Money & the World

We All Went a Little Crazy on Tesla Stock. And That Tells Us a Lot

We charted what our clients did on our Trade app as the price of TSLA rose roughly 40% in just two days last week. And what it showed us was how emotion and hype can affect not just the stock market but our individual bottom lines.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

We noticed something kind of crazy last week. As you probably know, Wealthsimple Trade is a platform that lets people buy and sell stocks and ETFs with no commission. We like to look at the data we get from the Trade app—because we’re data-driven in general, but also because it’s an interesting prism for understanding the way people behave when they’re investing. With us so far? Great.

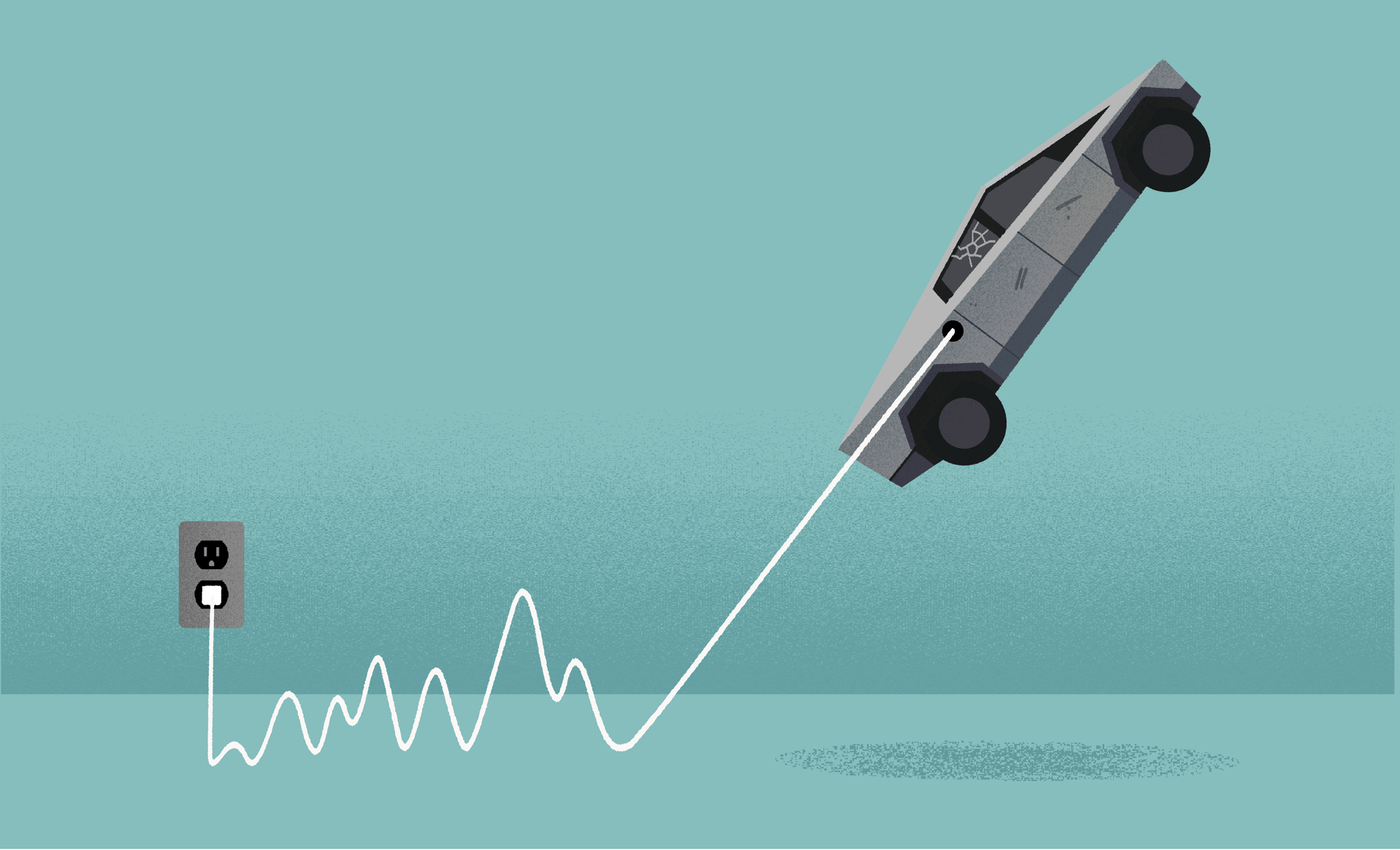

Now you may have seen that Tesla stock went absolutely bananas last week. After closing at $650.57 on Friday, January 31, Elon Musk’s electric-car company swung wildly in all directions over the next five trading days, peaking at $968.99 before ending the week at $748.07. It was trading at about $510 on January 17, so you’re looking at a stock that nearly doubled in price in less than a month — and came close to that inside of a few days. Also interesting to note: it was trading at $179 in June 2019.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

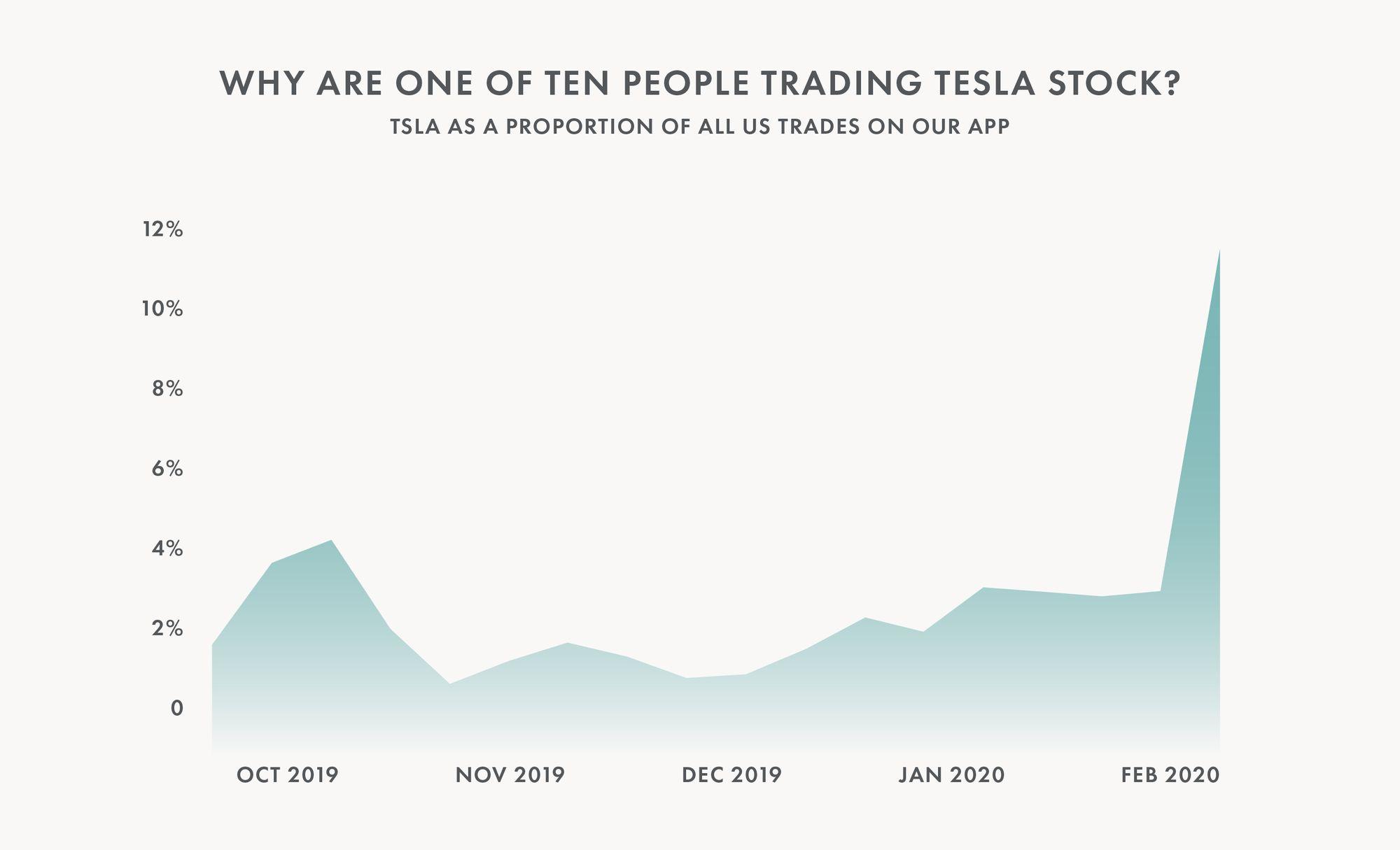

Here’s what was especially interesting to us: during the period from February 3rd to February 7th, Tesla accounted for roughly 40% of all USD trading volume on Wealthsimple Trade. Forty percent! And that capped a period that was already unusually Tesla centric — since the beginning of the year it represented between 13 and 15% of U.S. trades on our platform. Prior to 2020, it never exceeded 10%. And that gives us some insight as to how the behaviour of this single stock relates to a lot of us, even folks who have never bought or sold a share of Tesla.

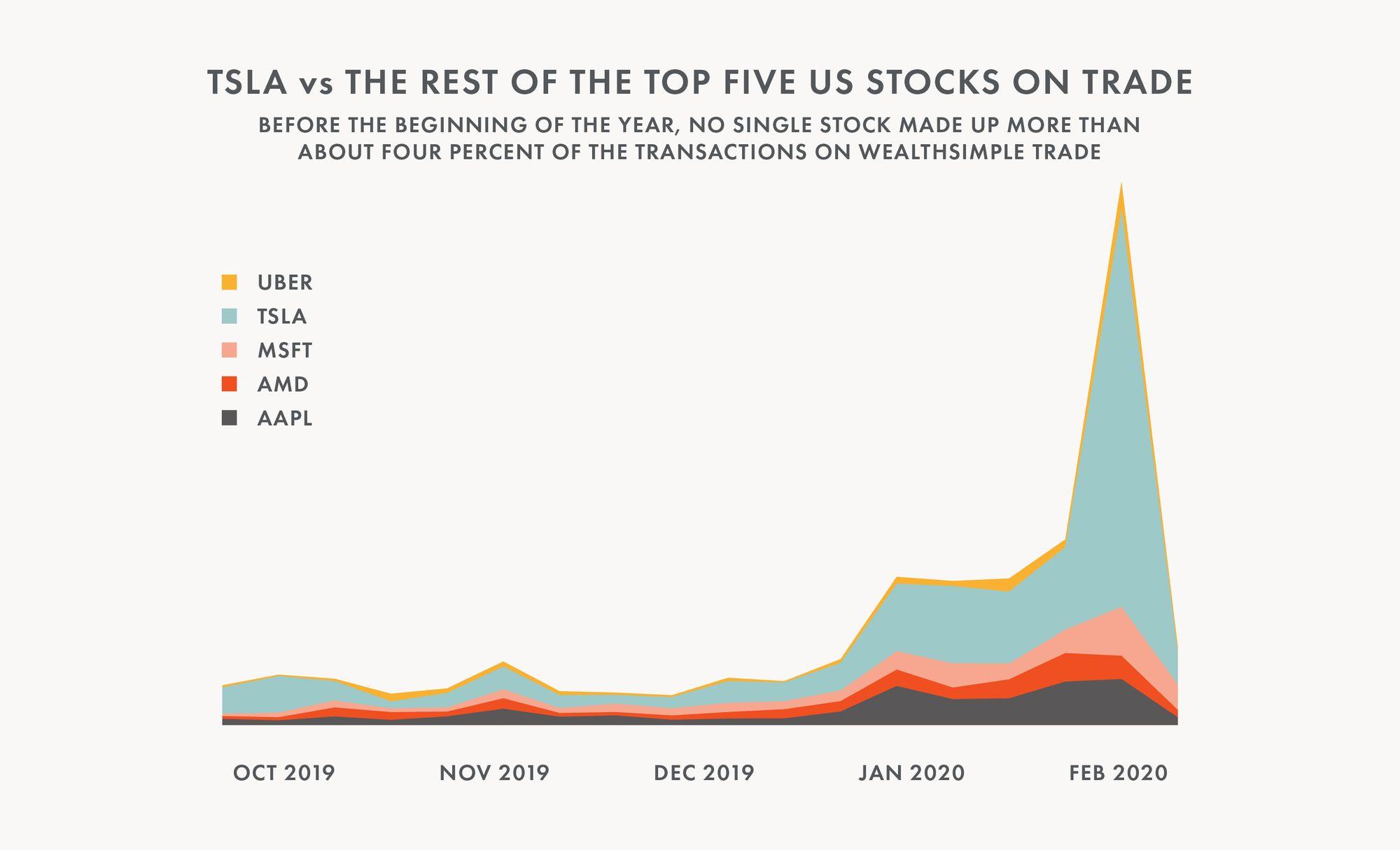

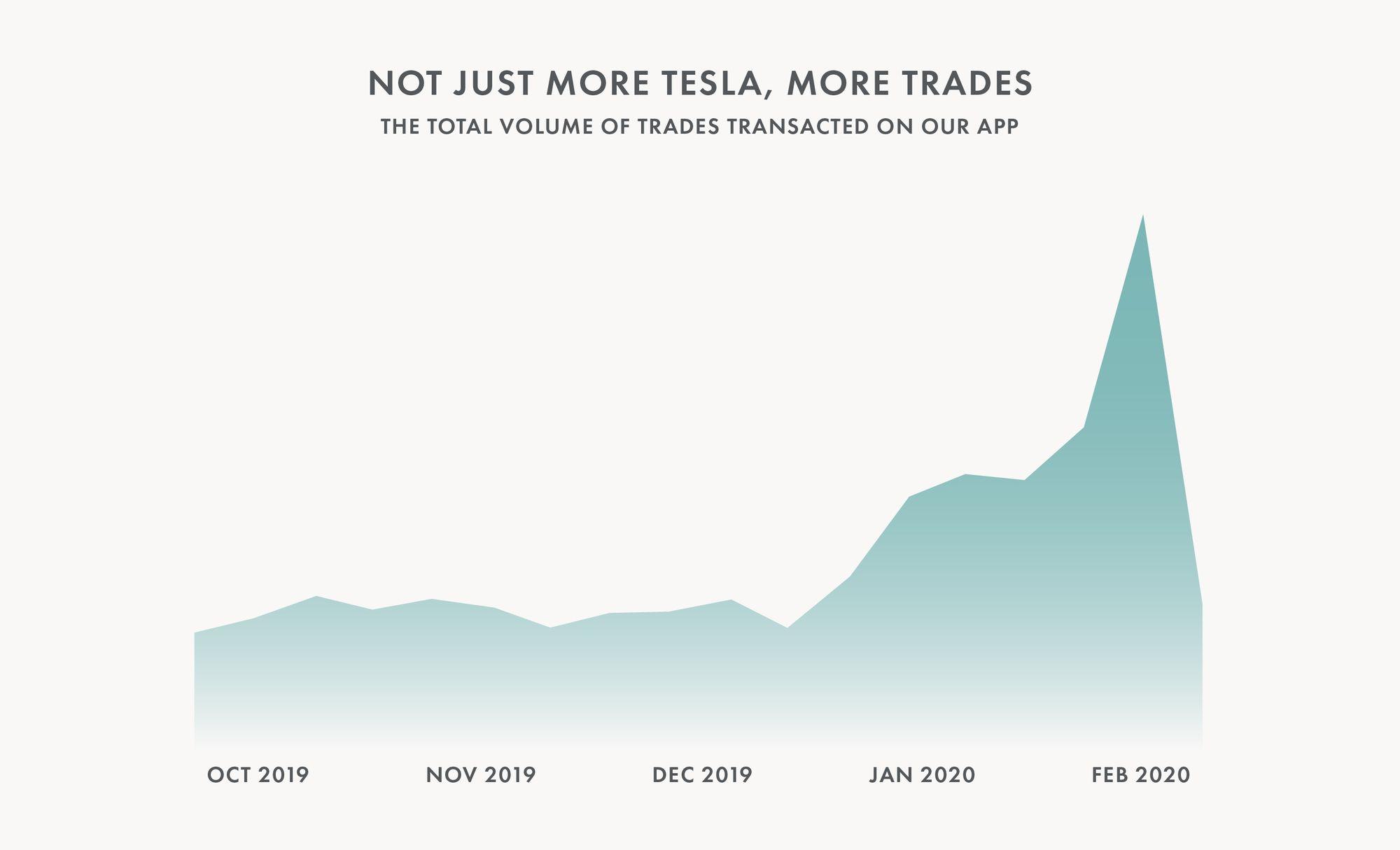

Both of the graphs above are pretty fascinating illustrations of the TSLA frenzy that took over Trade. But there’s another layer of data that’s even more fascinating and instructive. During the period we’re talking about, the overall volume of trading on our platform rose about 100% compared to the month prior. Some of that is because we’re growing. But it wasn’t just that people were buying and selling the same amount of stocks (albeit more TSLA than other securities), but that way more stock was being bought and sold during that time, period. It seems to suggest people wanted to get in on Tesla; that the soaring price of a stock was a bright shiny object that brought all types of people in from the sidelines.

What is going on here?

A few things. Let’s start with the likely reason Tesla’s stock price started going up. The first answer is that Tesla has been on a corporate hot streak. They had better than expected results last quarter that followed a six-month run of mostly positive news dating back to last August. And the company got more good news when the Chinese government announced it would help Tesla, as well as other foreign companies, resume production sooner than expected after delays caused by the coronavirus crisis. The prospects of a company get rosier, the stock price likely goes up. Is the increase in price proportionate to how good the corporate news was? That’s an important question.

But that good news is only part of the story. Because to understand what happened last week you need to understand not just the behaviour of investors who like Tesla but the behaviour of investors who are betting against the company. That’s because part of Tesla’s wild ride was most likely due to a phenomenon known as a short squeeze. When someone “shorts” a stock, it means she is essentially selling the stock first, with the intention of repurchasing it later at a lower price, for a profit. But when the price keeps going up, the short seller is watching her losses grow. Some begin buying back shares before the stock gets even more expensive. That increases demand, and the price keeps going up and up in a vicious and paradoxical circle. That’s called a “short squeeze.”

Recommended for you

The interesting thing is most of this has very little relationship to the underlying fundamentals of the company. Tesla, for example, has never turned an annual profit. There’s a lot to argue that Tesla will be a successful company. We just don’t know yet.

None of this is a new phenomenon. It’s a kind of speculative bubble fed by the media and new technology, a case study in the sometimes dangerous interplay between human behaviour and the stock market that goes back centuries. Few if any of those people trading Tesla possessed any special insights that justified their behaviour. Certainly a decent proportion of what transpired involved emotional, FOMO-driven trading that happens all the time, the type of stuff that lots of investors succumb to. Plenty of other stocks that are fundamentally sound — but much less sexy — were ignored while Tesla has become (by valuation) bigger than GM and Ford combined.

The essential question is whether Tesla is going to be a WorldCom or a Google.

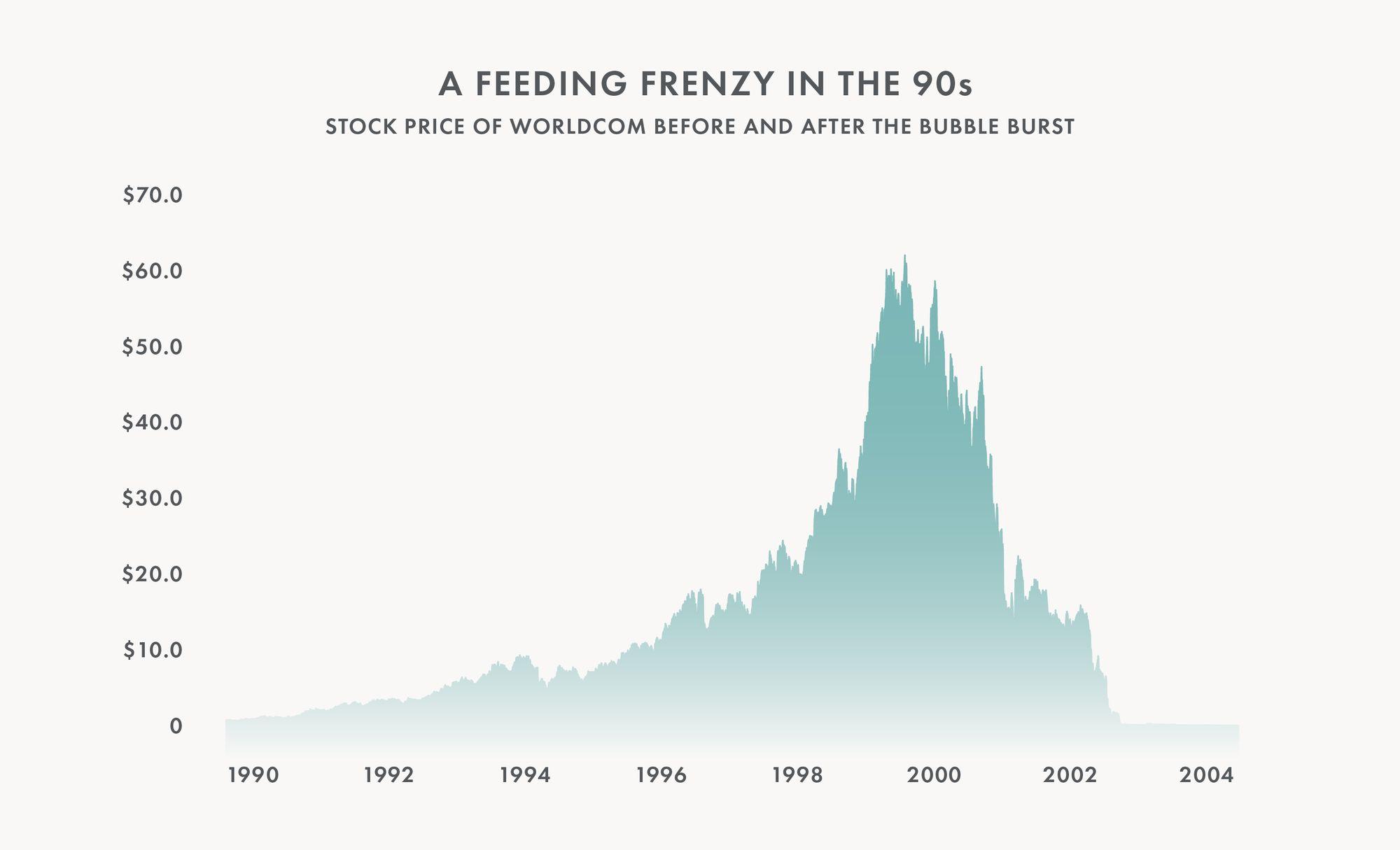

Your WorldCom scenario: a telecom boom of the 1990s led to a litany of overhyped, overpriced companies whose blue-sky valuations vastly exceeded their real-world bottom lines. More examples of media coverage, wild fluctuations, and FOMO helping investors ignore fundamentals. Many of these companies never generated enough market share or profit to justify their stock prices. Others, like WorldCom, went bankrupt in a storm of fraud and scandal. We’re not saying Tesla is going to meet the same fate. But we are saying its future is far from guaranteed.

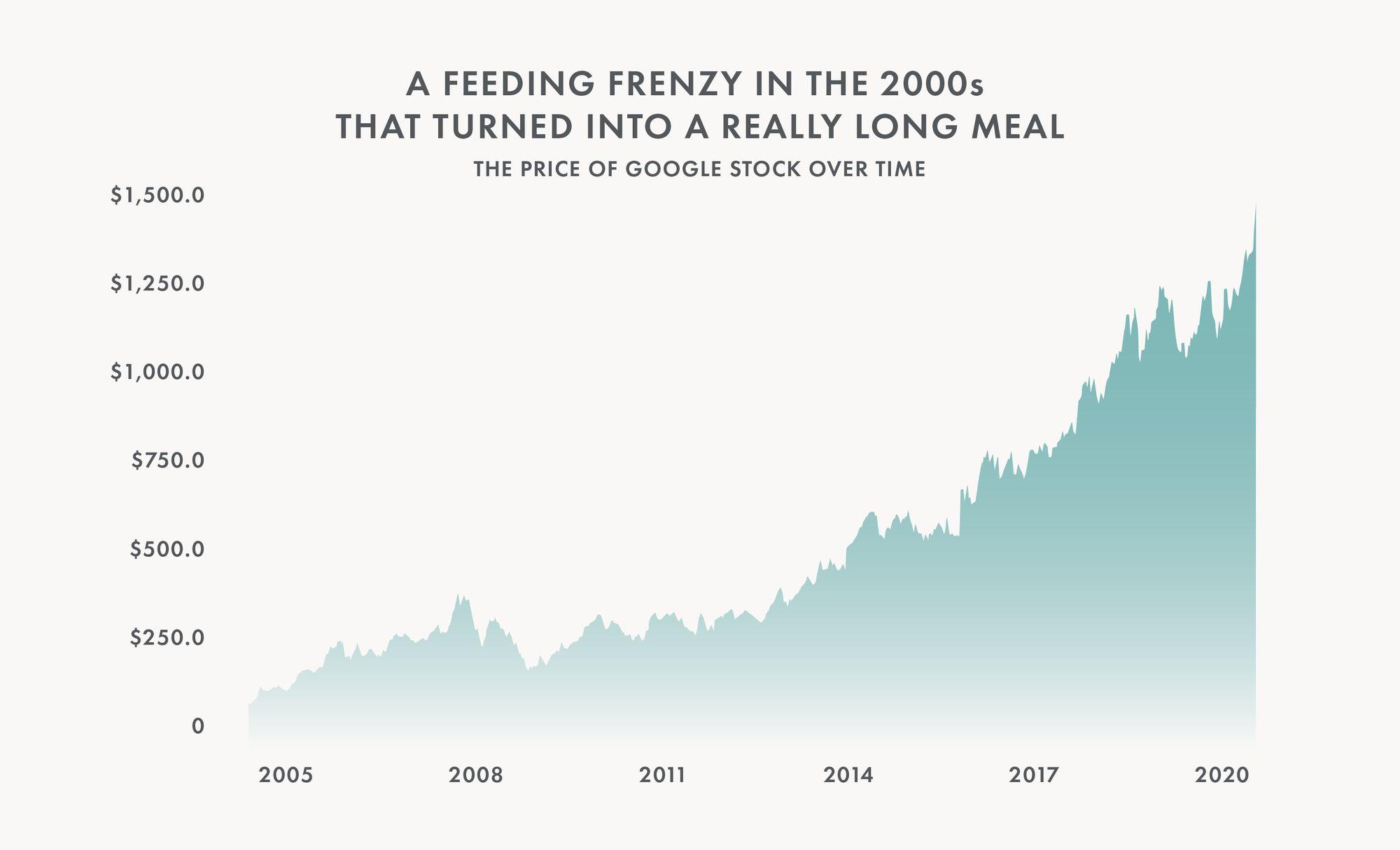

Your Google scenario: on the other hand, speculation about Google turned out to be accurate, if arguably a bit early.

So is Tesla a bubble that bursts or a future titan that ends up being a great investment at any price? The answer to that is: no one knows. Right now it’s speculation.

Great, you may be saying to yourself, but this has nothing to do with me because I’m not a Tesla investor. Well that may be true. But underpinning the story of last week are a couple of really simple lessons that hold true for anyone who wants to make money in the longterm. First and foremost, it means don’t think of “trading” as “investing.” The whole idea of buying individual stocks low and selling them high is always speculative, and not even professional investors are very good at timing the market. (According to the latest SPIVA Scorecard, nearly 88% of active investment managers underperformed the market over the longterm.) Our message about longterm investing is the same as it’s always been: put your money in an optimally diversified portfolio of lots of stocks and bonds, keep your fees as low as possible, and make sure your risk level matches your timeline and risk tolerance. Then keep funding that portfolio on a regular basis, exercising patience and riding out any rough patches, knowing that the value of your portfolio will achieve positive annualized growth over the longterm. And for the vast majority of us, saving more is a much more consequential action than tweaking your investment mix.

“If you want to speculate on some Tesla stock, fine,” says Ben Reeves, Head of Investments at Wealthsimple. “But it’s not a longterm way to invest. So don’t put any money in there that you can’t afford to lose.”

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.