News

Take Care of Yourself

Our first advertising campaign launches this week. We hope it makes you crazy excited about being boringly responsible.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

No one flosses in their 20s. It’s an eternal truth. This is because it’s hard for most of us to worry about taking care of ourselves when we’re young. Yeah, you might think, Fish-oil pills are probably good for me, but no one dies of a heart attack when they’re my age, so why not just put it off? And then, when you get old enough, you see the error of your ways. And suddenly you’d like to go back in time and do some things differently.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

This gets at the question we had in mind when we created our very first ad campaign, “Take Care of Yourself”:How do we get people interested in wise, dispassionate, optimized investing when they’re young and they still have time to do it painlessly?

Super Bowl spot

Maybe investing sounds dicey to you. We understand. If you’re part of the generation of people who are just now getting started on their career path, you’re a special case. Your first real knowledge of the financial world was probably witnessing the biggest stock market crash of the last 85 years.

And you were born into a culture in which investing is treated an awful lot like a sporting event. Turn on any financial news network, and there will be a lot of sweaty people yelling at you to buy something or sell something. Which is not only annoying and confusing but also terrible advice. (There’s a study that shows dead people are actually better investors than living people because they’re not always trying to buy and sell things to outsmart the market.)

"Pugs"

But listen, whether you do it with Wealthsimple or someone else, you shouldn’t be afraid to invest. Stocks will go up, and stocks will go down. There may even be another crash between now and retirement. But there’s really only one fact you need to know about the stock market: It has gone up over time. It’s been true since the first day we had stock markets. What you’re betting on when you leave your money in the stock market is human progress, and as long as that happens you’ll be in good shape.

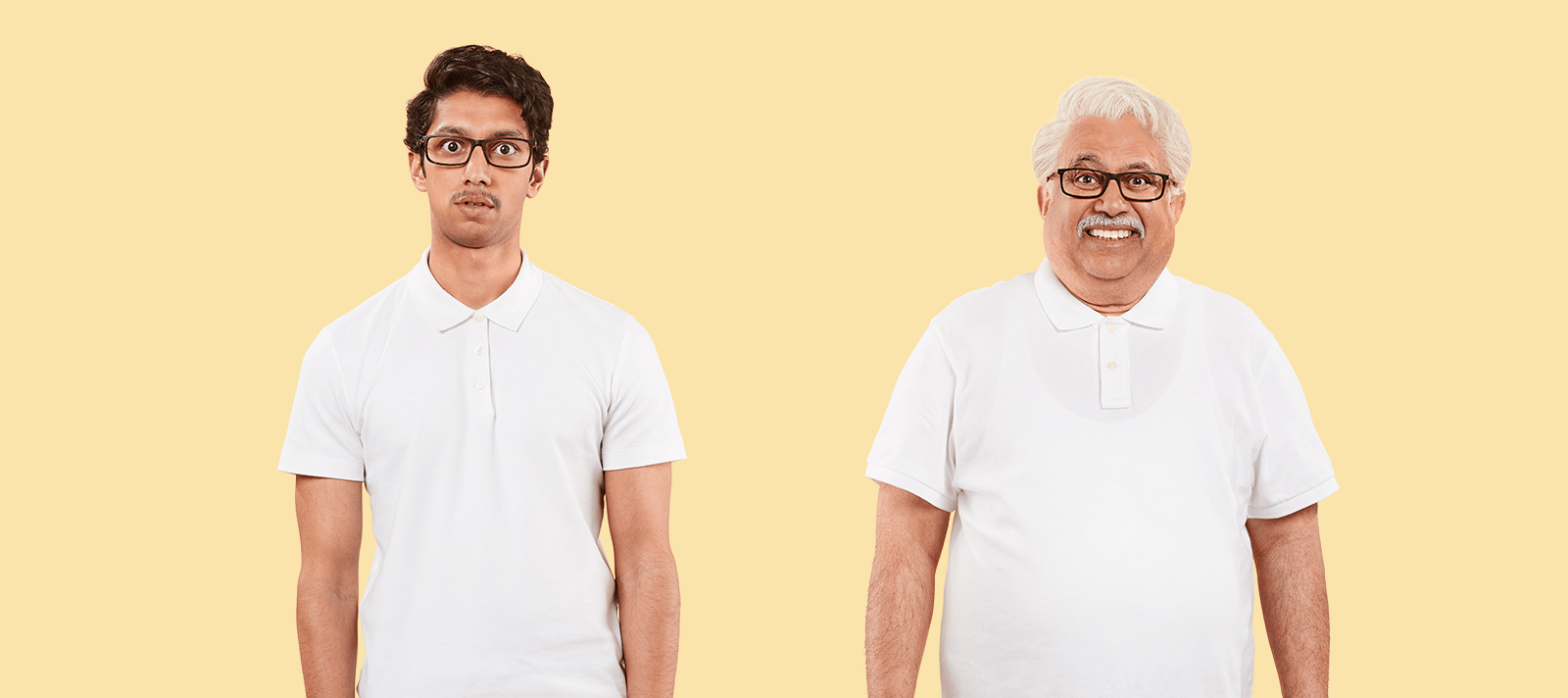

OK. So given that investing early in your life is good, we wondered who would be the perfect person to deliver that important news. We think we came up with a pretty good answer: you. In our new “Take Care of Yourself” campaign—it’ll premiere during the Super Bowl, which we’ve discovered is the advertising deal of the century—someone we’ve named Future You comes back to tell you to start investing now. To tell you that, whether it’s saving for your dream cottage on the lake or making sure your kids go to college, money is just one instrument to help you live a better life.

"Mr. Know it all"

"Headphones"

There’s one other piece of good news about taking care of yourself financially: With Wealthsimple, it’s way easier to invest than it is to floss or jog. You have to go jogging three times a week; at Wealthsimple, you just set up an automated plan and let it do its thing.

But don’t take our word for it—let Future You tell you all about it.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.