News

We're Helping WNBA Star Skylar Diggins-Smith Fight for Fair Pay

A few months ago, Wealthsimple helped Diggins-Smith tell her story about pay inequality in professional sports. Now we're standing with her again.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

It's not just the size of the contract.

That's one of the things people don't understand about the disparity between the NBA and the WNBA. Earlier this summer Skylar Diggins-Smith spoke out about the pay gap in our Money Diary. “I’m at a loss for words sometimes, talking about this,” she said. “I always wonder: If I have a son and I have a daughter, what do I tell them? What do I tell my daughter if it's her dream to play in the WNBA?” And the conversation went viral. Places like Yahoo, Bleacher Report and SB Nation picked up the conversation. Mark Cuban, the owner of the Dallas Mavericks, met with her to help find a better financial path forward.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

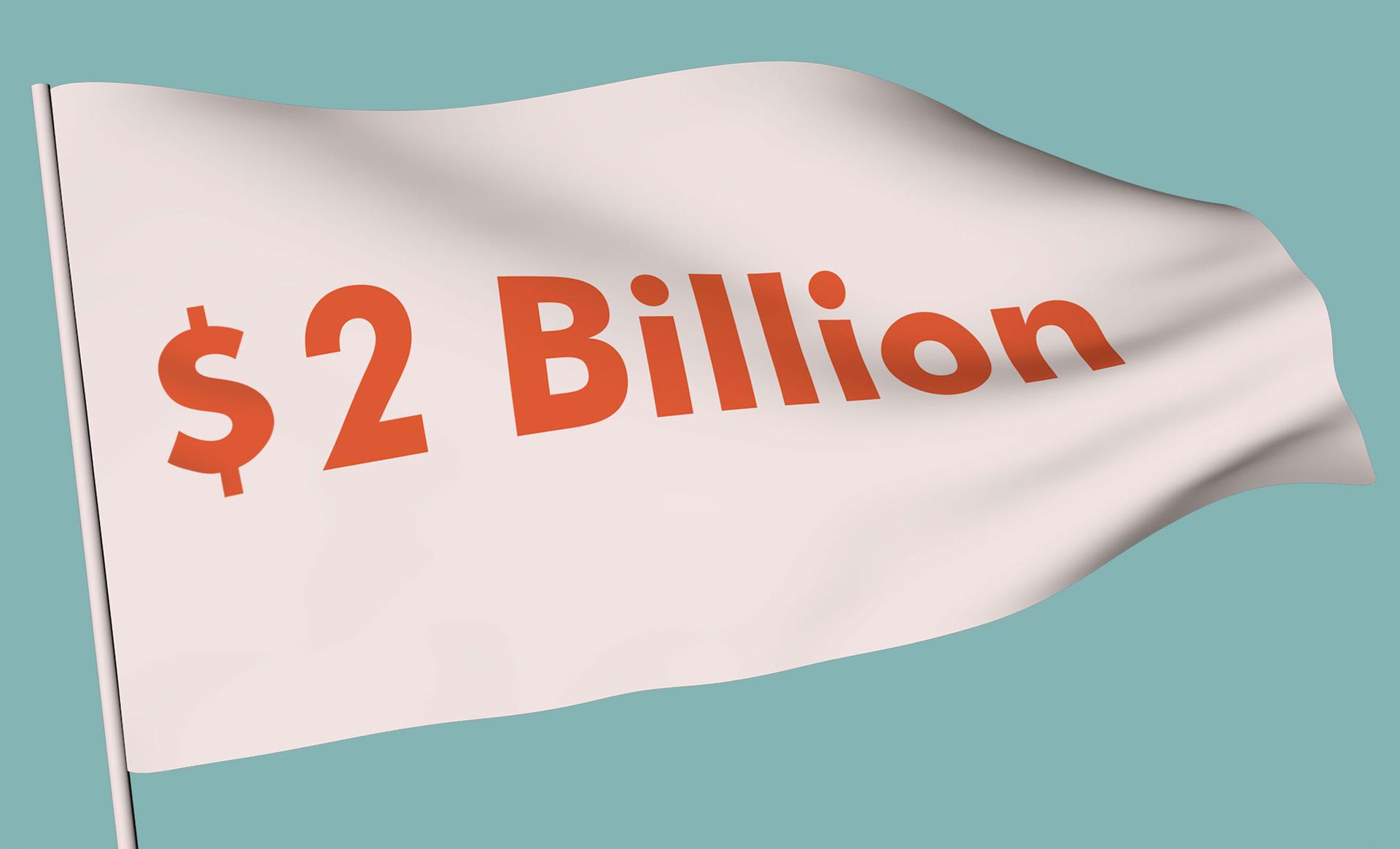

But Diggins-Smith didn't just mean that she — a four-time WNBA all-star — gets paid less than a guy who rides the bench in the NBA. She was also talking about the share of revenue players get. In the NBA, the players receive 50% of every dollar earned. In the WBNA, that figure is in the 20s. And more importantly, she was talking about the ways in which the WNBA, which was founded in 1996, isn't given the same chance to succeed as the NBA, which has been around for decades longer: the highlights aren't shown on sports channels so the public knows less, which means the networks don't broadcast as many games, which means less money to cover operating costs. She was talking about a structural inequality.

We learned something from the conversation, too. If we really believe it when we say that we want to give every person — no matter who you are or what you look like — the ability to gain financial freedom), then we should be part of the income inequality conversation, too. So we decided to make a commercial with Diggins-Smith: it's about how different your financial life is if you're one of the best female basketball players in the world instead of one of the best male basketball players.

Recommended for you

And we also had her tell us her life story — give it a watch, it's awfully compelling.

And then, of course, we paid her for it. That's how endorsements work. But we didn't did just hand over the money — giving someone a chunk of cash without some good old-fashioned long-term planning is in violation of everything we believe. Instead we gave her the same deal we gave top-ten NBA rookie, Mikal Bridges: a $50,000 investment in a personalized, diversified portfolio. The same kind of portfolio every Wealthsimple client has access to. The kind that helps a woman plan for the future, whatever it may be.

Why did we do it that way? Because there isn't just an income gap. There's a wealth gap, and it's an even bigger problem. Investing is one important way to close that wealth gap. That $50,000, if history is our guide, could be worth more than $350,000in 30 years.* Though, like all our clients, we hope she won't just invest that first chunk but will contribute to that account regularly — investing early, and on a schedule, is the best recipe for making your money work harder.

We hope, in the future, we’ll invest in the future of their daughters, just like Skylar Diggins-Smith is doing. And that by providing a platform for Diggins-Smith to speak up, professional basketball will take notice of the need for a more equal tomorrow.

*For this projection, we’ve assumed a US Growth portfolio will grow at 6.4% net of fees. To learn more about our projections — and to learn about how much your investments could turn into — check out the interactive graph here.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.