News

NBA Rookie Mikal Bridges Didn’t Want an Endorsement. He Wanted a Future.

Careers in professional sports are notoriously uncertain. That's why NBA rookie Mikal Bridges got a long-term investment portfolio instead of a regular endorsement.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

A lot of athletes get endorsement deals. It's one of the major revenue streams for people who are famous for being very very good at sports. Stand right here and say you like Funions! Or tacos! Or cold sore medication! Great, now here's a bunch of money. We get it. Famous people help make sure other humans pay attention to your message.

But when we decided to partner with an NBA player, we didn't want to have a regular endorsement deal. Because, financially, simply handing someone a chunk of cash without some good old-fashioned long-term planning is in violation of everything we believe. And because by doing it a different way, we figured we'd have a better chance of helping him create a different future.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

So we got in touch with Mikal Bridges before he ever scored a basket in the NBA. Before he'd even been drafted! Sure, Bridges was promising. He was a 21-year-old small forward who shot 43.5% from three last year, won two NCAA championships at Villanova, and was projected to be a top 10 pick. But his future was completely uncertain — because that's what all futures are: uncertain. And one way to control an uncertain future is to invest wisely.

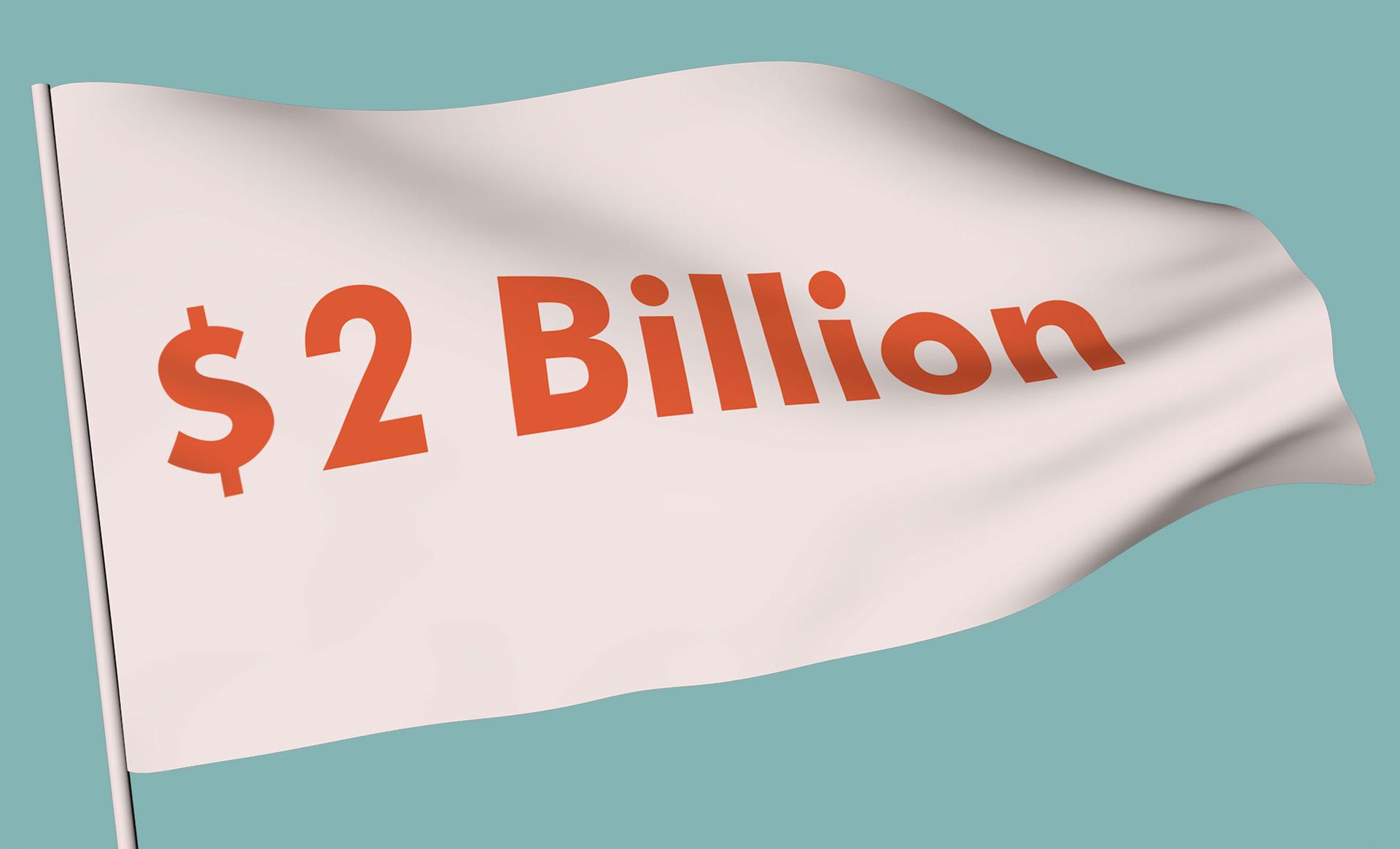

So Wealthsimple and Bridges made a very unusual agreement, the first of its kind: We would invest in him with a $50,000 endorsement deal. But his endorsement would come in the form of an investment portfolio — the same kind of portfolio every Wealthsimple client has access to.

Why would any of this matter to a guy like Mikal Bridges, who, in literally one day, went from being a guy with a four-figure bank account to a young man with a contract that paid $3.5 million in the first year alone?

You may have read the famous Sports Illustrated article from a few years ago that reported 78% of NFL players were bankrupt or under “financial stress” within two years of retiring; it also reported that 60% of NBA players were broke within five years of retirement.

The lives of athletes are similar to ours in one important way: They're uncertain. It’s a well-worn trope at this point: A player who's just one or two years out of high school gets a professional sports contract worth millions of dollars, buys a mansion, wrecks a Ferrari, becomes the target of some bad-faith financial advisors, or simply gets hurt. And suddenly... That's what we mean by uncertain — any of us could get sick or lose a job. Bridges is one of a growing number of athletes — like Andre Iguodala, who became a venture capitalist even while winning championships; or Arsenal defender Hector Bellerin, who started investing from his first paycheque — who are learning from the failures of the past.

Most of us don't earn even a fraction of the yearly salary that a guy like Mikal Bridges does. But the principle is the same for all of us: Start now, save, invest, control what you can. That $50,000, if history is our guide, could be worth more than $350,000 in 30 years*. And if he keeps investing the same amount every year? Well, we suggest you go check out our interactive chart to see how quickly that'd stack up — and how quickly your own investment portfolio would add up, even if it's $500 instead of $50,000.

So when you're watching the Raptors, or the Grizzlies, or the Warriors, or Bridges' own team, the Phoenix Suns, and you see our commercial, just think: If a 22-year-old can undertake sensible financial planning, why can't you? Sure, you may be starting off with fewer zeroes, but the principles are the same.

And our investment in Bridges? Well, we think he's got a pretty bright future ahead of him, too.

*For this projection, we’ve assumed a US Growth portfolio will grow at 6.4% net of fees. To learn more about our projections — and to learn about how much your investments could turn into — check out the interactive graph here.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.