News

Don’t Forget: You Only Have One Month to Lower Your 2018 Tax Bill

The last day to contribute to your RRSP is less than a month away (Mar 1). It could save you a lot on taxes — and put your money to work making more money.

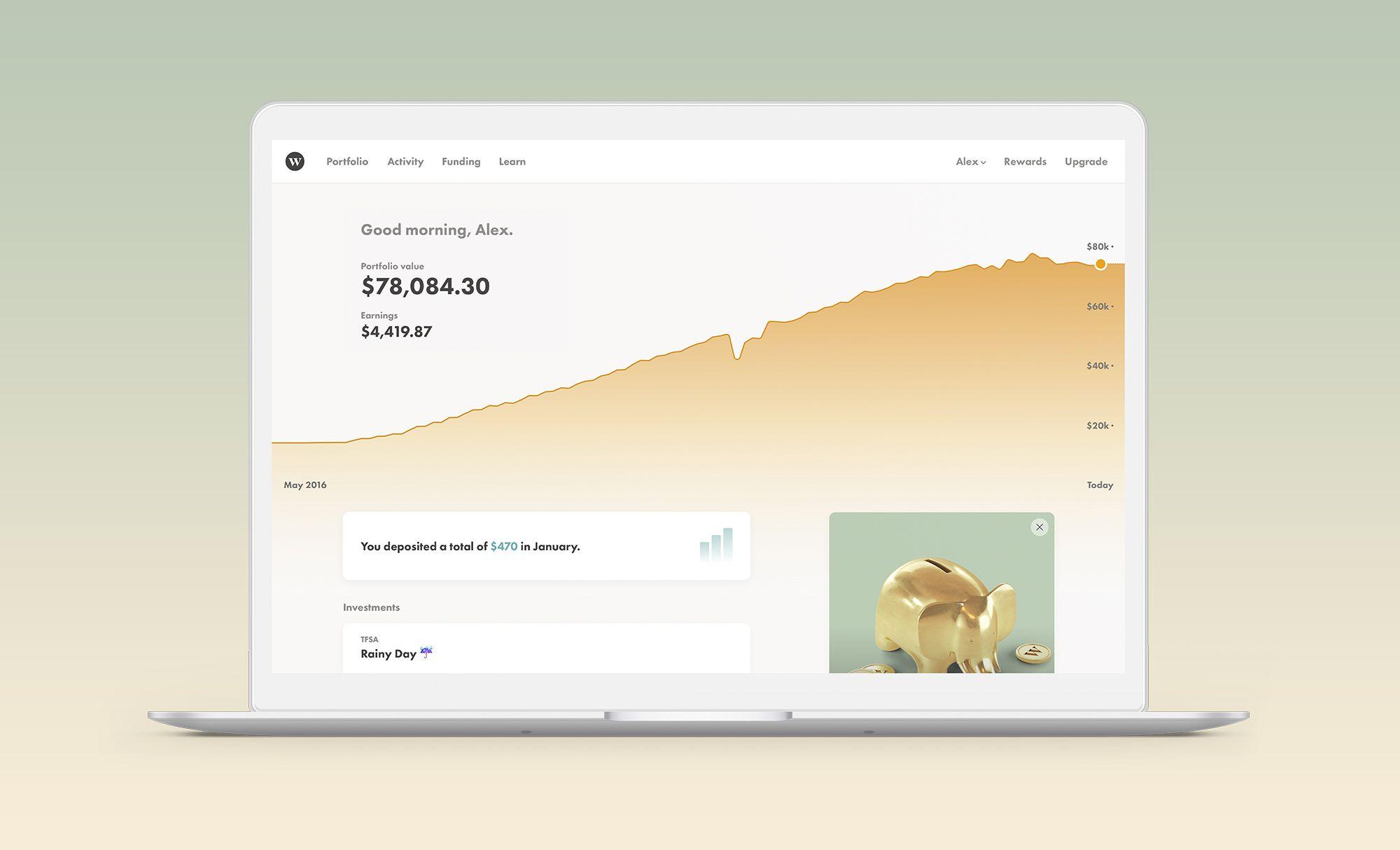

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

We’re coming up on the deadline for one of the biggest annual investment deals in Canada. March 1 is the last day to contribute to RRSP accounts for the 2018 tax year. If you can even barely afford it, getting as close as you can to maxing out the contribution limit for your RRSP is a no-brainer. Why? In part because anyone who doesn’t put as much as possible into his or her RRSP is giving the government lots of money for taxes that they don’t need to.

And yet, that's exactly what most of us do. According to Stats Canada, only about 22.5% of Canadians made a contribution in 2016, the most recent year we have numbers for. And even those of us who do contribute are a long way from maximizing our benefit. Since 1990, Canadians have left more than $700 billion of contribution money on the table — and paid taxes on a lot of that money.

How It Works

The government wants its citizens to save money for retirement. And to incentivize us, it essentially pay us to save money in an RRSP. This isn’t simply because the government cares about us. The math is simple: It’s less expensive to give up some tax revenue now than it is to take care of us when we’re old.

The first question you have may be: what's an RRSP? And second: should I use a RRSP or a TFSA account? If an RRSP is the best option, it’s time to understand how it works.

Recommended for you

Every year, the contribution limit goes up a bit. For the 2018 tax year, a Canadian can contribute up to 18% of their income per year, with a maximum of $26,230, to an RRSP. That money is considered pretax, which means you don’t have to pay income taxes on that portion of your earnings. If you make $100,000, for instance, and contribute $18,000 to an RRSP, you only have to pay income tax on $82,000. You defer the taxes on that $18,000 now, and, if you invest it wisely, use it to make even more money.

But socking that money away now has another advantage: if you wait to withdraw the money until you're retired, your tax rate will likely be lower than it is now. That means you’ll pay less. And you may be in for a little tax-season bonus too: if your income tax is already deducted from your paycheque by the company you work for, and you put money into an RRSP, it's often the case that you've paid too much tax. So the government will send you a nice cheque in a few weeks to reimburse you for your overpayment.

To figure out how much you stand to save on your tax bill with an RRSP, check out this calculator. If you’re still confused, give us a call.

Keeping Track of How Much Room You've Got Left is Hard. So We Built a Tracker

Remember that the government is the government, so RRSP contribution rules are confusing. What's your yearly limit based on your income? How much have you already contributed? And did you max out your contributions for last year? And the year before that? Because every year you don't contribute the maximum amount, the extra room gets pushed to the following year. How much have you contributed to your company's GRSP plan (which counts toward your limit)?

If you have an RRSP with Wealthsimple, all you have to do to use make all of that easier is turn your tracker on. Log onto your account, click on your RRSP account page, and you’ll see a status bar that will say either “tracking contributions” or “not tracking contributions.” To opt in, simply click the “set up” button on the bar.

A few last-minute tips:

1) The easiest, most cost-effective way to take advantage of this moment is to open an RRSP account at Wealthsimple. Start here.

2) When you get that tax refund, invest it!

3) Going forward, it's best not to wait until the last minute. If you have cash on hand, invest at the beginning of the year. Or set up a monthly contribution and let us do it for you.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.