Money & the World

The World Is on Fire. Yet Life Is ... Getting Better?

The news is filled with VERY heavy stuff these days. But, big picture, human existence is actually, and surprisingly, improving in profound ways for millions of people.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Note: This story first ran in TLDR, Wealthsimple’s weekly, non-boring newsletter about money, markets, and crypto.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Scanning news headlines is bleak business these days: climate change, market turmoil, WWIII. And, though we don’t want to downplay the Very Scary Stuff happening, human life is improving in major ways, so we thought we’d talk about some of them. So pump the brakes on your doom-and-gloom spiral for one hot second because — to paraphrase economist Max Roser — it’s true that the world is awful, but it’s also true that the world is getting better.

INCOME

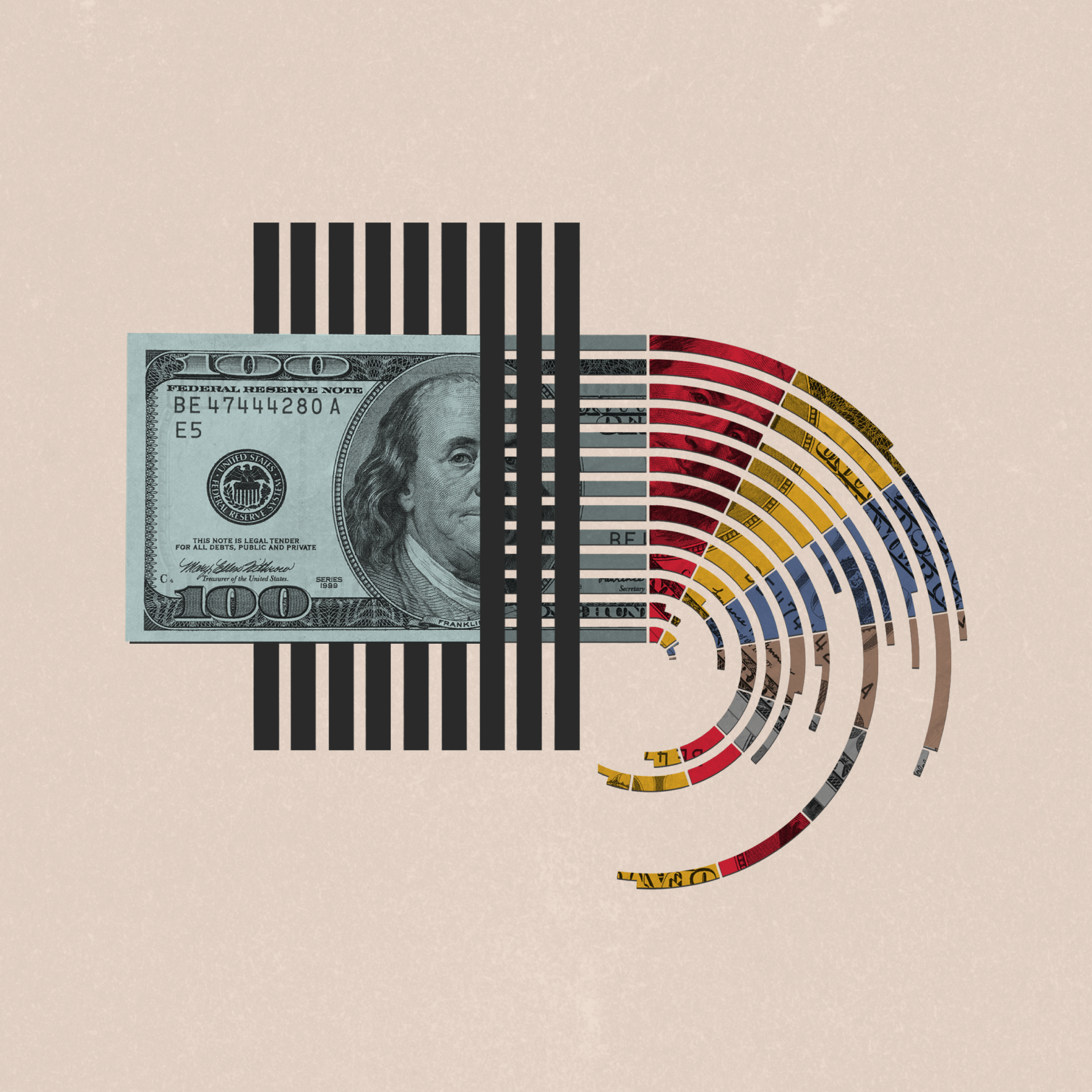

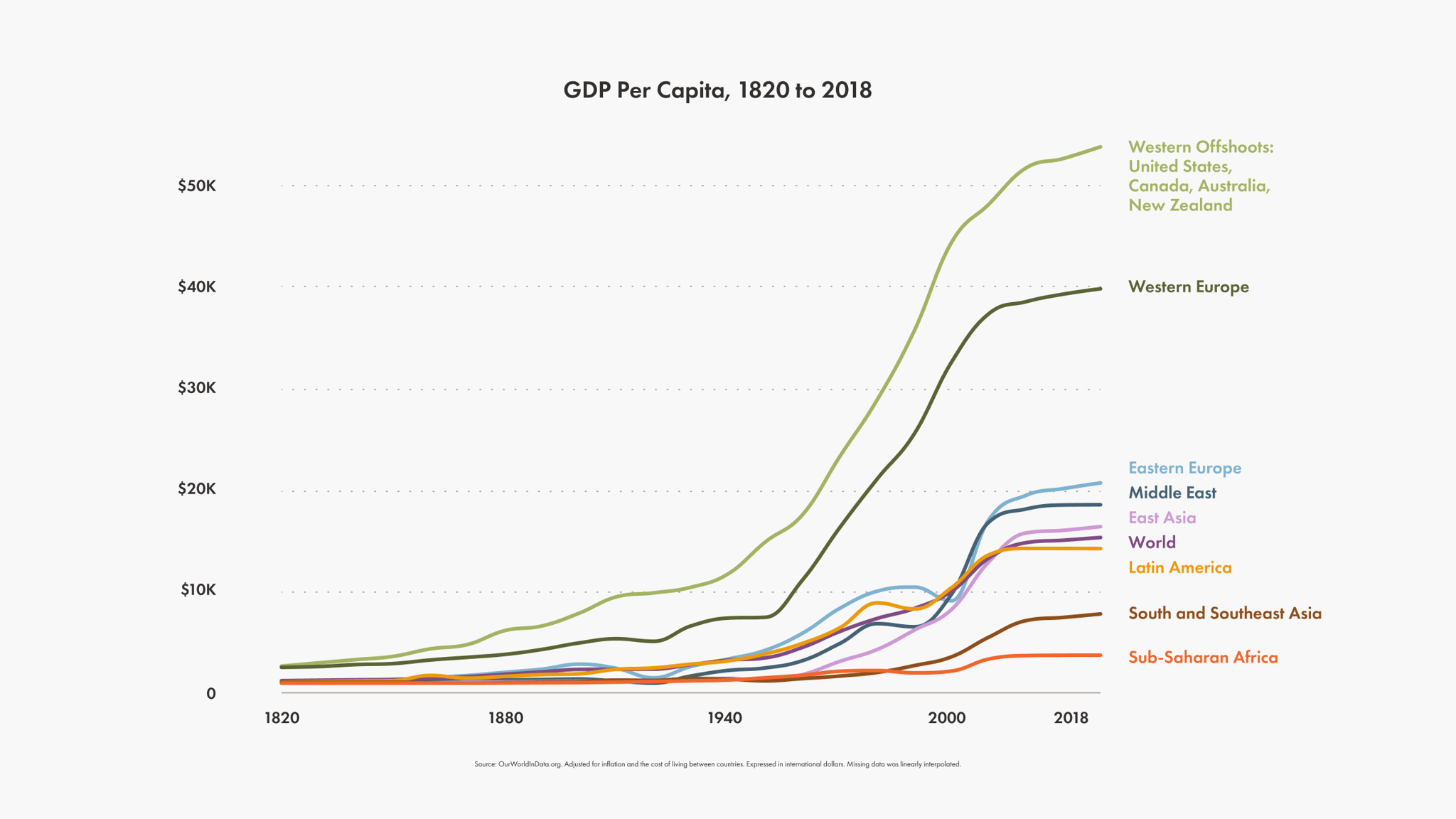

WORLD: Let’s start broad: odds are, if you’re reading this sentence, you’re among the 1% wealthiest humans ever (congrats!). As J. Bradford DeLong points out in his new book, Slouching Towards Utopia, 70% of the world’s population lived in extreme poverty until about 1870, when technology sparked rapid wealth growth. Worldwide, the average person today is 10 times as rich as the average person in 1870, and 4.5 times as rich as the 1950 average. It’s hard to grasp how drastic that increase is until you see it charted (below).* There’s tremendous inequality, no doubt, but all regions are better off than they were.

CANADA: Canada has one of the world’s highest GDPs per capita. As a result, its middle class is among the world’s richest, with a median per-capita income of $66,800 in 2020, a more than 20% jump from 2000. Go us.

POVERTY

WORLD: To be sure, the massive technological and economic changes of the past century have caused a ton of dystopian fallout. But market reforms, education, and industrialization have also made life far less horrid for billions of people. That 70% global poverty rate we mentioned? It now stands at less than 9%. And get this: an estimated 49% of the world’s population is now middle class, up from roughly a quarter in 1975.

CANADA: Canada has had a lowish poverty rate for a long time. But between 2015 and 2020, its rate fell from 14.5% to a mere 6%, largely thanks to a basic-income guarantee for families with children, which took effect in 2016.

LIFE EXPECTANCY & WELLBEING

WORLD: With greater wealth come better standards of living and medical care — which explains why people live almost 40 years longer today than they did a century ago. (Life expectancy in 1913? 34 years.) Moreover, the average person today receives more than twice as many years of education compared to 100 years ago and is 10 times less likely to lose a child.

CANADA: Canadians are croaking at age 82 on average, up from age 59 in 1920. School-wise, since 1980, the proportion of Canadians with post-secondary education has risen from 31% to 64%, the second-highest rate among OECD countries, behind only Korea.

THE UPSHOT What’s interesting now is that, after all these years of dizzying growth, a lot of smart people have realized that our progress has slowed. The prevailing thought is that society has progressed so much that, by some measurements, it’s getting harder to invent new ways to make life better. And, honestly, that’s a pretty good problem.

*GDP doesn’t reflect individual prosperity, but it’s a good measure of a country’s or region’s general wealth.

Wealthsimple Favorites

Author Karen Russell on writing, money, and motherhood.

A computer language that controls the financial world.

Why does the stock market go up over time, anyway?

Raising middle-class kids when you’re no longer middle class.

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.