Money & the World

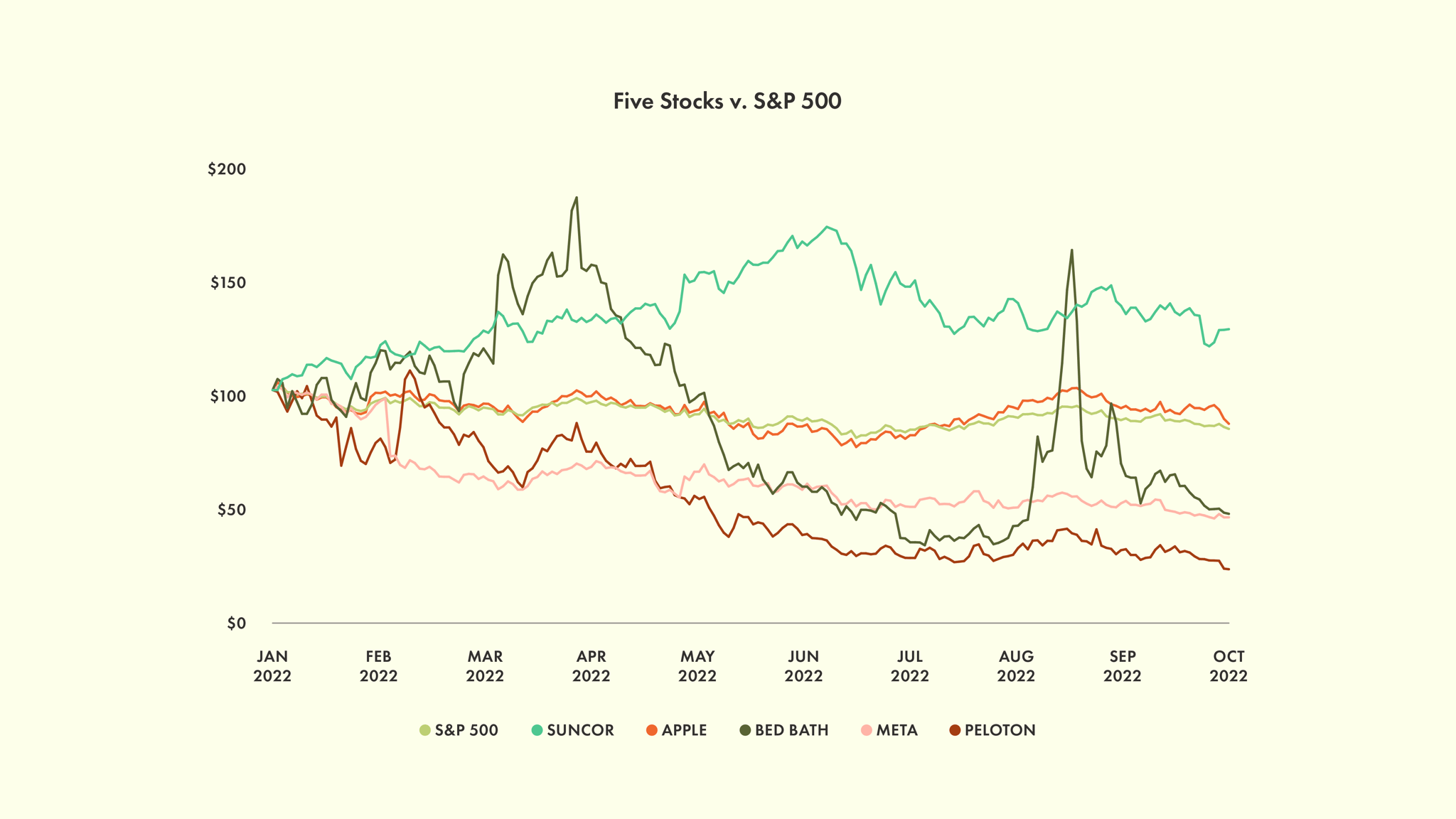

The Story of the Stock Market, Told by Five Companies

The easy-money era came to an abrupt, painful end this year. These stocks help to explain what the heck that meant in Q3 2022.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

For more than a decade, high-growth stocks soared. But when the era of easy money ended that trend reversed quick, with profitable, slower-growth companies suddenly outperforming speculative investments. Here are five stocks that tell that and the market’s other prevailing narratives this quarter.

Recommended for you

THE PANDEMIC UNICORN Peloton ($PTON) wasn’t the only company that did a boom-and-bust pandemic cycle, but its tumble has been the most Icarus-like, with its stock down an apocalyptic 90% since this time last year. Like other pandemic darlings (👋Shopify), it benefitted big time from customers stuck at home with extra cash. But, when life returned to normal-ish, sales slumped as costs skyrocketed. Other pandemic favourites have suffered similarly: Wayfair is down 91% from its pandemic high. Zoom: -87%. Docusign: -85%. In May, Peloton reported a US$757 million loss.

THE TECH GIANT Meta ($META) rode a wave of growth and cheap money to glory: from May 2012 to September 2021, its stock climbed a bananas 1,180%. Then digital advertising slumped, thrusting Zuck & Co. into a strange new, less profitable world. As a result, $META is down a painful 62% YTD. And tech stocks have tanked broadly. The ARK Innovation fund — deep on Tesla, Roku, Spotify — sits -77% from its peak, and the tech-heavy Nasdaq (-34% YTD) lags the other major indices. Why? Basically, higher interest rates slow growth, and growth is tech’s entire MO. Higher rates also incentivize investing in companies that spit out a lot of cash, and tech companies aren’t famous for that. Meta is now c̶u̶t̶t̶i̶n̶g̶ ̶c̶o̶s̶t̶s shifting vibes.

THE NEW VALUE STOCK Apple ($AAPL) is a tech company in that it makes gadgets and apps, etc. Yet it rakes in cash (it generated US$23 billion in free cash flow last quarter) and has strong margins and loyal customers to boot. These qualities, some argue, resemble those of a value stock. For the uninitiated: value stocks (think: oil or banks) don’t necessarily grow like crazy and for that reason tend to be undervalued. But for the price they’re reliable moneymakers and thus relatively resilient. Value stocks have fallen 17% YTD, compared to the more precipitous drop of growth stocks, which have slid about 35%. Apple has split the difference, sinking only (“only” being relative in ’22) 23% YTD.

THE ENERGY EMPIRE Suncor ($SU), in normal times, would likely be reeling right now, after a boardroom shake-up and the resignation of its CEO. But normal times these are not. A global energy crunch, courtesy of Russia’s war against Ukraine, means energy companies basically can’t go wrong. Suncor’s stock, shake-ups be damned, is up 36% YTD. Surging commodity prices have placed Canadian oil and gas companies squarely among the TSX’s top performers, and industry watchers say demand is likely to stay high at least in the short term.

THE MEMESTOCK Bed Bath & Beyond ($BBBY) shot up in early 2021 during the first big memestock fever. $BBBY’s wild ride, like so many speculative investments’, should have ended when rates rose and markets retreated. And yet August saw a memestock revival, during which $BBBY (briefly) shot up 300%. Like meme hysterias of yore, the frenzy, which also included r/wallstreetbets mainstays $GME and $AMC, was basically driven by hype and Reddit chatter. But this time, the energy just wasn’t the same, and BBBY stock is now trading about 70% lower than where it started the year. (GME and $AMC crashed back to Earth too.)

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.