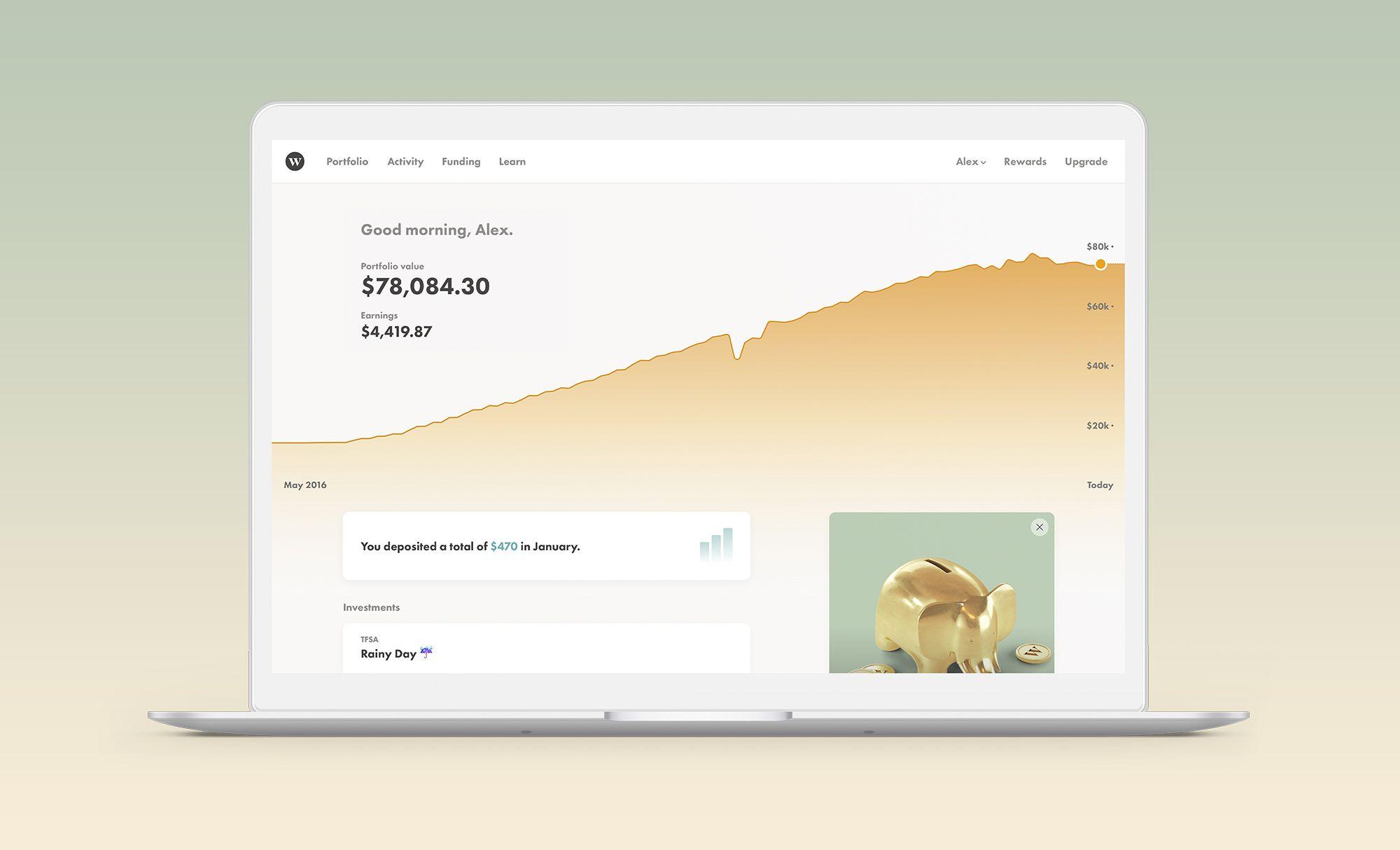

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

It took us two and a half years to reach $1 billion in assets. We were all pretty proud of that milestone when we hit it in May 2017, considering that we started the company with four people and a conference room. We were also flattered that the Prime Minister of Canada came to our offices to toast us on our accomplishment. But I may actually be more proud that today I get to announce we’ve reached the $2 billion mark.

Why? Not only have smart investors trusted us with $2 billion of their hard-earned money, but the second billion took less than half as much time as the first — only eight months. And our plan is to hit our next billion even faster. We’re confident in that goal because today we’re also announcing that we’ve raised an additional CAD $65 million investment in our company. That money will grow our award-winning team of engineers and financial minds, aid our expansion to new financial products, and fuel faster growth so we can bring smart investing to more people, more quickly.

As CEO, I talk a lot about our plans for the future. That’s part of the job description. But today I want to leave you with a list of the things we’re most proud to have accomplished in just the last year.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

• We launched our investing service in the United States

• We launched our investing service in the United Kingdom

• We tripled the number of clients we serve — now more than 65,000

• We won the Webby Award for best financial service website (for the second time in a row)

• Our Super Bowl ad, Mad World, won a Director’s Guild of America award

• We won Start-Up of the Year at the Canadian Innovation Awards

We’re looking forward to doubling the size of that list, too.

Meanwhile, and most importantly, we owe a huge debt of gratitude to our clients for helping us build something so beautiful, so quickly. Thank you. And thank you to the whole Wealthsimple team, the smartest, most tireless group of engineers and financial wizards and people pros in the whole world.

Michael Katchen

CEO

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.